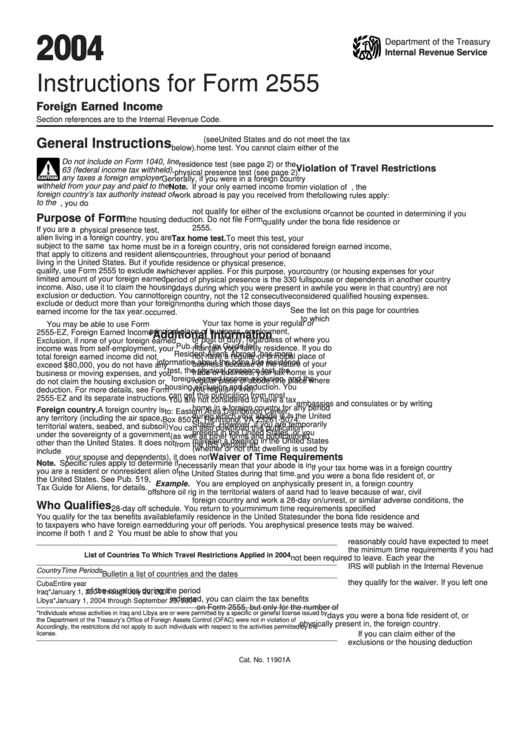

Instructions Form 2555

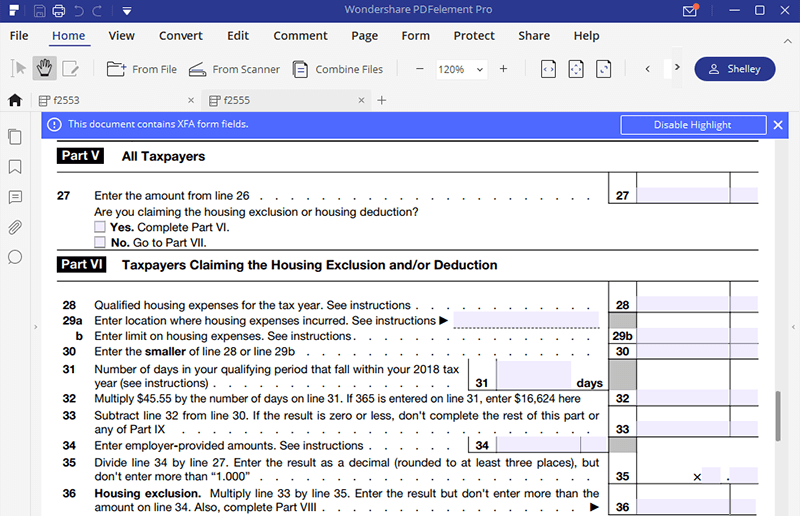

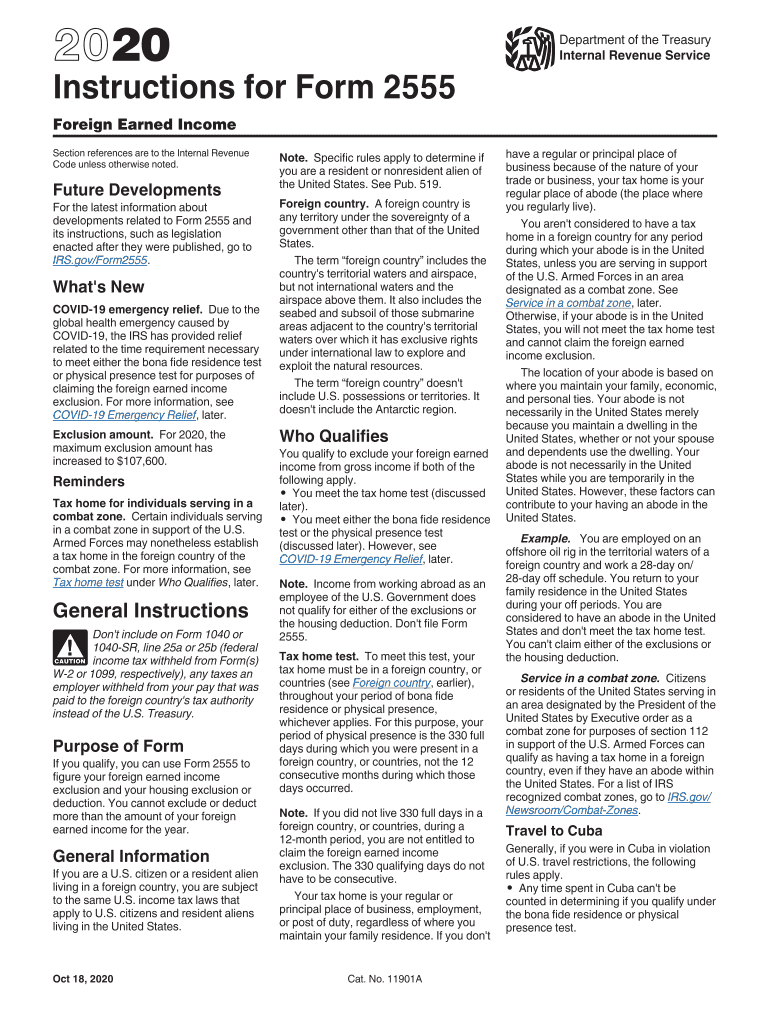

Instructions Form 2555 - Publication 54, tax guide for u.s. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web instructions for form 2555, foreign earned income. Web the form 2555 instructions however are eleven pages long. Previously, some tax filers could. Include information about your employer and. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Web form 2555 is the form you need to file to benefit from the feie. Web proseries includes two forms 2555, one for the taxpayer and one for the spouse. Web general instructions not qualify for either of the exclusions or embassies and consulates or by writing the housing deduction.

Web general instructions not qualify for either of the exclusions or embassies and consulates or by writing the housing deduction. We are now certified acceptance agents (caa). Citizens and resident aliens abroad. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Do not file form to: Include information about your employer and. Publication 514, foreign tax credit for. Expats are generally required to file their returns. Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Previously, some tax filers could.

Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Web the form 2555 instructions however are eleven pages long. The instructions provide detailed answers for a variety of situations. Complete part i of form 2555. We are now certified acceptance agents (caa). Form 2555 can make an expat’s life a lot easier! Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Do not file form to: Previously, some tax filers could. Web instructions for form 2555, foreign earned income.

Instructions For Form 2555 printable pdf download

Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Publication 514, foreign tax credit for. Publication 54, tax guide for u.s. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Do not file form to:

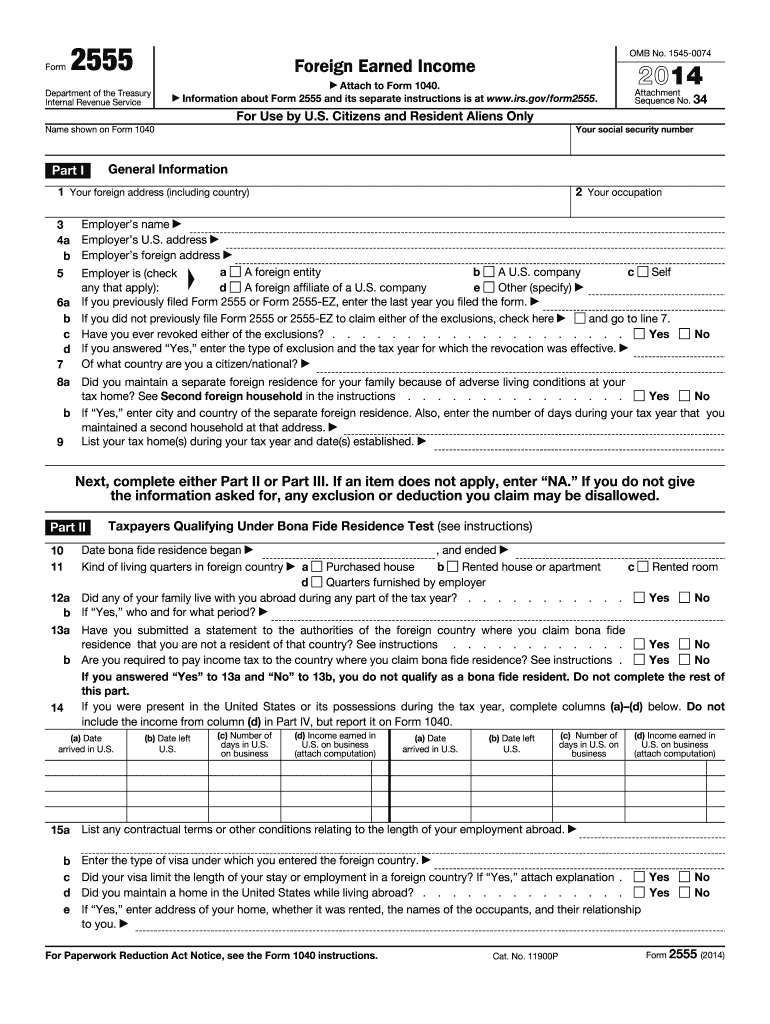

2014 Form IRS 2555 Fill Online, Printable, Fillable, Blank pdfFiller

The instructions provide detailed answers for a variety of situations. Publication 514, foreign tax credit for. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers can use to figure out their foreign earned income exclusion as well as their housing exclusion. Expats are generally required to file their returns. If you qualify, you.

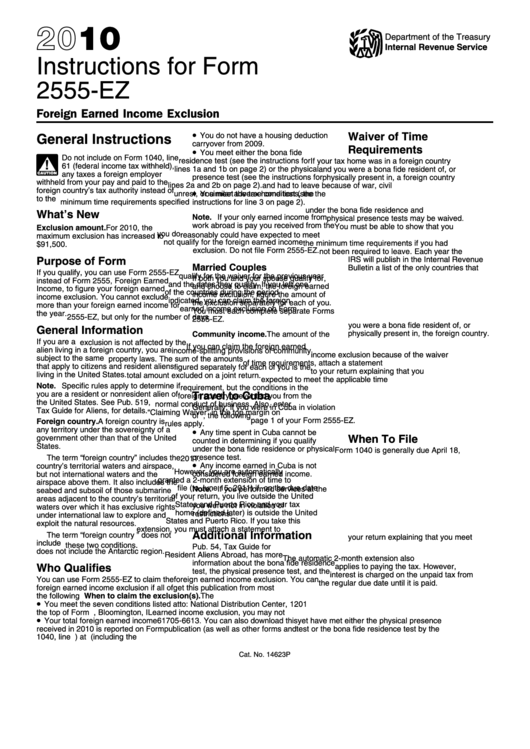

Instructions For Form 2555Ez Foreign Earned Exclusion

Complete part i of form 2555. Publication 54, tax guide for u.s. Web attach form 2555 to form 1040 when filed. This form helps expats elect to use the foreign earned income exclusion (feie), one of the. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers can use to figure out their foreign.

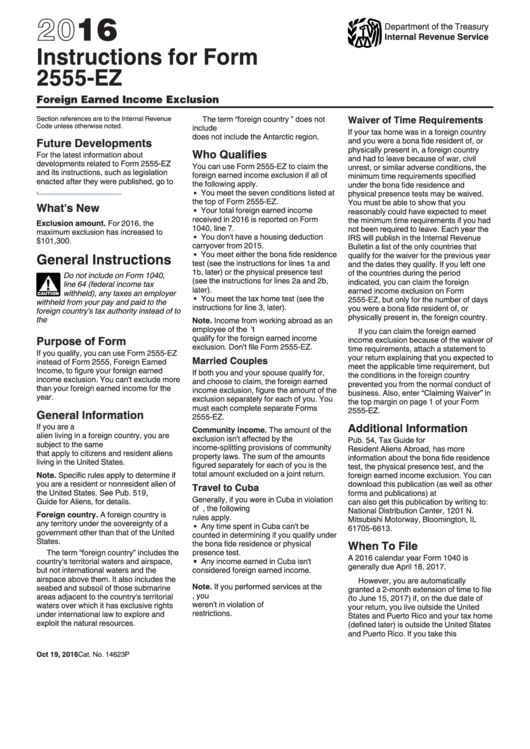

Instructions For Form 2555Ez Foreign Earned Exclusion 2016

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers can use to figure out their foreign earned income exclusion as well as their housing exclusion. If you qualify, you can use form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. Web developments related to form 2555 and.

IRS Form 2555 Fill out with Smart Form Filler

The form consists of nine different sections: Citizens and resident aliens abroad. Publication 54, tax guide for u.s. Expats are generally required to file their returns. Web solved•by intuit•3•updated august 25, 2022.

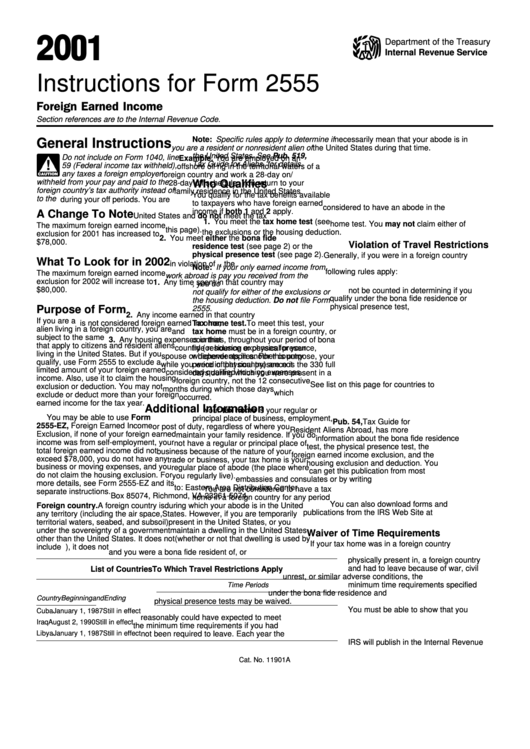

Instructions For Form 2555 Foreign Earned 2001 printable pdf

Web april 2, 2022. Web instructions for form 2555, foreign earned income. Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers can use to figure out their foreign earned income exclusion as well as their housing exclusion. Citizens and resident aliens abroad. Previously, some tax filers could.

Ssurvivor Form 2555 Instructions 2018 Pdf

Web april 2, 2022. Web proseries includes two forms 2555, one for the taxpayer and one for the spouse. Web general instructions not qualify for either of the exclusions or embassies and consulates or by writing the housing deduction. We are now certified acceptance agents (caa). Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income.

Instructions For Form 2555 Instructions For Form 2555, Foreign Earned

You cannot exclude or deduct more. Citizens and resident aliens abroad. Web attach form 2555 to form 1040 when filed. Go to www.irs.gov/form2555 for instructions and the. Complete part i of form 2555.

Ssurvivor Form 2555 Instructions

You cannot exclude or deduct more. Previously, some tax filers could. Publication 514, foreign tax credit for. Web april 2, 2022. Web form 2555 is the form you need to file to benefit from the feie.

Form 2555 ez instructions

Web the form 2555 instructions however are eleven pages long. If you qualify, you can use form. Publication 54, tax guide for u.s. Web developments related to form 2555 and its instructions, such as legislation enacted after they were published, go to irs.gov/form2555. Previously, some tax filers could.

Web Solved•By Intuit•3•Updated August 25, 2022.

Web form 2555 (foreign earned income exclusion) calculates the amount of foreign earned income and/or foreign housing you can exclude from taxation. Include information about your employer and. Web proseries includes two forms 2555, one for the taxpayer and one for the spouse. Web april 2, 2022.

Go To Www.irs.gov/Form2555 For Instructions And The.

Web the tax form 2555, or foreign earned income, is an irs form that qualifying taxpayers can use to figure out their foreign earned income exclusion as well as their housing exclusion. Expats are generally required to file their returns. Complete part i of form 2555. Form 2555 can make an expat’s life a lot easier!

Publication 54, Tax Guide For U.s.

The instructions provide detailed answers for a variety of situations. Citizens and resident aliens abroad. Previously, some tax filers could. If you qualify, you can use form.

Web The Form 2555 Instructions However Are Eleven Pages Long.

The form consists of nine different sections: Web form 2555 is the form you need to file to benefit from the feie. Web information about form 2555, foreign earned income, including recent updates, related forms, and instructions on how to file. Web general instructions not qualify for either of the exclusions or embassies and consulates or by writing the housing deduction.