How Much To Form An Llc In Delaware

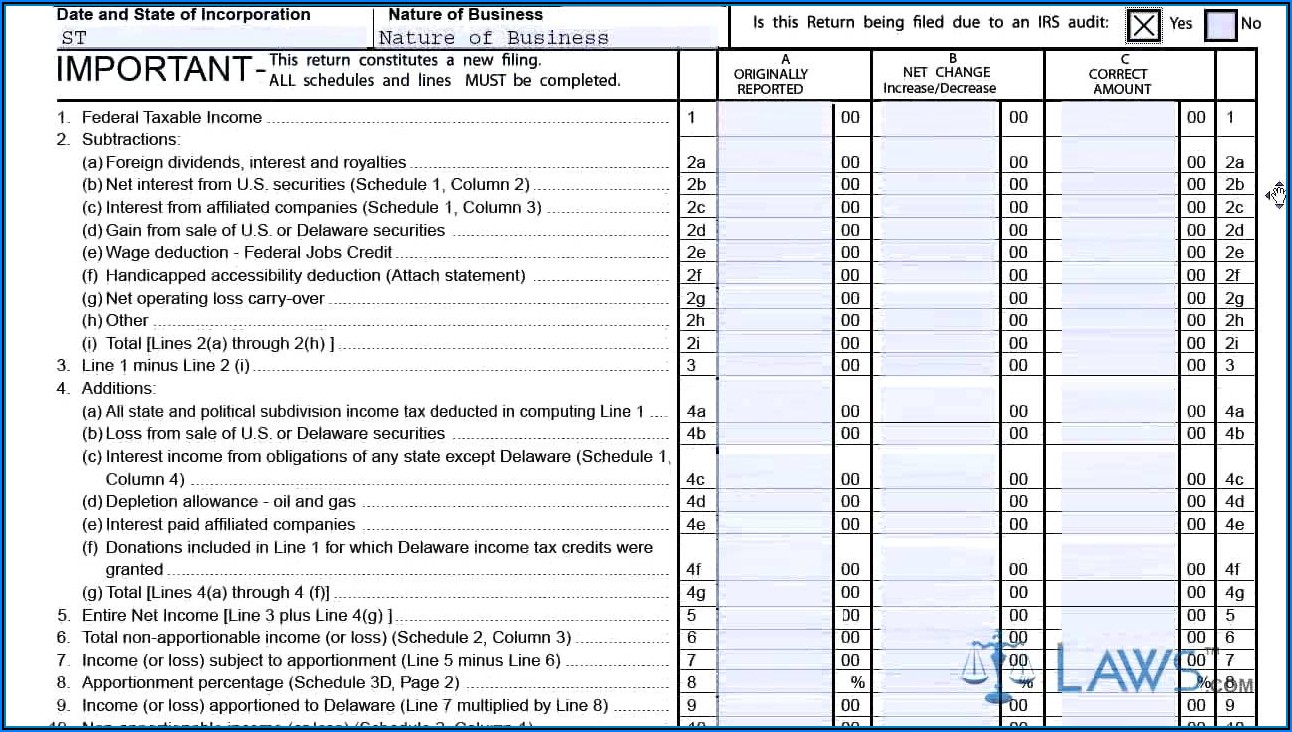

How Much To Form An Llc In Delaware - Create your llc in delaware. Cost to form a foreign. Web we have a list of fees for your convenience. Lp/llc/gp although limited partnerships, limited liability companies and general partnerships formed in the state of delaware do not file an annual report, they are required to pay an annual tax of $300.00. Web create your llc with forbes advisor. In delaware, all llcs are required to file and pay a $300 annual franchise tax. Fill out the application form, and send it to delaware division of corporations 401 federal street suite 4 dover, de 19901 costs $200 an additional certified copy costs $50 franchise tax $300 (annual) can be done online. Click here for more information.) ucc forms and fee information The first step to forming a delaware llc is to choose a name for your business. Web delaware has mandated electronic filing of domestic corporations annual reports.

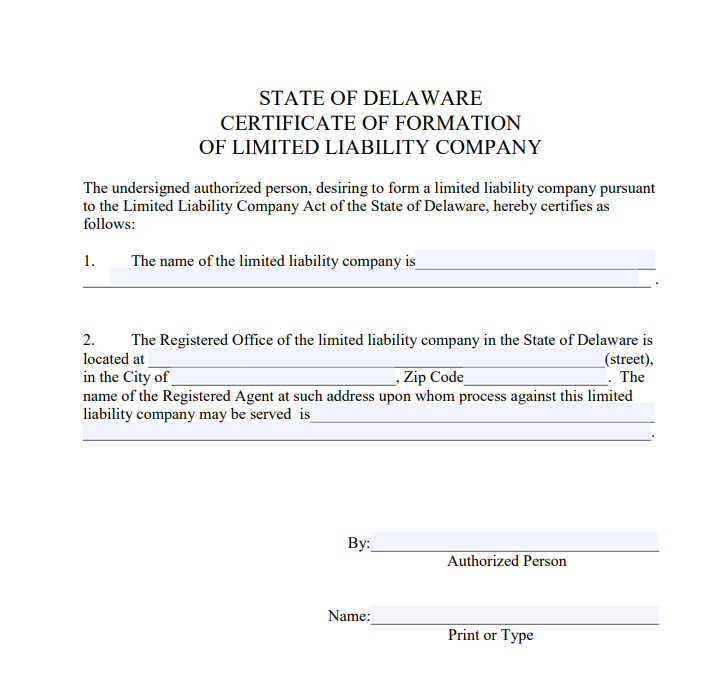

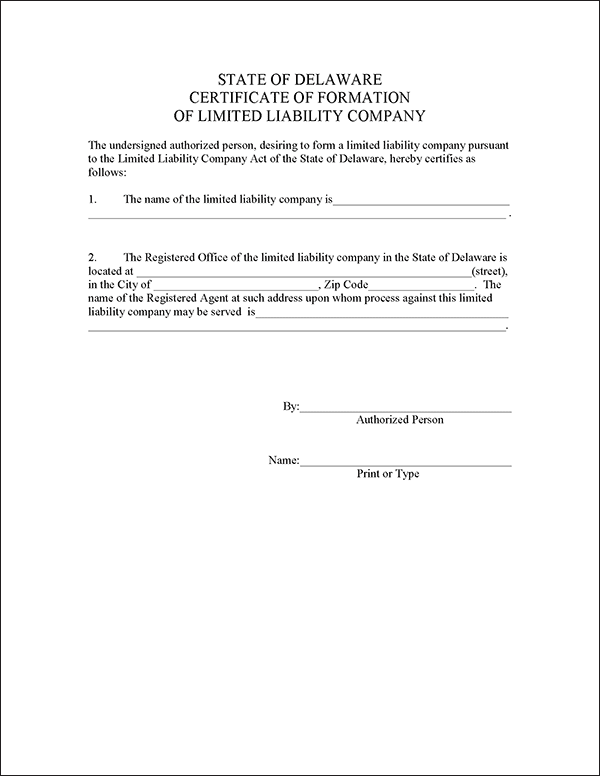

You can apply online or by mail. A separate state election is not allowed on a llc. Web our pick is northwest registered agent ($29 + state fees). Web delaware has mandated electronic filing of domestic corporations annual reports. Name your delaware llc choose a registered agent file the certificate of formation Web to form a delaware llc, you'll need to file a certificate of formation with the delaware department of state, which costs $90. The main cost to start an llc in delaware is the $90 fee to file your llc's. Statutory trust fees will increase on august 1, 2018. Web we have a list of fees for your convenience. Fill out the application form, and send it to delaware division of corporations 401 federal street suite 4 dover, de 19901 costs $200 an additional certified copy costs $50 franchise tax $300 (annual) can be done online.

Corporate fee schedule ( important: Obtain a delaware business license. The first step to starting an llc in delaware is choosing a name. Web delaware has mandated electronic filing of domestic corporations annual reports. Web how much does an llc cost in delaware? Form an llc in delaware today starting at $0 plus state fees This is the state fee for a document called the. The main cost to start an llc in delaware is the $90 fee to file your llc's. Fill out the application form, and send it to delaware division of corporations 401 federal street suite 4 dover, de 19901 costs $200 an additional certified copy costs $50 franchise tax $300 (annual) can be done online. Lp/llc/gp although limited partnerships, limited liability companies and general partnerships formed in the state of delaware do not file an annual report, they are required to pay an annual tax of $300.00.

Gold Delaware LLC Package Order Form

Corporate fee schedule ( important: Choose a name for your delaware llc. Web a llc is always classified in the same manner for delaware income tax as it is for federal income tax purposes. Obtain a delaware business license. A separate state election is not allowed on a llc.

How To Register An LLC In Delaware (In Only 5 Steps)

Choose a name for your llc. Web a llc is always classified in the same manner for delaware income tax as it is for federal income tax purposes. The first step to forming a delaware llc is to choose a name for your business. Corporate fee schedule ( important: Create your llc in delaware.

How To Form An LLC In Delaware In 10 Minutes! YouTube

The main cost to start an llc in delaware is the $90 fee to file your llc's. Fill out the application form, and send it to delaware division of corporations 401 federal street suite 4 dover, de 19901 costs $200 an additional certified copy costs $50 franchise tax $300 (annual) can be done online. Click here for more information.) ucc.

How to form a Delaware INC or LLC in 4 Steps

The main cost to start an llc in delaware is the $90 fee to file your llc's. Web delaware has mandated electronic filing of domestic corporations annual reports. Corporate fee schedule ( important: Name your delaware llc choose a registered agent file the certificate of formation Create your llc in delaware.

Delaware LLC Notices De Limited Liability Company US Legal Forms

Web we have a list of fees for your convenience. Lp/llc/gp although limited partnerships, limited liability companies and general partnerships formed in the state of delaware do not file an annual report, they are required to pay an annual tax of $300.00. Create your llc in delaware. Name your delaware llc choose a registered agent file the certificate of formation.

Delaware LLC and Corporation Registration and Formation IncParadise

Web to form a delaware llc, you'll need to file a certificate of formation with the delaware department of state, which costs $90. Choose a name for your delaware llc. Delaware llc online filing fee: In delaware, all llcs are required to file and pay a $300 annual franchise tax. Web we have a list of fees for your convenience.

Cost Of Forming A Delaware Llc Form Resume Examples BpV5mz5V1Z

Fill out the application form, and send it to delaware division of corporations 401 federal street suite 4 dover, de 19901 costs $200 an additional certified copy costs $50 franchise tax $300 (annual) can be done online. This is the state fee for a document called the. Click here for more information.) ucc forms and fee information Deciding on the.

Delaware Llc Conversion Forms Form Resume Examples Bw9j6q797X

Choose a name for your llc. In delaware, all llcs are required to file and pay a $300 annual franchise tax. A separate state election is not allowed on a llc. Obtain a delaware business license. Web we have a list of fees for your convenience.

Delaware LLC How to Start an LLC in Delaware TRUiC

Choose a name for your llc. Click here for more information.) ucc forms and fee information Create your llc in delaware. The main cost to start an llc in delaware is the $90 fee to file your llc's. Web to form a delaware llc, you'll need to file a certificate of formation with the delaware department of state, which costs.

Llc In Delaware >

You can apply online or by mail. Choose a name for your delaware llc. The first step to forming a delaware llc is to choose a name for your business. The first step to starting an llc in delaware is choosing a name. Deciding on the perfect name for your new business is one of the most crucial parts of.

Deciding On The Perfect Name For Your New Business Is One Of The Most Crucial Parts Of Starting A Company.

Statutory trust fees will increase on august 1, 2018. Lp/llc/gp although limited partnerships, limited liability companies and general partnerships formed in the state of delaware do not file an annual report, they are required to pay an annual tax of $300.00. Web starting an llc costs $90 in delaware. Fill out the application form, and send it to delaware division of corporations 401 federal street suite 4 dover, de 19901 costs $200 an additional certified copy costs $50 franchise tax $300 (annual) can be done online.

Name Your Delaware Llc Choose A Registered Agent File The Certificate Of Formation

Choose a name for your delaware llc. Web we have a list of fees for your convenience. Limited liability companies classified as partnerships must file delaware form 300. Corporate fee schedule ( important:

The First Step To Starting An Llc In Delaware Is Choosing A Name.

A separate state election is not allowed on a llc. Choose a name for your llc. Delaware llc online filing fee: Cost to form a foreign.

You Can Apply Online Or By Mail.

This is the state fee for a document called the. The first step to forming a delaware llc is to choose a name for your business. Web how much does an llc cost in delaware? Form an llc in delaware today starting at $0 plus state fees