What Is Form 592 B

What Is Form 592 B - Solved•by intuit•8•updated july 13, 2022. 1065 california (ca) california partners are taxed based on the amount of the cash and property. Exemption from withholding the withholding requirements do not apply to:. There are 9 integers that are factors of 592. Form 592 is the statement the withholding agent fills out, signs, dates and submits to the ftb. Please provide your email address and it will be emailed to. The biggest factor of 592 is 296. Business name ssn or itin fein ca corp no. Web file form 592 to report withholding on domestic nonresident individuals. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023.

The biggest factor of 592 is 296. Go to the input returntab and select state & local. Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Exemption from withholding the withholding requirements do not apply to:. Form 592 is the statement the withholding agent fills out, signs, dates and submits to the ftb. Web file form 592 to report withholding on domestic nonresident individuals. 1065 california (ca) california partners are taxed based on the amount of the cash and property. Positive integers that divides 592.

There are 9 integers that are factors of 592. Go to the input returntab and select state & local. Form 592 is the statement the withholding agent fills out, signs, dates and submits to the ftb. The biggest factor of 592 is 296. Web file form 592 to report withholding on domestic nonresident individuals. Positive integers that divides 592. Exemption from withholding the withholding requirements do not apply to:. Please provide your email address and it will be emailed to. Items of income that are subject to withholding are payments to independent contractors,. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023.

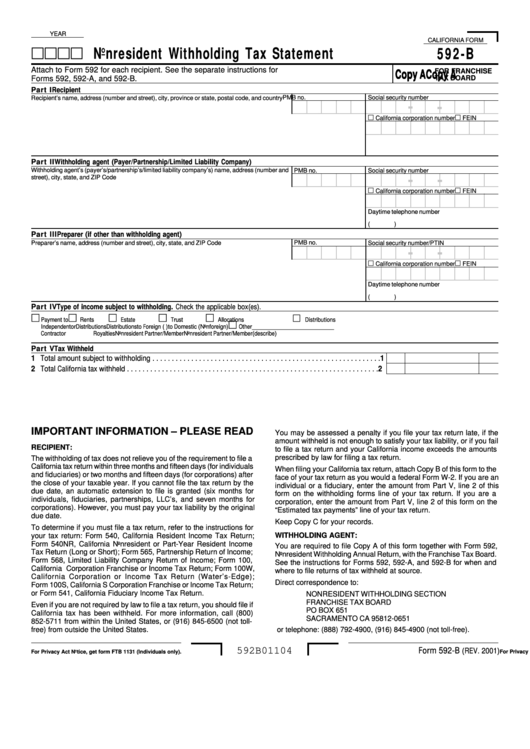

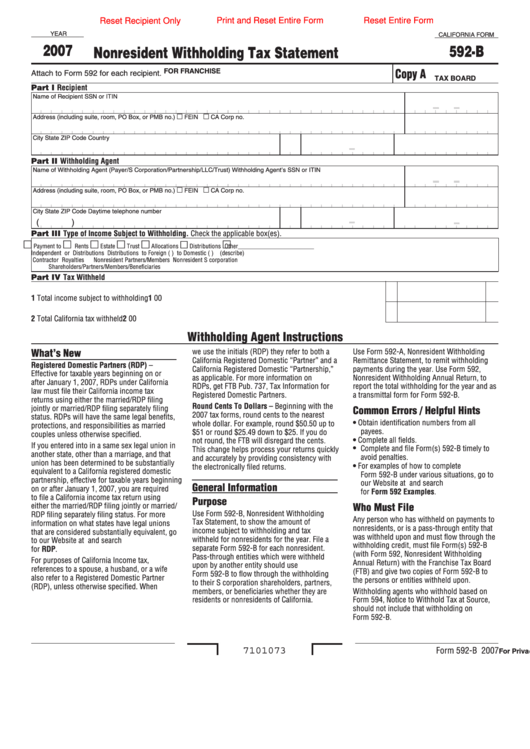

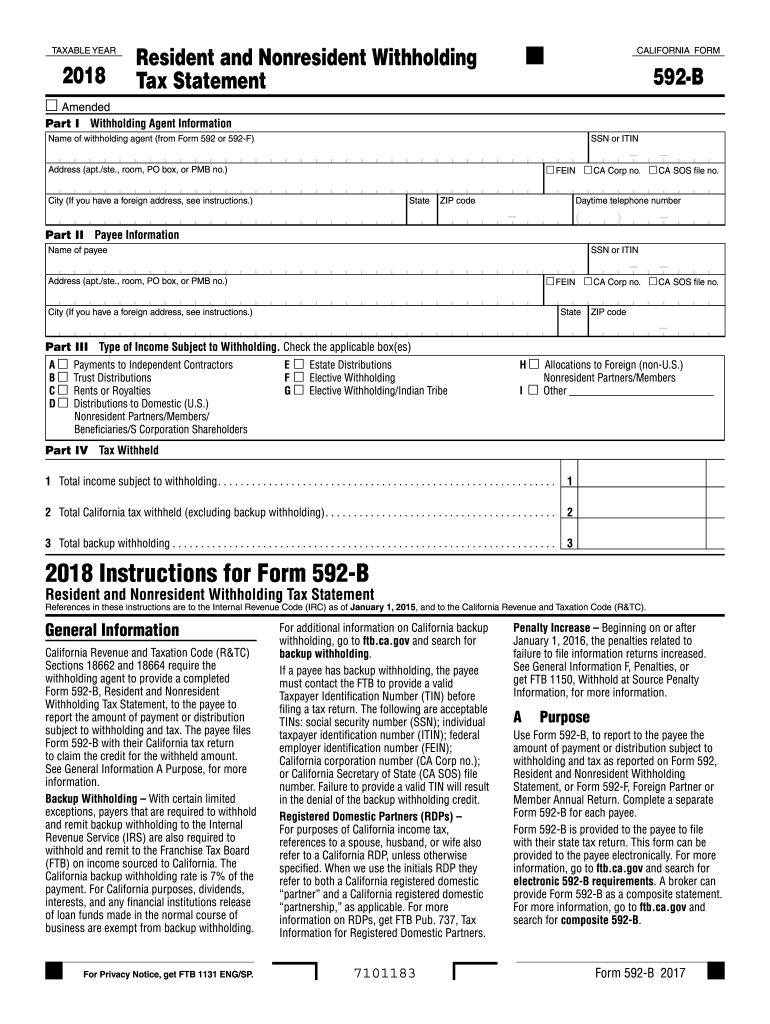

Form 592B Nonresident Withholding Tax Statement 2001 printable pdf

The biggest factor of 592 is 296. Web file form 592 to report withholding on domestic nonresident individuals. Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. • april 18, 2022 june 15, 2022 september 15, 2022 january.

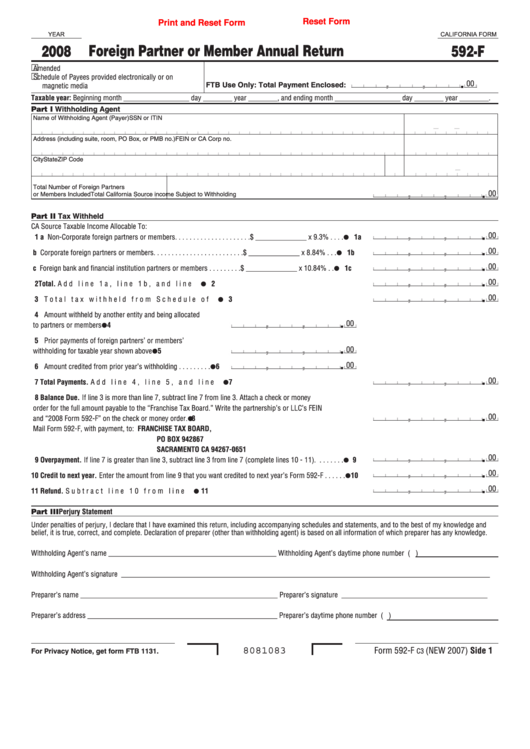

Fillable California Form 592F Foreign Partner Or Member Annual

Web file form 592 to report withholding on domestic nonresident individuals. Items of income that are subject to withholding are payments to independent contractors,. • april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Positive integers that divides 592. Exemption from withholding the withholding requirements do not apply to:.

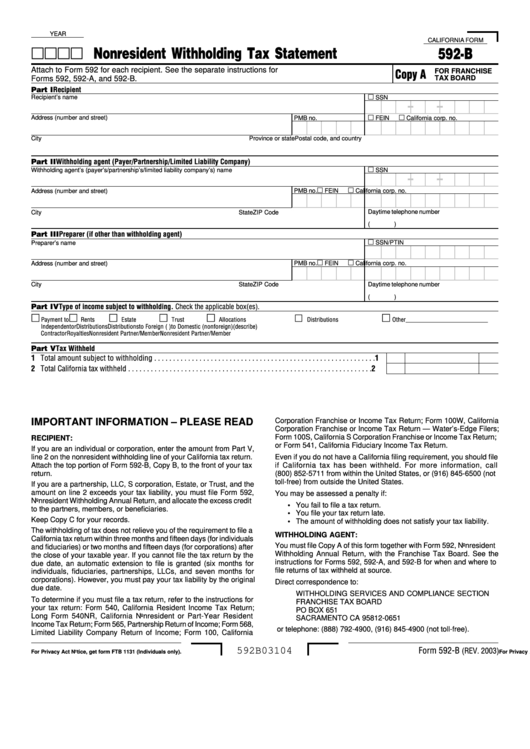

Form 592B Nonresident Withholding Tax Statement printable pdf download

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. There are 9 integers that are factors of 592. Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Web file form 592 to report withholding on domestic nonresident individuals. Go to the input returntab and select state & local.

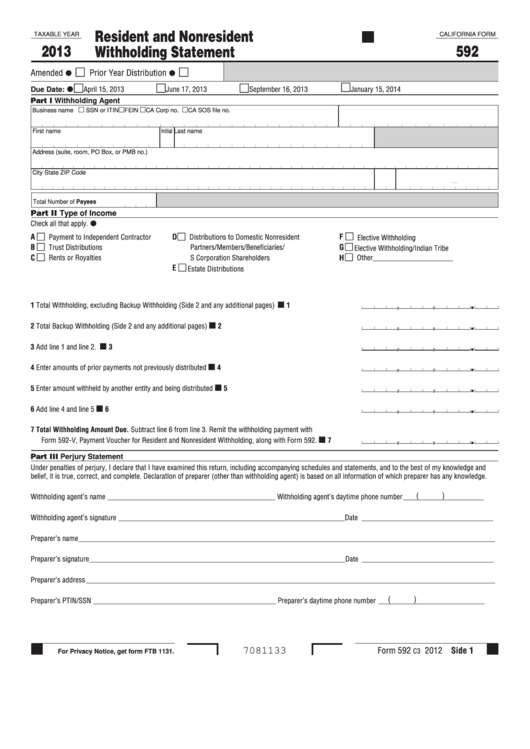

44 California Ftb 592 Forms And Templates free to download in PDF

There are 9 integers that are factors of 592. Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Business name ssn or itin fein ca corp no. Positive integers that divides 592.

Fillable California Form 592B Nonresident Withholding Tax Statement

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. There are 9 integers that are factors of 592. Go to the input returntab and select state & local. Web file form 592 to report withholding on domestic nonresident individuals. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by.

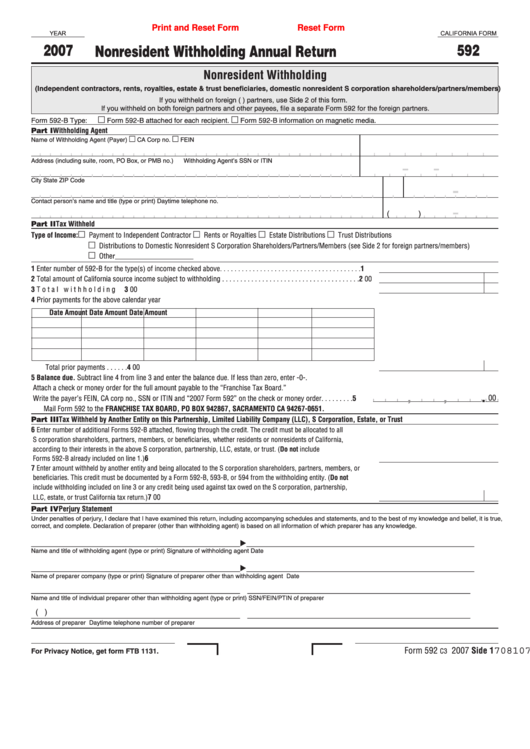

California Form 592 Nonresident Withholding Annual Return 2007

1065 california (ca) california partners are taxed based on the amount of the cash and property. Form 592 is the statement the withholding agent fills out, signs, dates and submits to the ftb. Go to the input returntab and select state & local. Business name ssn or itin fein ca corp no. Positive integers that divides 592.

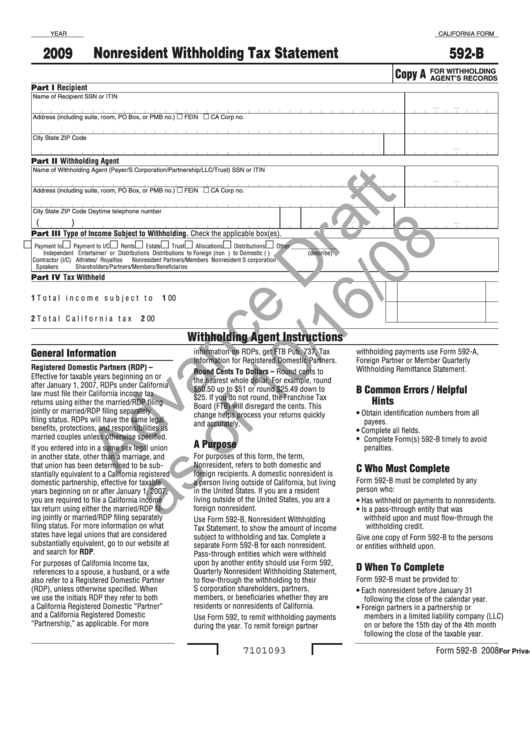

California Form 592B Draft Nonresident Withholding Tax Statement

Please provide your email address and it will be emailed to. Items of income that are subject to withholding are payments to independent contractors,. 1065 california (ca) california partners are taxed based on the amount of the cash and property. Exemption from withholding the withholding requirements do not apply to:. The biggest factor of 592 is 296.

Form 592B Franchise Tax Board Edit, Fill, Sign Online Handypdf

Business name ssn or itin fein ca corp no. 1065 california (ca) california partners are taxed based on the amount of the cash and property. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Exemption from withholding the.

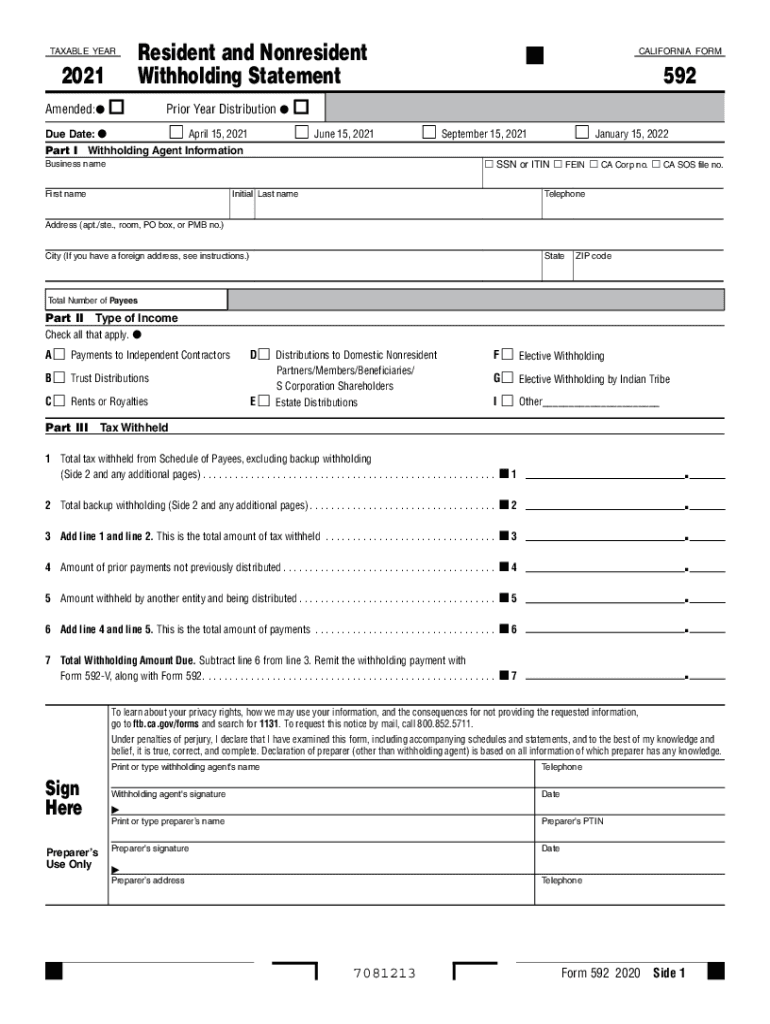

Ca 592 form Fill out & sign online DocHub

Form 592 is the statement the withholding agent fills out, signs, dates and submits to the ftb. There are 9 integers that are factors of 592. Items of income that are subject to withholding are payments to independent contractors,. Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Please provide your email address and it will.

2018 Form CA FTB 592B Fill Online, Printable, Fillable, Blank pdfFiller

Factors of 592 are 1, 2, 4, 8, 16, 37, 74, 148, 296. Business name ssn or itin fein ca corp no. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request. Items of income that are subject to withholding are payments to independent contractors,. Positive integers that divides 592.

Exemption From Withholding The Withholding Requirements Do Not Apply To:.

Web file form 592 to report withholding on domestic nonresident individuals. Go to the input returntab and select state & local. 1065 california (ca) california partners are taxed based on the amount of the cash and property. Web 2021, 592, instructions for form 592, resident and nonresident withholding statement this is only available by request.

Factors Of 592 Are 1, 2, 4, 8, 16, 37, 74, 148, 296.

Form 592 is the statement the withholding agent fills out, signs, dates and submits to the ftb. Please provide your email address and it will be emailed to. The biggest factor of 592 is 296. Solved•by intuit•8•updated july 13, 2022.

Items Of Income That Are Subject To Withholding Are Payments To Independent Contractors,.

• april 18, 2022 june 15, 2022 september 15, 2022 january 17, 2023. Business name ssn or itin fein ca corp no. There are 9 integers that are factors of 592. Positive integers that divides 592.