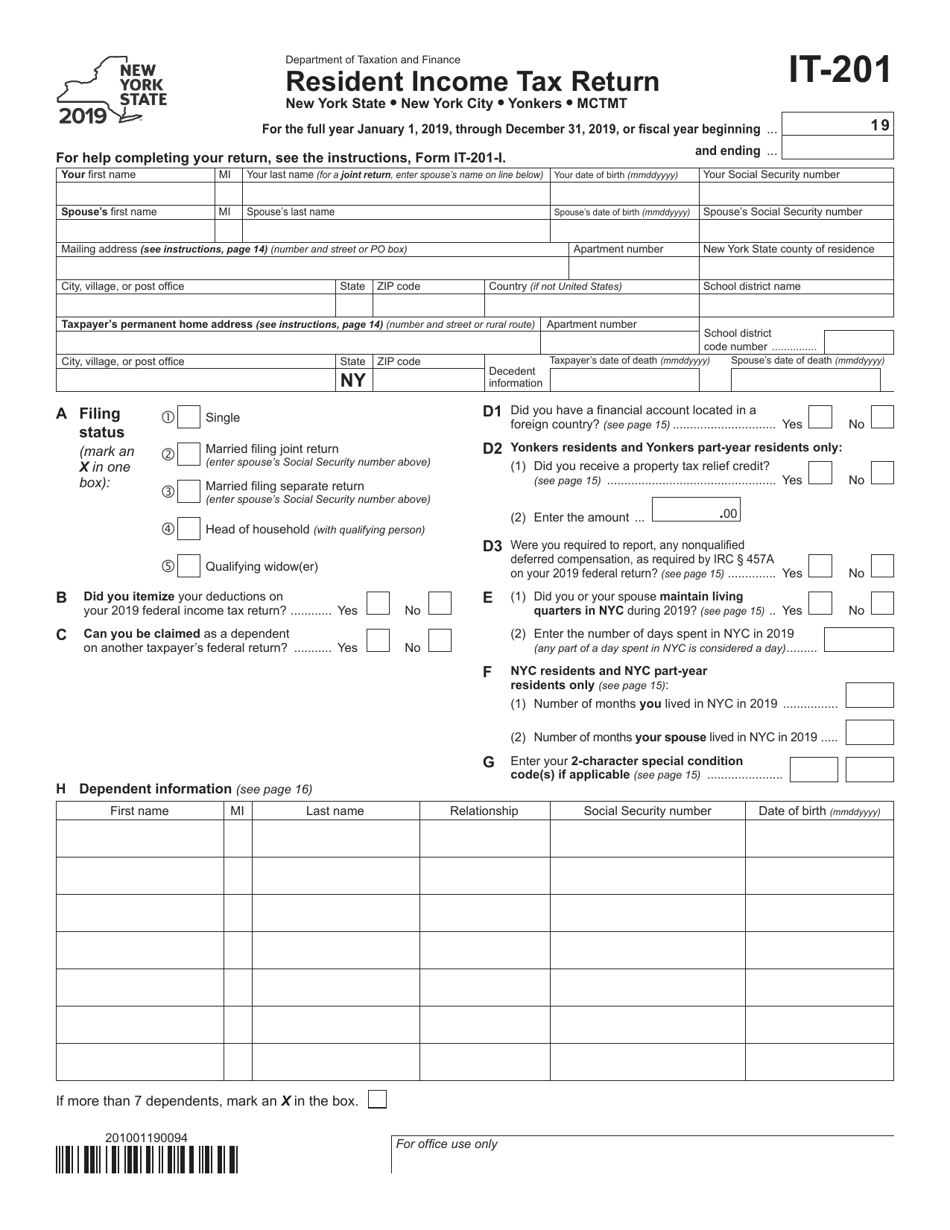

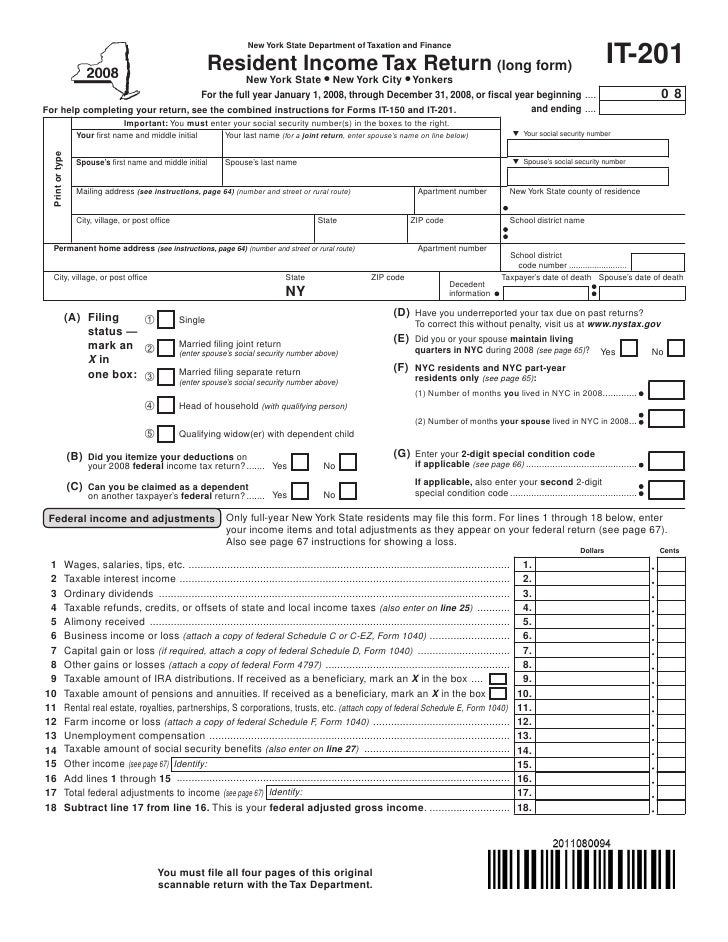

Ny Form It 201

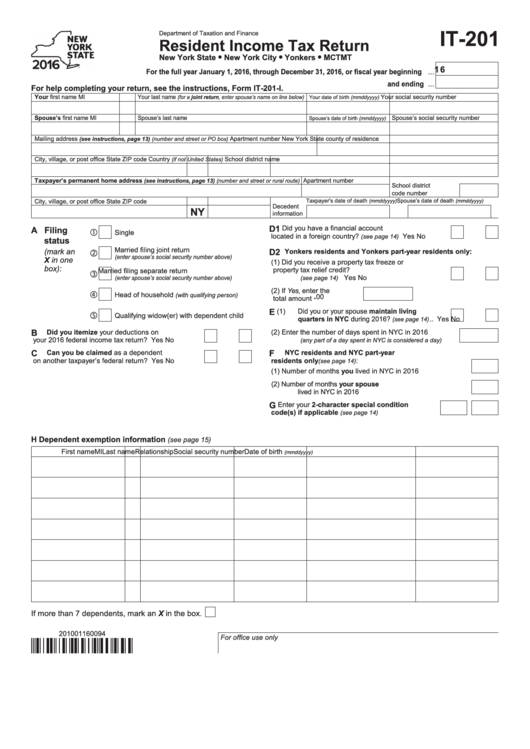

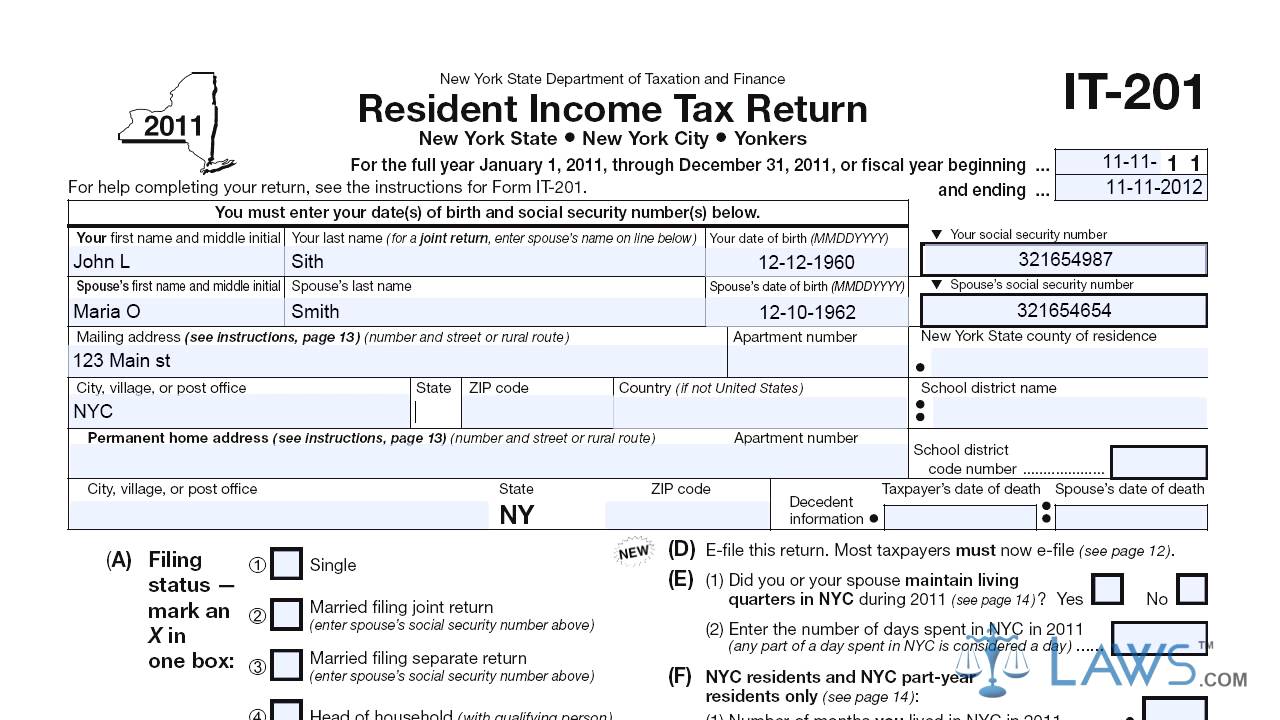

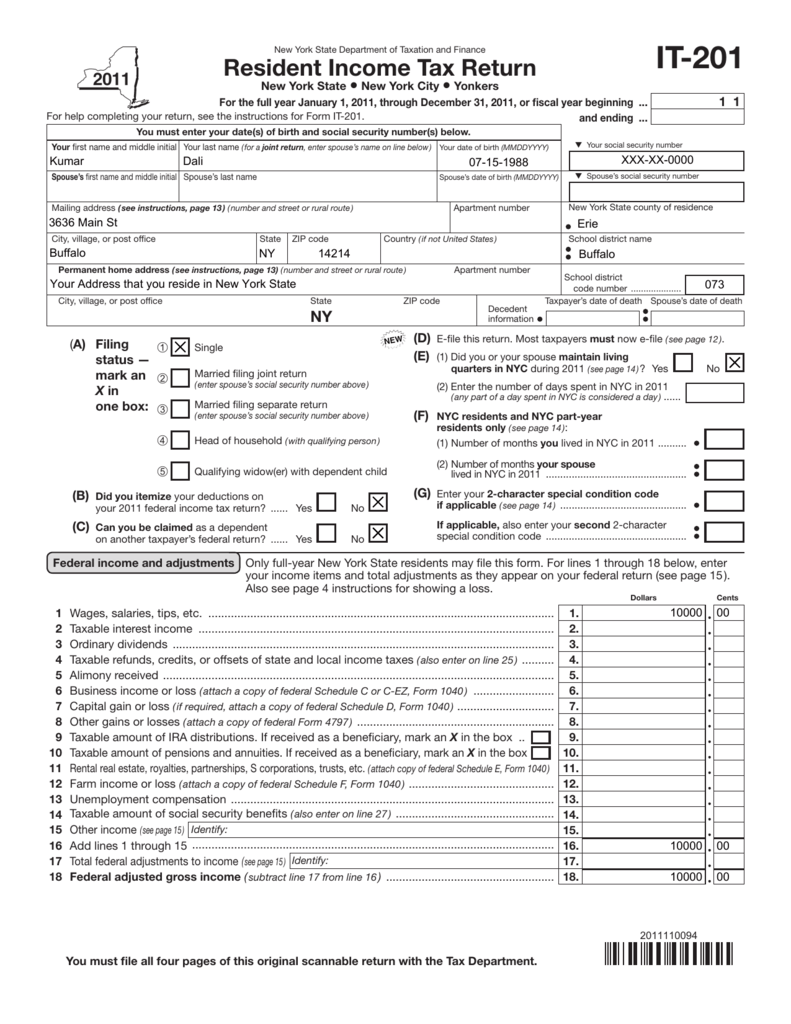

Ny Form It 201 - No further information is available at this time. Web if you are a resident of new york you need to file form 201. Web 2022 new york state tax table. This instruction booklet will help you to fill out and file form 201. We last updated the individual income tax. Complete, edit or print tax forms instantly. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Web this may result in your new york state return taking longer to process than your federal return. • new york itemized deduction the current 25% and 50% new york itemized deduction limitation for. This form is for income earned in tax.

We last updated the individual income tax. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. No further information is available at this time. To claim a tax credit. Complete, edit or print tax forms instantly. This instruction booklet will help you to fill out and file form 201. • new york itemized deduction the current 25% and 50% new york itemized deduction limitation for. Web this may result in your new york state return taking longer to process than your federal return. Web if you are a resident of new york you need to file form 201. Web 2022 new york state tax table.

We last updated the individual income tax. Web 2022 new york state tax table. Complete, edit or print tax forms instantly. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. This instruction booklet will help you to fill out and file form 201. To claim a tax credit. Web this may result in your new york state return taking longer to process than your federal return. This form is for income earned in tax. Web if you are a resident of new york you need to file form 201. • new york itemized deduction the current 25% and 50% new york itemized deduction limitation for.

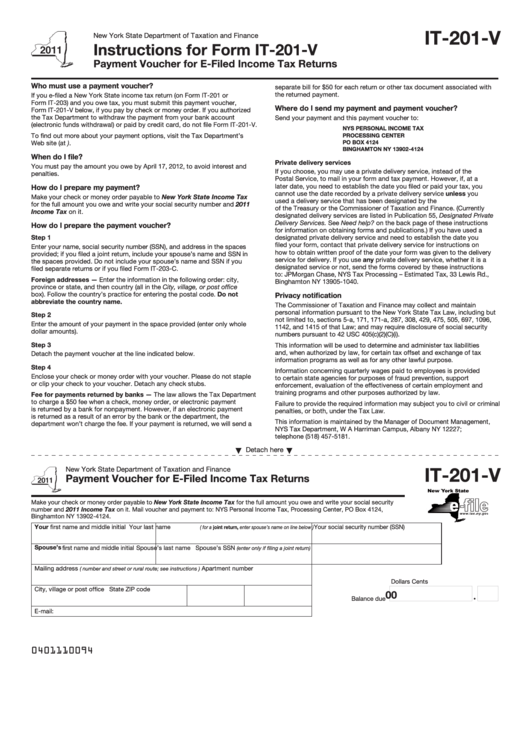

Fillable Form It201V (2011) Payment Voucher For EFiled Tax

This form is for income earned in tax. Web if you are a resident of new york you need to file form 201. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. We last updated the individual income tax. Web 2022 new york state tax table.

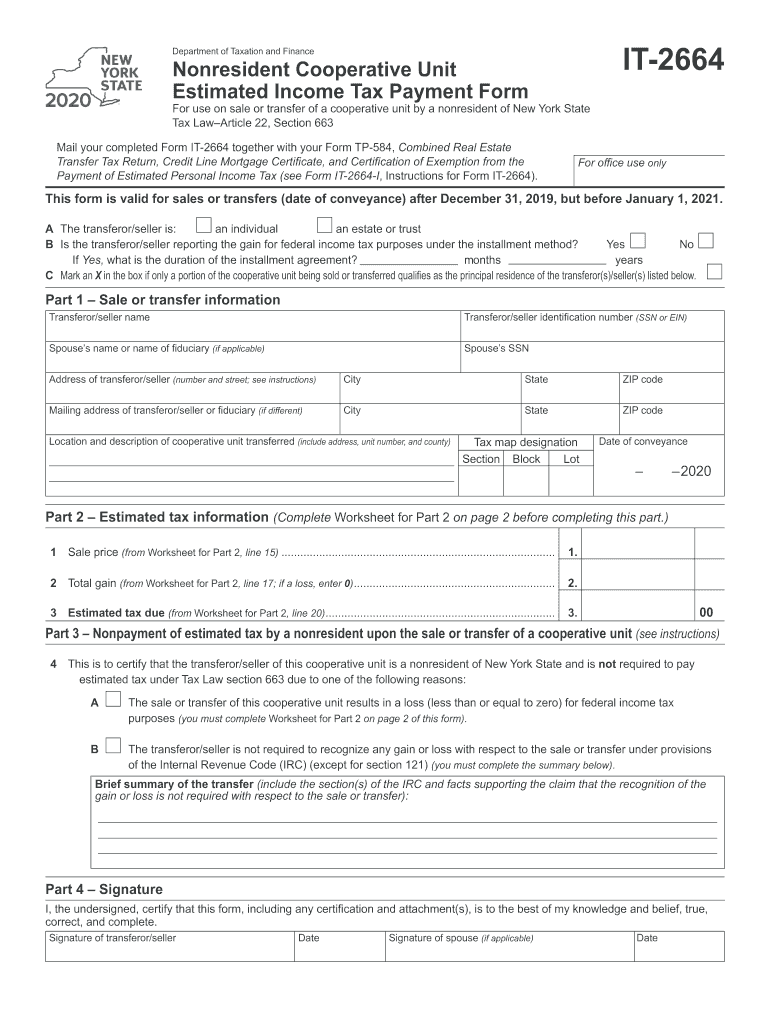

2020 Form NY DTF IT2664 Fill Online, Printable, Fillable, Blank

This instruction booklet will help you to fill out and file form 201. To claim a tax credit. No further information is available at this time. This form is for income earned in tax. Web this may result in your new york state return taking longer to process than your federal return.

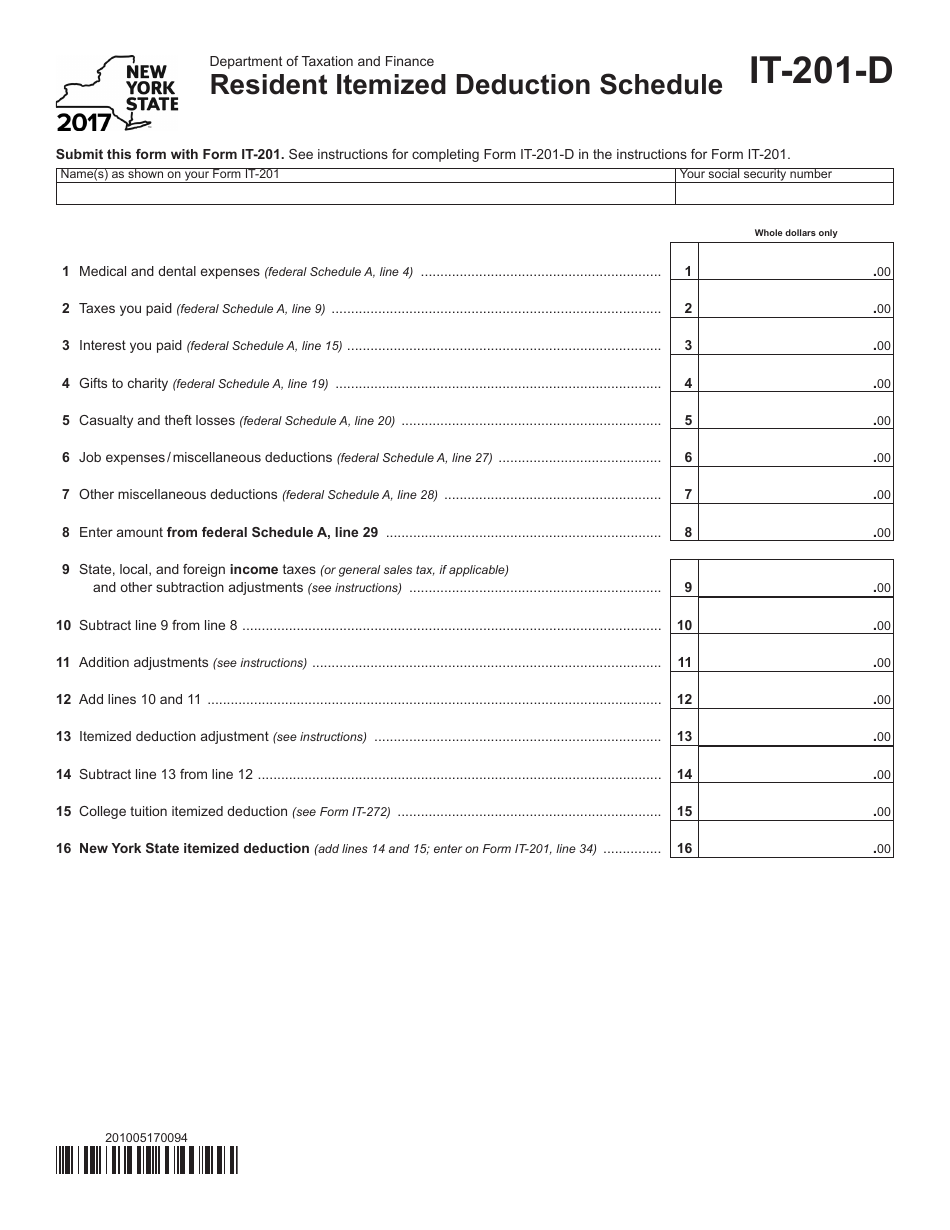

Form IT201D Download Printable PDF or Fill Online Resident Itemized

Web if you are a resident of new york you need to file form 201. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. This instruction booklet will help you to fill out and file form 201. Web this may result in your new york state return.

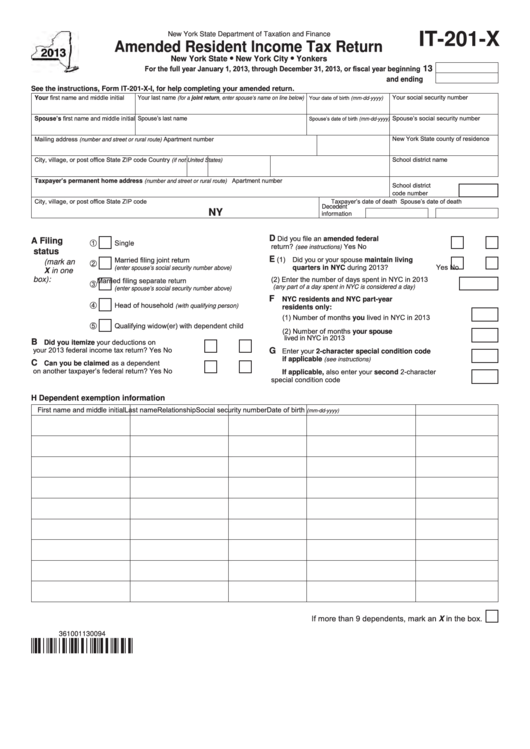

Fillable Form It201X New York Amended Resident Tax Return

Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. This instruction booklet will help you to fill out and file form 201. Web this may result in your new york state return taking longer to process than your federal return. To claim a tax credit. Complete, edit.

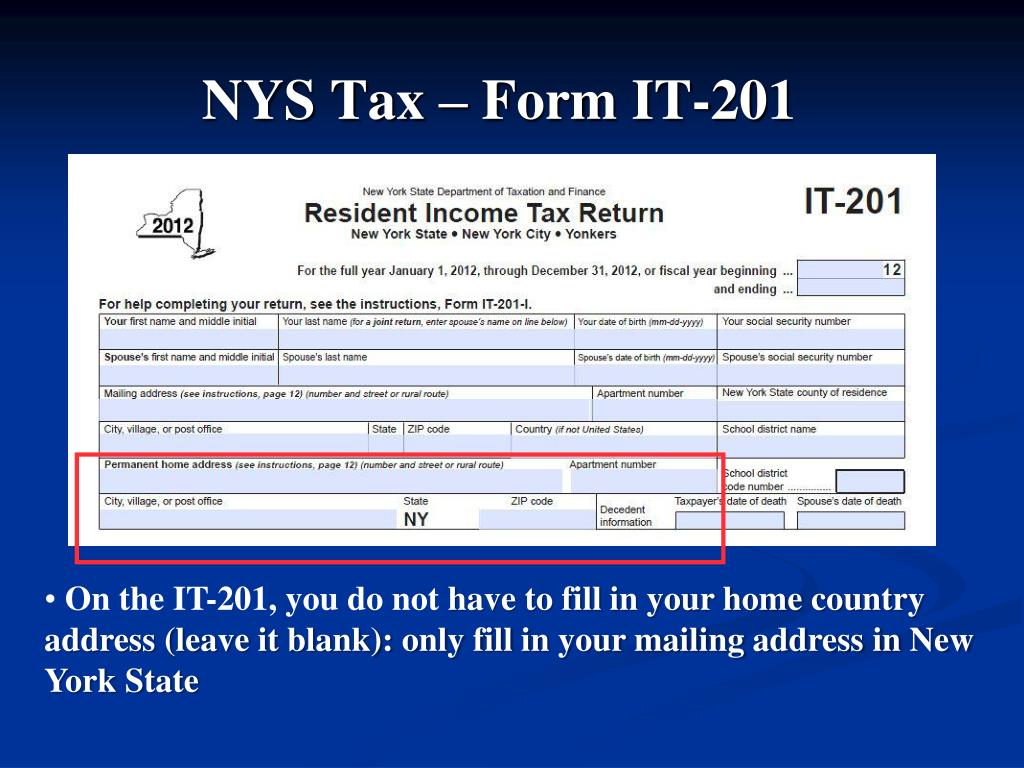

PPT ISSO New York State Tax Information Session PowerPoint

Web if you are a resident of new york you need to file form 201. This form is for income earned in tax. Web this may result in your new york state return taking longer to process than your federal return. No further information is available at this time. We last updated the individual income tax.

Top 106 New York State Form It201 Templates free to download in PDF format

• new york itemized deduction the current 25% and 50% new york itemized deduction limitation for. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. This instruction booklet will help you to fill out and file form 201. No further information is available at this time. Complete,.

Form IT 201 Resident Tax Return YouTube

No further information is available at this time. We last updated the individual income tax. Web if you are a resident of new york you need to file form 201. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. This instruction booklet will help you to fill.

Form IT2012011Resident Tax ReturnIT201

This instruction booklet will help you to fill out and file form 201. No further information is available at this time. This form is for income earned in tax. Complete, edit or print tax forms instantly. Web if you are a resident of new york you need to file form 201.

Form IT201 Download Fillable PDF or Fill Online Resident Tax

This instruction booklet will help you to fill out and file form 201. Web this may result in your new york state return taking longer to process than your federal return. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Web 2022 new york state tax table..

IT201ATT Other Taxes and Tax Credits Attachment to Form IT201

No further information is available at this time. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth. Web this may result in your new york state return taking longer to process than your federal return. Web 2022 new york state tax table. This form is for income.

Web This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return.

We last updated the individual income tax. Web if you are a resident of new york you need to file form 201. • new york itemized deduction the current 25% and 50% new york itemized deduction limitation for. Web 2022 new york state tax table.

This Instruction Booklet Will Help You To Fill Out And File Form 201.

To claim a tax credit. Complete, edit or print tax forms instantly. This form is for income earned in tax. Your first name mi your last name (for a joint return , enter spouse’s name on line below) your date of birth.