Irs Form 8878

Irs Form 8878 - Web form 8867, paid preparer’s due diligence checklist for the earned income credit, american opportunity tax credit, child tax credit (including the additional child. Get ready for tax season deadlines by completing any required tax forms today. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Web a return completed form 8878 to your ero. Web report error it appears you don't have a pdf plugin for this browser. These forms serve as a. December 2008) authorization for form 7004 omb no. Web • do not send form 8878 to the irs unless requested to do so.

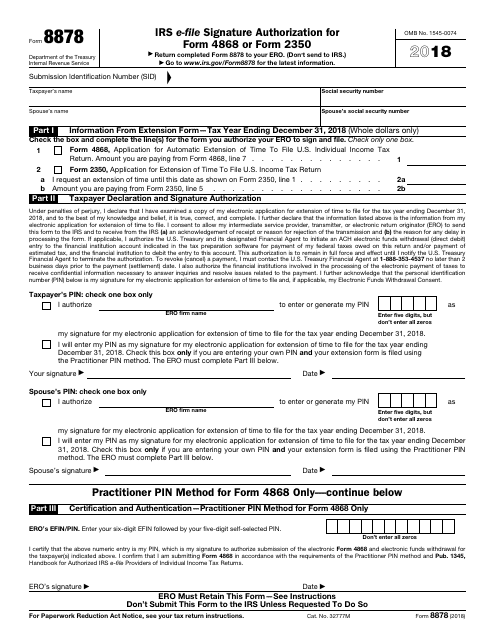

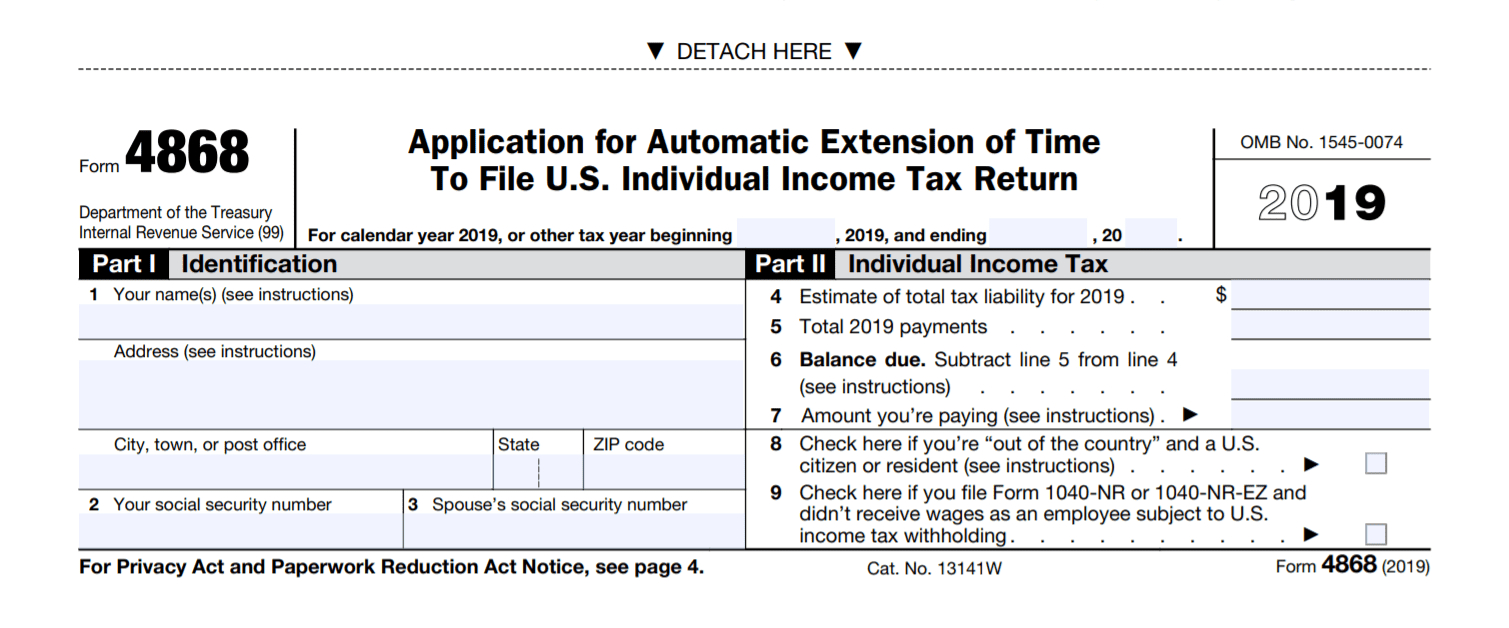

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. (don't send to irs.) ago to www.irs.gov/form8878 for the latest information. Ad access irs tax forms. These forms serve as a. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Complete, edit or print tax forms instantly. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Web report error it appears you don't have a pdf plugin for this browser. Web form 8867, paid preparer’s due diligence checklist for the earned income credit, american opportunity tax credit, child tax credit (including the additional child.

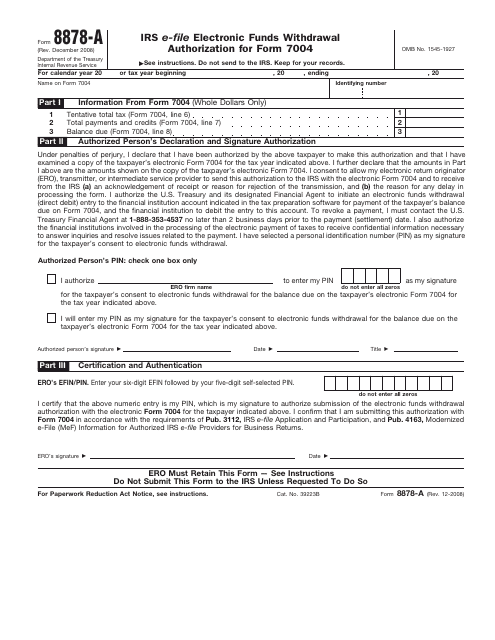

Web • do not send form 8878 to the irs unless requested to do so. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. These forms serve as a. Web form 8867, paid preparer’s due diligence checklist for the earned income credit, american opportunity tax credit, child tax credit (including the additional child. Web forms 8878 and 8879 are declaration documents required by the irs when a tax preparer files an electronic return on behalf of a taxpayer. Web a return completed form 8878 to your ero. December 2008) authorization for form 7004 omb no. Ad access irs tax forms. Web report error it appears you don't have a pdf plugin for this browser. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,.

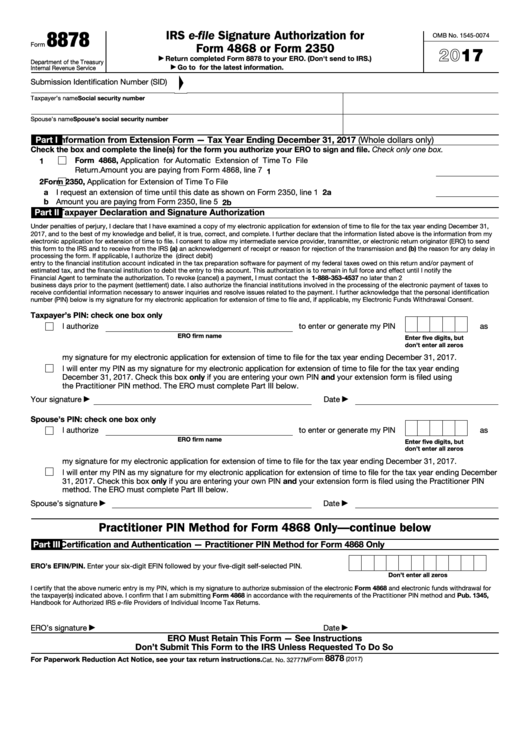

Fillable Form 8878 Irs EFile Signature Authorization For Form 4868

Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Complete, edit or print tax forms instantly. These forms are similar to form 8879 and are. (don't send to irs.) ago to www.irs.gov/form8878 for the latest information. Web • do not send form 8878 to the irs unless requested.

IRS Form 8878A Download Fillable PDF or Fill Online IRS EFile

Web • do not send form 8878 to the irs unless requested to do so. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Web forms 8878 and 8879 are declaration documents required by the irs when a tax preparer files an electronic return on behalf of a taxpayer. Complete, edit.

Form 8879 Electronic Signature

Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Complete, edit or print tax forms instantly. A person authorized to sign. Web report error it appears you don't have a pdf plugin for this browser. These forms serve as.

IRS Form 8878 Download Fillable PDF or Fill Online IRS EFile Signature

Ad access irs tax forms. Web a return completed form 8878 to your ero. Get ready for tax season deadlines by completing any required tax forms today. These forms serve as a. Get ready for tax season deadlines by completing any required tax forms today.

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Web • do not send form 8878 to the irs unless requested to do so. Ad access irs tax forms. A person authorized to sign.

Form 8878 IRS efile Signature Authorization for Form 4868 or Form

Ad access irs tax forms. These forms serve as a. Web report error it appears you don't have a pdf plugin for this browser. Web • do not send form 8878 to the irs unless requested to do so. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,.

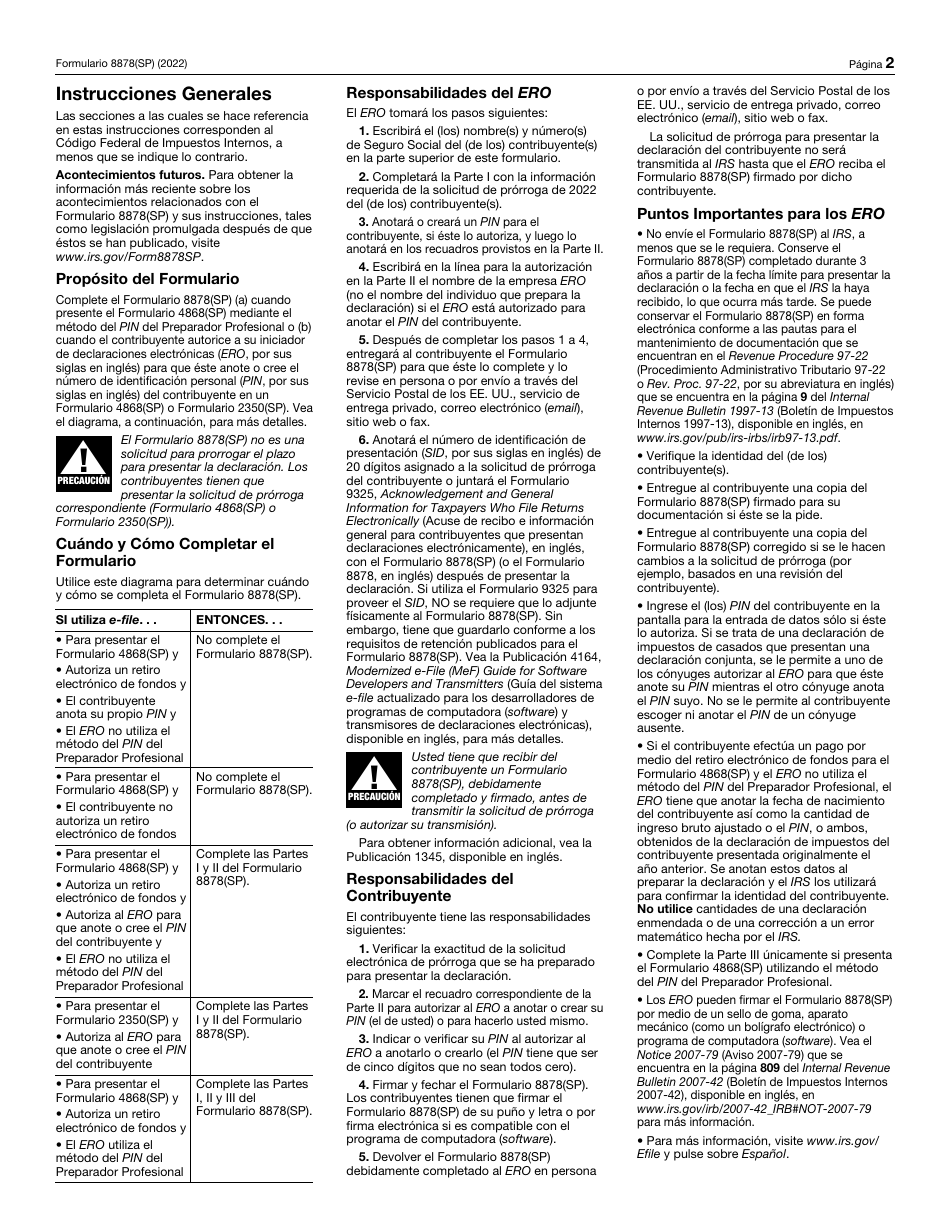

IRS Formulario 8878(SP) Download Fillable PDF or Fill Online

Ad access irs tax forms. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Web forms 8878 and 8879 are declaration documents required by the irs when a tax preparer files an electronic return on behalf of a taxpayer. Get ready for tax season deadlines by completing any.

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

Web a return completed form 8878 to your ero. Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file..

Fillable W 9 Tax Form Form Resume Examples N8VZaW3Ywe

Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. Web form 8867, paid preparer’s due diligence checklist for the earned income credit, american opportunity tax credit, child tax credit (including the additional child. (don't send to irs.) ago to www.irs.gov/form8878 for the latest information. Get ready for tax.

Form 8878A IRS EFile Electronic Funds Withdrawal Authorization for

Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. Web report error it appears you don't have a.

These Forms Serve As A.

Web submission identification number (sid) check the box and complete the line(s) for the form you authorize your ero to sign and file. Web a return completed form 8878 to your ero. These forms are similar to form 8879 and are. Web form 8867, paid preparer’s due diligence checklist for the earned income credit, american opportunity tax credit, child tax credit (including the additional child.

Web Forms 8878 And 8879 Are Declaration Documents Required By The Irs When A Tax Preparer Files An Electronic Return On Behalf Of A Taxpayer.

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. A person authorized to sign. Ad access irs tax forms.

Web Report Error It Appears You Don't Have A Pdf Plugin For This Browser.

Complete, edit or print tax forms instantly. Web • do not send form 8878 to the irs unless requested to do so. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,. (don't send to irs.) ago to www.irs.gov/form8878 for the latest information.

Ad Access Irs Tax Forms.

Web form 8878 allows the taxpayer to authorizes the electronic return originator (ero) to enter or generate their personal identification number (pin) on form 4868 or form 2350. Web complete form 8878 (a) when form 4868 is filed using the practitioner pin method, or (b) when the taxpayer authorizes the electronic return originator (ero) to enter or generate. Web • do not send form 8878 to the irs unless requested to do so. Retain the completed form 8878 for 3 years from the return due date or the date the irs received the return,.