Form 8824 Worksheet

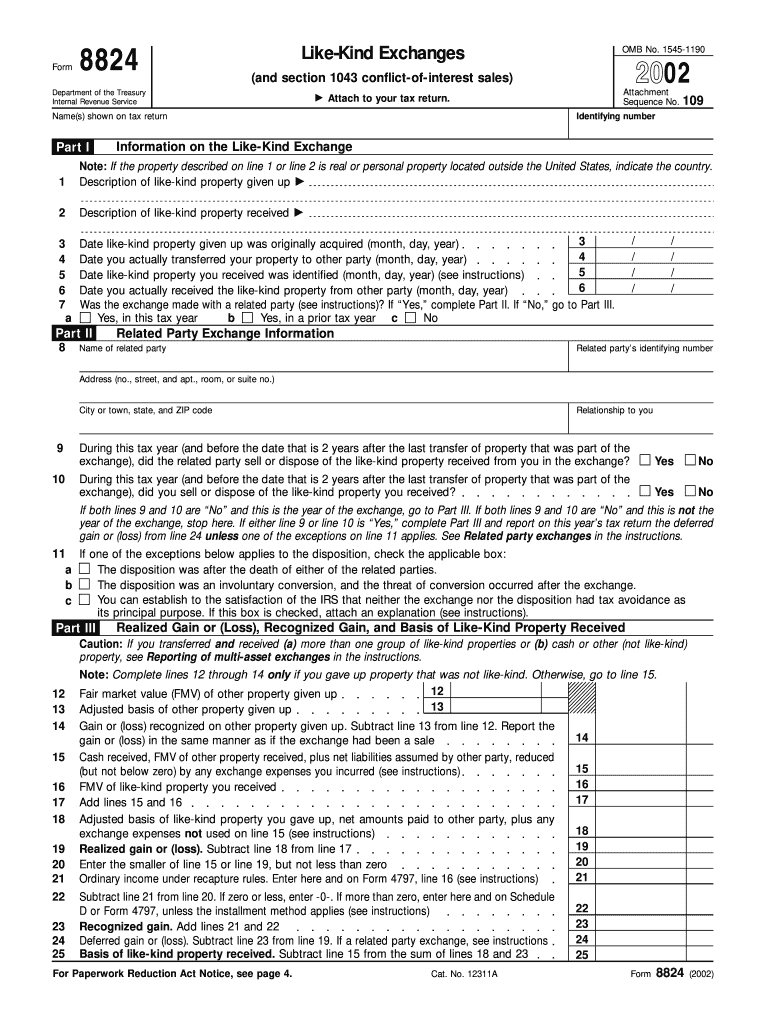

Form 8824 Worksheet - Ordinarily, when you sell something for more than what you paid to get it, you have a capital gain; Web common questions for form 8824 in proseries. Add the newly received vehicle in the next available column (create a new copy of the worksheet if necessary). Below are the most popular support articles associated with form 8824. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Date closed taxpayer exchange property replacement property. Use one worksheet for the part of the property used as a home, and the other worksheet for the part used for business or investment. To help, we have published annually since 1991 a workbook and 8824 worksheet to help exchangers complete the required form 8824. Solved • by intuit • 3 • updated july 14, 2022. How do we report the exchange?

Add the newly received vehicle in the next available column (create a new copy of the worksheet if necessary). Solved • by intuit • 3 • updated july 14, 2022. Do not send them with your tax return. Web on the worksheet form 8824 for the part of the property used for business or investment, follow steps (1) through (3) above only if you can exclude at least part of any gain from the exchange of that part of the property; Name(s) shown on tax return. List the address or legal description and type of property received. The form 8824 is divided into four parts: Web worksheet #s 7 & 8. List the address or legal description and type of property relinquished (sold). How do we report the exchange?

Related party exchange information part iii. Web complete all applicable fields on form 8824. Do not send them with your tax return. Web common questions for form 8824 in proseries. When you sell it for less than what you paid, you have a capital loss. Name(s) shown on tax return. List the address or legal description and type of property relinquished (sold). Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Solved • by intuit • 3 • updated july 14, 2022. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind.

Download Instructions for IRS Form 8824 LikeKind Exchanges PDF, 2018

Web worksheet april 17, 2018. Insert a brief description such as “duplex located at 123 anywhere street, city, state, zip.”. List the month, day, year relinquished property was originally acquired. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Web common questions for form 8824.

Publication 225 Farmer's Tax Guide; Farmer's Tax Guide

Completing the income tax form 8824 can be a complex task. We tried to find some amazing references about 1031 exchange worksheet excel and example of form 8824 filled out for you. List the date relinquished property was transferred to the buyer. Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property.

Irs Form 8824 Simple Worksheet herofinstant

Completing the income tax form 8824 can be a complex task. Certain exchanges of property are not taxable. The form 8824 is divided into four parts: How do we report the exchange? Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of.

Form 8824 Example Fill Out and Sign Printable PDF Template signNow

On the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of Do not send these worksheets with your tax return. Open the car and truck expenses worksheet (vehicle expenses worksheet for form 2106). Form 8824 line 15 cash and other property received and net debt relief..

How to Fill Out Form 8824 5 Steps (with Pictures) wikiHow

Insert a brief description such as “duplex located at 123 anywhere street, city, state, zip.”. Web complete all applicable fields on form 8824. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031. You can either keep or shred your completed worksheets. Use part iii to figure the amount of gain required to be reported on the tax.

Publication 544 Sales and Other Dispositions of Assets; Example

Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Web worksheet april 17, 2018. We hope you can find what you need here. Name(s) shown on tax return. Fill out only lines 15 through 25 of each worksheet form 8824.

Instructions For Form 8824 2009 printable pdf download

Web worksheet april 17, 2018. Do not send them with your tax return. Form 8824 line 15 cash and other property received and net debt relief. This means any gain from the exchange is not recognized, and. We tried to find some amazing references about 1031 exchange worksheet excel and example of form 8824 filled out for you.

Form 8824 LikeKind Exchanges 2004 printable pdf download

Clear guidance is given for each line on the form. Date closed taxpayer exchange property replacement property. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. List the address or legal description and.

Online IRS Form 8824 2019 Fillable and Editable PDF Template

Form 8824 line 15 cash and other property received and net debt relief. We hope you can find what you need here. Go to www.irs.gov/form8824 for instructions and the latest information. List the address or legal description and type of property relinquished (sold). List the month, day, year relinquished property was originally acquired.

Instructions For Form 8824 LikeKind Exchanges 1998 printable pdf

Completing a like kind exchange in the 1040 return. Form 8824 line 15 cash and other property received and net debt relief. Instructions to form 8824 worksheets Part iii computes the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the.

Completing The Income Tax Form 8824 Can Be A Complex Task.

Use parts i, ii, and iii of form 8824 to report each exchange of business or investment property for property of a like kind. Web form 8824 worksheetworksheet 1 tax deferred exchanges under irc § 1031. Open the car and truck expenses worksheet (vehicle expenses worksheet for form 2106). We hope you can find what you need here.

Part Iii Computes The Amount Of Gain Required To Be Reported On The Tax Return In The Current Year If Cash Or Property That Isn't Of A Like Kind Is Involved In The Exchange.

Completing a like kind exchange in the 1040 return. List the address or legal description and type of property received. Clear guidance is given for each line on the form. Do not send these worksheets with your tax return.

When You Sell It For Less Than What You Paid, You Have A Capital Loss.

Date closed taxpayer exchange property replacement property. You can either keep or shred your completed worksheets. Insert a brief description such as “duplex located at 123 anywhere street, city, state, zip.”. On the worksheet form 8824 for the part of the property used as a home, follow steps (1) through (3) above, except that instead of

Web Worksheet April 17, 2018.

List the date relinquished property was transferred to the buyer. Use part iii to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Fill out only lines 15 through 25 of each worksheet form 8824. We tried to find some amazing references about 1031 exchange worksheet excel and example of form 8824 filled out for you.