Il 2210 Form

Il 2210 Form - • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax. This form allows you to figure penalties you may owe if you did not make timely estimated. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. Save or instantly send your ready documents. This form allows you to figure penalties you may owe if you did not make timely estimated. Designed by the illinois department of. Edit your il il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. This includes any corrected return fi led before the extended due date of the.

Use get form or simply click on the template preview to open it in the editor. Statement of person claiming refund due a deceased taxpayer: Sign it in a few clicks draw your signature, type it,. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax. The irs will generally figure your penalty for you and you should not file form 2210. • for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. Sign it in a few clicks draw your signature, type it,. This form allows you to figure penalties you may owe if you did not make timely estimated. Easily fill out pdf blank, edit, and sign them. The irs will generally figure your penalty for you and you should not file.

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file form 2210. This form allows you to figure penalties you may owe if you did not make timely estimated. The irs will generally figure your penalty for you and you should not file form 2210. Easily fill out pdf blank, edit, and sign them. Start completing the fillable fields and carefully. Designed by the illinois department of. This includes any corrected return fi led before the extended due date of the. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax.

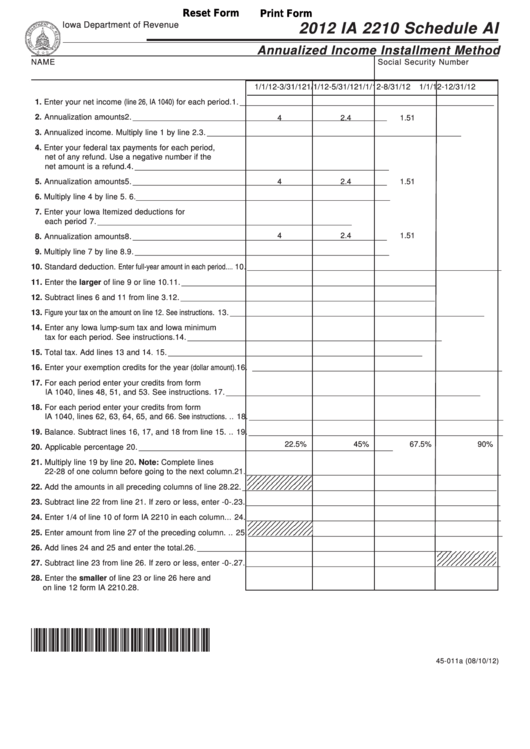

Fillable Form Ia 2210 Schedule Ai Annualized Installment

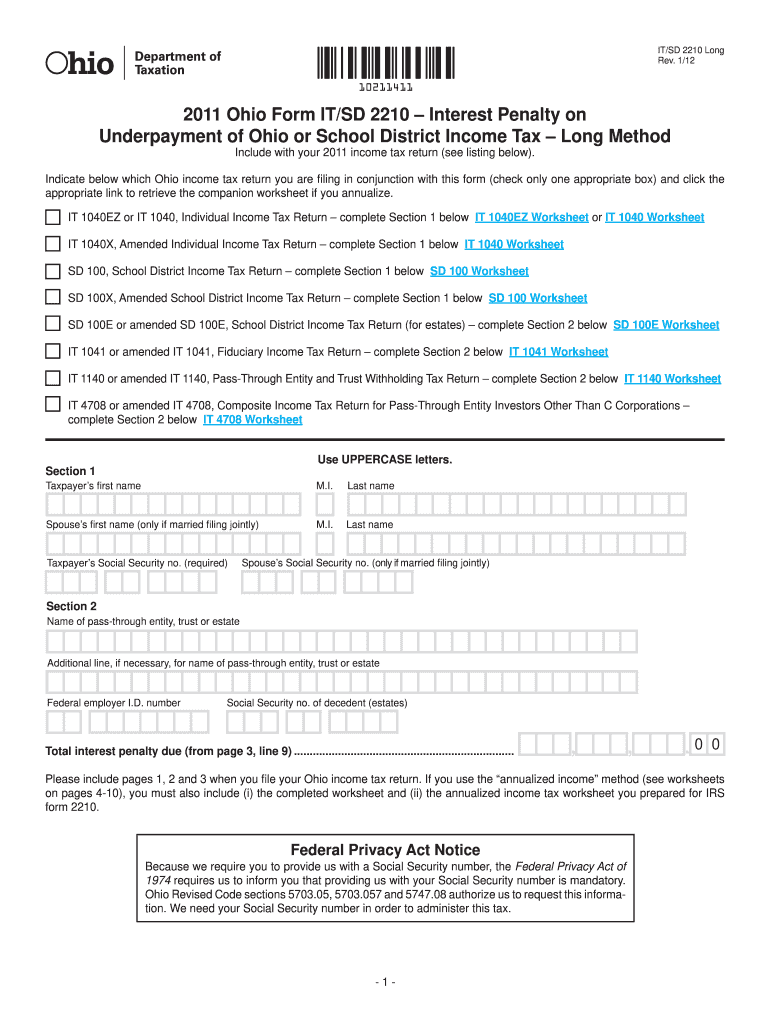

• for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. This includes any corrected return fi led before the extended due date of the. Web general information what is the purpose of this form? Start completing the fillable fields and.

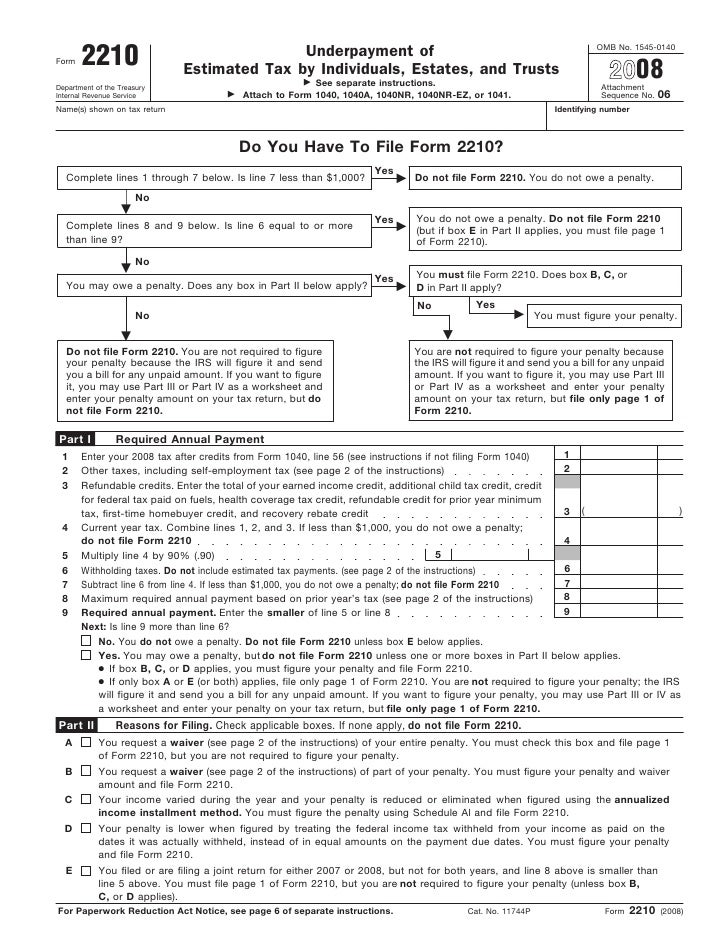

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

This includes any corrected return fi led before the extended due date of the. Edit your il il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Sign it in a few clicks draw your signature, type it,. The.

Form 2210 Underpayment of Estimated Tax by Individuals, Estates and

Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Edit your illinois il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and.

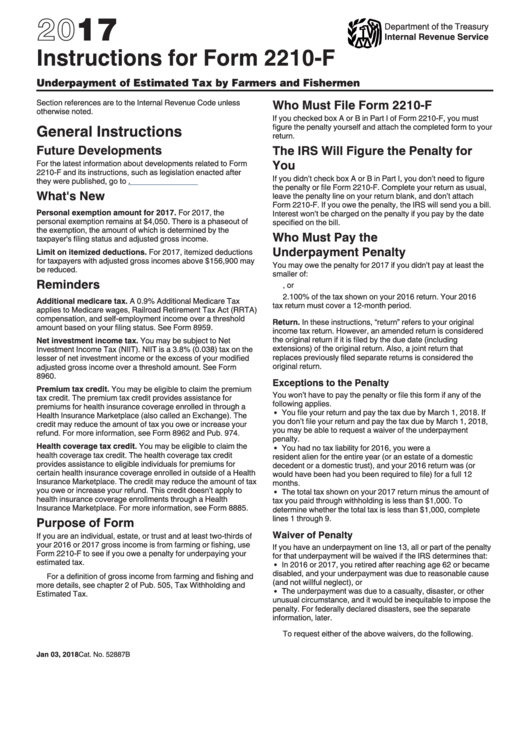

Instructions For Form 2210F Underpayment Of Estimated Tax By Farmers

Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax. This form allows you to figure penalties you may owe if you did not make timely.

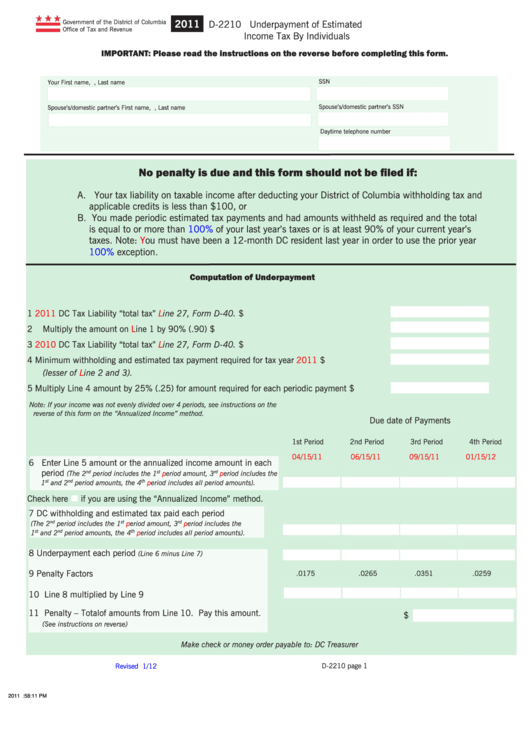

Form D2210 Underpayment Of Estimated Tax By Individuals

Web general information what is the purpose of this form? Easily fill out pdf blank, edit, and sign them. Sign it in a few clicks draw your signature, type it,. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. The irs will generally figure your penalty for you and you should not file.

Form 2210Underpayment of Estimated Tax

Web general information what is the purpose of this form? This includes any corrected return fi led before the extended due date of the. Web purpose of form use form 2210 to see if you owe a penalty for underpaying your estimated tax. Start completing the fillable fields and carefully. Easily fill out pdf blank, edit, and sign them.

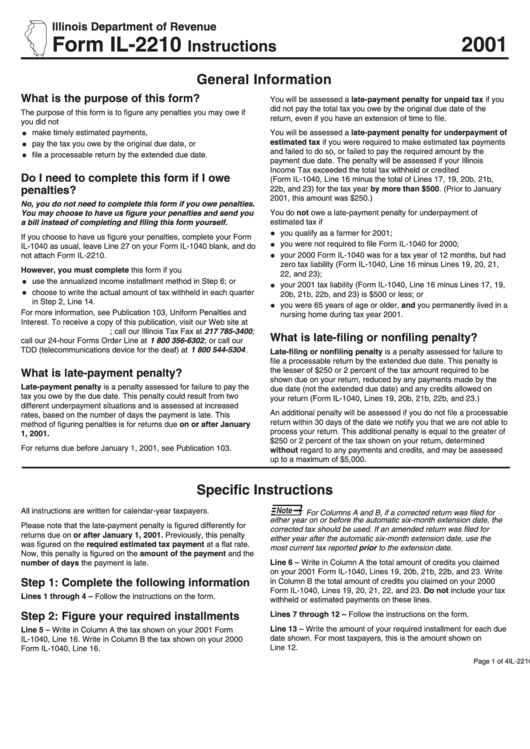

Form Il2210 Instructions 2001 printable pdf download

This includes any corrected return fi led before the extended due date of the. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. Edit your illinois il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. Designed by the illinois department of. The.

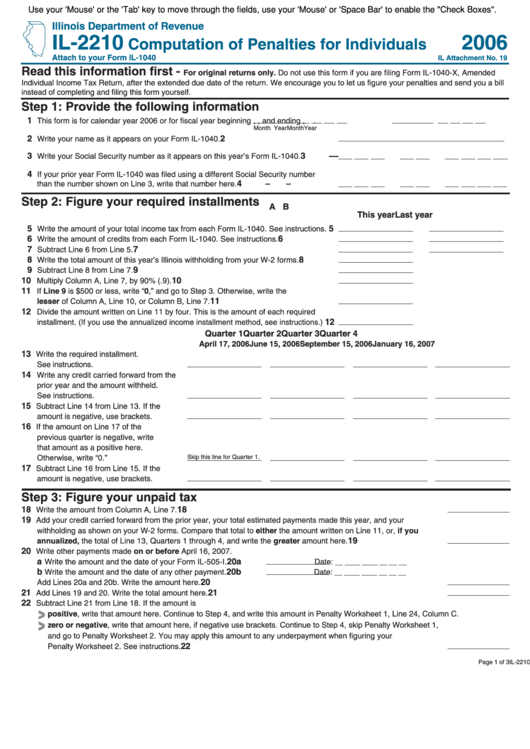

Fillable Form Il2210 Computation Of Penalties For Individuals 2006

The irs will generally figure your penalty for you and you should not file form 2210. This form is for income earned in tax year 2022, with tax returns due in april. Use get form or simply click on the template preview to open it in the editor. Designed by the illinois department of. Edit your il il 2210 online.

2210 Form Fill Out and Sign Printable PDF Template signNow

• for most filers, if your federal tax withholdings and timely payments are not equal to 90% of your current year tax, or 100% of the total tax from the. Easily fill out pdf blank, edit, and sign them. Designed by the illinois department of. The purpose of this form is to fi gure any penalties you may owe if.

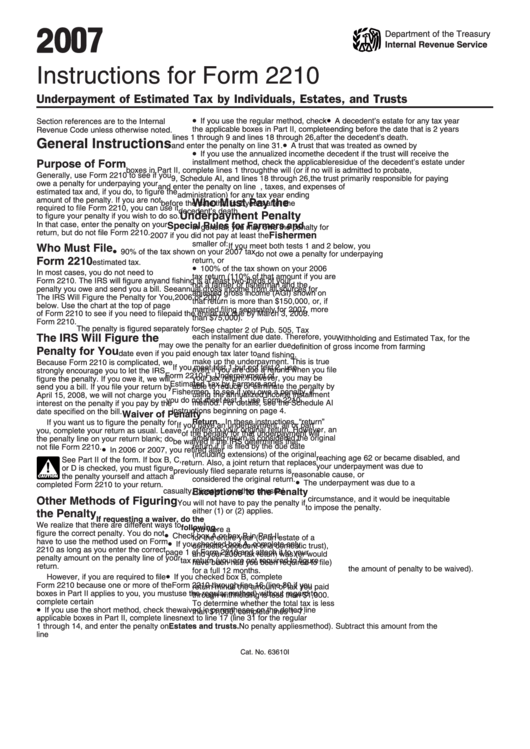

Instructions For Form 2210 Underpayment Of Estimated Tax By

The irs will generally figure your penalty for you and you should not file. Use get form or simply click on the template preview to open it in the editor. The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. Designed by the illinois department of. • for most.

Edit Your Il Il 2210 Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Easily fill out pdf blank, edit, and sign them. This form allows you to figure penalties you may owe if you did not make timely estimated. The irs will generally figure your penalty for you and you should not file. Start completing the fillable fields and carefully.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Edit your illinois il 2210 online type text, add images, blackout confidential details, add comments, highlights and more. Statement of person claiming refund due a deceased taxpayer: The purpose of this form is to figure any penalties you may owe if you did not make timely estimated payments,. The irs will generally figure your penalty for you and you should not file form 2210.

Save Or Instantly Send Your Ready Documents.

This includes any corrected return fi led before the extended due date of the. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. Web use form 2210 to see if you owe a penalty for underpaying your estimated tax. This form allows you to figure penalties you may owe if you did not make timely estimated.

The Irs Will Generally Figure Your Penalty For You And You Should Not File Form 2210.

Web general information what is the purpose of this form? Designed by the illinois department of. The purpose of this form is to fi gure any penalties you may owe if you did not make timely estimated payments, pay the tax. This includes any corrected return fi led before the extended due date of the.