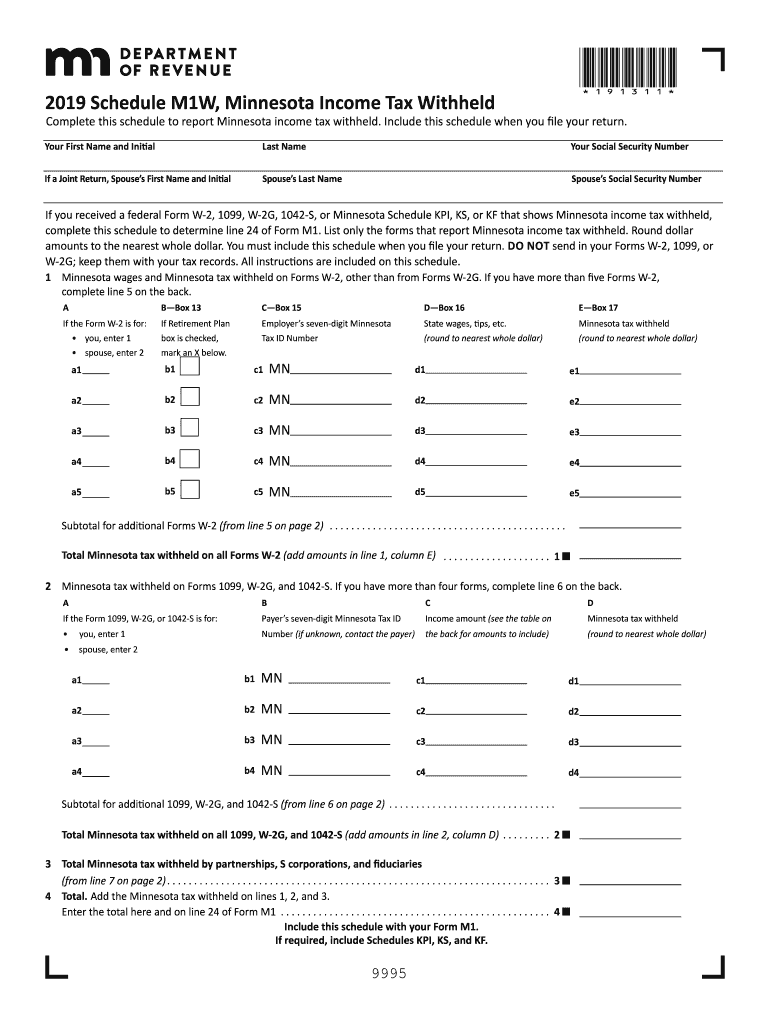

Mn Form M1W

Mn Form M1W - The minnesota department of revenue must receive your return electronically or have it delivered or. This form is for income earned in tax year 2022, with tax returns due in april. Type text, add images, blackout. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. Schedule m1w, minnesota income tax withheld, is a form that is used for reporting about your tax withheld. Sign it in a few clicks draw your signature, type. Web the 2022 minnesota state income tax return forms for tax year 2022 (jan. Web follow the simple instructions below: Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. You can also download it, export it or print it out.

Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment form. Schedule m1w, minnesota income tax withheld, is a form that is used for reporting about your tax withheld. Sign it in a few clicks draw your signature, type. Business, tax, legal along with other documents demand a top level of protection and compliance with the law. Web we last updated minnesota form m1w in december 2022 from the minnesota department of revenue. Web send minnesota tax form m1w via email, link, or fax. Web follow the simple instructions below: Web list all minnesota income tax withheld from your wages, salaries, pensions, or other income. Complete this schedule to report minnesota income tax withheld.

Edit your mn schedule m1w online type text, add images, blackout confidential details, add comments, highlights and more. Business, tax, legal along with other documents demand a top level of protection and compliance with the law. Web list all minnesota income tax withheld from your wages, salaries, pensions, or other income. Include this schedule when you file your return. Complete this schedule to report minnesota income tax withheld. You should add it when you send. Web 2020 schedule m1w, minnesota income tax withheld. Web follow the simple instructions below: This form is for income earned in tax year 2022, with tax returns due in april. Schedule m1w, minnesota income tax withheld, is a form that is used for reporting about your tax withheld.

2020 Minnesota Tax Fill Out and Sign Printable PDF Template signNow

Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment form. Sign it in a few clicks draw your signature, type. The minnesota department of revenue must receive your return electronically or have it delivered or. Before starting your minnesota income tax return ( form m1 , individual.

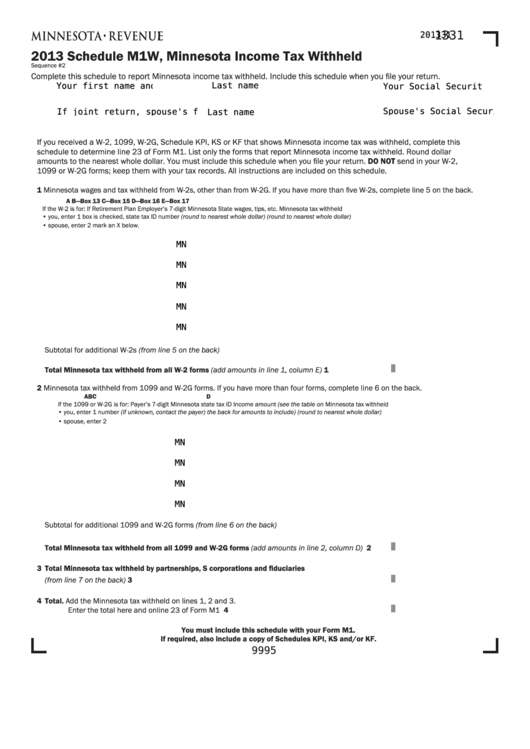

Fillable Schedule M1w Minnesota Tax Withheld 2013 printable

Type text, add images, blackout. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. Web the 2022 minnesota state income tax return forms for tax year 2022 (jan. Web 2020 schedule m1w, minnesota income tax withheld. You can also download it, export it or.

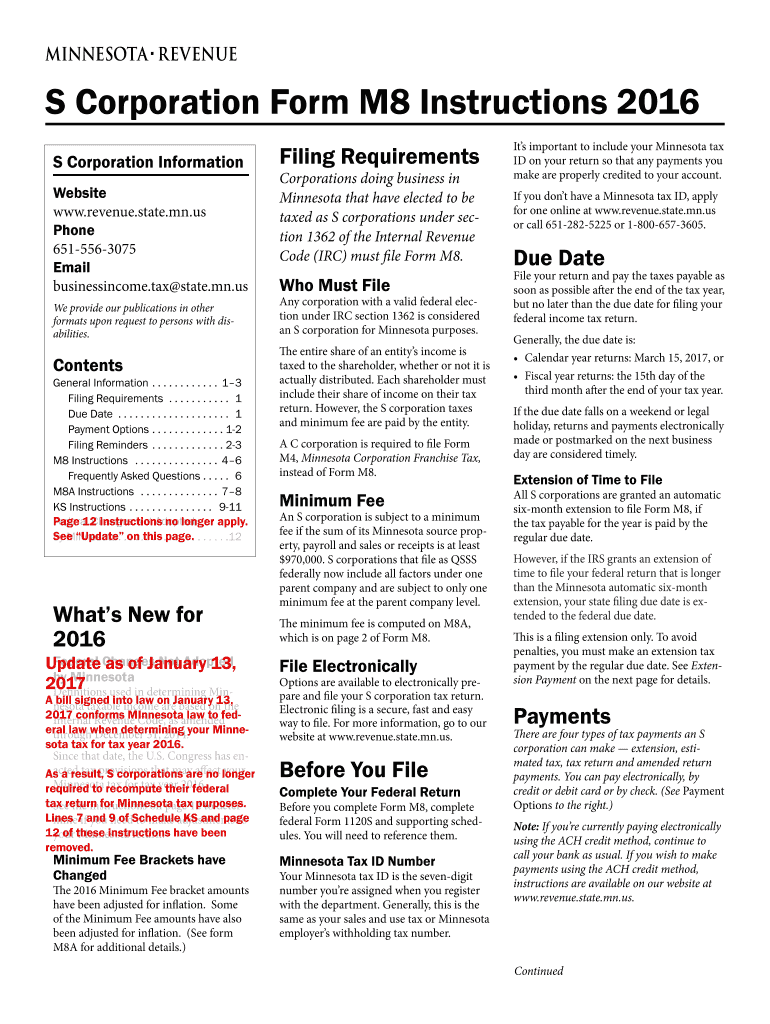

Mn Form Instructions Fill Out and Sign Printable PDF Template signNow

Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web what is minnesota schedule m1w? You can also download it, export it or print it out. Web the 2022 minnesota state income tax return forms for tax.

Fill Free fillable Minnesota Department of Revenue PDF forms

Sign it in a few clicks draw your signature, type. Web we last updated minnesota form m1w in december 2022 from the minnesota department of revenue. Web follow the simple instructions below: You should add it when you send. Web list all minnesota income tax withheld from your wages, salaries, pensions, or other income.

Minnesota Tax Table M1

This form is for income earned in tax year 2022, with tax returns due in april. Sign it in a few clicks draw your signature, type. You can also download it, export it or print it out. Web the 2022 minnesota state income tax return forms for tax year 2022 (jan. Web most people must file their 2022 minnesota tax.

2016 Form MN M1W Fill Online, Printable, Fillable, Blank pdfFiller

Sign it in a few clicks draw your signature, type. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. The minnesota department of revenue must receive your return electronically or have it delivered or. Web the 2022 minnesota state income tax return forms for tax year 2022.

Form M1W ≡ Fill Out Printable PDF Forms Online

Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax. Include this schedule when you file your return. Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. Edit your minnesota form m1w.

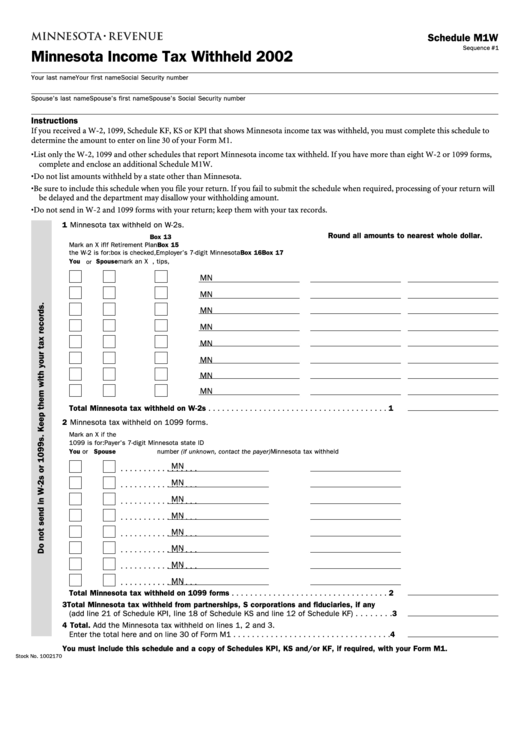

Schedule M1w Minnesota Tax Withheld 2002 printable pdf download

This form is for income earned in tax year 2022, with tax returns due in april. Schedule m1w, minnesota income tax withheld, is a form that is used for reporting about your tax withheld. Web follow the simple instructions below: Web most people must file their 2022 minnesota tax return by april 18, 2023. Edit your mn schedule m1w online.

Fill Free fillable Minnesota Department of Revenue PDF forms

Type text, add images, blackout. Web what is minnesota schedule m1w? Business, tax, legal along with other documents demand a top level of protection and compliance with the law. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment form. The minnesota department of revenue must receive your.

Fill Free fillable 2019 Form M1X, Amended Minnesota Tax

Business, tax, legal along with other documents demand a top level of protection and compliance with the law. You should add it when you send. Schedule m1w, minnesota income tax withheld, is a form that is used for reporting about your tax withheld. The minnesota department of revenue must receive your return electronically or have it delivered or. This form.

Schedule M1W, Minnesota Income Tax Withheld, Is A Form That Is Used For Reporting About Your Tax Withheld.

Web minnesota individual income tax forms and instructions > form m1 minnesota individual income tax return > schedule m1w minnesota income tax withheld > schedule. Web the 2022 minnesota state income tax return forms for tax year 2022 (jan. Before starting your minnesota income tax return ( form m1 , individual income tax ), you must complete federal form. Web we last updated minnesota form m1w in december 2022 from the minnesota department of revenue.

Web Send Minnesota Tax Form M1W Via Email, Link, Or Fax.

Web what is minnesota schedule m1w? Include this schedule when you file your return. Business, tax, legal along with other documents demand a top level of protection and compliance with the law. You should add it when you send.

Complete This Schedule To Report Minnesota Income Tax Withheld.

Type text, add images, blackout. Web follow the simple instructions below: This form is for income earned in tax year 2022, with tax returns due in april. Edit your mn schedule m1w online type text, add images, blackout confidential details, add comments, highlights and more.

Edit Your Minnesota Form M1W Online.

Sign it in a few clicks draw your signature, type. Web minnesota forms and schedules form m 100*—request for copy of tax return form m1—individual income tax form m13—income tax extension payment form. Web 2018 m1w, minnesota income tax withheld | minnesota department of revenue. Web 2020 schedule m1w, minnesota income tax withheld.