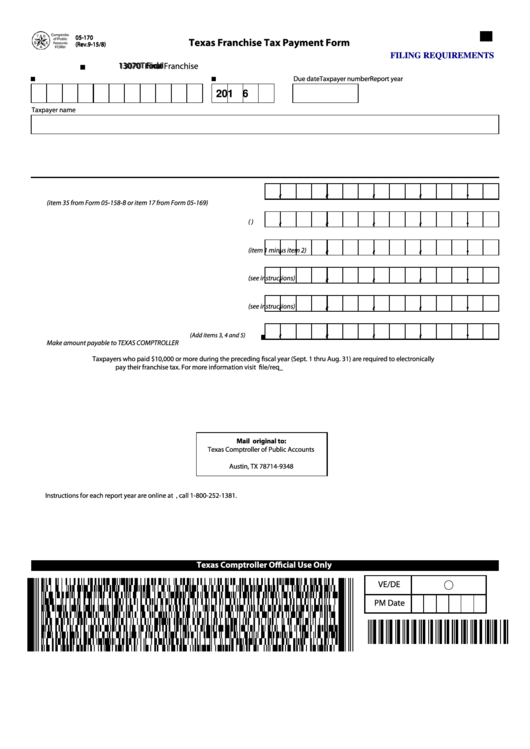

Texas Form 05-170

Texas Form 05-170 - If the tax due is less than $1,000 no payment is required, so the voucher will not print. If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is required. Top marriage/divorce record forms use these. *must be a qualified person. Download your customized form and share it as you needed. Web how to edit and sign texas form 05 170 online. Texas driver license or texas identification card not expired more than 2 years. Texas franchise tax tiered partnership report. Web primary identity documents include: If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is.

Web birth record forms use these forms for ordering or changing birth records. Texas franchise tax tiered partnership report. At first, direct to the “get form” button and click on it. Customize your document by using the toolbar on the top. Select texas > select franchise tax. If tax due is less than $1,000 no payment is required, so the voucher will not print. Web how to edit and sign texas form 05 170 online. Download your customized form and share it as you needed. If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is. If the tax due is less than $1,000 no payment is required, so the voucher will not print.

If tax due is less than $1,000 no payment is required, so the voucher will not print. Web primary identity documents include: *must be a qualified person. At first, direct to the “get form” button and click on it. Texas franchise tax common owner information report. Web how to edit and sign texas form 05 170 online. Only amounts over $1,000 will show on this form. The files will be transmitted to texas. Texas franchise tax tiered partnership report. Web birth record forms use these forms for ordering or changing birth records.

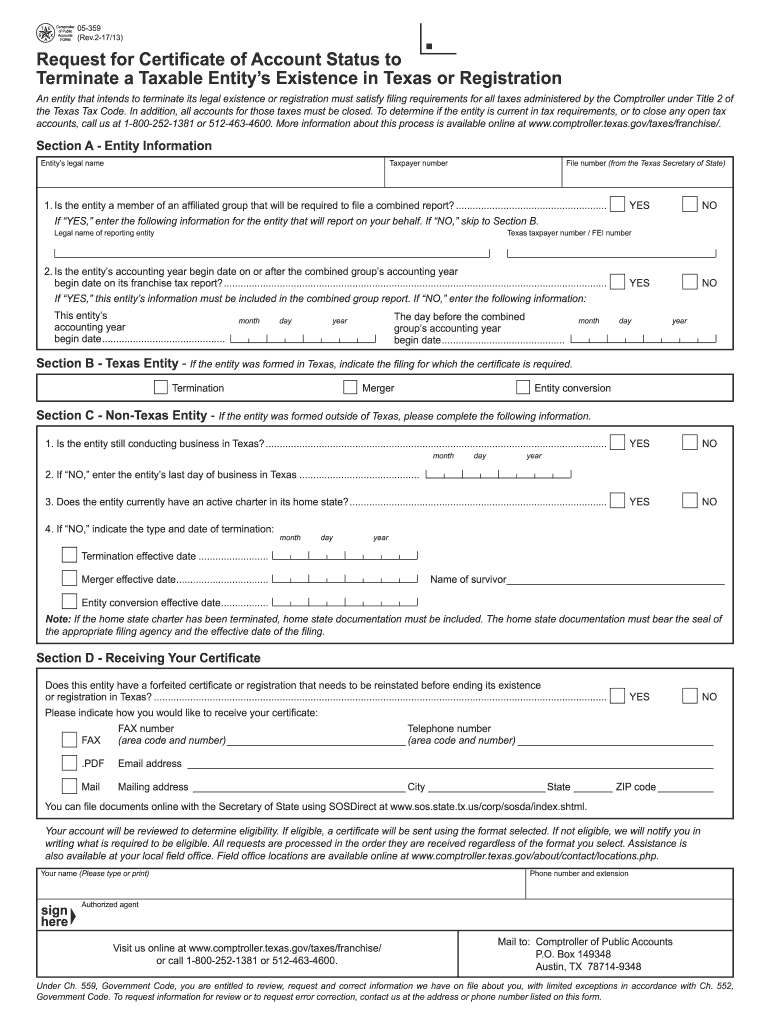

20172022 Form TX 05359 Fill Online, Printable, Fillable, Blank

Customize your document by using the toolbar on the top. Texas franchise tax tiered partnership report. *must be a qualified person. The files will be transmitted to texas. Download your customized form and share it as you needed.

Gallery of Texas form 05 359 New Wo A2 Antibo S Directed to

Total tax due on this report 1. Top death record forms use these forms for ordering or changing death records. Only amounts over $1,000 will show on this form. Top marriage/divorce record forms use these. Franchise (1), bank franchise (2).

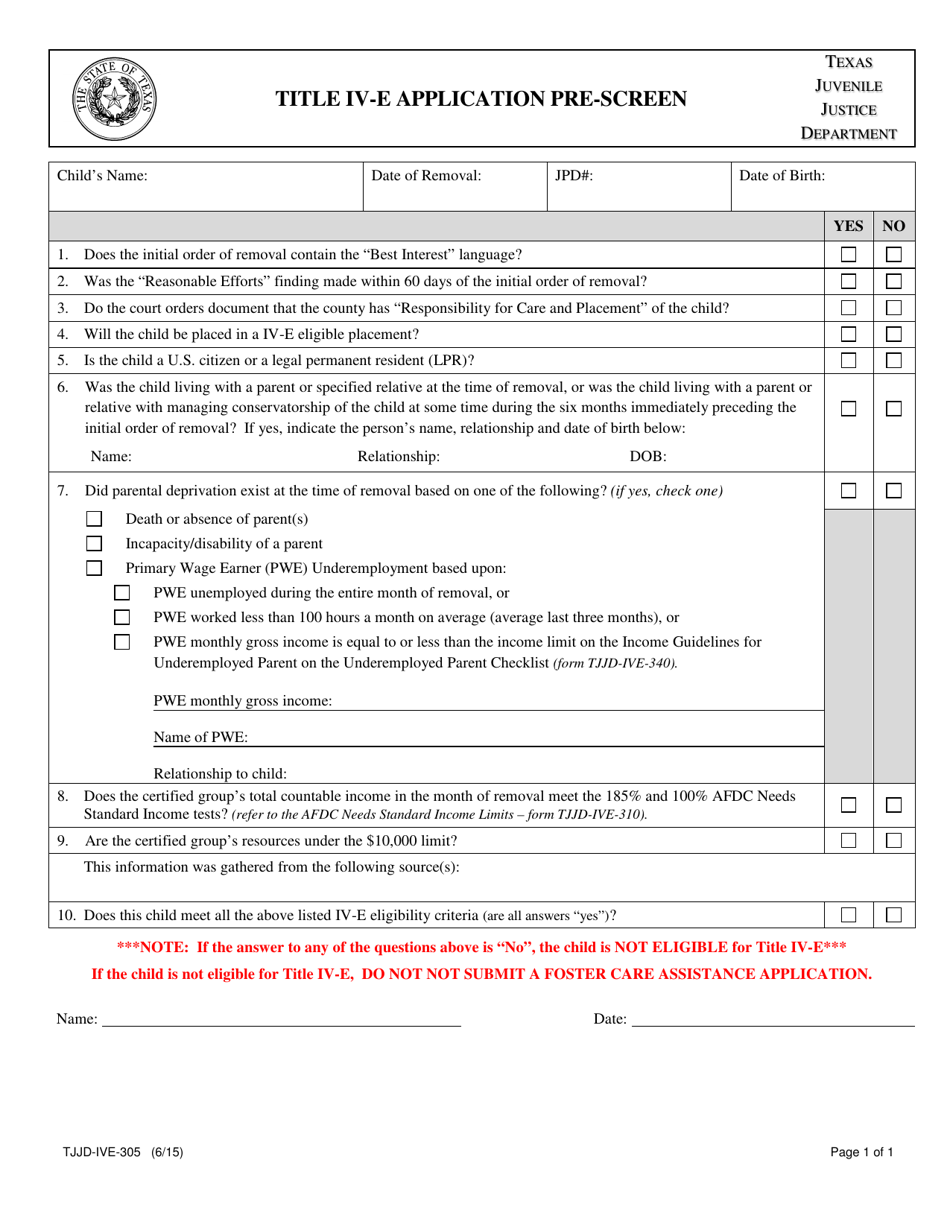

Form TJJDIVE305 Download Fillable PDF or Fill Online Title IVE

If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is required. If the tax due is less than $1,000 no payment is required, so the voucher will not print. Wait until texas form 05 170 is shown. *must be a qualified person. Texas franchise tax ez.

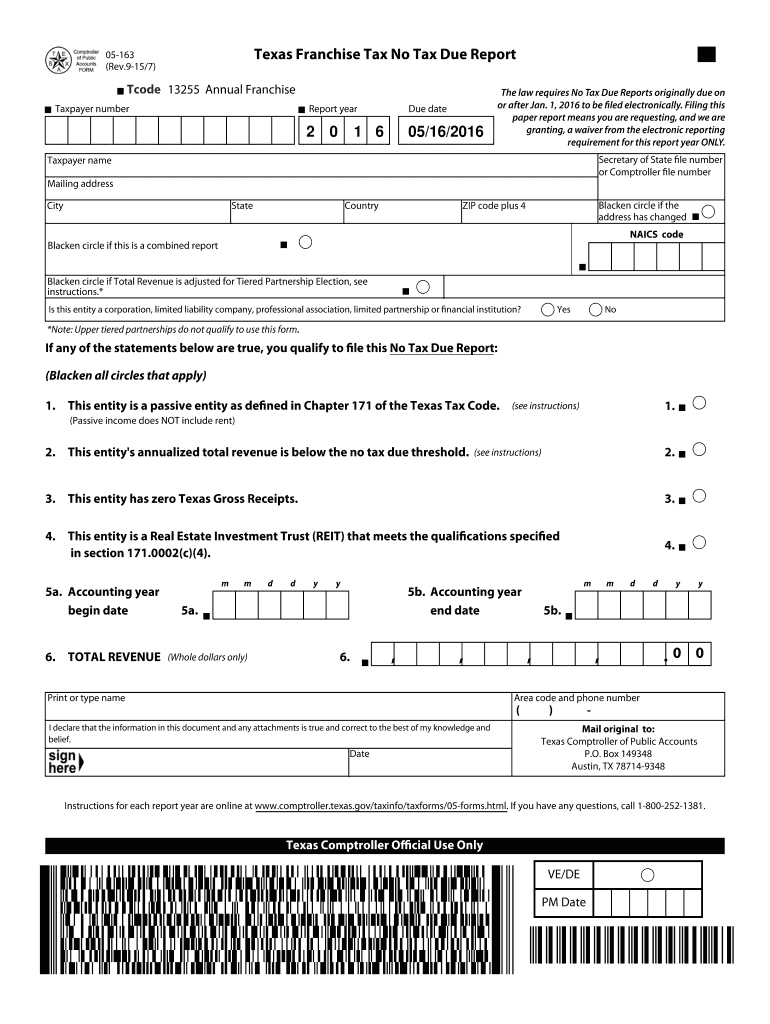

2015 Form TX Comptroller 05163 Fill Online, Printable, Fillable, Blank

Texas franchise tax common owner information report. Select texas > select franchise tax. Download your customized form and share it as you needed. Wait until texas form 05 170 is shown. If tax due is less than $1,000 no payment is required, so the voucher will not print.

How To Estimate Texas Franchise Tax

Texas franchise tax common owner information report. Texas franchise tax tiered partnership report. Texas franchise tax ez computation report. If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is. Texas franchise tax payment form.

Texas Form 05 102 Instructions

The files will be transmitted to texas. Select texas > select franchise tax. Top death record forms use these forms for ordering or changing death records. Texas franchise tax ez computation report. If tax due is less than $1,000 no payment is required, so the voucher will not print.

Gallery of Texas form 05 359 New Wo A2 Antibo S Directed to

Web birth record forms use these forms for ordering or changing birth records. Texas franchise tax common owner information report. If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is. Web primary identity documents include: Total tax due on this report 1.

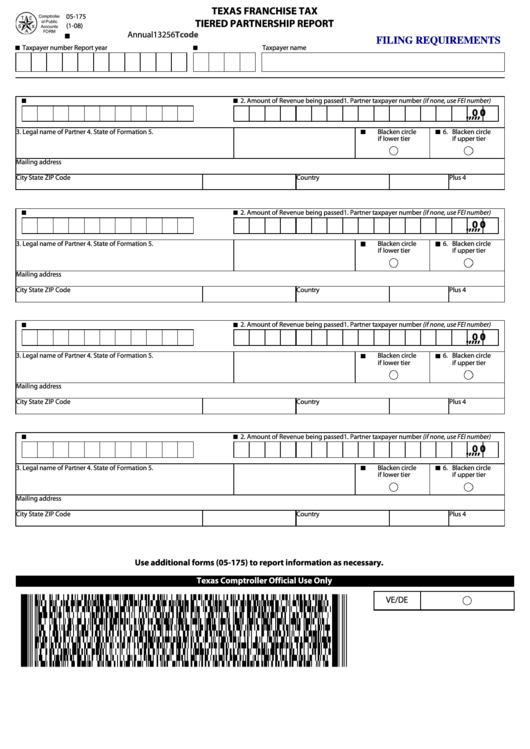

Fillable Form 05175 Texas Franchise Tax Annual Tiered Partnership

Web how to edit and sign texas form 05 170 online. *must be a qualified person. If tax due is less than $1,000 no payment is required, so the voucher will not print. At first, direct to the “get form” button and click on it. If the tax due is less than $1,000 no payment is required, so the voucher.

Form 398 Download Printable PDF or Fill Online Order Transferring Venue

Web how to edit and sign texas form 05 170 online. If tax due is less than $1,000 no payment is required, so the voucher will not print. If the total revenue amount is below the no tax due threshold, even if the tax due is more than $1,000, no payment is required. Select texas > select franchise tax. Download.

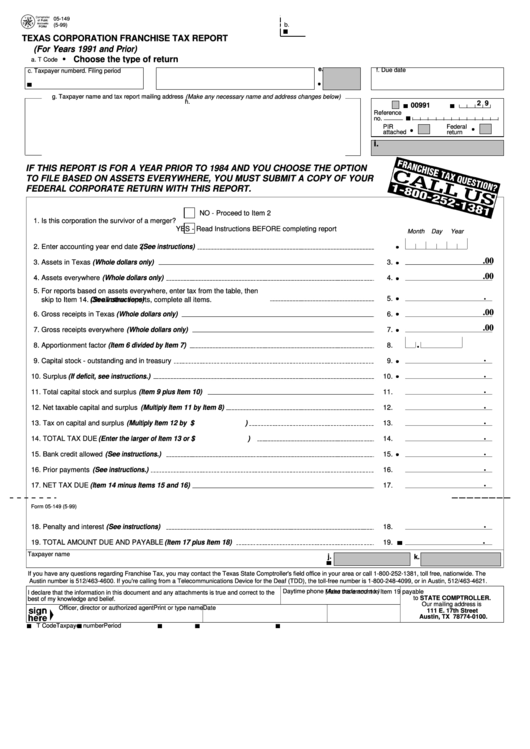

Fillable Form 05364 Texas Corporation Franchise Tax Report printable

Wait until texas form 05 170 is shown. The files will be transmitted to texas. Web primary identity documents include: Web birth record forms use these forms for ordering or changing birth records. Download your customized form and share it as you needed.

If The Total Revenue Amount Is Below The No Tax Due Threshold, Even If The Tax Due Is More Than $1,000, No Payment Is Required.

If the tax due is less than $1,000 no payment is required, so the voucher will not print. Total tax due on this report 1. *must be a qualified person. The files will be transmitted to texas.

Select Texas > Select Franchise Tax.

Only amounts over $1,000 will show on this form. Texas franchise tax payment form. Web how to edit and sign texas form 05 170 online. Texas franchise tax tiered partnership report.

If The Total Revenue Amount Is Below The No Tax Due Threshold, Even If The Tax Due Is More Than $1,000, No Payment Is.

Top death record forms use these forms for ordering or changing death records. *must be a qualified person. Web birth record forms use these forms for ordering or changing birth records. Texas driver license or texas identification card not expired more than 2 years.

Download Your Customized Form And Share It As You Needed.

Certificate of citizenship or certificate of naturalization with identifiable photograph. Franchise (1), bank franchise (2). Customize your document by using the toolbar on the top. Web primary identity documents include: