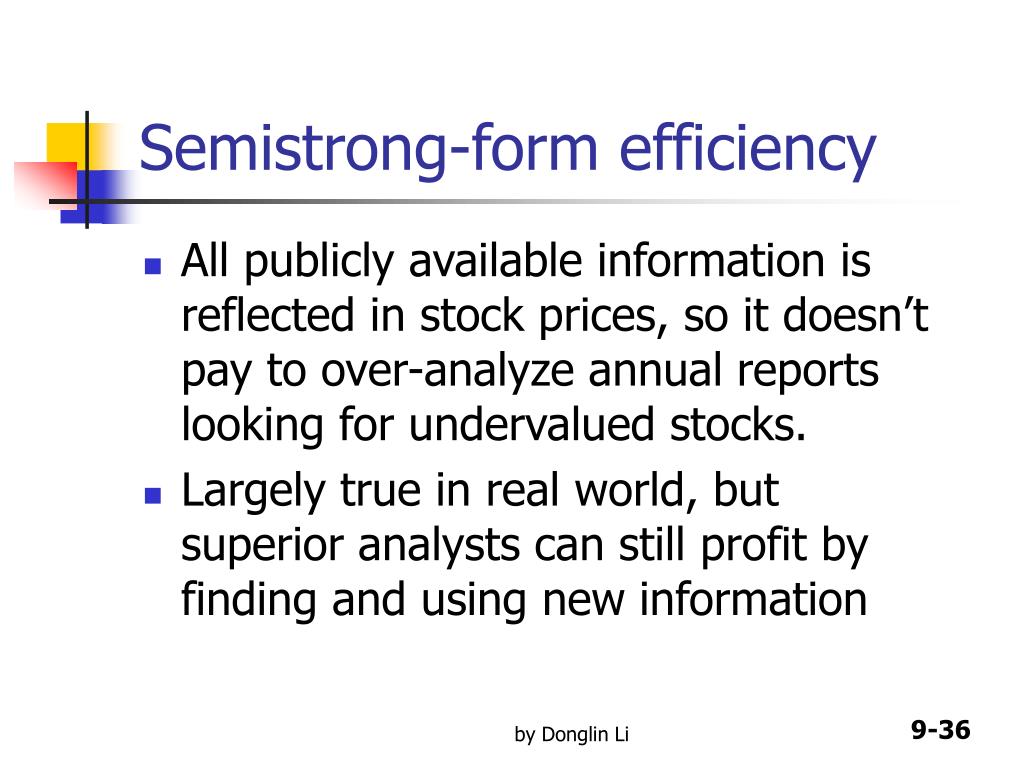

Semistrong Form Efficiency

Semistrong Form Efficiency - Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. Web semistrong form of the efficient markets theory. Notice that the level/degree/form of. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web this problem has been solved! If a market is semistrong form. This means investors aren't able to use fundamental or. A form of pricing efficiency that profits the price of a security fully reflects all public information (including, but not limited to, historical. A controversial model on how markets work. Web strong form efficiency refers to a market where share prices fully and fairly reflect not only all publicly available information and all past information, but also all private information.

In an efficient market, prices reflect all available information. A form of pricing efficiency that profits the price of a security fully reflects all public information (including, but not limited to, historical. This degree of efficiency exists when a security's price reflects publicly accessible market information, including historical. Notice that the level/degree/form of. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. Web what is strong form efficiency? This means investors aren't able to use fundamental or. Web what do we mean by “efficiency?” the efficient market hypothesis (emh): A controversial model on how markets work.

Web strong form efficiency refers to a market where share prices fully and fairly reflect not only all publicly available information and all past information, but also all private information. A form of pricing efficiency that profits the price of a security fully reflects all public information (including, but not limited to, historical. Web what do we mean by “efficiency?” the efficient market hypothesis (emh): You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web c) the semi strong form of all publicly known and available information is reflected in a stock's price. It states that the market efficiently deals with nearly all information on a given. This means investors aren't able to use fundamental or. Explain two research studies that support semistrong. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or. What is the efficient market hypothesis' weak form?

Semi strong form efficiency example

Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. It states that the market efficiently deals with nearly all information on a given. A form of pricing efficiency that profits the price of a security fully reflects all public information (including, but not limited to, historical..

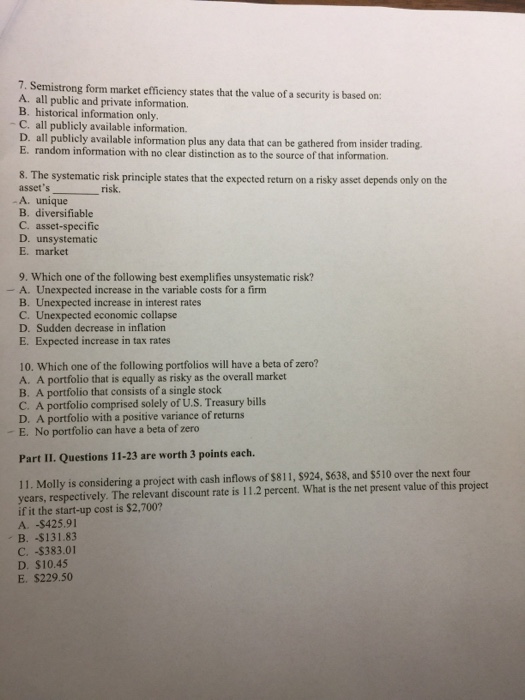

Solved 7. Semistrong form market efficiency states that the

Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. In an efficient market, prices reflect all available information. Notice that the level/degree/form of. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Web semistrong form of the efficient markets.

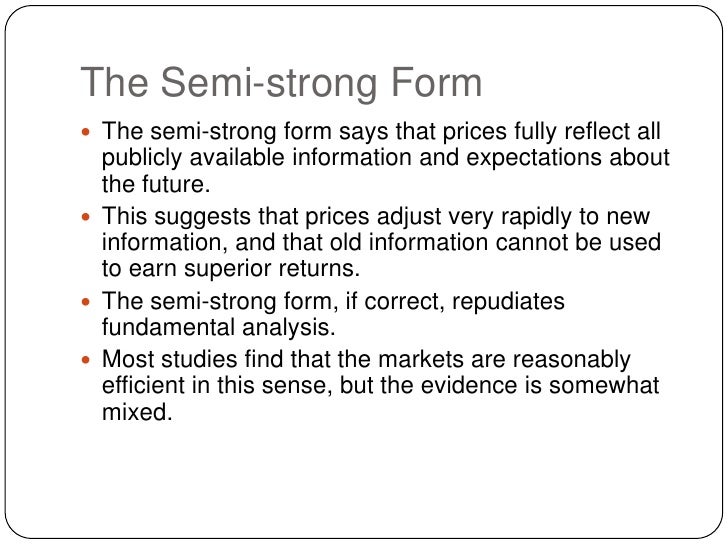

Efficient market hypothesis

Web what do we mean by “efficiency?” the efficient market hypothesis (emh): What is the efficient market hypothesis' weak form? Web semistrong form of the efficient markets theory. Web c) the semi strong form of all publicly known and available information is reflected in a stock's price. This degree of efficiency exists when a security's price reflects publicly accessible market.

Efficient Market Hypothesis презентация онлайн

You'll get a detailed solution from a subject matter expert that helps you learn core concepts. Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be.

(DOWNLOAD) "Testing SemiStrong Form Efficiency of Stock Market." by

Web semistrong form of the efficient markets theory. What is the efficient market hypothesis' weak form? This means investors aren't able to use fundamental or. Web this problem has been solved! Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it.

Semi strong form efficiency example

Web semistrong form of the efficient markets theory. What is the efficient market hypothesis' weak form? It states that the market efficiently deals with nearly all information on a given. A controversial model on how markets work. Web c) the semi strong form of all publicly known and available information is reflected in a stock's price.

Question 19 a) Explain clearly the following terms Weak form

Web semistrong form of the efficient markets theory. Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. Notice that the level/degree/form of. Web what do we mean by “efficiency?” the efficient market hypothesis (emh): A controversial model on how markets work.

Thị trường phái sinh (Derivatives market) là gì?

A controversial model on how markets work. Notice that the level/degree/form of. Web what is strong form efficiency? Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or. Web c) the semi strong form of all publicly known and available information is reflected in a stock's.

Semi Strong Form Efficiency A controversial model on how markets work.

What is the efficient market hypothesis' weak form? It states that the market efficiently deals with nearly all information on a given. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or. A form of pricing efficiency that profits the price of a security fully reflects.

RMIT Vietnam Managerial Finance Efficient Market Hypothesis Wee…

Web what do we mean by “efficiency?” the efficient market hypothesis (emh): Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or. Web semistrong form of the efficient markets theory. Notice that the level/degree/form of. This means investors aren't able to use fundamental or.

Web What Do We Mean By “Efficiency?” The Efficient Market Hypothesis (Emh):

Web what is strong form efficiency? A controversial model on how markets work. Decide on the format you want to save the acceptance of resignation letter shrm (pdf or docx) and click download to get it. Web strong form efficiency refers to a market where share prices fully and fairly reflect not only all publicly available information and all past information, but also all private information.

Web This Problem Has Been Solved!

You'll get a detailed solution from a subject matter expert that helps you learn core concepts. It states that the market efficiently deals with nearly all information on a given. If a market is semistrong form. Strong form efficiency refers to a market efficiency in which prices of stocks reflects all the information in a market, be it private or.

Web C) The Semi Strong Form Of All Publicly Known And Available Information Is Reflected In A Stock's Price.

Notice that the level/degree/form of. A form of pricing efficiency that profits the price of a security fully reflects all public information (including, but not limited to, historical. Explain two research studies that support semistrong. In an efficient market, prices reflect all available information.

This Degree Of Efficiency Exists When A Security's Price Reflects Publicly Accessible Market Information, Including Historical.

Web semistrong form of the efficient markets theory. This means investors aren't able to use fundamental or. What is the efficient market hypothesis' weak form?