Sale Of Rental Property Form 4797

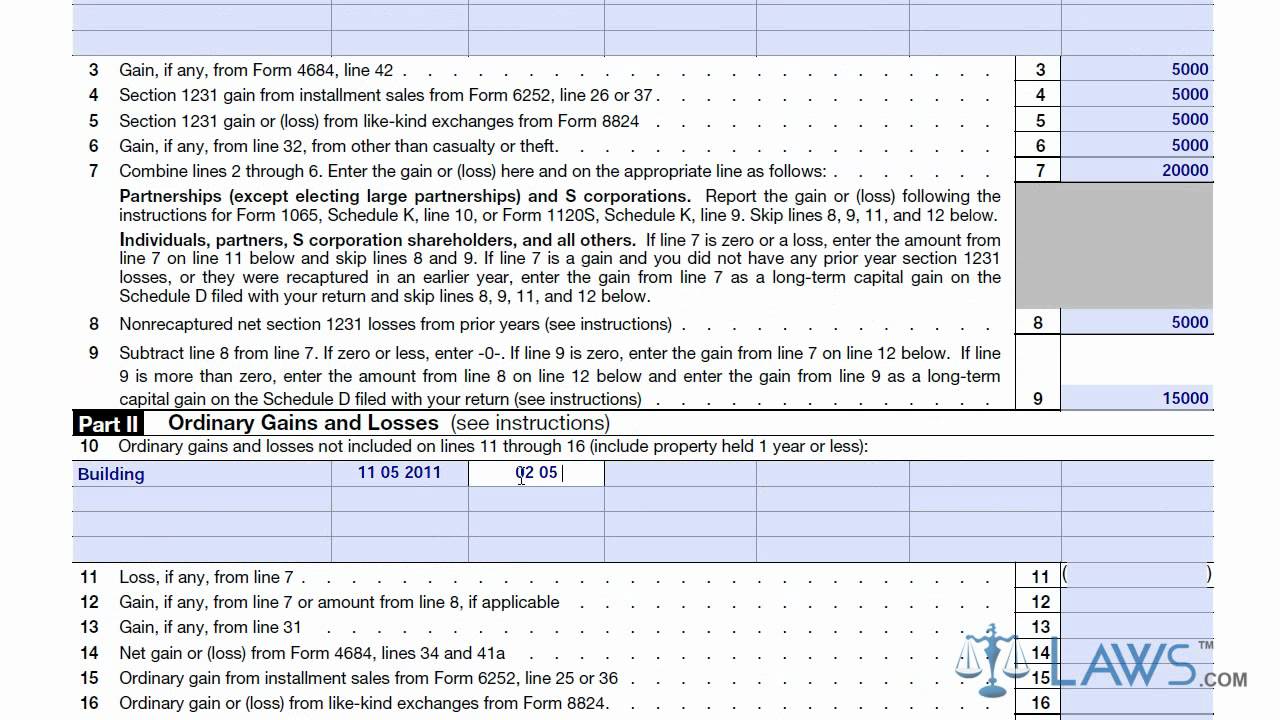

Sale Of Rental Property Form 4797 - When i open the form 4797, this is what i see it there. Web use form 4797 to report the following. Go to www.irs.gov/form4797 for instructions and the latest information. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the end of the tax year. You cannot claim depreciation,indexation, or taper relief as cost adjustments. Web form 4797 collects information about property sold, the accompanying gains or losses, and any appropriate depreciation recapture amounts. Can i claim rental expenses? Where to make first entry for certain items reported on this form the sale or exchange of: Can we move into our rental property, live there as our main home for two years, and sell it without having to pay capital gains tax? Depreciable and amortizable tangible property used in your trade or business (however, see disposition of depreciable property not used in trade or business , later);

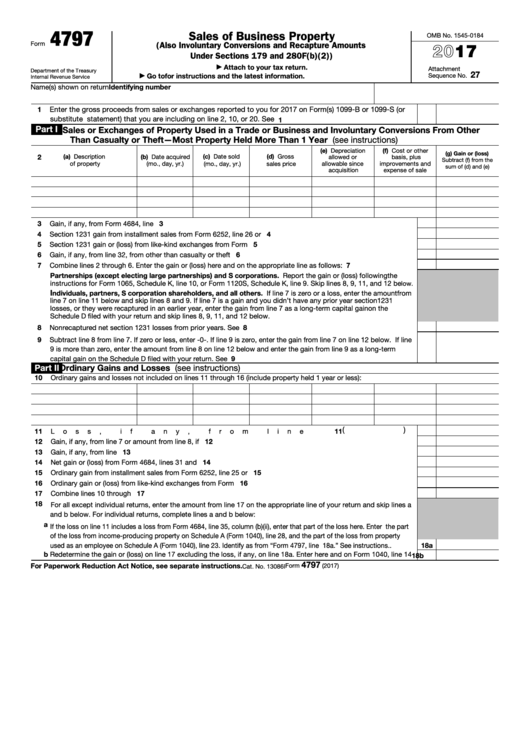

Go to www.irs.gov/form4797 for instructions and the latest information. When i open the form 4797, this is what i see it there. Can i claim rental expenses? Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web form 4797 collects information about property sold, the accompanying gains or losses, and any appropriate depreciation recapture amounts. Depreciable and amortizable tangible property used in your trade or business (however, see disposition of depreciable property not used in trade or business , later); Can we move into our rental property, live there as our main home for two years, and sell it without having to pay capital gains tax? Web use form 4797 to report the following. In fact, if you rented out the property, the depreciation that has incurred since the rental would need to be recaptured and would add to the ordinary gains on the sale of the house. Where to make first entry for certain items reported on this form the sale or exchange of:

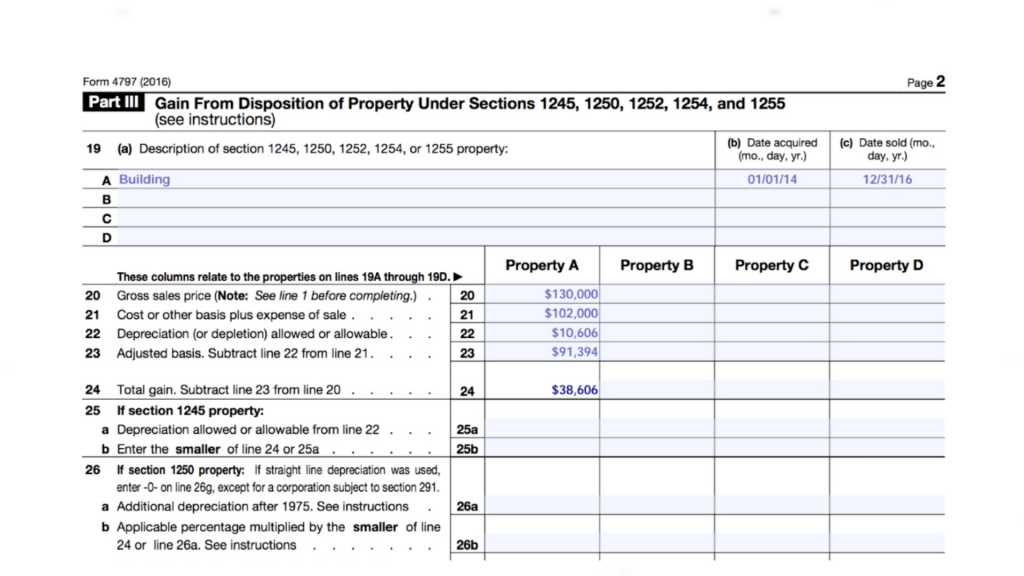

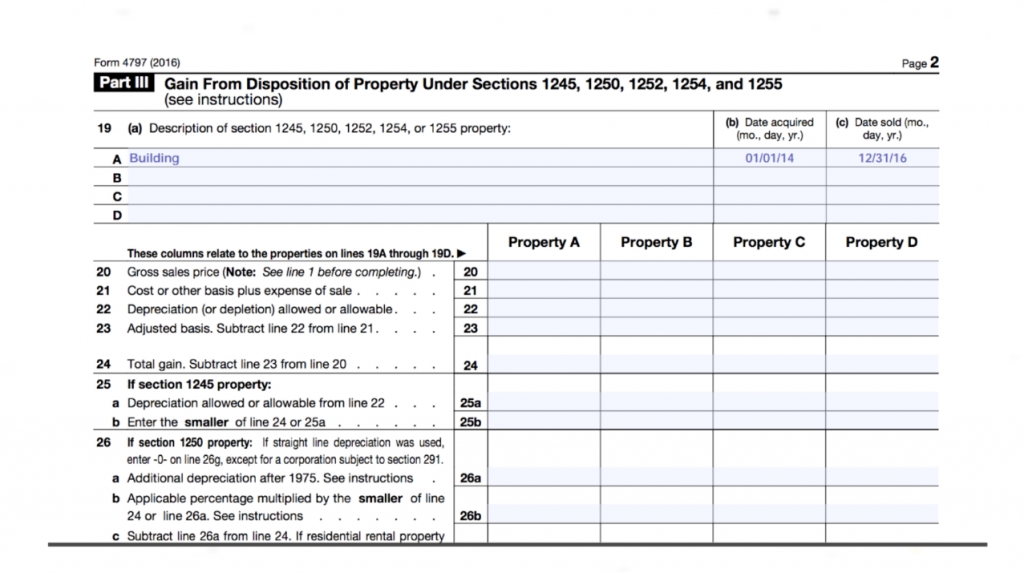

Web how do i fill out tax form 4797 after sale of a rental property? Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building in part iii and land in part i). Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. Where to make first entry for certain items reported on this form the sale or exchange of: Don’t use form 4797 to report the sale of personal property, just property used as a business. What form (s) do we need to fill out to report the sale of rental property? Selling a rental property may create tax liabilities for depreciation recapture and capital gains. Can we move into our rental property, live there as our main home for two years, and sell it without having to pay capital gains tax? Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Real property used in your trade or business;

Calculating cost basis on rental property sale JasminCarrie

Real property used in your trade or business; Do i still use form 4797 for a 1031 exchange? Don’t use form 4797 to report the sale of personal property, just property used as a business. Go to www.irs.gov/form4797 for instructions and the latest information. Form 4797 is used to report the details of gains and losses from the sale, exchange,.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Selling a rental property may create tax liabilities for depreciation recapture and capital gains. Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the end of the tax year. Do i still use form 4797 for a 1031 exchange? Web.

How to Report the Sale of a U.S. Rental Property Madan CA

Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the end of the tax year. When i open the form 4797, this is what i see it there. Can we move into our rental property, live there as our main.

Form 4797 Sales of Business Property (2014) Free Download

When i open the form 4797, this is what i see it there. Can i claim rental expenses? In fact, if you rented out the property, the depreciation that has incurred since the rental would need to be recaptured and would add to the ordinary gains on the sale of the house. Web three steps followed to report the sale.

How to Report the Sale of a U.S. Rental Property Madan CA

Can we move into our rental property, live there as our main home for two years, and sell it without having to pay capital gains tax? Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assets. Real property used in your trade or business;.

Form 4797 Sales of Business Property Definition

Don’t use form 4797 to report the sale of personal property, just property used as a business. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and 280f(b)(2)) attach to your tax return. Web form 4797 collects information about property sold, the accompanying gains or losses,.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

Don’t use form 4797 to report the sale of personal property, just property used as a business. For more information, refer to the irs form 4797, sale of business property, instructions. When i open the form 4797, this is what i see it there. Go to www.irs.gov/form4797 for instructions and the latest information. Web the disposition of each type of.

Form 4797 YouTube

What form (s) do we need to fill out to report the sale of rental property? Web three steps followed to report the sale of a rental property are calculating capital gain or loss, completing form 4797, and filing schedule d with form 1040 at the end of the tax year. Web how do i fill out tax form 4797.

Fillable Form 4797 Sales Of Business Property 2016 printable pdf

Go to www.irs.gov/form4797 for instructions and the latest information. Selling a rental property may create tax liabilities for depreciation recapture and capital gains. You cannot claim depreciation,indexation, or taper relief as cost adjustments. When i open the form 4797, this is what i see it there. Don’t use form 4797 to report the sale of personal property, just property used.

How to Report the Sale of a U.S. Rental Property Madan CA

Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building in part iii and land in part i). Web form 4797 collects information about property sold, the accompanying gains or losses, and any appropriate depreciation recapture amounts..

Web Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280F(B)(2)) Attach To Your Tax Return.

Web form 4797 collects information about property sold, the accompanying gains or losses, and any appropriate depreciation recapture amounts. Can we move into our rental property, live there as our main home for two years, and sell it without having to pay capital gains tax? Web the disposition of each type of property is reported separately in the appropriate part of form 4797 (for example, for property held more than 1 year, report the sale of a building in part iii and land in part i). Web use form 4797 to report the following.

Form 4797 Is Used To Report The Details Of Gains And Losses From The Sale, Exchange, Involuntary Conversion, Or Disposition Of Certain Business Property And Assets.

In fact, if you rented out the property, the depreciation that has incurred since the rental would need to be recaptured and would add to the ordinary gains on the sale of the house. Web information about form 4797, sales of business property, including recent updates, related forms and instructions on how to file. For more information, refer to the irs form 4797, sale of business property, instructions. Can i claim rental expenses?

Selling A Rental Property May Create Tax Liabilities For Depreciation Recapture And Capital Gains.

Do i still use form 4797 for a 1031 exchange? What form (s) do we need to fill out to report the sale of rental property? Go to www.irs.gov/form4797 for instructions and the latest information. Depreciable and amortizable tangible property used in your trade or business (however, see disposition of depreciable property not used in trade or business , later);

Web How Do I Fill Out Tax Form 4797 After Sale Of A Rental Property?

When i open the form 4797, this is what i see it there. You cannot claim depreciation,indexation, or taper relief as cost adjustments. Where to make first entry for certain items reported on this form the sale or exchange of: Don’t use form 4797 to report the sale of personal property, just property used as a business.

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://image.slidesharecdn.com/1273290/95/form-4797sales-of-business-property-2-728.jpg?cb=1239371111)

/32082667638_810297ef22_k-cabd90e96d994717af9624c12dc728bc.jpg)

![[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797](https://www.calt.iastate.edu/system/files/resize/images-premium-article/4797_two-643x831.jpg)