Epf Form 19 Settlement Time

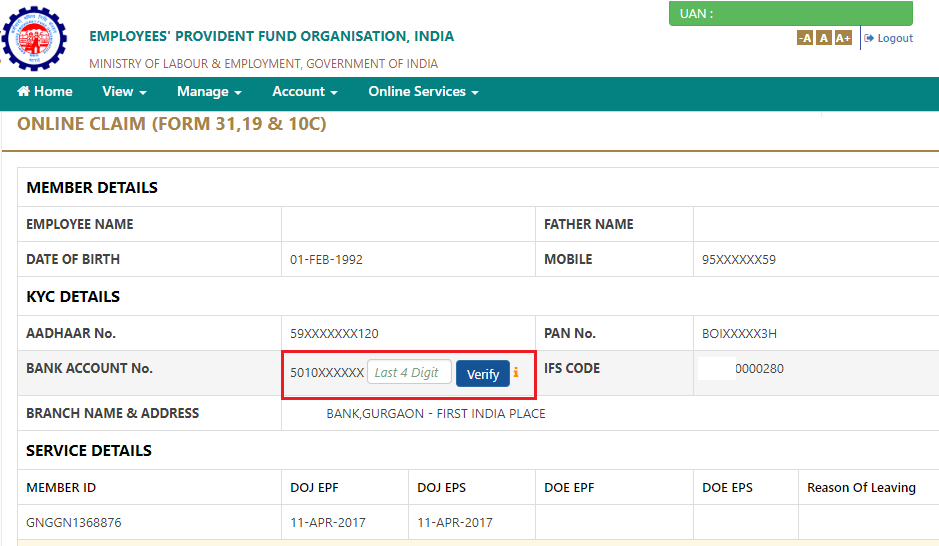

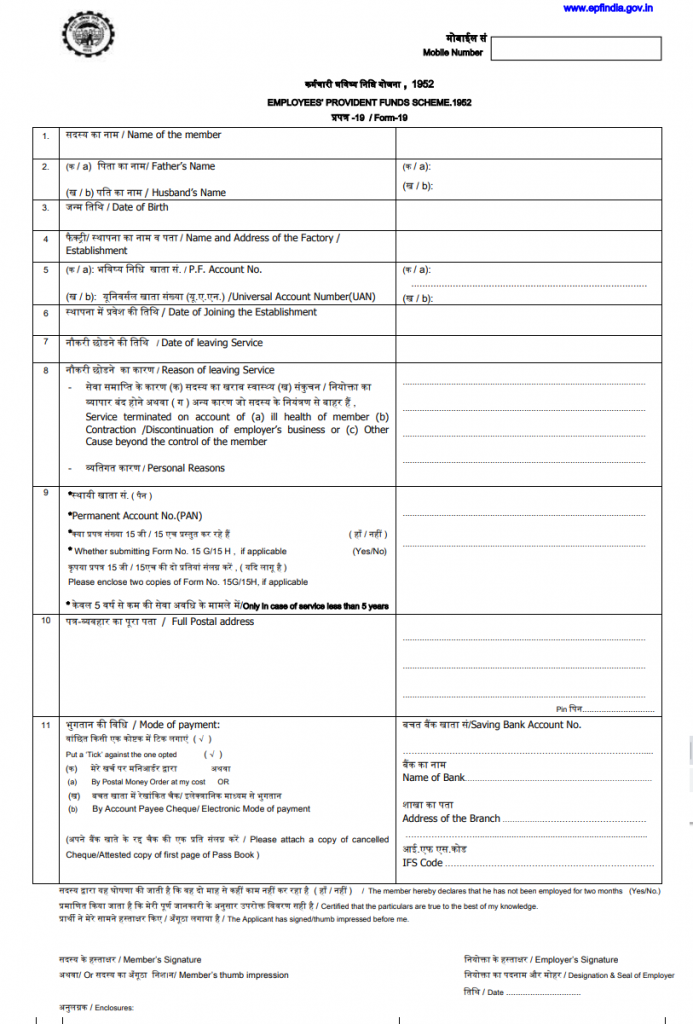

Epf Form 19 Settlement Time - Web an employee can fill form 19 to claim the settlement amount only after two months of the date of retirement. However, if an employee joins another organisation. Most claims are settled within this time. The member only needs to provide their pf account number when filing pf form no. Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. सदस्य का िाम / name of the member. Settlement of my provident fund account. Here are some things to remember while filing epf form. Web form 19 is an employee’s application form to withdraw their accumulated provident fund (pf) balance. Web pf form 19:

Web pf form 19: Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. Web epf form 19 or pf form 19 should be used while removing epf money in the form of a pf final settlement. The form can also be used to receive a pf advance. They can also request for the final settlement of the epf account once they leave the job. It is only applicable to employees who do not have a universal account number. However, if an employee joins another organisation. Look through various aspects of pf form 19 below in this. Kindly do not paste revenue stamp in case of payments. Read more about form filling process, submissions & more online.

Here are some things to remember while filing epf form. Web employees without a universal account number are subject to it (uan). The member only needs to provide their pf account number when filing pf form no. For this, they need to fill. Kindly do not paste revenue stamp in case of payments. They can also request for the final settlement of the epf account once they leave the job. Look through various aspects of pf form 19 below in this. Settlement of my provident fund account. Existing employees who wish to close their existing epf account: It is only applicable to employees who do not have a universal account number.

withdraw epf for house Connor Quinn

Existing employees who wish to close their existing epf account: They can also request for the final settlement of the epf account once they leave the job. Most claims are settled within this time. For this, they need to fill. The member only needs to provide their pf account number when filing pf form no.

Epfo Claim Form 19 Pf Provident Fund Final Settlement Gambaran

Web an employee can fill form 19 to claim the settlement amount only after two months of the date of retirement. Settlement of my provident fund account. Kindly do not paste revenue stamp in case of payments. Web complete postal address mode of payment apart from the above information, signatures of the member and the employer are required. Web by.

EPFO Simplified UAN based withdrawal claim Forms No 19 (UAN), 10C (UAN

Settlement of my provident fund account. Web pf form 19: Web the time taken to settle a pf claim can vary depending on various factors, but the epfo has set a maximum limit of 20 days. The member only needs to provide their pf account number when filing pf form no. Kindly do not paste revenue stamp in case of.

EPFO Claim Form 19 PF (Provident Fund) Final Settlement

Web pf form 19: सदस्य का िाम / name of the member. Settlement of my provident fund account. Existing employees who wish to close their existing epf account: However, if an employee joins another organisation.

EPFO FORM 19 EMPLOYEES' PROVIDENT FUND SCHEME , 1952

Web employees without a universal account number are subject to it (uan). Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. The member only needs to provide their pf account number when filing pf form no. Look through various aspects of pf form 19 below in this..

EPF Form 19 Easy Steps to Fill Form 19 for PF Withdrawal

Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. Web epf form 19 or pf form 19 should be used while removing epf money in the form of a pf final settlement. They can also request for the final settlement of the epf account once they leave.

Form19 Employees' Provident Fund Scheme, 1952 Free Download

Web an employee can fill form 19 to claim the settlement amount only after two months of the date of retirement. However, if an employee joins another organisation. For this, they need to fill. Settlement of my provident fund account. Web the time taken to settle a pf claim can vary depending on various factors, but the epfo has set.

EPF FORM 19 FILLED SAMPLE Wisdom Jobs India

Web an employee can fill form 19 to claim the settlement amount only after two months of the date of retirement. Web get the information you need on the employee provident fund (epf) form 19 on coverfox! Kindly do not paste revenue stamp in case of payments. Web employees without a universal account number are subject to it (uan). Existing.

Form 19 & 10c Epf PDF Cheque Payments

For this, they need to fill. Look through various aspects of pf form 19 below in this. Web get the information you need on the employee provident fund (epf) form 19 on coverfox! Web employees’ provident fund scheme 1952 form 19 for claiming final settlement from provident fund instructions who can apply: They can also request for the final settlement.

EPF Form 19 10 C Format PDF Money Order Cheque

It is only applicable to employees who do not have a universal account number. Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. Existing employees who wish to close their existing epf account: Web the time taken to settle a pf claim can vary depending on various.

Settlement Of My Provident Fund Account.

Web form 19 is an employee’s application form to withdraw their accumulated provident fund (pf) balance. Web pf form 19 has to be filled when a member wants to go for a final settlement of his/her pf account. Web the time taken to settle a pf claim can vary depending on various factors, but the epfo has set a maximum limit of 20 days. The form can also be used to receive a pf advance.

Kindly Do Not Paste Revenue Stamp In Case Of Payments.

Here are some things to remember while filing epf form. Read more about form filling process, submissions & more online. However, if an employee joins another organisation. Web get the information you need on the employee provident fund (epf) form 19 on coverfox!

Existing Employees Who Wish To Close Their Existing Epf Account:

Web epf form 19 or pf form 19 should be used while removing epf money in the form of a pf final settlement. Web pf form 19: It is only applicable to employees who do not have a universal account number. The member only needs to provide their pf account number when filing pf form no.

For This, They Need To Fill.

Web by rajesh if your pf claim status shows payment under process then it means your application is being verified by the epfo, after verification, you will receive a message. Web employees without a universal account number are subject to it (uan). Web an employee can fill form 19 to claim the settlement amount only after two months of the date of retirement. Look through various aspects of pf form 19 below in this.