Form 1128 Instructions

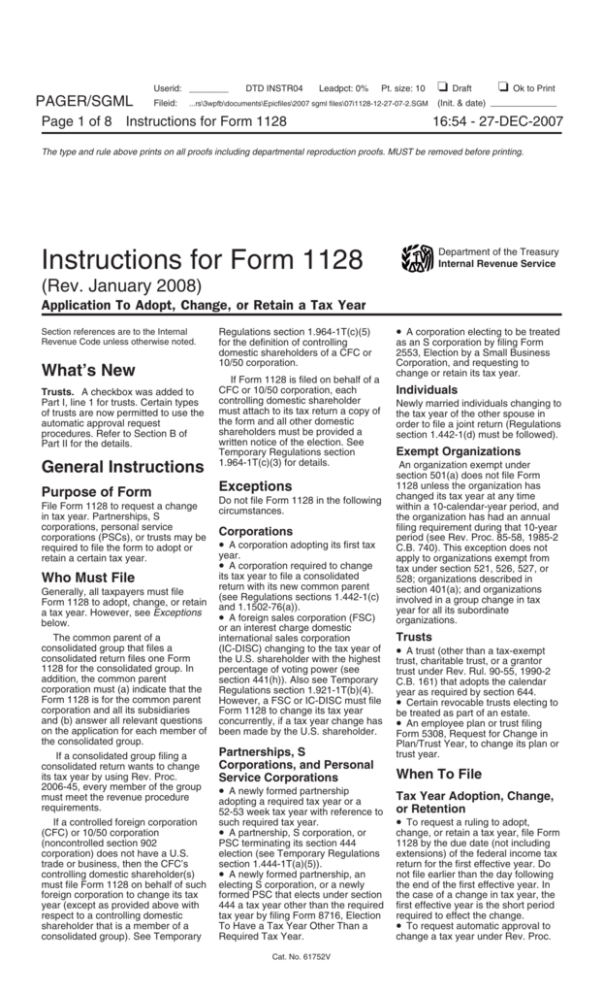

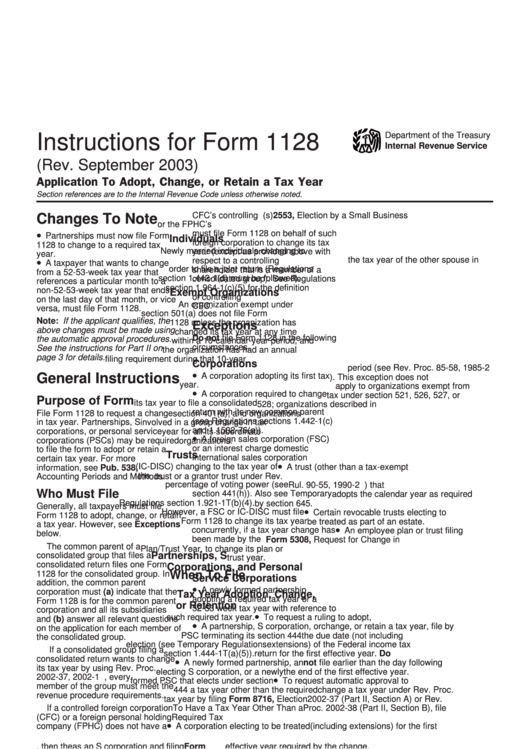

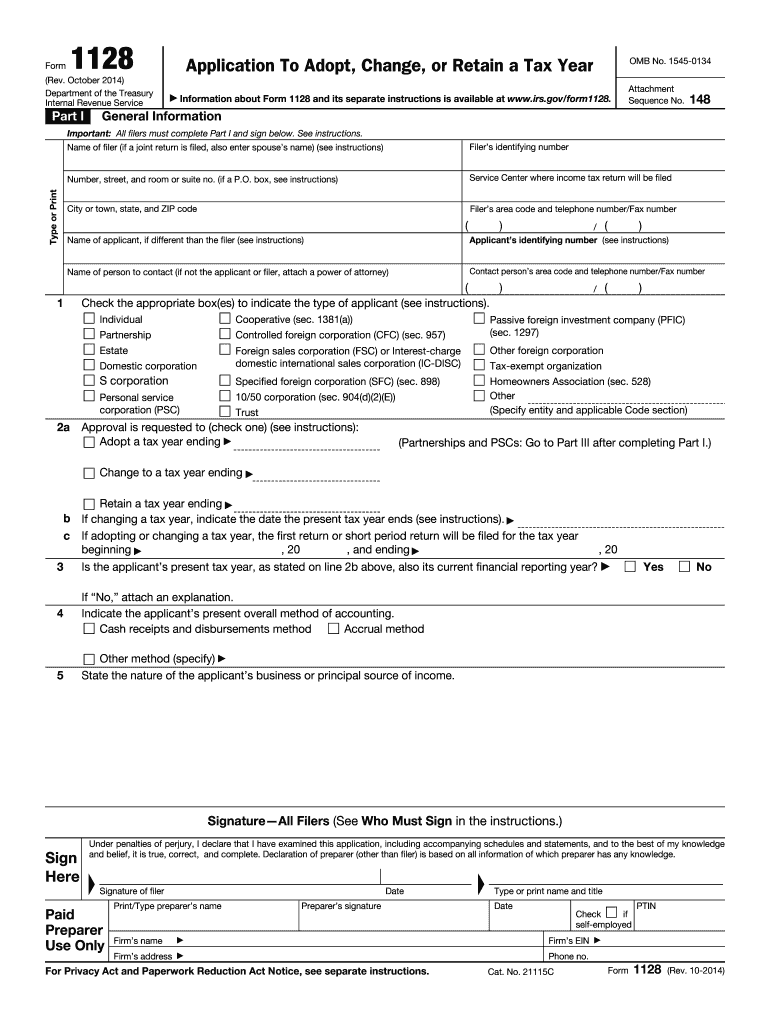

Form 1128 Instructions - Partnerships, s corporations, personal service corporations (pscs), or trusts may be required to file form 1128 to adopt or retain a certain tax year. Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287: Internal revenue service check the appropriate box(es) to indicate the type of applicant that is filing this form (see page 2 of the instructions). Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. If the form does not have a valid signature, it will not be considered. Part ii is used for an automatic approval request. Web form 1128 application to adopt, change, or retain a tax year (rev. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent Bank payment problem identification 1209 07/17/2012 form 8328:

Web form 1128 application to adopt, change, or retain a tax year (rev. The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change. Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. Partnerships, s corporations, personal service corporations (pscs), or trusts may be required to file form 1128 to adopt or retain a certain tax year. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. Web file form 1128 with: A valid signature by the individual or an officer of the organization is required on form 1128. Web form 1128 must be signed by the applicant as discussed below. Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Bank payment problem identification 1209 07/17/2012 form 8328:

Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Part ii is used for an automatic approval request. Where the applicant's income tax return is filed. Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. Web file form 1128 with: Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287: Carryforward election of unused private activity bond volume cap 0822 09/01/2022 form 15028 Web form 1128 must be signed by the applicant as discussed below. Web file form 1128 to request a change in tax year. A valid signature by the individual or an officer of the organization is required on form 1128.

Instructions for Form 1128 (Rev. January 2008)

In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent A valid signature by the individual or an officer of the organization is required on form 1128. Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. The common parent.

3.13.222 BMF Entity Unpostable Correction Procedures Internal Revenue

If the form does not have a valid signature, it will not be considered. If this application is for a husband and wife, enter both names on the line, “applicant's name.” A valid signature by the individual or an officer of the organization is required on form 1128. Web form 1128 must be signed by the applicant as discussed below..

LASKO 1128 INSTRUCTIONS Pdf Download ManualsLib

Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. If this application is for a husband and wife, enter both names on the line, “applicant's name.” All filers must complete part i. Web information about form 1128, application to adopt, change or retain a tax year, including.

Form 1128 Application to Adopt, Change or Retain a Tax Year(2014

The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change. All filers must complete part i. Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. Where the applicant's.

Instructions For Form 1128 Application To Adopt, Change, Or Retain A

Web a tax year, you must file form 1128 by the 75th day of the beginning of the tax year that you want to retain. Bank payment problem identification 1209 07/17/2012 form 8328: In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent The applicant also must attach a copy of form.

Form C23 (BWC1128) Download Printable PDF or Fill Online Notice to

Carryforward election of unused private activity bond volume cap 0822 09/01/2022 form 15028 If this application is for a husband and wife, enter both names on the line, “applicant's name.” Web form 1128 must be signed by the applicant as discussed below. All filers must complete part i. Web form 1128 application to adopt, change, or retain a tax year.

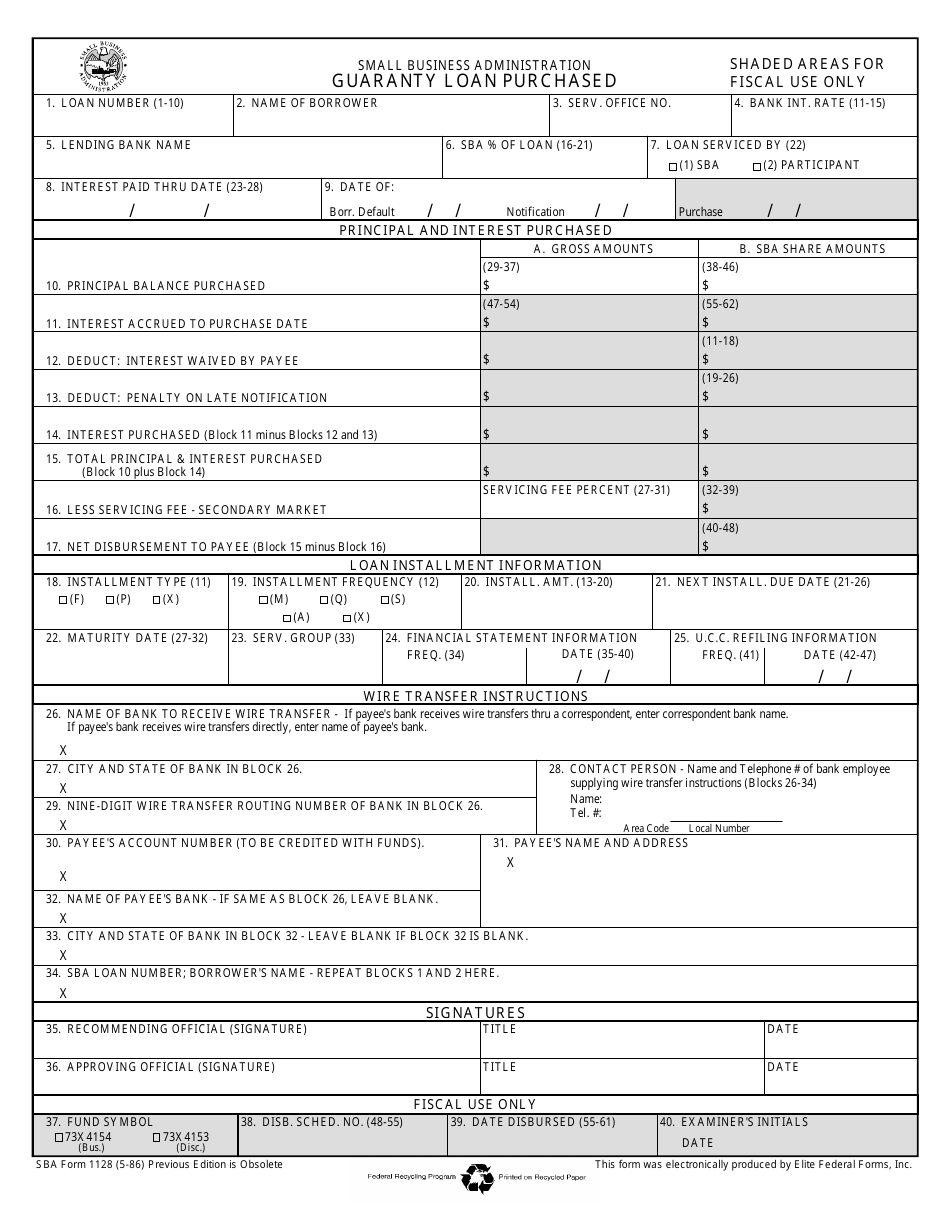

SBA Form 1128 Download Fillable PDF or Fill Online Guaranty Loan

Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late. Application to adopt, change or retain a tax year 1014 04/28/2017 form 13287: Web file form 1128 with: If the form does not have a valid signature, it will not be considered. Internal revenue service check the appropriate.

Instructions For Form 1128 Application To Adopt, Change, Or Retain A

Web form 1128 application to adopt, change, or retain a tax year (rev. Where the applicant's income tax return is filed. Form 1128 is used to request a change in tax year, and to adopt or retain a certain tax year (partnerships, s corporations, or personal service corporations). Partnerships, s corporations, personal service corporations (pscs), or trusts may be required.

Form 1128 Fill Out and Sign Printable PDF Template signNow

Web file form 1128 with: Web information about form 1128, application to adopt, change or retain a tax year, including recent updates, related forms, and instructions on how to file. Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Bank payment problem identification 1209 07/17/2012 form 8328: Form 1128 is used to request a.

Tax credit screening on job application

The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change. Web a tax year, you must file form 1128 by the 75th day of the beginning of the tax year that you want to retain. If the form does not have a valid signature,.

Web Information About Form 1128, Application To Adopt, Change Or Retain A Tax Year, Including Recent Updates, Related Forms, And Instructions On How To File.

Web file form 1128 with: Internal revenue service check the appropriate box(es) to indicate the type of applicant that is filing this form (see page 2 of the instructions). Web form 1128 application to adopt, change, or retain a tax year (rev. The applicant also must attach a copy of form 1128 to the federal income tax return filed for the short period required to effect the change.

Partnerships, S Corporations, Personal Service Corporations (Pscs), Or Trusts May Be Required To File Form 1128 To Adopt Or Retain A Certain Tax Year.

If this application is for a husband and wife, enter both names on the line, “applicant's name.” A valid signature by the individual or an officer of the organization is required on form 1128. Web a tax year, you must file form 1128 by the 75th day of the beginning of the tax year that you want to retain. Late applications.—if you file form 1128 after the appropriate due date as stated in instruction d above, your form 1128 is late.

Form 1128 Is Used To Request A Change In Tax Year, And To Adopt Or Retain A Certain Tax Year (Partnerships, S Corporations, Or Personal Service Corporations).

Carryforward election of unused private activity bond volume cap 0822 09/01/2022 form 15028 Web information about form 1128 and its separate instructions is available at. In addition, the common parent corporation must (a) indicate that the form 1128 is for the common parent Web form 1128 must be signed by the applicant as discussed below.

Where The Applicant's Income Tax Return Is Filed.

The common parent of a consolidated group that files a consolidated return files one form 1128 for the consolidated group. Web file form 1128 to request a change in tax year. Web generally, taxpayers must file form 1128 to adopt, change, or retain a tax year. Bank payment problem identification 1209 07/17/2012 form 8328: