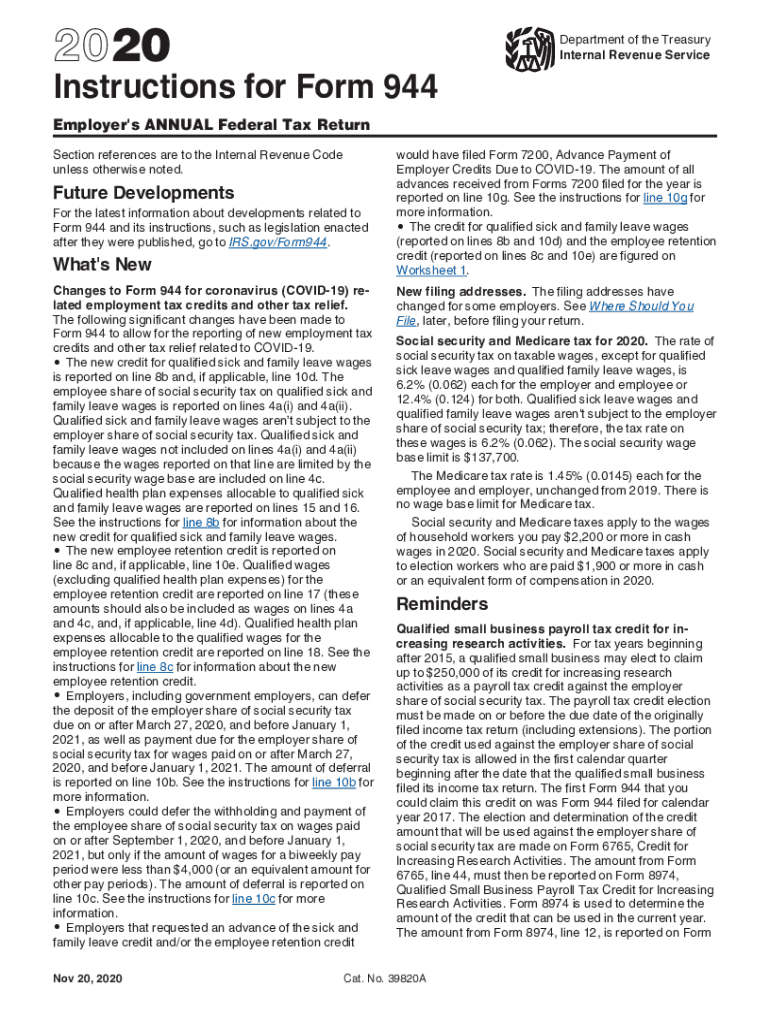

Instructions For Form 944

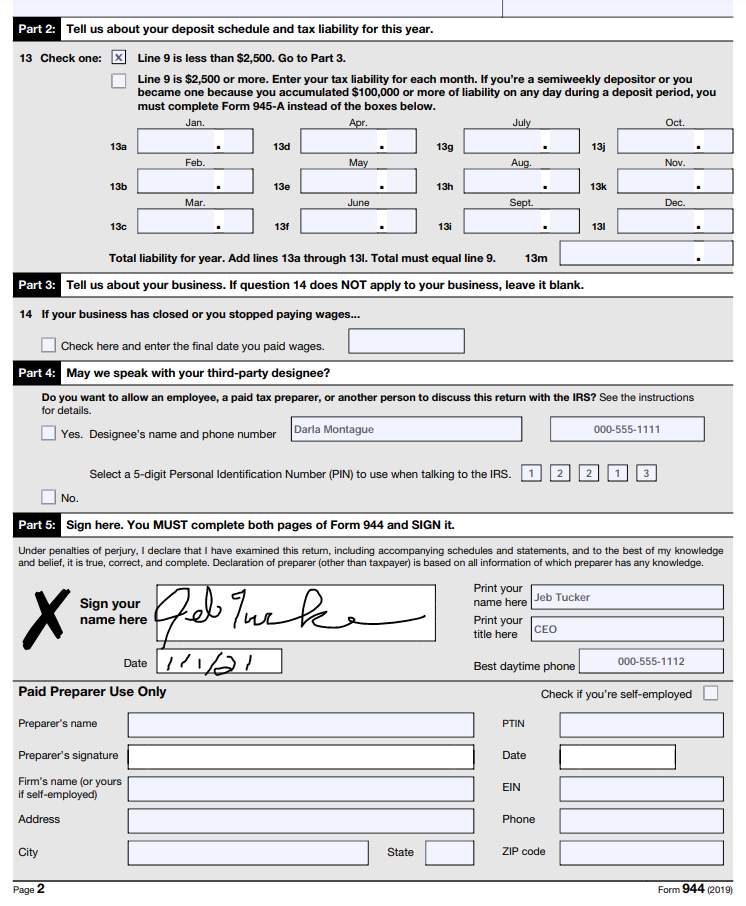

Instructions For Form 944 - The deadline for filing the form is feb. Who must file form 944. Employer’s annual federal tax return department of the treasury — internal revenue service. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). Web irs form 944 is an annual filing. That means employers eligible to file form 944 are only required to complete and submit it once per year. Get ready for tax season deadlines by completing any required tax forms today. Web “form 944,” and “2020” on your check or money order. Double click the payroll item in question. However, if you made deposits on time in full payment of the.

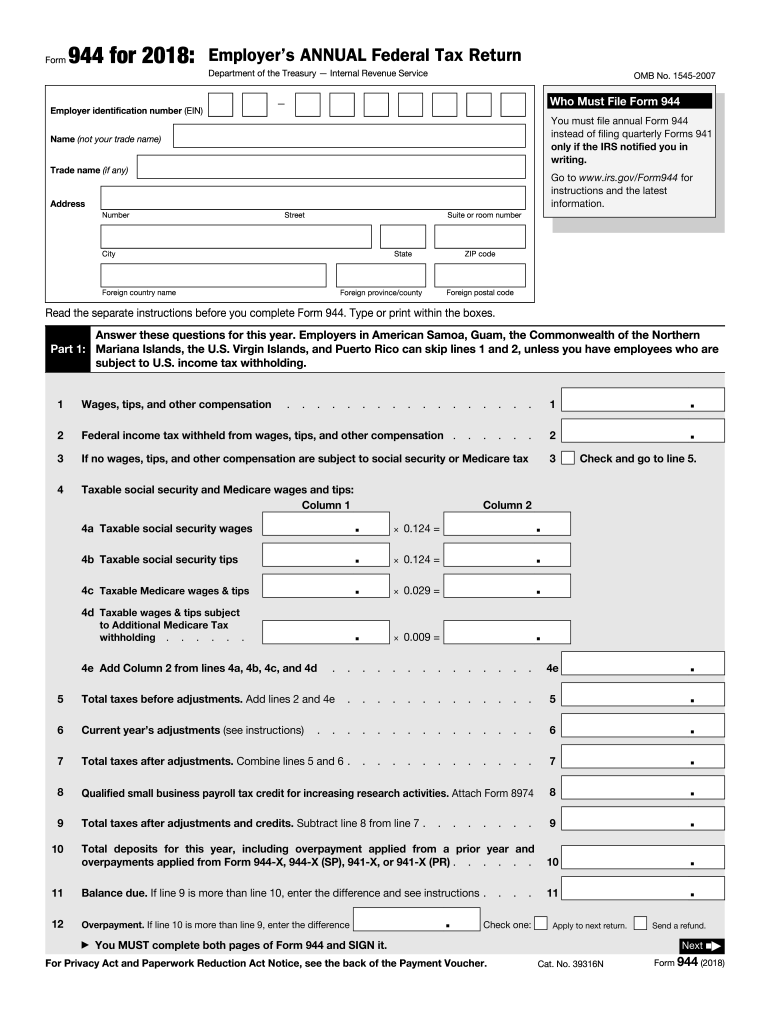

Get ready for tax season deadlines by completing any required tax forms today. To modify tax tracking for any payroll item: Web this 944 form is designed for small businesses with a tax liability of $1,000 or less. Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. That means employers eligible to file form 944 are only required to complete and submit it once per year. Web form 944 is due by january 31st every year, regardless of the filing method (paper or electronic filing). For filing the employer's annual federal tax return, employers must know the. Complete, edit or print tax forms instantly. How should you complete form 944?

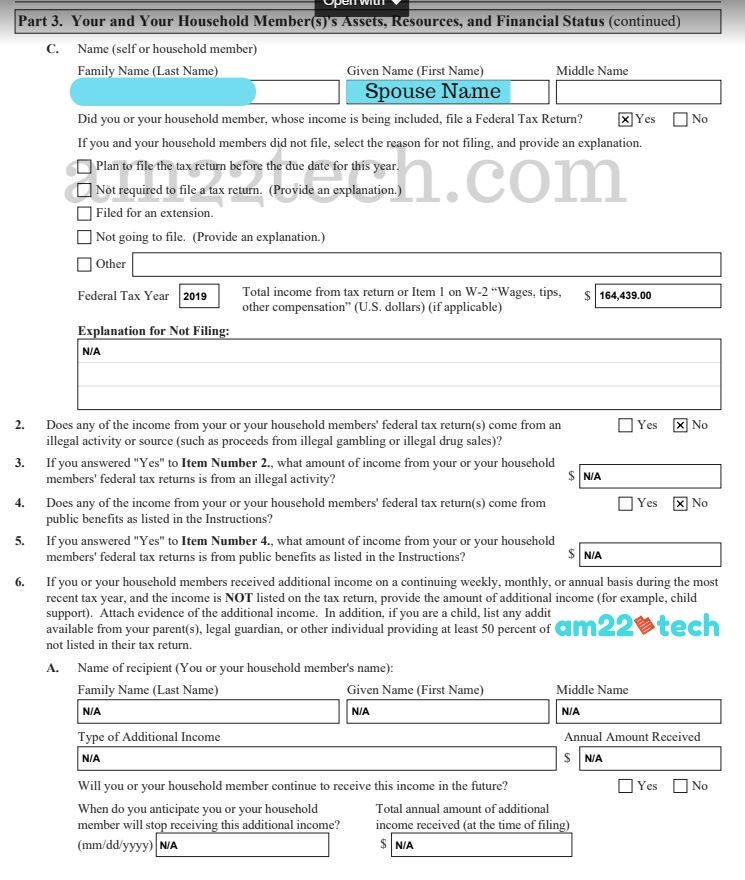

Complete, edit or print tax forms instantly. That means employers eligible to file form 944 are only required to complete and submit it once per year. Who must file form 944. Web “form 944,” and “2020” on your check or money order. Web this 944 form is designed for small businesses with a tax liability of $1,000 or less. Web though the form has instructions to guide you through filling it out, make sure you take your time to do it accurately. For the vast majority of these. If you are a child,. To modify tax tracking for any payroll item: Web irs form 944 is an annual filing.

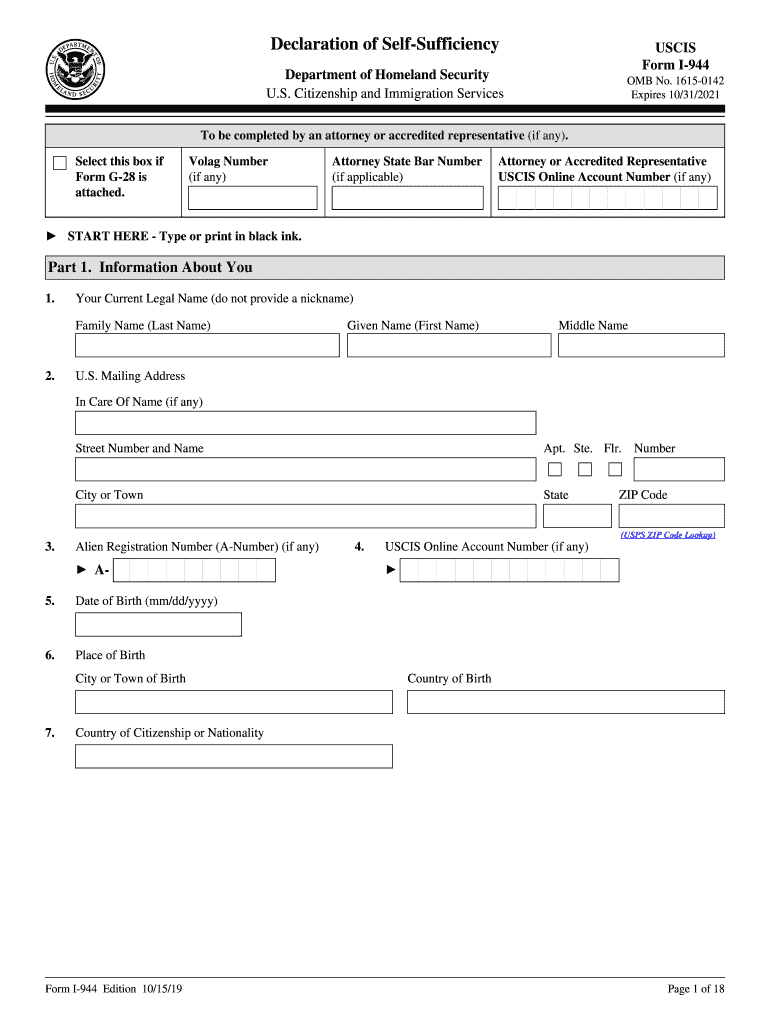

Form i944 Self Sufficiency US Green Card (Documents Required) USA

For filing the employer's annual federal tax return, employers must know the. Complete, edit or print tax forms instantly. The form is used instead of form 941. Web irs form 944 is an annual filing. Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly.

What Is Form 944? Plus Instructions

If you are a child,. Who must file form 944? All employers are required to hold their employee’s fica (medicare and social security) and income. Web the total should equal line 1 on form 944. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s.

IRS Form 944 LinebyLine Instructions 2022 Employer's Annual Federal

Finalized versions of the 2020 form 944 and its instructions are available. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s. Ad access irs tax forms. How should you complete form 944? Web this 944 form is designed for small businesses with a tax.

Form 944 2020 Fill Out and Sign Printable PDF Template signNow

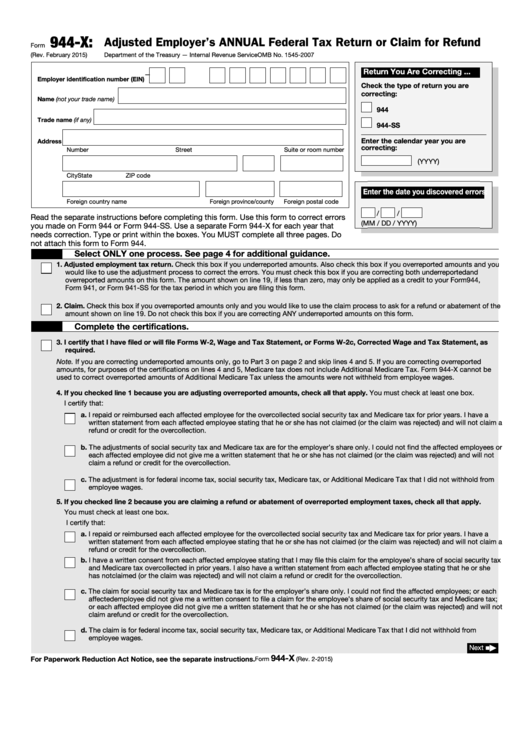

Who must file form 944? Web form 944 for 2022: Finalized versions of the 2020 form 944 and its instructions are available. Or claim for refund, to replace form 941c, supporting statement to correct information. Web irs form 944 is an annual filing.

Form 944 Internal Revenue Code Simplified

Or claim for refund, to replace form 941c, supporting statement to correct information. The form is divided into five different. How should you complete form 944? Web form 944 for 2022: Web “form 944,” and “2020” on your check or money order.

I 944 Pdf 20202021 Fill and Sign Printable Template Online US

To modify tax tracking for any payroll item: That means employers eligible to file form 944 are only required to complete and submit it once per year. The form is divided into five different. Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. All employers are required to hold.

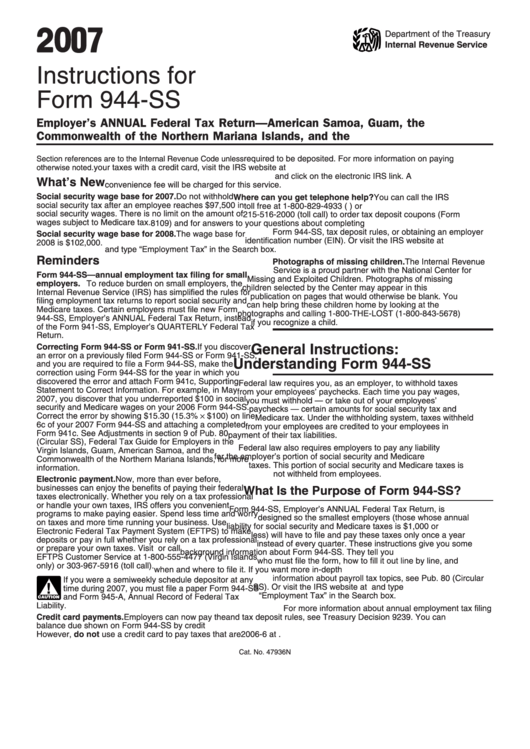

Instructions For Form 944Ss Employer'S Annual Federal Tax Return

Web though the form has instructions to guide you through filling it out, make sure you take your time to do it accurately. Complete, edit or print tax forms instantly. That means employers eligible to file form 944 are only required to complete and submit it once per year. Web irs form 944 is an annual filing. The finalized versions.

Fillable Form 944X Adjusted Employer'S Annual Federal Tax Return Or

However, if you made deposits on time in full payment of the. The form is divided into five different. The deadline for filing the form is feb. Web form 944 for 2022: Web the irs form 944 takes the place of form 941 if a small business qualifies.

2018 Form IRS 944 Fill Online, Printable, Fillable, Blank pdfFiller

The finalized versions of the. Get ready for tax season deadlines by completing any required tax forms today. That means employers eligible to file form 944 are only required to complete and submit it once per year. Web the total should equal line 1 on form 944. Get ready for tax season deadlines by completing any required tax forms today.

IRS 944 Instructions 2015 Fill out Tax Template Online US Legal Forms

Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly. The form is used instead of form 941. Web the total should equal line 1 on form 944. Who must file form 944. Get ready for tax season deadlines by completing any required tax forms today.

However, If You Made Deposits On Time In Full Payment Of The.

Web “form 944,” and “2020” on your check or money order. Complete, edit or print tax forms instantly. Or claim for refund, to replace form 941c, supporting statement to correct information. For the vast majority of these.

For Filing The Employer's Annual Federal Tax Return, Employers Must Know The.

All employers are required to hold their employee’s fica (medicare and social security) and income. Ad complete irs tax forms online or print government tax documents. Web form 944 for 2022: Web the irs form 944 takes the place of form 941 if a small business qualifies.

To Modify Tax Tracking For Any Payroll Item:

Who must file form 944. The finalized versions of the. Web irs form 944 is an annual filing. Web irs form 944 allows smaller employers to report and pay federal payroll taxes once a year rather than quarterly.

Double Click The Payroll Item In Question.

The deadline for filing the form is feb. Web though the form has instructions to guide you through filling it out, make sure you take your time to do it accurately. If you are a child,. Web form 944, or the employer’s annual federal tax return, is an internal revenue services (irs) form that reports the taxes you’ve withheld from employee’s.