Ri 1040 Tax Form

Ri 1040 Tax Form - Individual tax return form 1040 instructions; Complete your 2021 federal income tax return first. Instead, just put them loose in the envelope. Web multiply line 1 by line 7. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022. And must pay the appropriate tax due with a check payable to the ri division of taxa tion. Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. Web we last updated the 1040 estimated tax return with instructions in january 2022, so this is the latest version of form 1040es, fully updated for tax year 2022. Web form 1040h is a rhode island individual income tax form. Web information about form 1040, u.s.

Web dealer/consumer other tobacco products return name address address 2. Web multiply line 1 by line 7. This form is for income earned in. 03 fill out the forms: Web information about form 1040, u.s. The amount of your expected refund, rounded to the nearest dollar. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your spouse. Individual income tax return, including recent updates, related forms and instructions on how to file. Qualifying widow (er) ri 1040 h only. For example, if your expected refund is between $151.50 and $151.99 enter $152.

Web information about form 1040, u.s. The amount of your expected refund, rounded to the nearest dollar. Web we last updated the 1040 estimated tax return with instructions in january 2022, so this is the latest version of form 1040es, fully updated for tax year 2022. For example, if your expected refund is between $151.50 and $151.99 enter $152. You will have to fill out the forms with the information from your financial documents. If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. Your first name and middle initial last name 03 fill out the forms:

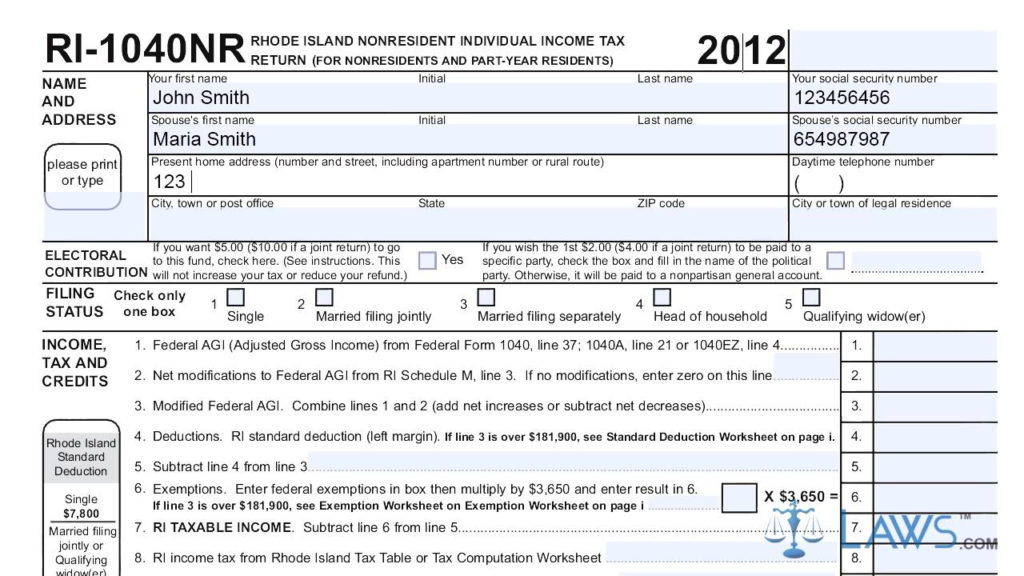

Form Ri 1040nr Nonresident Individual Tax Return 2021 Tax

Individual tax return form 1040 instructions; Qualifying widow (er) ri 1040 h only. Rhode island standard deduction single $8,900 married filing jointly or qualifying widow(er) $17,800 married filing separately $8,900 8 head of household $13,350 We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022..

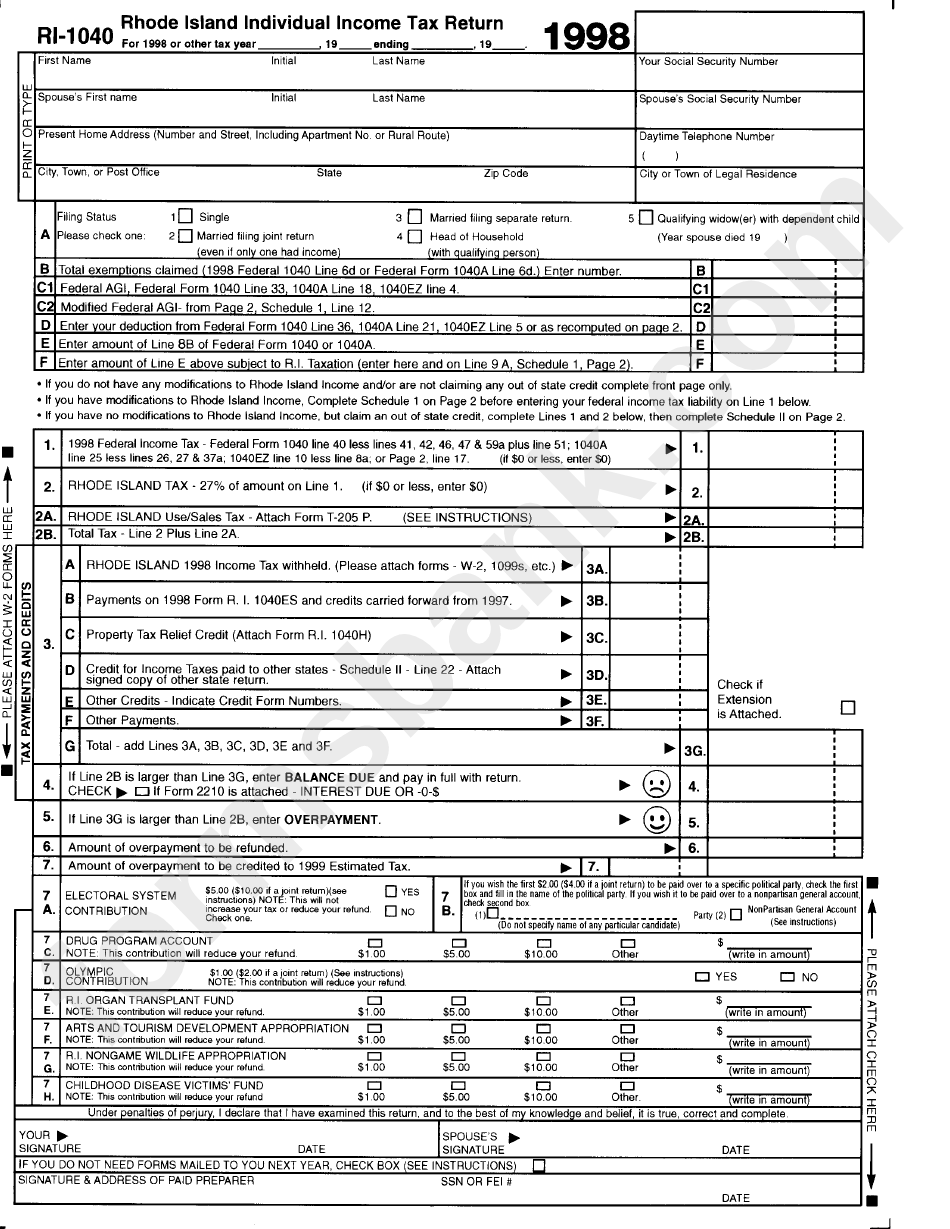

Fillable Form Ri1040 Rhode Island Individual Tax Return

Web information about form 1040, u.s. Web popular forms & instructions; Individual income tax return, including recent updates, related forms and instructions on how to file. The amount of your expected refund, rounded to the nearest dollar. Web head of household.

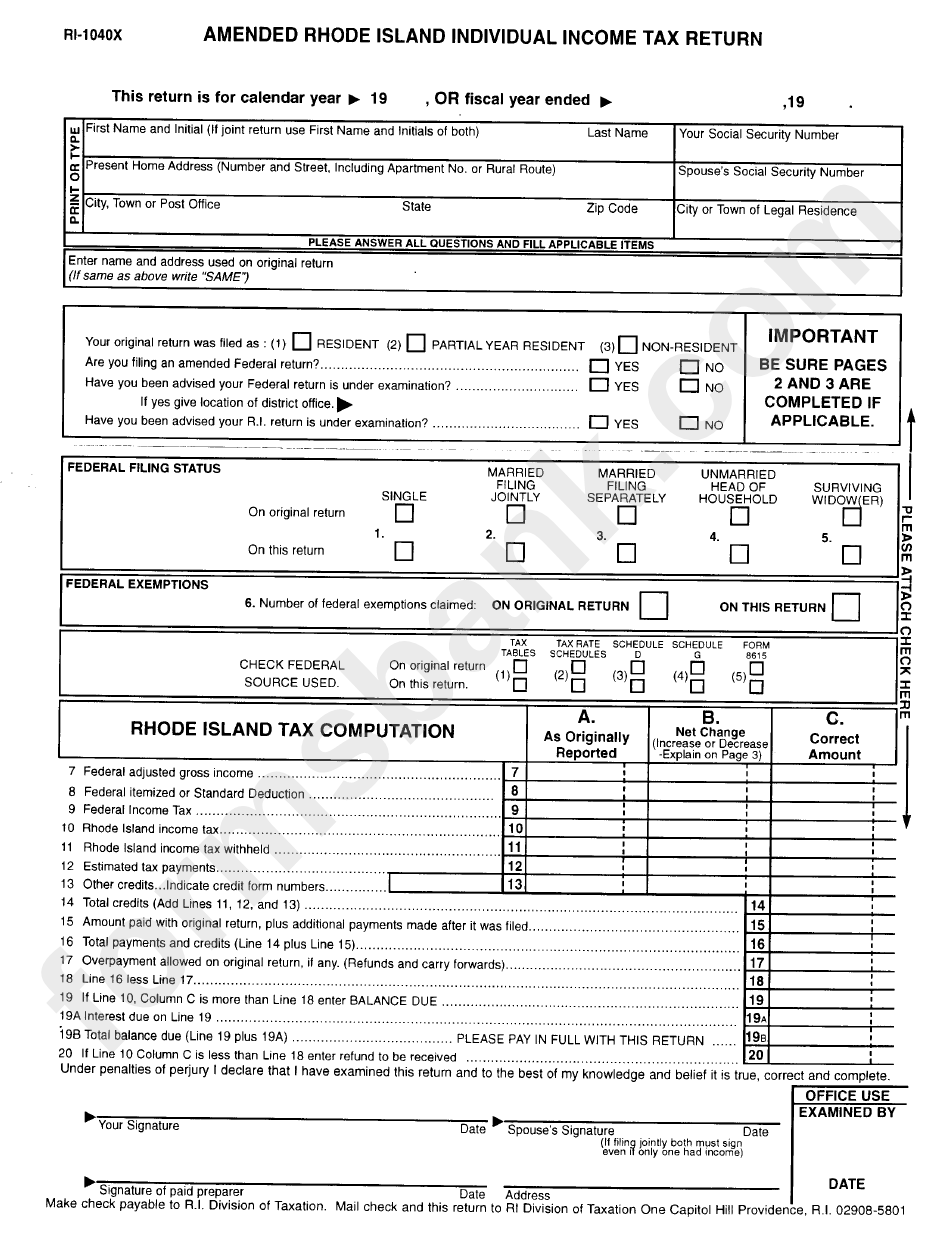

Fillable Form Ri1040x Amended Rhode Island Individual Tax

Web download or print the 2022 rhode island form 1040v (resident/nonresident return payment voucher ) for free from the rhode island division of taxation. Individual income tax return, including recent updates, related forms and instructions on how to file. Qualifying widow (er) ri 1040 h only. Web dealer/consumer other tobacco products return name address address 2. Web these 2021 forms.

RI RI1040MU 20202021 Fill out Tax Template Online US Legal Forms

We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022. Complete your 2021 federal income tax return first. Individual tax return form 1040 instructions; For example, if your expected refund is between $151.50 and $151.99 enter $152. Form 1040 is used by citizens or residents.

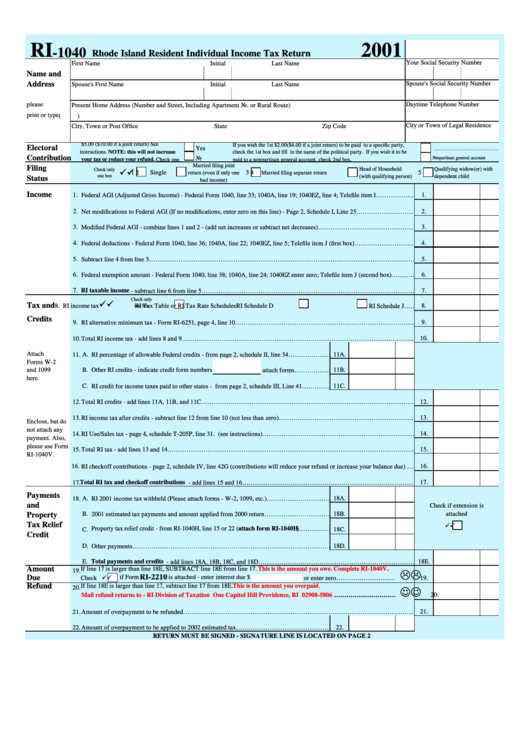

Form Ri1040 Rhode Island Resident Individual Tax Return 2001

03 fill out the forms: Web download or print the 2022 rhode island form 1040v (resident/nonresident return payment voucher ) for free from the rhode island division of taxation. Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. Web we last updated the 1040 estimated.

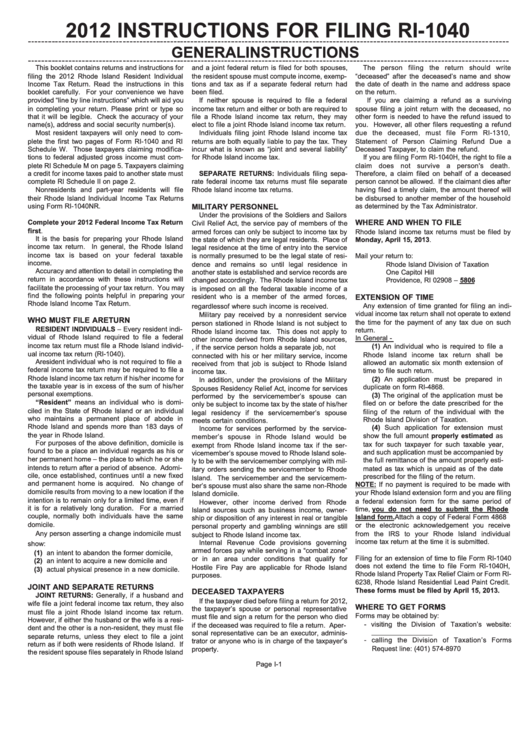

Instructions For Form Ri1040 2012 printable pdf download

It is the basis for preparing your rhode island income tax return. Web form 1040h is a rhode island individual income tax form. If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: Web head of household. Web multiply line 1 by line 7.

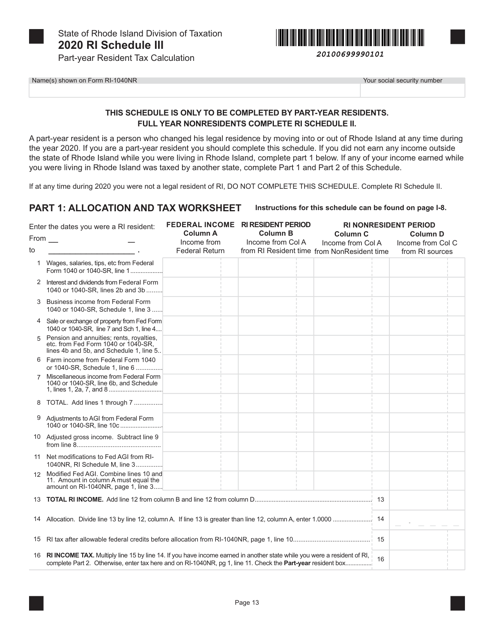

Form RI1040NR Schedule III Download Fillable PDF or Fill Online Part

Instead, just put them loose in the envelope. You will have to fill out the forms with the information from your financial documents. Web form 1040h is a rhode island individual income tax form. Individual income tax return, including recent updates, related forms and instructions on how to file. It is the basis for preparing your rhode island income tax.

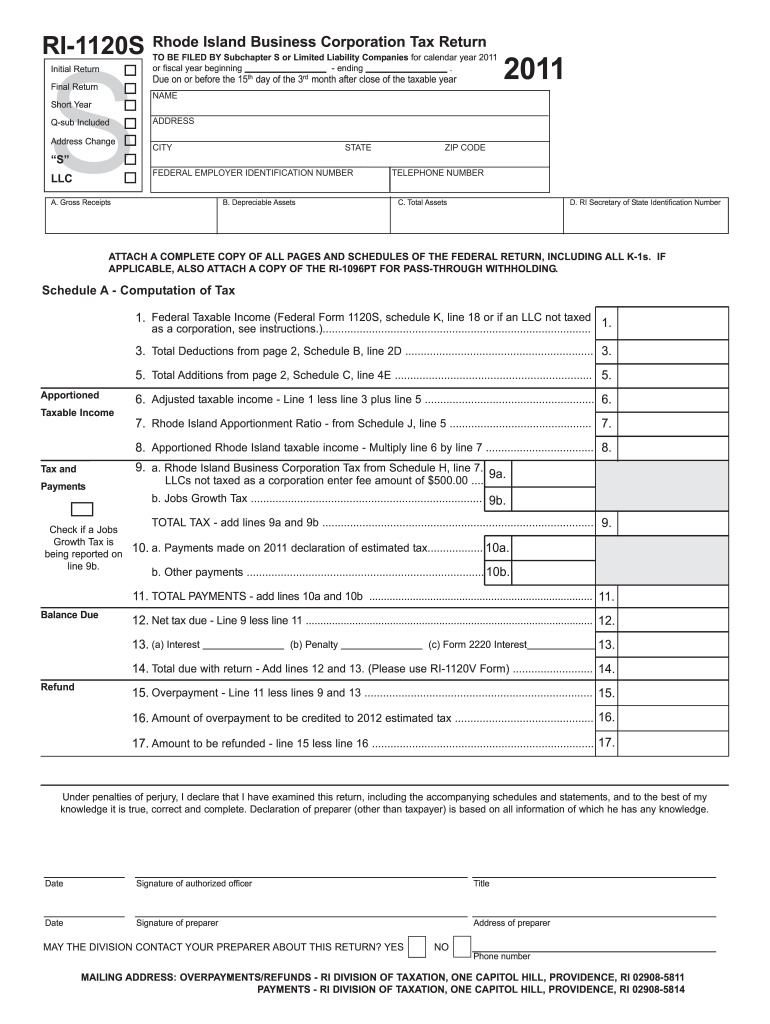

Ri 1120S Fill Out and Sign Printable PDF Template signNow

Rhode island standard deduction single $8,900 married filing jointly or qualifying widow(er) $17,800 married filing separately $8,900 8 head of household $13,350 Instead, just put them loose in the envelope. Web form 1040h is a rhode island individual income tax form. Web information about form 1040, u.s. Web head of household.

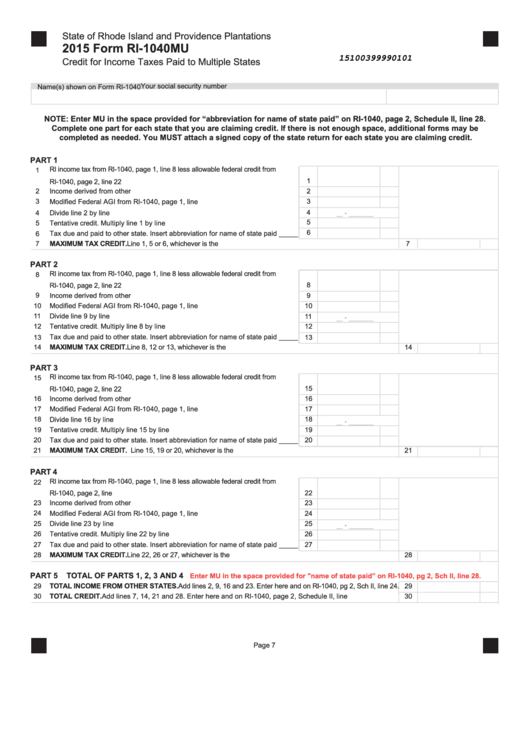

Fillable Form Ri1040mu Credit For Taxes Paid To Multiple

Web dealer/consumer other tobacco products return name address address 2. Web we last updated the 1040 estimated tax return with instructions in january 2022, so this is the latest version of form 1040es, fully updated for tax year 2022. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated.

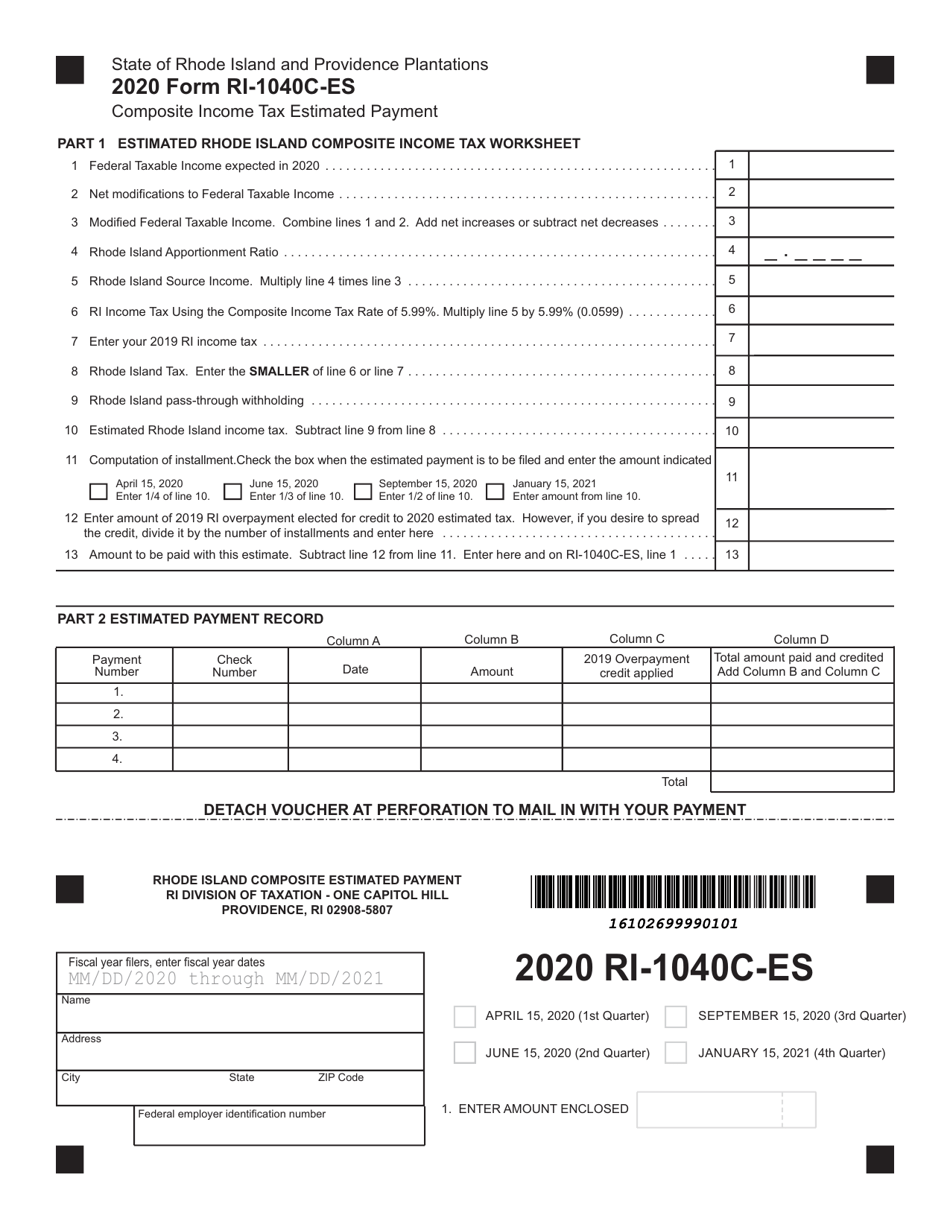

Form RI1040CES Download Fillable PDF or Fill Online Composite

Web head of household. Qualifying widow (er) ri 1040 h only. We last updated the resident tax return in february 2023, so this is the latest version of form 1040, fully updated for tax year 2022. If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: Your.

Web The Ri Division Of Taxation Makes Available All Of The Forms And Instructions Needed To Register With The Division, File And Pay Taxes, Request A Letter Of Good Standing, Request A Sales Tax Exemption, Comply With Reporting Requirements, Among Others.

Web dealer/consumer other tobacco products return name address address 2. Web information about form 1040, u.s. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your spouse. You will have to fill out the forms with the information from your financial documents.

Individual Tax Return Form 1040 Instructions;

Individual income tax return, including recent updates, related forms and instructions on how to file. It is the basis for preparing your rhode island income tax return. Web if you are a nonresident or part time resident that needs to file taxes in rhode island, you need to file form 1040nr. The amount of your expected refund, rounded to the nearest dollar.

This Form Is For Income Earned In.

Web these 2021 forms and more are available: And must pay the appropriate tax due with a check payable to the ri division of taxa tion. Some common tax credits apply to many taxpayers, while others only apply to extremely specific situations. Complete your 2021 federal income tax return first.

Your First Name And Middle Initial Last Name

Form 1040 is used by citizens or residents of the united states to file an annual income tax return. Instead, just put them loose in the envelope. Web multiply line 1 by line 7. Qualifying widow (er) ri 1040 h only.