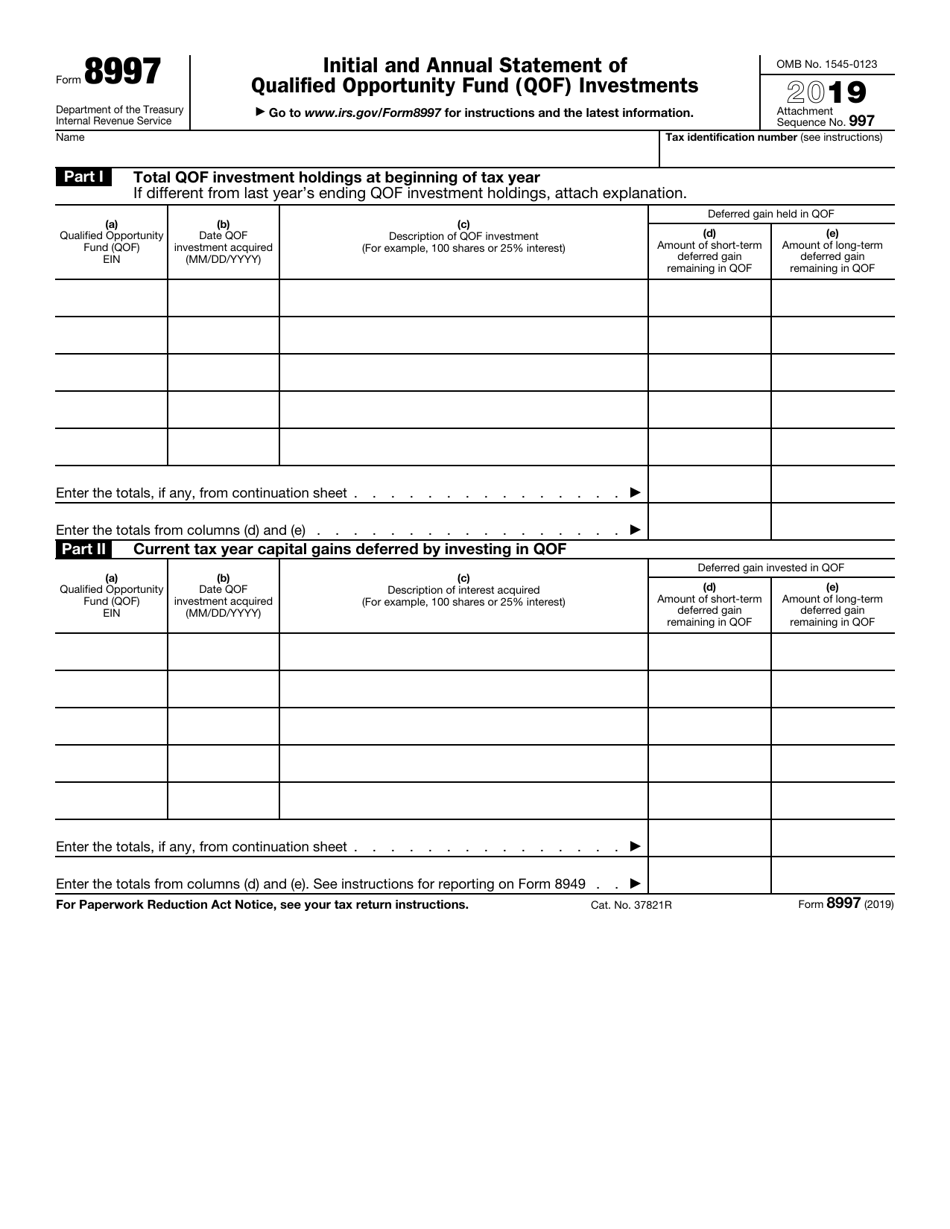

Irs Form 8997

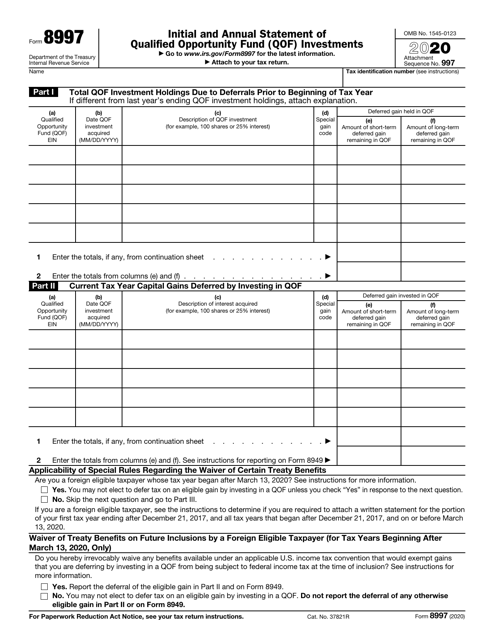

Irs Form 8997 - Current year gain recognized from qof investments (through disposition or other inclusion event) 4. Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form. Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. You may not elect to defer tax on an eligible gain by investing in a qof unless you check “yes” in response to the next question. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. Skip the next question and go to part iii. Current year capital gains deferred through qof investment 3.

Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. Web form 8997, initial and annual statement of qualified opportunity fund (qof) investments any taxpayer who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Current year gain recognized from qof investments (through disposition or other inclusion event) 4. Web what is form 8997? Current year capital gains deferred through qof investment 3. 37821r form 8997 (2019) 2 part iii qof investments disposed of during current tax year deferred gain included due to disposition of qof interest qualified opportunity fund (qof) ein (b) date qof sold or disposed (mm/dd/yyyy) (c) description of interest disposed (for example, 100 shares or 25% interest) Skip the next question and go to part iii.

Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Web what is form 8997? Web form 8997, initial and annual statement of qualified opportunity fund (qof) investments any taxpayer who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Web on september 25, 2019, the irs released draft form 8997, initial and annual statement of qualified opportunity fund (qof) investments, which investors in qualified opportunity zone funds (qofs) must file to report qof investments held at the beginning and end of the current tax year, current tax year capital gains deferred by investing in qofs,. 37821r form 8997 (2019) 2 part iii qof investments disposed of during current tax year deferred gain included due to disposition of qof interest qualified opportunity fund (qof) ein (b) date qof sold or disposed (mm/dd/yyyy) (c) description of interest disposed (for example, 100 shares or 25% interest) Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a qof and qof investments disposed of during the current tax year.

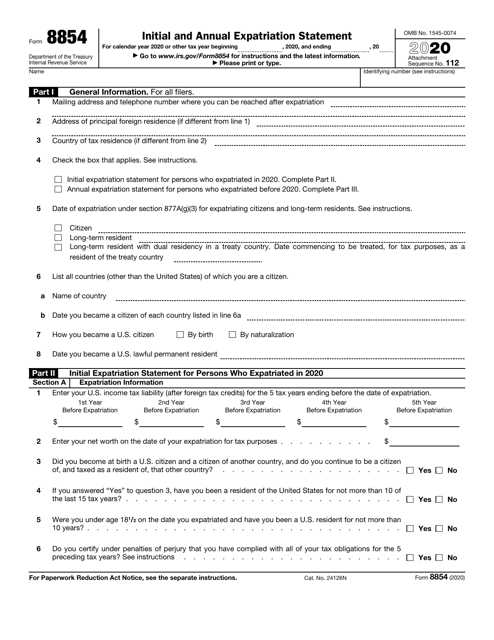

IRS Form 8854 Download Fillable PDF or Fill Online Initial and Annual

See instructions for more information. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Qof investments held at the beginning of the year 2. Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Current year capital gains deferred through qof investment 3.

IRS FORM 9297 SUMMARY OF CONTACT Get Tax Help

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a qof and qof investments disposed of during the current tax year. Web form 8997, initial and annual statement of qualified opportunity fund investments.

Qualified Opportunity Zones Are They Really Effective? Western CPE

Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. Skip the next question and go to part iii. Current year capital gains deferred through qof investment 3..

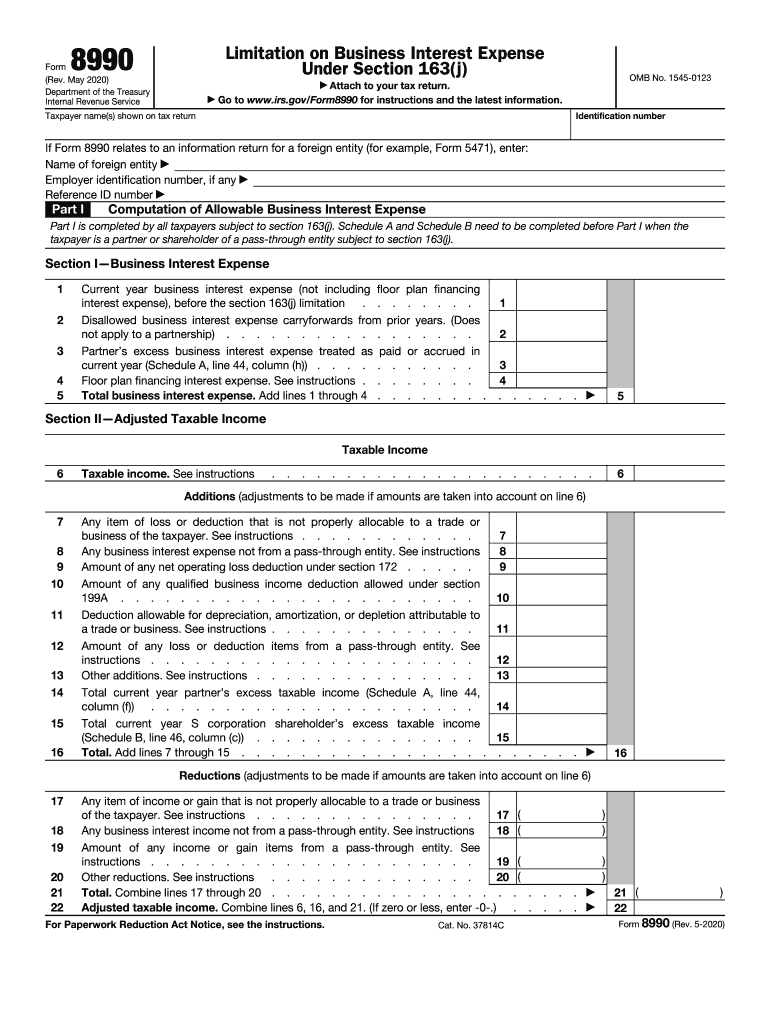

Irs Business 163 J Form Fill Out and Sign Printable PDF Template

Web form 8997, initial and annual statement of qualified opportunity fund (qof) investments any taxpayer who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Web what is form 8997? This process starts with form 8949. Current year gain recognized from qof investments (through disposition or other.

Fill Free fillable IRS PDF forms

Qof investments held at the beginning of the year 2. Web the form 8997 consists of 4 parts: Qof investors sell a capital asset for a gain and drop that gain into a qof within 180 days, allowing them to defer taxes on the gain. Current year capital gains deferred through qof investment 3. Current year gain recognized from qof.

Irs Form 1090 T Universal Network

Web the form 8997 consists of 4 parts: Skip the next question and go to part iii. Qof investments held at the beginning of the year 2. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Web you must file annually form 8997, initial and annual statement of qualified opportunity fund.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. Skip the next question and go to part iii. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? See instructions for more information..

IRS Form 1040es Estimated Tax for Individuals Lies on Flat Lay Office

Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180. 37821r form 8997 (2019) 2 part iii qof investments disposed of during current tax year deferred gain included due.

IRS FORM 12257 PDF

See instructions for more information. Let’s first summarize how investors defer capital gains using a qof ( qualified opportunity fund ). Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Skip the next question and go to part iii. 37821r form 8997 (2019) 2 part iii qof investments disposed of during current tax year deferred gain.

IRS Form 8997 Download Fillable PDF or Fill Online Initial and Annual

This process starts with form 8949. Web the form 8997 consists of 4 parts: You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Qof investors sell a capital asset for.

Current Year Gain Recognized From Qof Investments (Through Disposition Or Other Inclusion Event) 4.

Web use form 8997 to inform the irs of the qof investments and deferred gains held at the beginning and end of the current tax year, as well as any capital gains deferred by investing in a qof and qof investments disposed of during the current tax year. You may not elect to defer tax on an eligible gain by investing in a qof unless you check “yes” in response to the next question. Current year capital gains deferred through qof investment 3. Timing of investments to defer tax on an eligible gain, you must invest in a qualified opportunity fund in exchange for equity interest (not debt interest) within 180.

Let’s First Summarize How Investors Defer Capital Gains Using A Qof ( Qualified Opportunity Fund ).

Web taxpayers use form 8997 to inform the irs of the qof/qoz investments and deferred capital gains held at the beginning and end of the current tax year, any capital gains deferred by investing in a qof, and qoz investments disposed of. This process starts with form 8949. Web form 8997, initial and annual statement of qualified opportunity fund (qof) investments any taxpayer who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. 37821r form 8997 (2019) 2 part iii qof investments disposed of during current tax year deferred gain included due to disposition of qof interest qualified opportunity fund (qof) ein (b) date qof sold or disposed (mm/dd/yyyy) (c) description of interest disposed (for example, 100 shares or 25% interest)

Qof Investors Sell A Capital Asset For A Gain And Drop That Gain Into A Qof Within 180 Days, Allowing Them To Defer Taxes On The Gain.

Web the form 8997 consists of 4 parts: You can file your tax return without that, however according the new irs rule all taxpayers who holds a qof investment during the tax year must file form 8997, even if they did not dispose of any qof investments. Thus, individuals, c corporations, s corporations, partnerships, estates and trusts with qof investments. Web form 8997, initial and annual statement of qualified opportunity fund investments is a new form.

See Instructions For More Information.

Web you must file annually form 8997, initial and annual statement of qualified opportunity fund (qof) investments with your timely filed federal tax return (including extensions). Skip the next question and go to part iii. Web applicability of special rules regarding the waiver of certain treaty benefits are you a foreign eligible taxpayer? Web on september 25, 2019, the irs released draft form 8997, initial and annual statement of qualified opportunity fund (qof) investments, which investors in qualified opportunity zone funds (qofs) must file to report qof investments held at the beginning and end of the current tax year, current tax year capital gains deferred by investing in qofs,.

.jpg)