How Do I Attach Form 8862 On Turbotax

How Do I Attach Form 8862 On Turbotax - Sign in to efile.com sign in to efile.com 2. Web in the turbotax print center, check the 2022 federal returns box and select the just my tax returns(s) option. Web you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web you must complete form 8862 and attach it to your tax return to claim the eic, ctc/rctc/actc/odc, or aotc if both of the following apply. Open your return if you don't already have it open. If it isn't, the irs could reject your return. Web tax tips & video homepage. Answer the questions accordingly, and we’ll include form 8862 with your return. Log into your account and click take me to my. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit.

Sign in to efile.com sign in to efile.com 2. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web in the turbotax print center, check the 2022 federal returns box and select the just my tax returns(s) option. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web taxpayers complete form 8862 and attach it to their tax return if: Pay back the claims, plus interest. Answer the questions accordingly, and we’ll include form 8862 with your return. File an extension in turbotax online before the deadline to avoid a late filing penalty. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit (actc),.

Web tax tips & video homepage. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Answer the questions accordingly, and we’ll include form 8862 with your return. Web then enter the relationship of each person to the child on the appropriate line. Search for 8862 and select the link to go to the section. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web how do i file an irs extension (form 4868) in turbotax online? Web click continue and then done. You can use the steps. Pay back the claims, plus interest.

How TurboTax turns a dreadful user experience into a delightful one

Web instructions for form 8862 (rev. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. Web american opportunity tax credit (aotc) you may need to: Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior.

Intuit TurboTax SelfEmployed 2017 (Tax Year 2016) Review YouTube

File an extension in turbotax online before the deadline to avoid a late filing penalty. File form 8862 when you claim the credit again. Web then enter the relationship of each person to the child on the appropriate line. Sign in to efile.com sign in to efile.com 2. Search for 8862 and select the link to go to the section.

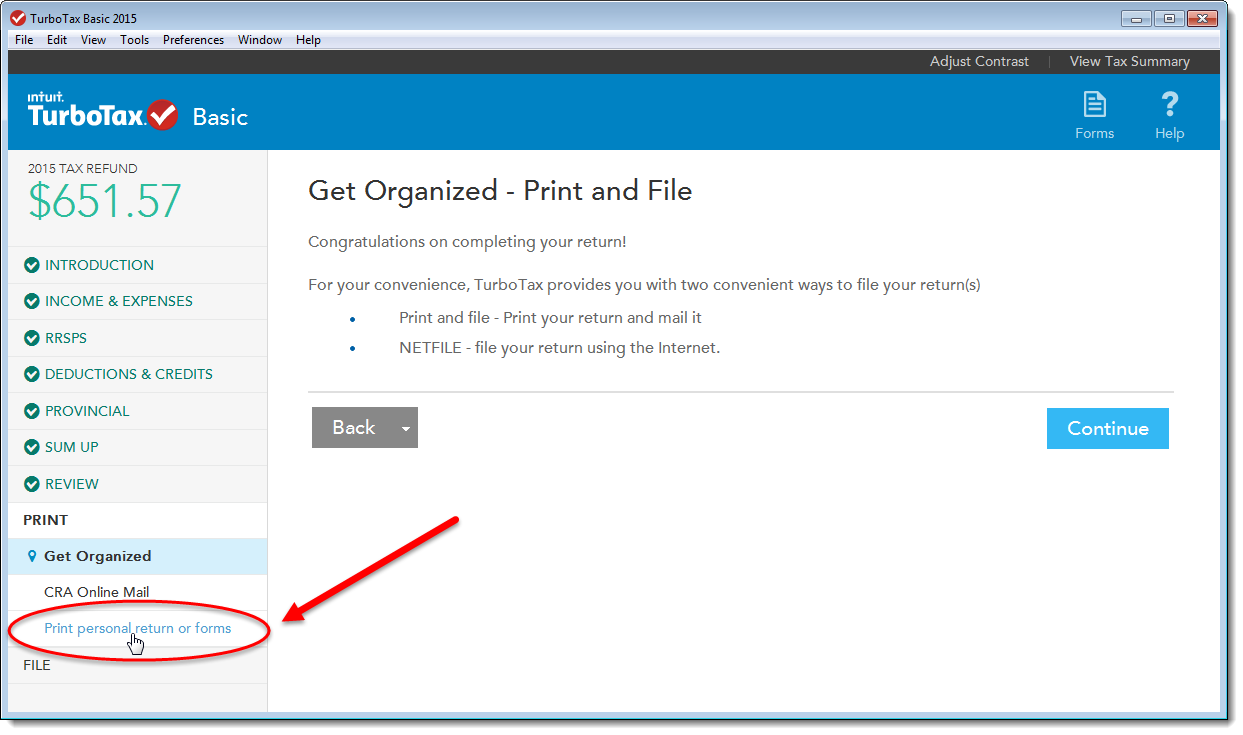

How do I save a PDF copy of my tax return in TurboTax AnswerXchange

Web reply dianew777 expert alumni february 11, 2022 5:27 am if you could provide the reject code it would help with clarification of exactly what your reject issue. Web it’s easy to do in turbotax. Log into your account and click take me to my. Web you must complete form 8862 and attach it to your tax return to claim.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Log into your account and click take me to my. (to do this, sign in to turbotax and click the orange take me to.

What Does Form 8862 Look Like Fill Online, Printable, Fillable, Blank

Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. We'll generate a pdf copy. Web you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Web form.

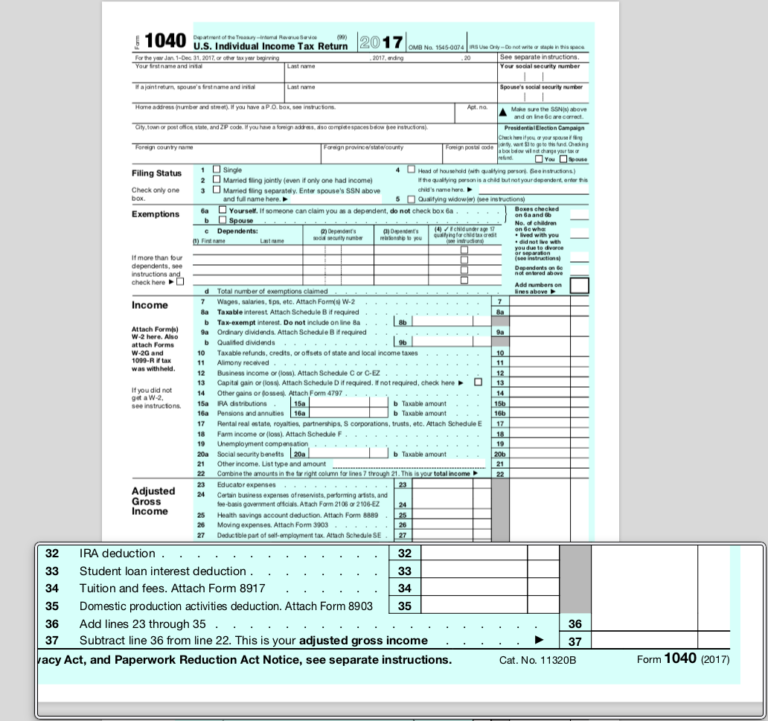

I Am Trying To Find My Agi Number Please Help TurboTax 2021 Tax Forms

Guide to head of household. Web then enter the relationship of each person to the child on the appropriate line. In the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no,. Log into your account and click take me to my. Web taxpayers.

turbotax entering 1031 exchange Fill Online, Printable, Fillable

You can use the steps. Open your return if you don't already have it open. Add certain credit click the green button to add information to claim a certain credit after disallowance. Answer the questions accordingly, and we’ll include form 8862 with your return. (to do this, sign in to turbotax and click the orange take me to my return.

Top 14 Form 8862 Templates free to download in PDF format

Web how do i file an irs extension (form 4868) in turbotax online? If no one else (other than your spouse and dependents you claim on your income tax. Log into your account and click take me to my. File form 8862 when you claim the credit again. Add certain credit click the green button to add information to claim.

Form 8862 TurboTax How To Claim The EITC [The Complete Guide]

Search for 8862 and select the link to go to the section. Web irs form 8862 (information to claim certain credits after disallowance) must be included with your tax return if you have previously been denied the earned. Guide to head of household. Web click continue and then done. File form 8862 when you claim the credit again.

Form 8862 Information to Claim Earned Credit After

Web it’s easy to do in turbotax. File an extension in turbotax online before the deadline to avoid a late filing penalty. Select view or print forms; Web then enter the relationship of each person to the child on the appropriate line. Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out.

Web In The Turbotax Print Center, Check The 2022 Federal Returns Box And Select The Just My Tax Returns(S) Option.

Web instructions for form 8862 (rev. Web it’s easy to do in turbotax. Select view or print forms; Web how do i file an irs extension (form 4868) in turbotax online?

File Form 8862 When You Claim The Credit Again.

(to do this, sign in to turbotax and click the orange take me to my return button.) 2. In the since you got an irs notice, we need to check if any of these apply to your situation screen, click the radio button next to no,. Web american opportunity tax credit (aotc) you may need to: Guide to head of household.

Web Click Continue And Then Done.

Web screen, check the box next toi/we got a letter/notice from the irs telling me/us to fill out an 8862 form to claim the earned income credit. December 2022) department of the treasury internal revenue service information to claim certain credits after disallowance section. Answer the questions accordingly, and we’ll include form 8862 with your return. Search for 8862 and select the link to go to the section.

Their Earned Income Credit (Eic), Child Tax Credit (Ctc)/Additional Child Tax Credit (Actc),.

File an extension in turbotax online before the deadline to avoid a late filing penalty. Web reply dianew777 expert alumni february 11, 2022 5:27 am if you could provide the reject code it would help with clarification of exactly what your reject issue. If it isn't, the irs could reject your return. Married filing jointly vs separately.

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/Screenshot-2022-08-25-170516.jpg)

![Form 8862 TurboTax How To Claim The EITC [The Complete Guide]](https://mwjconsultancy.com/wp-content/uploads/2022/08/aaa.jpg)