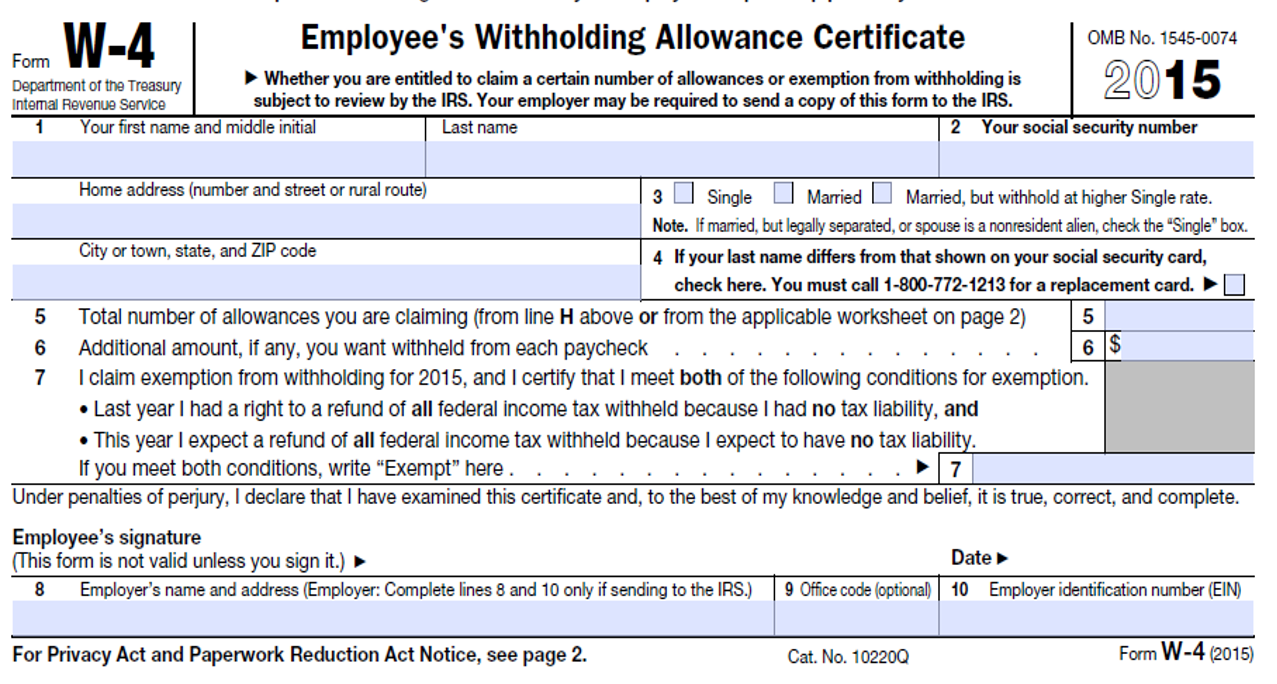

W 4 Form 2015

W 4 Form 2015 - Deductions, adjustments and additional income worksheet If you are exempt, complete The new form changes single to single or married filing separately and includes head of. Web the form has steps 1 through 5 to guide employees through it. Change the blanks with exclusive fillable fields. Your withholding is subject to review by the irs. One difference from prior forms is the expected filing status. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. This form tells your employer how much federal income tax withholding to keep from each paycheck. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty.

This form tells your employer how much federal income tax withholding to keep from each paycheck. Your withholding is subject to review by the irs. One difference from prior forms is the expected filing status. Deductions, adjustments and additional income worksheet The new form changes single to single or married filing separately and includes head of. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it. Get ready for this year's tax season quickly and safely with pdffiller! Fill in your chosen form If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed.

Get your online template and fill it in using progressive features. Web the form has steps 1 through 5 to guide employees through it. If too much is withheld, you will generally be due a refund. There are new ways to figure out your withholding amount, including an online. Change the blanks with exclusive fillable fields. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. Download & print with other fillable us tax forms in pdf. This form is crucial in determining. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed. This form tells your employer how much federal income tax withholding to keep from each paycheck.

W4 2015 Form Printable W4 Form 2021

The new form changes single to single or married filing separately and includes head of. There are new ways to figure out your withholding amount, including an online. Get ready for this year's tax season quickly and safely with pdffiller! If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it..

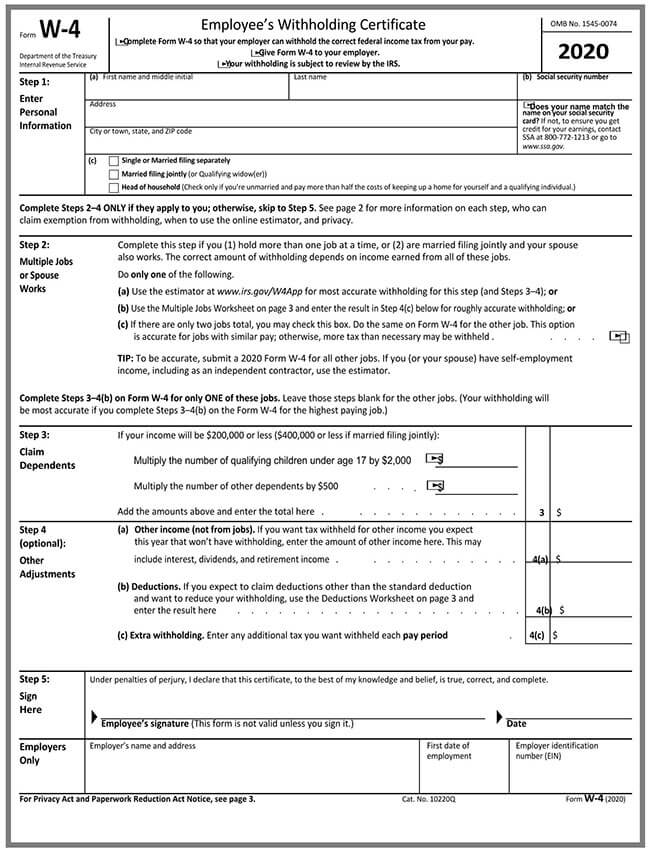

What Is a W4 Form?

There are new ways to figure out your withholding amount, including an online. This form is crucial in determining. Deductions, adjustments and additional income worksheet If too much is withheld, you will generally be due a refund. Get your online template and fill it in using progressive features.

How to Fill a W4 Form (with Guide)

Get your online template and fill it in using progressive features. This form is crucial in determining. The new form changes single to single or married filing separately and includes head of. If too much is withheld, you will generally be due a refund. It tells the employer how much to withhold from an employee’s paycheck for taxes.

What you should know about the new Form W4 Atlantic Payroll Partners

Web the form has steps 1 through 5 to guide employees through it. This form tells your employer how much federal income tax withholding to keep from each paycheck. Involved parties names, addresses and phone numbers etc. Your withholding is subject to review by the irs. One difference from prior forms is the expected filing status.

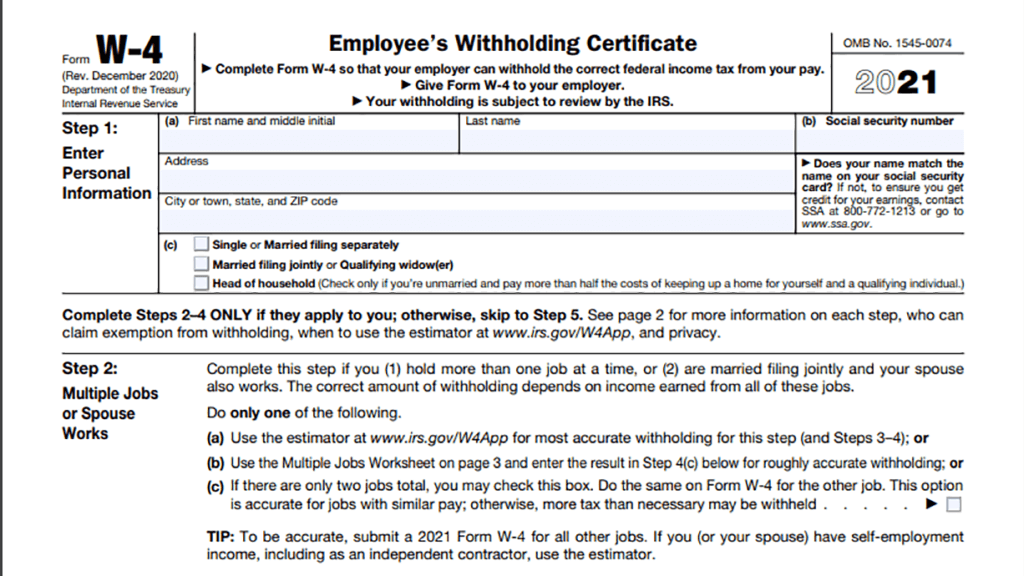

Form W 4v Fill Online, Printable, Fillable, Blank pdfFiller

Change the blanks with exclusive fillable fields. Involved parties names, addresses and phone numbers etc. This form is crucial in determining. There are new ways to figure out your withholding amount, including an online. One difference from prior forms is the expected filing status.

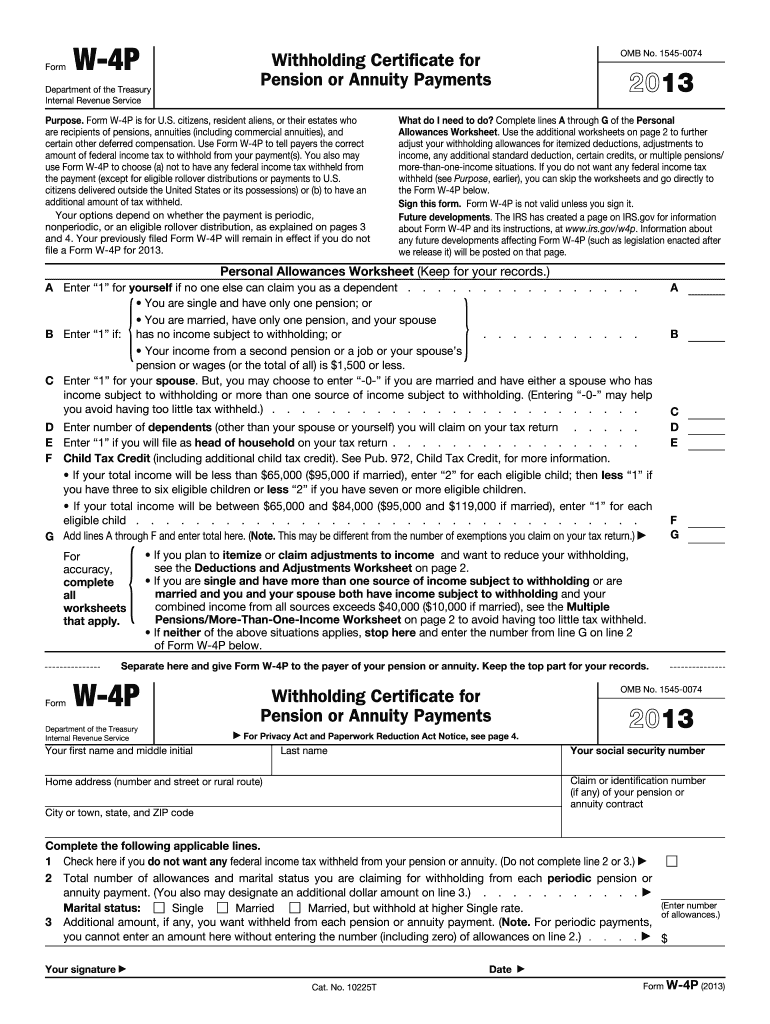

W 4p Form Fill Out and Sign Printable PDF Template signNow

If you are exempt, complete This form is crucial in determining. Get ready for this year's tax season quickly and safely with pdffiller! One difference from prior forms is the expected filing status. The new form changes single to single or married filing separately and includes head of.

Fill Free fillable Form W4 2015 PDF form

There are new ways to figure out your withholding amount, including an online. It tells the employer how much to withhold from an employee’s paycheck for taxes. Get your online template and fill it in using progressive features. Get ready for this year's tax season quickly and safely with pdffiller! Change the blanks with exclusive fillable fields.

State W4 Form Detailed Withholding Forms by State Chart

Deductions, adjustments and additional income worksheet There are new ways to figure out your withholding amount, including an online. If too much is withheld, you will generally be due a refund. It tells the employer how much to withhold from an employee’s paycheck for taxes. The new form changes single to single or married filing separately and includes head of.

Form w4

Your withholding is subject to review by the irs. If too little is withheld, you will generally owe tax when you file your tax return and may owe a penalty. One difference from prior forms is the expected filing status. If you are exempt, complete only lines 1, 2, 3, 4, and 7 and sign the form to validate it..

TakeOneForTheMoney Taking 1 Smart Financial Step At a Time

This form is crucial in determining. Download & print with other fillable us tax forms in pdf. It tells the employer how much to withhold from an employee’s paycheck for taxes. This form tells your employer how much federal income tax withholding to keep from each paycheck. Your withholding is subject to review by the irs.

This Form Tells Your Employer How Much Federal Income Tax Withholding To Keep From Each Paycheck.

It tells the employer how much to withhold from an employee’s paycheck for taxes. Download & print with other fillable us tax forms in pdf. This form is crucial in determining. Get ready for this year's tax season quickly and safely with pdffiller!

If You Are Exempt, Complete Only Lines 1, 2, 3, 4, And 7 And Sign The Form To Validate It.

Involved parties names, addresses and phone numbers etc. Fill in your chosen form One difference from prior forms is the expected filing status. Forms for wilmington university browse wilmington university forms fill has a huge library of thousands of forms all set up to be filled in easily and signed.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return And May Owe A Penalty.

Get your online template and fill it in using progressive features. If too much is withheld, you will generally be due a refund. The new form changes single to single or married filing separately and includes head of. If you are exempt, complete

Deductions, Adjustments And Additional Income Worksheet

There are new ways to figure out your withholding amount, including an online. Web the form has steps 1 through 5 to guide employees through it. Your withholding is subject to review by the irs. Change the blanks with exclusive fillable fields.