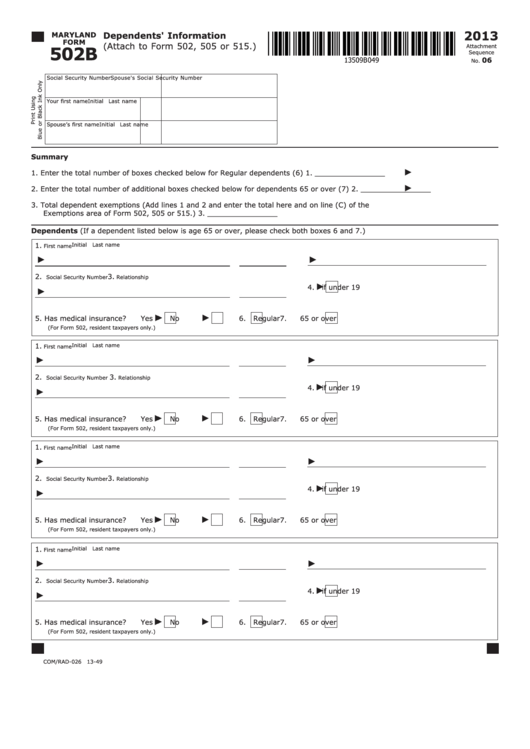

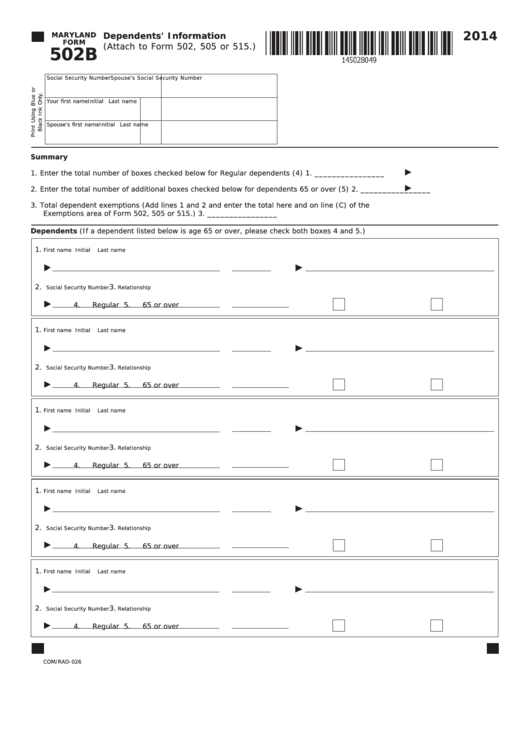

Maryland Form 502B

Maryland Form 502B - Complete, edit or print tax forms instantly. Ad fill, sign, email form 502b & more fillable forms, register and subscribe now! This form is for income earned in tax year 2022, with tax returns due in april. You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding. Dependents (if a dependent listed below is age 65 or over, check both 4 and 5.) 1. Web the fillable 502b form provides dependents information to the tax department. Accepted or enrolled in an eligible or approved program of study at a participating public college/university as a full. Web we last updated maryland form 502b in january 2023 from the maryland comptroller of maryland. Maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 first. Web follow the simple instructions below:

Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants. Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants. Complete, edit or print tax forms instantly. For more information about the maryland. Web follow the simple instructions below: It can be attached to the 502, 505, or 515 forms. Ad fill, sign, email form 502b & more fillable forms, register and subscribe now! Why do i owe comptroller of maryland? Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants. Complete, edit or print tax forms instantly.

Registering your revenue and submitting all the vital tax papers, including md comptroller 502b, is a us citizen?s sole obligation. Why do i owe comptroller of maryland? Complete, edit or print tax forms instantly. We last updated the maryland. For more information about the maryland. Web the fillable 502b form provides dependents information to the tax department. Where do i mail my maryland federal tax. This form is for income earned in tax year 2022, with tax returns due in april. Dependents (if a dependent listed below is age 65 or over, check both 4 and 5.) 1. Web you know that line 35 on the maryland state income tax form allows individuals to make a voluntary contribution to help save the chesapeake bay and protect endangered wildlife?

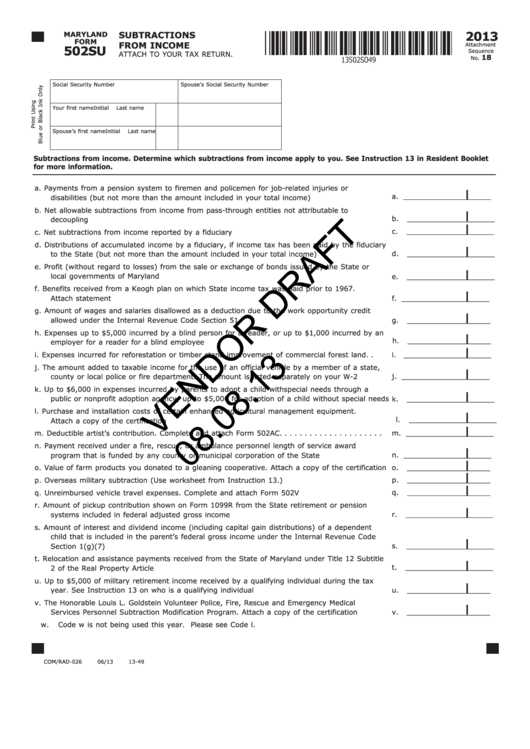

Maryland Form 502su Draft Subtractions From 2013 printable

Dependents (if a dependent listed below is age 65 or over, check both 4 and 5.) 1. This form is for income earned in tax year 2022, with tax returns due in april. We last updated the maryland. Web how it works open the form 502b and follow the instructions easily sign the maryland 502b with your finger send filled.

Fill Free fillable forms Comptroller of Maryland

Get ready for tax season deadlines by completing any required tax forms today. Where do i mail my maryland federal tax. For more information about the maryland. Ad fill, sign, email form 502b & more fillable forms, register and subscribe now! Web to be eligible for the acm, you must be:

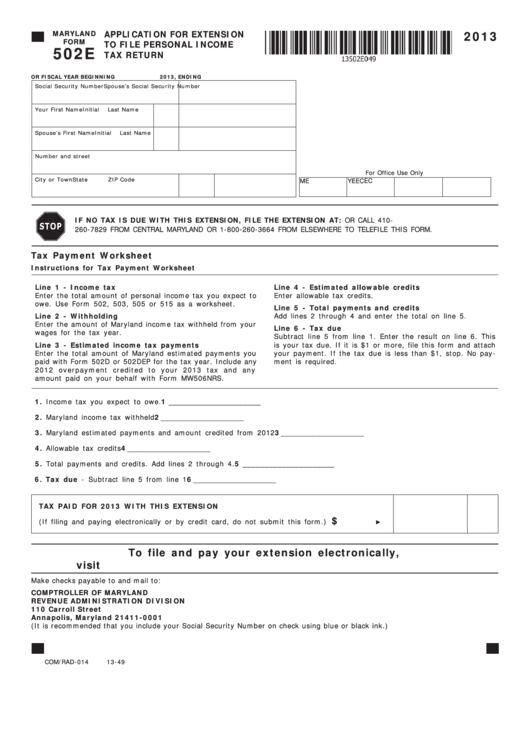

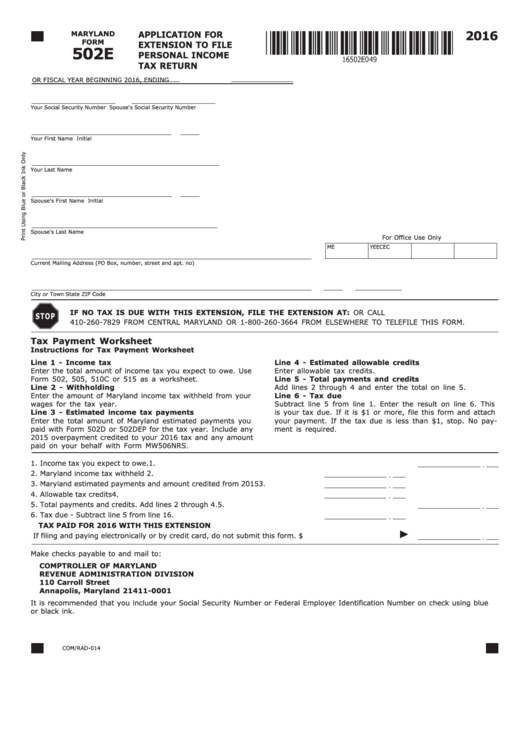

Fillable Maryland Form 502e Application For Extension To File

You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding. Registering your revenue and submitting all the vital tax papers, including md comptroller 502b, is a us citizen?s sole obligation. Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants..

2019 Maryland Form 502 Instructions designshavelife

Why do i owe comptroller of maryland? Web information form 502b to this form to receive the applicable exemption amount. You must file estimated individual income tax if you are self employed or do not pay sufficient tax withholding. Web how it works open the form 502b and follow the instructions easily sign the maryland 502b with your finger send.

502e Maryland Tax Forms And Instructions printable pdf download

Web marylandform 502b dependents' information 2022 (attachto form 502, 505 or 515.) your social security number spouse's social security number your first name mi your. Web maryland form 502b ependents' information 201 tta t rm 502 505 r 515 d026 first name mi last name social security number relationship regular 65 or over. It can be attached to the 502,.

Fill Free fillable forms Comptroller of Maryland

Web exemptions area of form 502, 505 or 515.). Why do i owe comptroller of maryland? For more information about the maryland. Web to be eligible for the acm, you must be: Maryland form 502b ependents' information 2015 tta t rm 502 505 r 515 d026 first.

Fillable Maryland Form 502b Dependents' Information 2013 printable

Complete, edit or print tax forms instantly. Registering your revenue and submitting all the vital tax papers, including md comptroller 502b, is a us citizen?s sole obligation. Where do i mail my maryland federal tax. We last updated the maryland. It can be attached to the 502, 505, or 515 forms.

Fillable Form 502b Maryland Dependents' Information 2014 printable

Web exemptions area of form 502, 505 or 515.). Web we last updated maryland form 502b in january 2023 from the maryland comptroller of maryland. Web you know that line 35 on the maryland state income tax form allows individuals to make a voluntary contribution to help save the chesapeake bay and protect endangered wildlife? Ad fill, sign, email form.

Fill Free fillable forms Comptroller of Maryland

Web we last updated maryland form 502b in january 2023 from the maryland comptroller of maryland. Dependents (if a dependent listed below is age 65 or over, check both 4 and 5.) 1. Get ready for tax season deadlines by completing any required tax forms today. For more information about the maryland. Web you know that line 35 on the.

Fill Free fillable forms Comptroller of Maryland

Web maryland form 502b ependents' information 201 tta t rm 502 505 r 515 d026 first name mi last name social security number relationship regular 65 or over. It can be attached to the 502, 505, or 515 forms. Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants..

You Must File Estimated Individual Income Tax If You Are Self Employed Or Do Not Pay Sufficient Tax Withholding.

For more information about the maryland. Web marylandform 502b dependents' information 2022 (attachto form 502, 505 or 515.) your social security number spouse's social security number your first name mi your. Web exemptions area of form 502, 505 or 515.). Complete, edit or print tax forms instantly.

Web Follow The Simple Instructions Below:

Web we last updated maryland form 502b in january 2023 from the maryland comptroller of maryland. We last updated the maryland. Where do i mail my maryland federal tax. Ad fill, sign, email form 502b & more fillable forms, register and subscribe now!

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants. This form is for income earned in tax year 2022, with tax returns due in april. Web maryland form 502b ependents' information 201 tta t rm 502 505 r 515 d026 first name mi last name social security number relationship regular 65 or over. Web information form 502b to this form to receive the applicable exemption amount.

Why Do I Owe Comptroller Of Maryland?

Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants. Web form 502 and form 502b filed together are the individual income tax return forms for maryland residents claiming any dependants. Accepted or enrolled in an eligible or approved program of study at a participating public college/university as a full. Web how it works open the form 502b and follow the instructions easily sign the maryland 502b with your finger send filled & signed md 502b or save rate the md form 502b 4.8.