Who Should File Form 3520

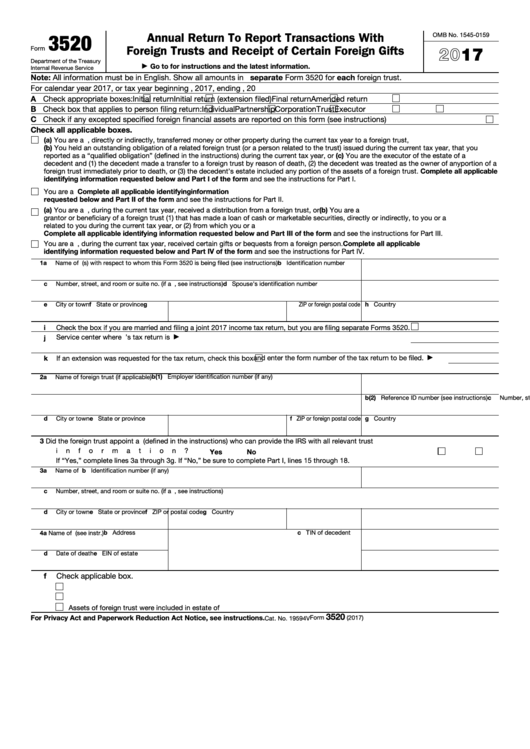

Who Should File Form 3520 - Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679. Decedents) file form 3520 to report: Learn everything you should know about reporting foreign trusts, inheritances, or gifts as an american abroad. This form is filed annually with your tax return. Web if you are a u.s. Person receives a gift from a foreign person, the irs may require the u.s. Person is required to file the form, and the related party rules apply. Persons (and executors of estates of u.s. Web at a glance not sure if you need to file form 3520? Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts:

Persons (and executors of estates of u.s. Receipt of certain large gifts or bequests from certain foreign persons. The form provides information about the foreign trust, its u.s. Citizen or resident who lives outside the unites states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto rico, then the due date to file a form 3520 is the 15th day of the 6th month following the end of the u.s. Person receives a gift from a foreign person, the irs may require the u.s. This form is filed annually with your tax return. Web “file form 3520 if any one or more of the following applies. You are the responsible party for reporting a reportable event that occurred during the current tax year, or you are a u.s. Person to file a form 3520 to report the transactions. There are certain filing threshold requirements that the gift(s) must meet before the u.s.

Person is required to file the form, and the related party rules apply. The form provides information about the foreign trust, its u.s. Learn everything you should know about reporting foreign trusts, inheritances, or gifts as an american abroad. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report transactions involving foreign trusts, entities, or gifts from foreign persons. This form is filed annually with your tax return. Web at a glance not sure if you need to file form 3520? Citizen or resident who lives outside the unites states and puerto rico or if you are in the military or naval service on duty outside the united states and puerto rico, then the due date to file a form 3520 is the 15th day of the 6th month following the end of the u.s. Web form 3520 is an information return for a u.s. Person who receives any direct or indirect distributions from a. Decedents) file form 3520 with the irs to report:

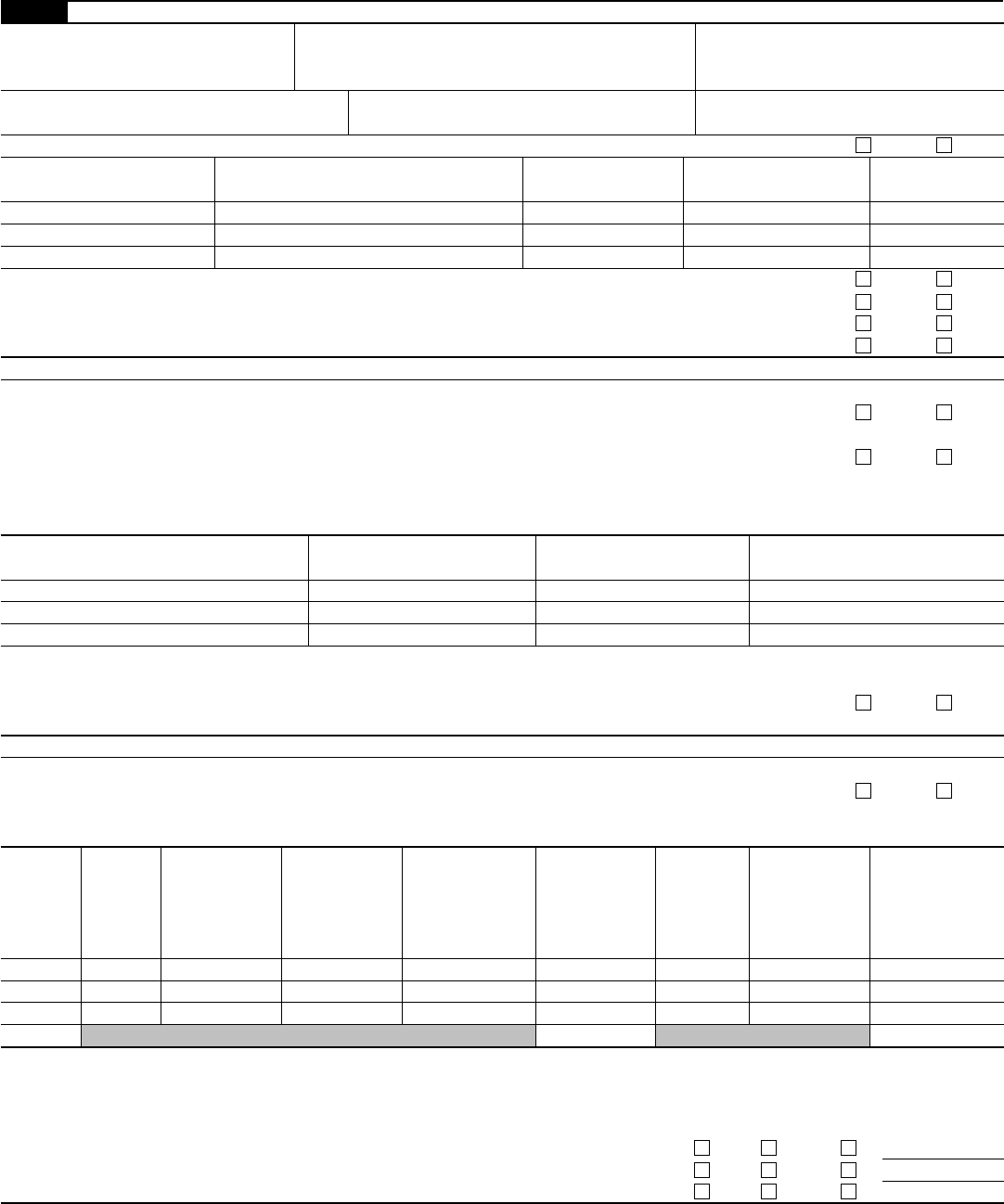

Form 3520 Annual Return to Report Transactions with Foreign Trusts

There are certain filing threshold requirements that the gift(s) must meet before the u.s. This form is filed annually with your tax return. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report the receipt of certain foreign gifts or bequests. Person who transferred property (including cash) to.

All landlords should file Form 1099MISC to qualify for important tax

Person or the executor of the estate of a u.s. Certain transactions with foreign trusts. Web form 3520 is an information return for a u.s. Person who receives any direct or indirect distributions from a. Ownership of foreign trusts under the rules of sections internal revenue code 671 through 679.

Form 3520 2012 Edit, Fill, Sign Online Handypdf

Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report transactions involving foreign trusts, entities, or gifts from foreign persons. Person receives a gift from a foreign person, the irs may require the u.s. Person or the executor of the estate.

US Taxes and Offshore Trusts Understanding Form 3520

Web form 3520 is an information return for a u.s. Receipt of certain large gifts or bequests from certain foreign persons. Web form 3520, also known as th e annual return to report transactions with foreign trusts and receipt of certain foreign gifts, is an informational return used to report transactions involving foreign trusts, entities, or gifts from foreign persons..

US Taxes and Offshore Trusts Understanding Form 3520

Web if you are a u.s. The form provides information about the foreign trust, its u.s. Person receives a gift from a foreign person, the irs may require the u.s. Person who transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation or you hold a. Our expat tax.

Fillable Form 3520 Annual Return To Report Transactions With Foreign

This form is filed annually with your tax return. Web at a glance not sure if you need to file form 3520? Person to file a form 3520 to report the transactions. Web “file form 3520 if any one or more of the following applies. Person who receives any direct or indirect distributions from a.

Form 3520 Annual Return to Report Transactions with Foreign Trusts

The form provides information about the foreign trust, its u.s. Web if you are a u.s. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and receipt of certain large gifts. Person is required to file the form, and the related party rules apply. Citizen or resident who lives outside the unites.

Download Instructions for IRS Form 3520 Annual Return to Report

Web if you are a u.s. Decedents) file form 3520 to report: Web at a glance not sure if you need to file form 3520? Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts: The form provides information about the foreign trust, its u.s.

Form 3520 Edit, Fill, Sign Online Handypdf

Person to file a form 3520 to report the transactions. Web if you are a u.s. Web “file form 3520 if any one or more of the following applies. This form is filed annually with your tax return. You are the responsible party for reporting a reportable event that occurred during the current tax year, or you are a u.s.

How to File Form I130A Supplemental Information for Spouse

There are certain filing threshold requirements that the gift(s) must meet before the u.s. Person who is treated as an owner of any portion of the foreign trust under the grantor trust rules (sections 671 through 679). The form provides information about the foreign trust, its u.s. Decedents) file form 3520 to report: Certain transactions with foreign trusts, ownership of.

Ownership Of Foreign Trusts Under The Rules Of Sections Internal Revenue Code 671 Through 679.

Web if you are a u.s. Certain transactions with foreign trusts, ownership of foreign trusts under the rules of sections 671 through 679, and receipt of certain large gifts. Person to report certain transactions with foreign trusts [as defined in internal revenue code (irc) section 7701 (a) (31)] or to report the receipt of certain foreign gifts or bequests. Decedents) file form 3520 to report:

Person Who Is Treated As An Owner Of Any Portion Of The Foreign Trust Under The Grantor Trust Rules (Sections 671 Through 679).

Our expat tax experts are a few clicks away. There are certain filing threshold requirements that the gift(s) must meet before the u.s. This form is filed annually with your tax return. Person who receives any direct or indirect distributions from a.

You Are The Responsible Party For Reporting A Reportable Event That Occurred During The Current Tax Year, Or You Are A U.s.

The form provides information about the foreign trust, its u.s. Persons (and executors of estates of u.s. Person who transferred property (including cash) to a related foreign trust (or a person related to the trust) in exchange for an obligation or you hold a. Web the following persons are required to file form 3520 to report certain distributions (or deemed distributions) during the tax year from foreign trusts:

Web At A Glance Not Sure If You Need To File Form 3520?

Learn everything you should know about reporting foreign trusts, inheritances, or gifts as an american abroad. Certain transactions with foreign trusts. Person to file a form 3520 to report the transactions. Persons (and executors of estates of u.s.