Injured Spouse Form Instructions

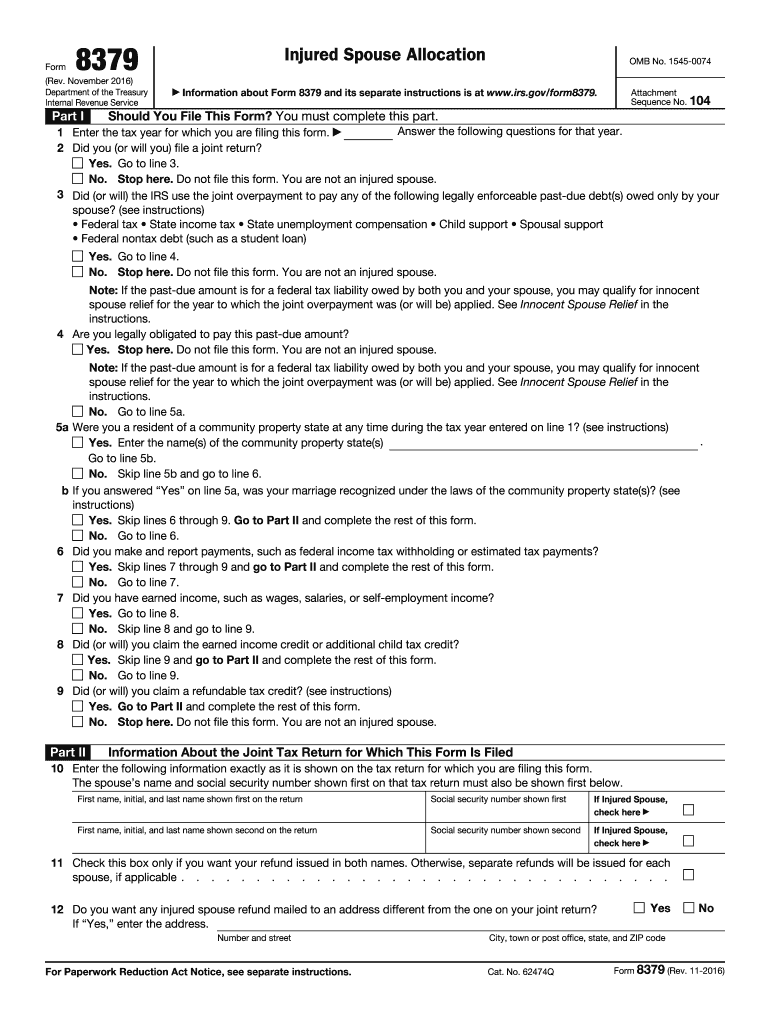

Injured Spouse Form Instructions - You, the “injured” spouse, must. Otherwise, in order to claim. Ad upload, modify or create forms. If you file form 8379 with a joint return on paper, the time. Web if you file form 8379 by itself after a joint return has already been processed, the time needed is about 8 weeks. Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. To file an injured spouse claim, the injured spouse must have: The request for mail order forms may be used to order one copy or. November 2021) department of the treasury internal revenue service.

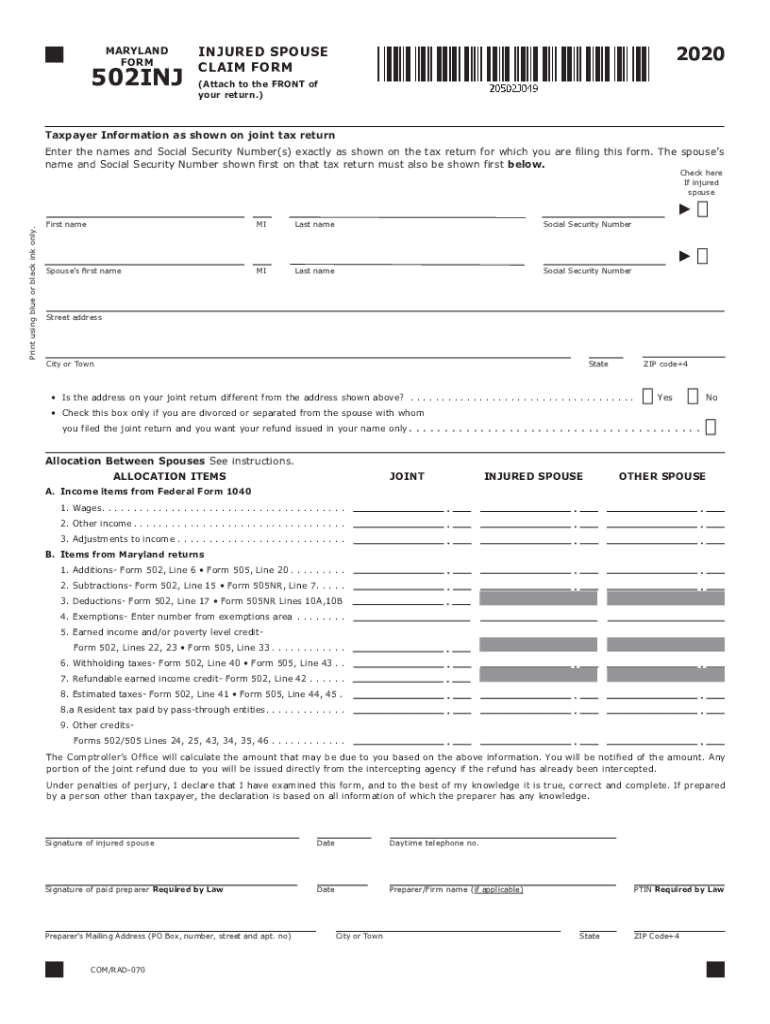

Injured spouse claim and allocation. You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment. It includes your name, social security number, address, and phone number. Web then, you will need to write some information about you and your spouse. Try it for free now! Form 8379 is used by injured. Web per irs instructions for form 8379, page 1: The form will be filed with your tax return, due on tax day. Ad upload, modify or create forms. If you file form 8379 with a joint return on paper, the time.

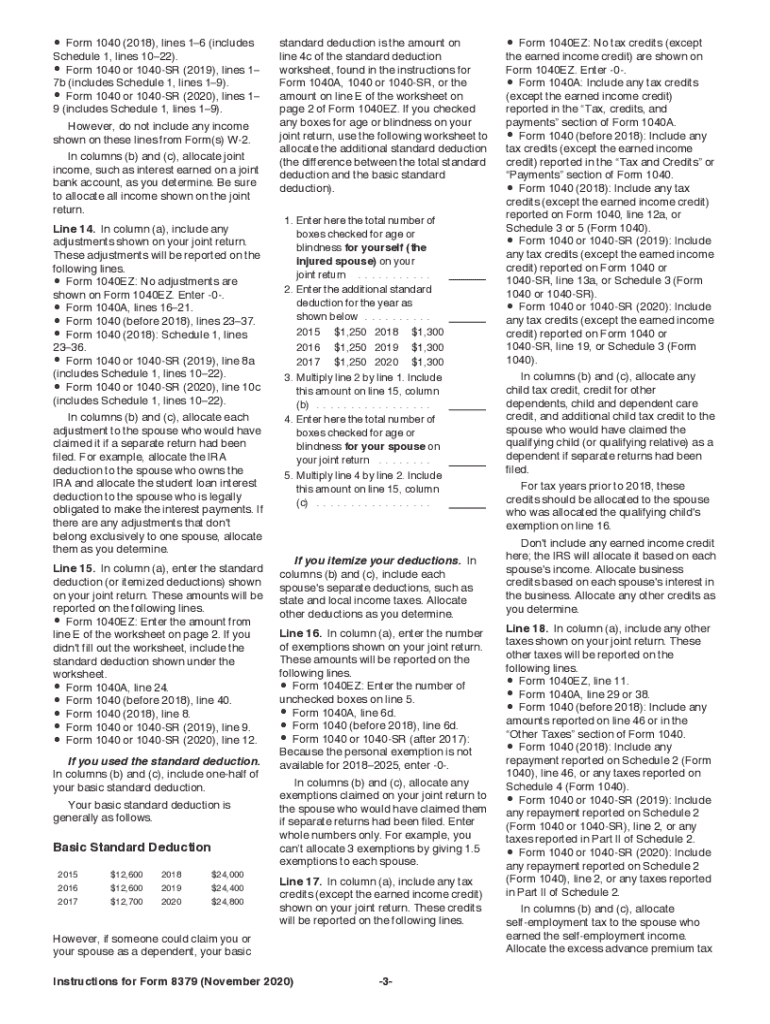

Try it for free now! The form will be filed with your tax return, due on tax day. Irs 8379 inst & more fillable forms, register and subscribe now! If you’re filing with h&r block, you won’t need to complete this form on. Ad upload, modify or create forms. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. Web to file as an injured spouse, you’ll need to complete form 8379: The request for mail order forms may be used to order one copy or. Upload, modify or create forms. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file.

F8379 injure spouse form

Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. You may be an injured.

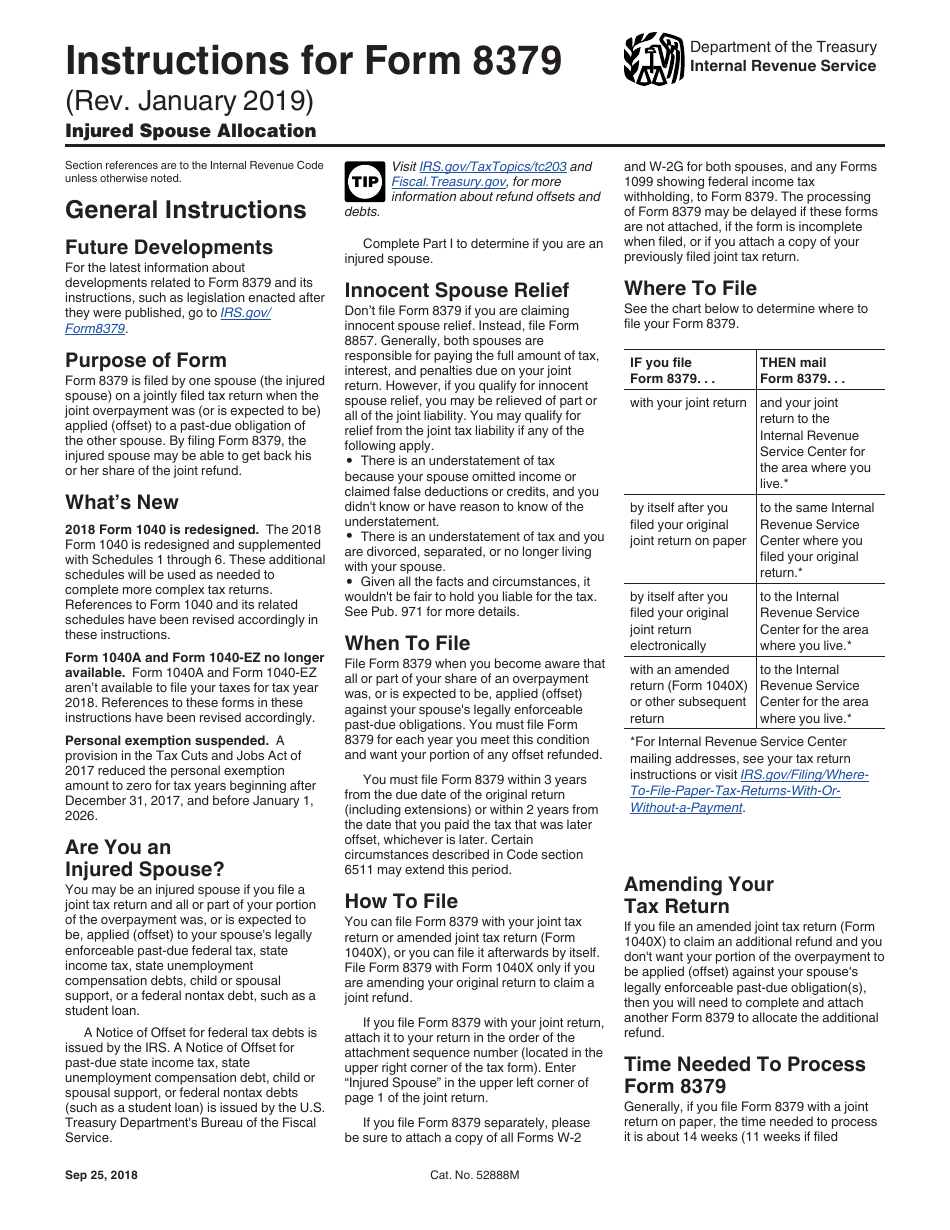

Download Instructions for IRS Form 8379 Injured Spouse Allocation PDF

Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. You will need to check a box. Form 8379 is used by injured. Web if you file form 8379 by itself after a joint return has already been processed, the time needed is about 8 weeks. November.

FREE 7+ Sample Injured Spouse Forms in PDF

Web to file as an injured spouse, you’ll need to complete form 8379: It must show both spouses’ social security numbers in the same order they appeared on your joint tax. Web then, you will need to write some information about you and your spouse. If you’re filing with h&r block, you won’t need to complete this form on. You.

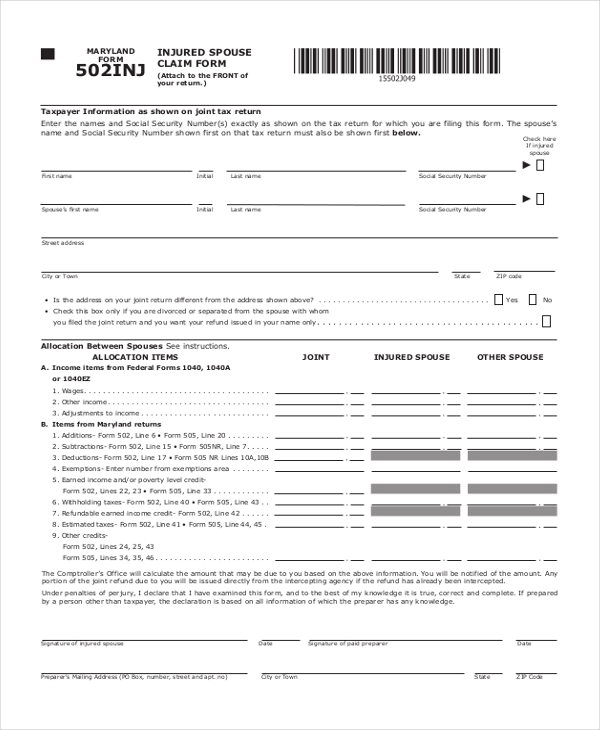

maryland injured spouse form Fill out & sign online DocHub

If you file form 8379 with a joint return on paper, the time. Web information about form 8379, injured spouse allocation, including recent updates, related forms, and instructions on how to file. Web the app will help complete and file form 8379, injured spouse allocation, in this situation. Irs 8379 inst & more fillable forms, register and subscribe now! November.

2020 Form IRS 8379 Instructions Fill Online, Printable, Fillable, Blank

If you’re filing with h&r block, you won’t need to complete this form on. Ad access irs tax forms. The form will be filed with your tax return, due on tax day. November 2021) department of the treasury internal revenue service. Try it for free now!

FREE 7+ Sample Injured Spouse Forms in PDF

Web after an offset happens, you can file form 8379 by itself. Ad access irs tax forms. Web per irs instructions for form 8379, page 1: Are you an injured spouse? Complete, edit or print tax forms instantly.

Injured Spouse Form Fill Out and Sign Printable PDF Template signNow

Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to. Try it for free now! Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt.

FREE 9+ Sample Injured Spouse Forms in PDF

Web to file as an injured spouse, you’ll need to complete form 8379: You will need to check a box. Try it for free now! The request for mail order forms may be used to order one copy or. You may be an injured spouse if you file a joint return and all or part of your portion of the.

FREE 7+ Sample Injured Spouse Forms in PDF

If you file form 8379 with a joint return on paper, the time. Web per irs instructions for form 8379, page 1: Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to a past. To file an injured spouse claim,.

Injured Spouse Allocation Free Download

Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. Web if you file form 8379 by itself after a joint return has already been processed, the time needed is about 8 weeks. Otherwise, in order to claim. Web per irs instructions for form 8379, page 1:.

Web If You File Form 8379 By Itself After A Joint Return Has Already Been Processed, The Time Needed Is About 8 Weeks.

The form will be filed with your tax return, due on tax day. Ad upload, modify or create forms. Are you an injured spouse? You will need to check a box.

Otherwise, In Order To Claim.

Web show both your and your spouse’s social security numbers in the same order as they appear on your original joint tax return. Web instructions please note this form is to be used when a spouse of a person owing child support agrees to voluntarily waive his or her right to claim a portion. Web form 8379 is filed by one spouse (the injured spouse) on a jointly filed tax return when the joint overpayment was (or is expected to be) applied (offset) to. Web then, you will need to write some information about you and your spouse.

Web After An Offset Happens, You Can File Form 8379 By Itself.

Web you may qualify as an injured spouse, if you plan on filing a joint return with your spouse and your spouse owes a debt that you are not responsible for. You, the “injured” spouse, must. To file an injured spouse claim, the injured spouse must have: You may be an injured spouse if you file a joint return and all or part of your portion of the overpayment.

Web Information About Form 8379, Injured Spouse Allocation, Including Recent Updates, Related Forms, And Instructions On How To File.

Additional information instructions for form 8379,. Try it for free now! It must show both spouses’ social security numbers in the same order they appeared on your joint tax. The request for mail order forms may be used to order one copy or.