Form 8829 Worksheet

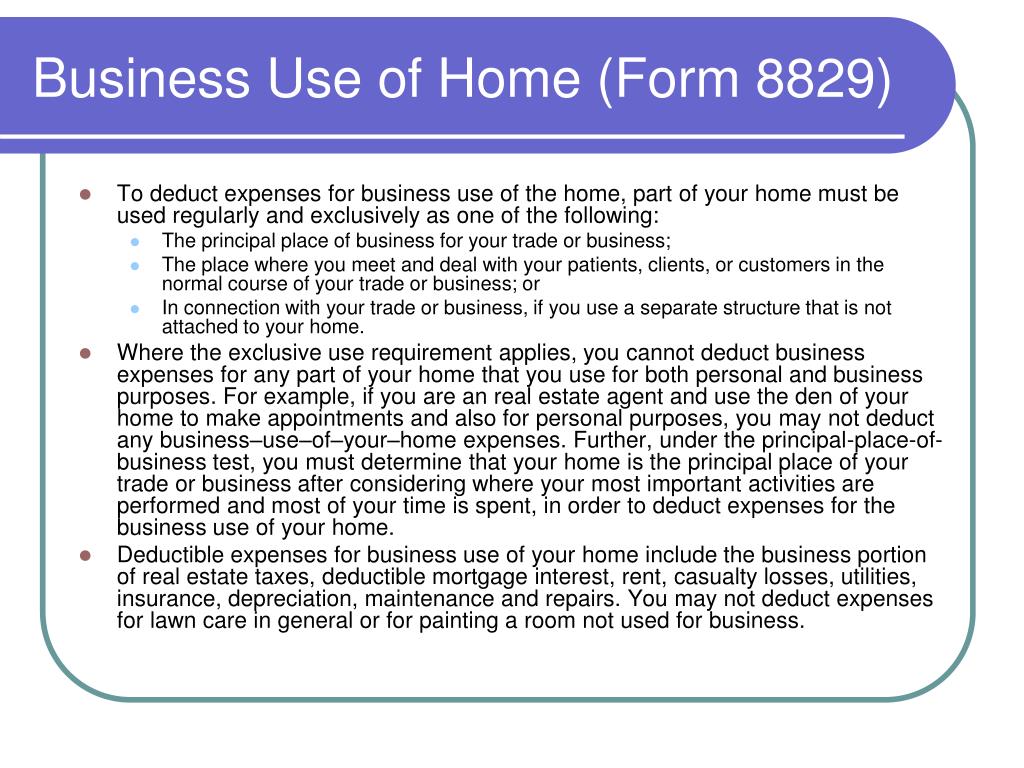

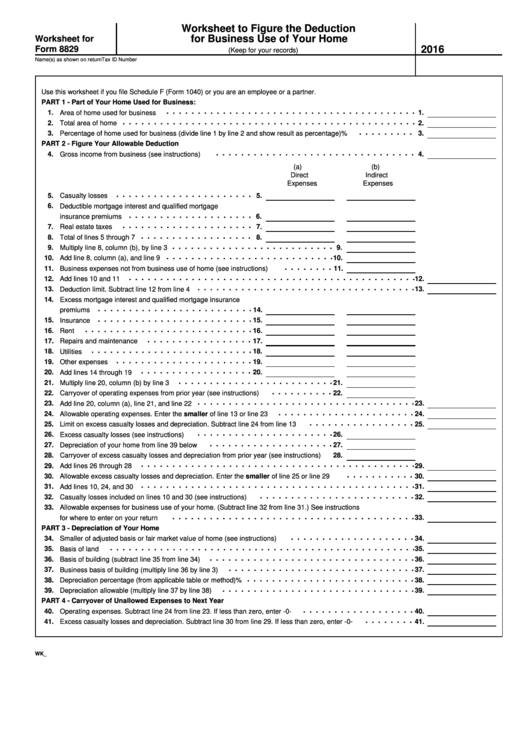

Form 8829 Worksheet - How can i enter multiple 8829's? The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. You must meet specific requirements to deduct expenses for the business use of your home. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. The irs determines the eligibility of an allowable home business space using two criterion: Form 8829—business use of home. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? Web department of the treasury internal revenue service file only with schedule c (form 1040). Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return.

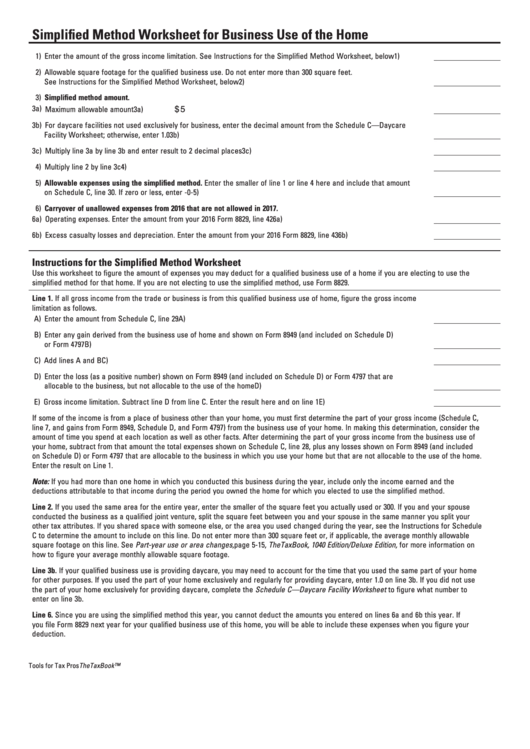

Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Web irs form 8829 is the form used to deduct expenses for your home business space. Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. You must meet specific requirements to deduct expenses for the business use of your home. Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. Go to www.irs.gov/form8829 for instructions and the latest information. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web there are two ways to claim the deduction: Form 8829—business use of home.

The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Web there are two ways to claim the deduction: The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Form 8829—business use of home. Use a separate form 8829 for each home you used for business during the year. The irs determines the eligibility of an allowable home business space using two criterion: Use a separate form 8829 for each home you used for the business during the year. Use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to next year of amounts. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file.

Simplified method worksheet 2023 Fill online, Printable, Fillable Blank

You must meet specific requirements to deduct expenses for the business use of your home. The irs determines the eligibility of an allowable home business space using two criterion: Use a separate form 8829 for each home you used for the business during the year. 176 name(s) of proprietor(s) your social security number Web you can deduct home office expenses.

For a new LLC in service this year, where my property has been

The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. How can i enter multiple 8829's? The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them.

Home Daycare Tax Worksheet

Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes. 176 name(s) of proprietor(s) your social security number The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return. Form 8829—business use of.

Major Hykr See You On the Trail!

Web irs form 8829 is the form used to deduct expenses for your home business space. Use a separate form 8829 for each home you used for the business during the year. Use a separate form 8829 for each home you used for business during the year. Web overview one of the many benefits of working at home is that.

worksheet. Form 8829 Worksheet. Worksheet Fun Worksheet Study Site

Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the.

Simplified Method Worksheet For Business Use Of The Home printable pdf

Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Web common questions about form 8829 in.

Solved Trying to fix incorrect entry Form 8829

Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? 176 name(s) of proprietor(s) your social security number Web there are two ways to claim the deduction: Web department of the treasury.

Worksheet For Form 8829 Worksheet To Figure The Deduction For

Web irs form 8829 is the form used to deduct expenses for your home business space. 176 name(s) of proprietor(s) your social security number Web department of the treasury internal revenue service file only with schedule c (form 1040). Form 8829—business use of home. Using the simplified method and reporting it directly on your schedule c, or by filing irs.

Solved Trying to fix incorrect entry Form 8829

Regular use of the space for business purposes and exclusivity—the space is used solely for business purposes. 176 name(s) of proprietor(s) your social security number Go to www.irs.gov/form8829 for instructions and the latest information. The irs determines the eligibility of an allowable home business space using two criterion: Web overview one of the many benefits of working at home is.

8829 Simplified Method (ScheduleC, ScheduleF)

Use a separate form 8829 for each home you used for business during the year. The business use of home worksheet is prepared rather than form 8829 if entered under the itemized deductions > employee business expensess, farming/4835, fiduciary passthrough, partnership passthrough, or s corporation passthrough worksheets. Web use form 8829 to figure the allowable expenses for business use of.

Web Department Of The Treasury Internal Revenue Service File Only With Schedule C (Form 1040).

Go to www.irs.gov/form8829 for instructions and the latest information. Web information about form 8829, expenses for business use of your home, including recent updates, related forms and instructions on how to file. 176 name(s) of proprietor(s) your social security number How can i enter multiple 8829's?

The Irs Determines The Eligibility Of An Allowable Home Business Space Using Two Criterion:

Use a separate form 8829 for each home you used for the business during the year. Web common questions about form 8829 in proseries solved • by intuit • 28 • updated september 22, 2022 electing the simplified method for form 8829 what is the difference between direct and indirect expenses on the 8829? Using the simplified method and reporting it directly on your schedule c, or by filing irs form 8829 to calculate your total deduction. Web there are two ways to claim the deduction:

Use Form 8829 To Figure The Allowable Expenses For Business Use Of Your Home On Schedule C (Form 1040) And Any Carryover To Next Year Of Amounts.

The downside is that since home office tax deductions are so easily abused, the internal revenue service (irs) tends to scrutinize them more closely than other parts of your tax return. Web irs form 8829 is the form used to deduct expenses for your home business space. Web you can deduct home office expenses by attaching form 8829 to your annual tax filing. Web overview one of the many benefits of working at home is that you can deduct legitimate expenses from your taxes.

The Business Use Of Home Worksheet Is Prepared Rather Than Form 8829 If Entered Under The Itemized Deductions > Employee Business Expensess, Farming/4835, Fiduciary Passthrough, Partnership Passthrough, Or S Corporation Passthrough Worksheets.

You must meet specific requirements to deduct expenses for the business use of your home. Form 8829—business use of home. Web use form 8829 to figure the allowable expenses for business use of your home on schedule c (form 1040) and any carryover to 2023 of amounts not deductible in 2022. Use a separate form 8829 for each home you used for business during the year.