Form 4797 Vs Schedule D

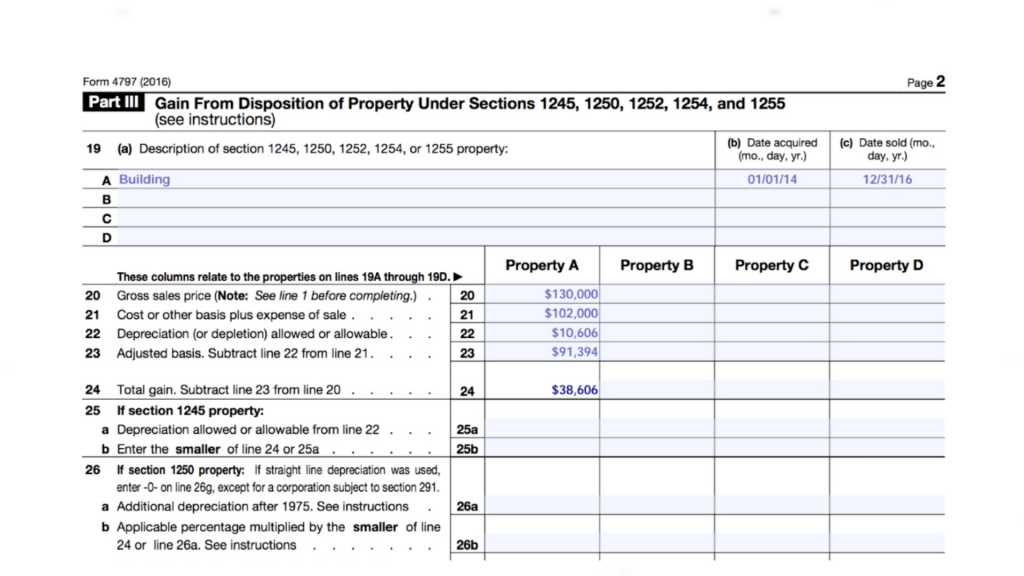

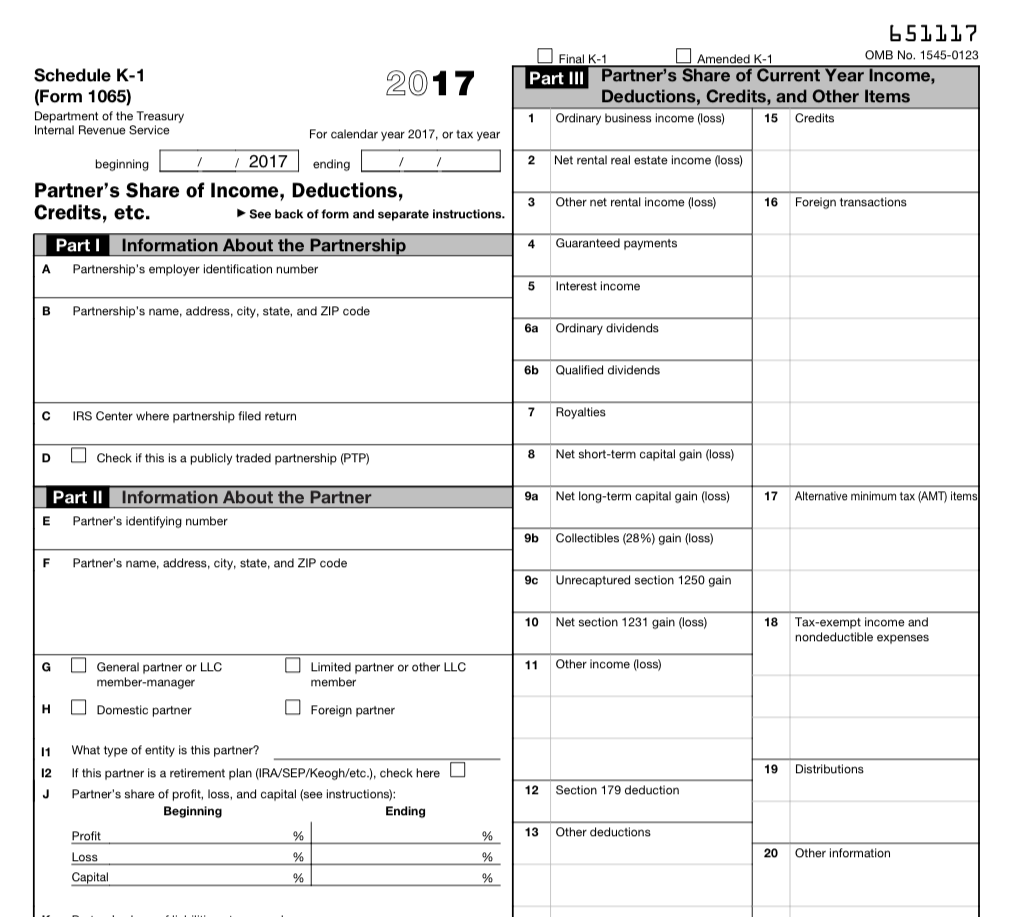

Form 4797 Vs Schedule D - These forms are used only to report sales of unrelated business activities for the calculation of form 990. Part 3, box 2 (net rental real estate income): However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as. Schedule d transfers to 1040 and is typically taxed at capital gain tax rates. Web whereas schedule d forms are used to report personal gains, irs form 4797 is used to report profits from real estate transactions centered on business use. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web final k1 tax computation schedule d vs 4797 i received a 'final k1' with following details: Property used in a trade or business. Web depending on your tax situation, schedule d may instruct you to prepare and bring over information from other tax forms. Web after completing the interview for the disposition of the rental property, this transaction will appear on form 4797 sales of business property as a gain.

Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. Web the disposition of capital assets not reported on schedule d. Web form 4797, sales of business property is used to report the following transactions: Web sale information is not appearing on form 4797 or schedule d. Property used in a trade or business. The sale or exchange of: Fstop123 / getty images all gains and losses aren't equal when you're paying taxes, especially. Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. The involuntary conversion of property and. Web according to the irs, you should use your 4797 form to report all of the following:

Form 8949 if you sell investments or your. Schedule d transfers to 1040 and is typically taxed at capital gain tax rates. Fstop123 / getty images all gains and losses aren't equal when you're paying taxes, especially. These forms are used only to report sales of unrelated business activities for the calculation of form 990. Web depending on your tax situation, schedule d may instruct you to prepare and bring over information from other tax forms. Web sale information is not appearing on form 4797 or schedule d. Web form 4797 and schedule d frequently asked questions photo: Web generally, the gain is reported on form 8949 and schedule d. Web overview the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Web according to the irs, you should use your 4797 form to report all of the following:

How to Report the Sale of a U.S. Rental Property Madan CA

Fstop123 / getty images all gains and losses aren't equal when you're paying taxes, especially. Web form 4797 and schedule d frequently asked questions photo: Part 3, box 2 (net rental real estate income): Web sale information is not appearing on form 4797 or schedule d. Web for the latest information about developments related to form 4797 and its instructions,.

Schedule K 1 Form 1040 2021 Tax Forms 1040 Printable

Reported on schedule d • not. Web overview the schedule d form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. These forms are used only to report sales of unrelated business activities for the calculation of form 990. Web sale information is not appearing.

TaxHow » You Win Some, You Lose Some. And Then You File Schedule D

Web whereas schedule d forms are used to report personal gains, irs form 4797 is used to report profits from real estate transactions centered on business use. Web for the latest information about developments related to form 4797 and its instructions, such as legislation enacted after they were published, go to irs.gov/form4797. However, part of the gain on the sale.

[10000ダウンロード済み√] 4797 form instructions 152446Mi form 4797

The gain or loss for partners and s corporation shareholders from certain section 179 property dispositions by. Part 3, box 2 (net rental real estate income): Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web overview the schedule d form is what most people use.

Publication 225 Farmer's Tax Guide; Preparing the Return

Web generally, the gain is reported on form 8949 and schedule d. The gain or loss for partners and s corporation shareholders from certain section 179 property dispositions by. Web the disposition of capital assets not reported on schedule d. Part 3, box 2 (net rental real estate income): The involuntary conversion of property and.

What Is the Difference Between a Schedule D and Form 4797?

Web the disposition of capital assets not reported on schedule d. 10000 part 3, box 10 (net. These forms are used only to report sales of unrelated business activities for the calculation of form 990. The sale or exchange of property. Under section 512(b)(5), sales of property are exempt from unrelated business tax and are not reported on form 4797.

Publication 925 Passive Activity and AtRisk Rules; Publication 925

Fstop123 / getty images all gains and losses aren't equal when you're paying taxes, especially. The gain or loss for partners and s corporation shareholders from certain section 179 property dispositions by. Complete, edit or print tax forms instantly. Web generally, the gain is reported on form 8949 and schedule d. Part 3, box 2 (net rental real estate income):

Schedule D Capital Gains and Losses Definition

Schedule d transfers to 1040 and is typically taxed at capital gain tax rates. The gain or loss for partners and s corporation shareholders from certain section 179 property dispositions by. Web answer report the gain or loss on the sale of rental property on form 4797, sales of business property or on form 8949, sales and other dispositions of.

Form 4797 1996 Fill out & sign online DocHub

Web sale information is not appearing on form 4797 or schedule d. Web according to the irs, you should use your 4797 form to report all of the following: The gain or loss for partners and s corporation shareholders from certain section 179 property dispositions by. Property used in a trade or business. Schedule d transfers to 1040 and is.

IRS 990 Schedule H 2019 Fill and Sign Printable Template Online

Complete, edit or print tax forms instantly. Web form 4797, sales of business property is used to report the following transactions: Web whereas schedule d forms are used to report personal gains, irs form 4797 is used to report profits from real estate transactions centered on business use. Reported on schedule d • not. However, part of the gain on.

Web For The Latest Information About Developments Related To Form 4797 And Its Instructions, Such As Legislation Enacted After They Were Published, Go To Irs.gov/Form4797.

Inventory or other property held for sale to customers Web according to the irs, you should use your 4797 form to report all of the following: Web 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Part 3, box 2 (net rental real estate income):

The Involuntary Conversion Of Property And.

Web sale information is not appearing on form 4797 or schedule d. Property used in a trade or business. Web form 4797 and schedule d frequently asked questions photo: Under section 512(b)(5), sales of property are exempt from unrelated business tax and are not reported on form 4797 or schedule d unless one of the following.

Web Form 4797, Sales Of Business Property Is Used To Report The Following Transactions:

Web schedule d is used to report gains from personal investments, while form 4797 is used to report gains from real estate dealings—those that are done primarily in. The sale or exchange of property. Web depending on your tax situation, schedule d may instruct you to prepare and bring over information from other tax forms. These forms are used only to report sales of unrelated business activities for the calculation of form 990.

Web Overview The Schedule D Form Is What Most People Use To Report Capital Gains And Losses That Result From The Sale Or Trade Of Certain Property During The Year.

Web generally, the gain is reported on form 8949 and schedule d. Web after completing the interview for the disposition of the rental property, this transaction will appear on form 4797 sales of business property as a gain. The full gain will be. Fstop123 / getty images all gains and losses aren't equal when you're paying taxes, especially.

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)