Business Tax Extension Form 7004 Instructions

Business Tax Extension Form 7004 Instructions - Ad with the right expertise, federal tax credits and incentives could benefit your business. Web more about the federal form 7004 corporate income tax extension ty 2022. Web the deadline to file business tax extension form 7004 is based on the type of tax return, what form you need to extend, the business type, and it’s fiscal tax year. With your return open, select search and enter extend; Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns is used to request an automatic extension of time. Work with federal tax credits and incentives specialists who have decades of experience. Web 5 rows we last updated the irs automatic business extension instructions in february 2023, so this is the. Web according to the irs 7004 form instructions, this document is required for corporations, partnerships, and certain trusts that need additional time to submit their income tax. Web purpose of form. Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns.

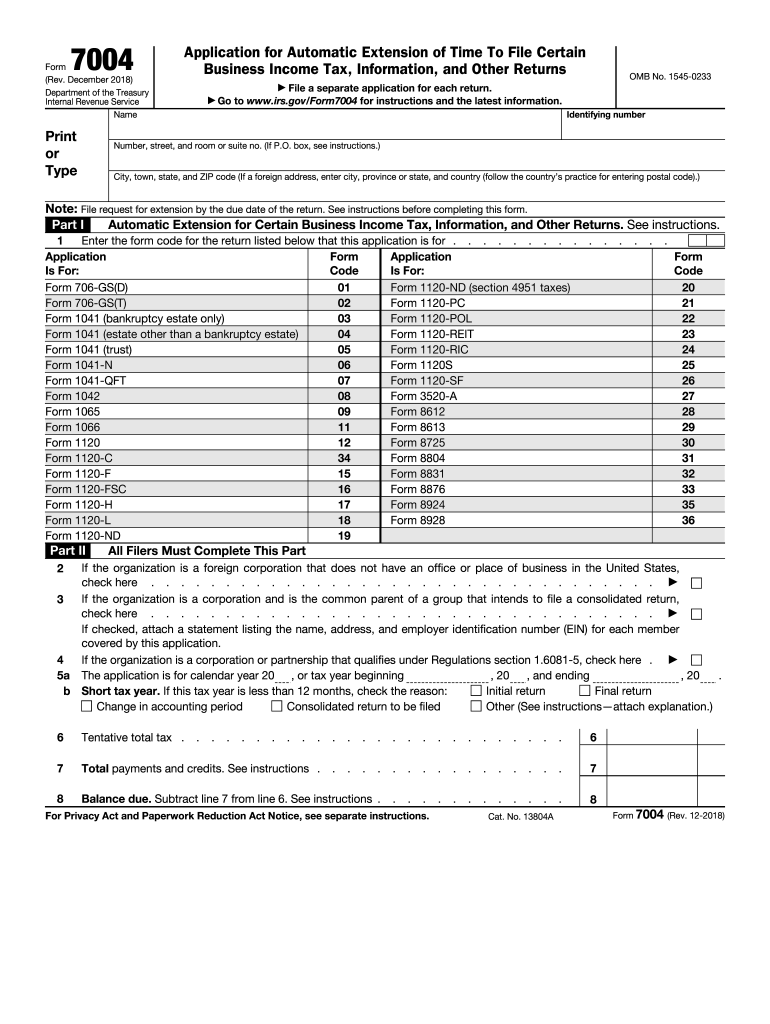

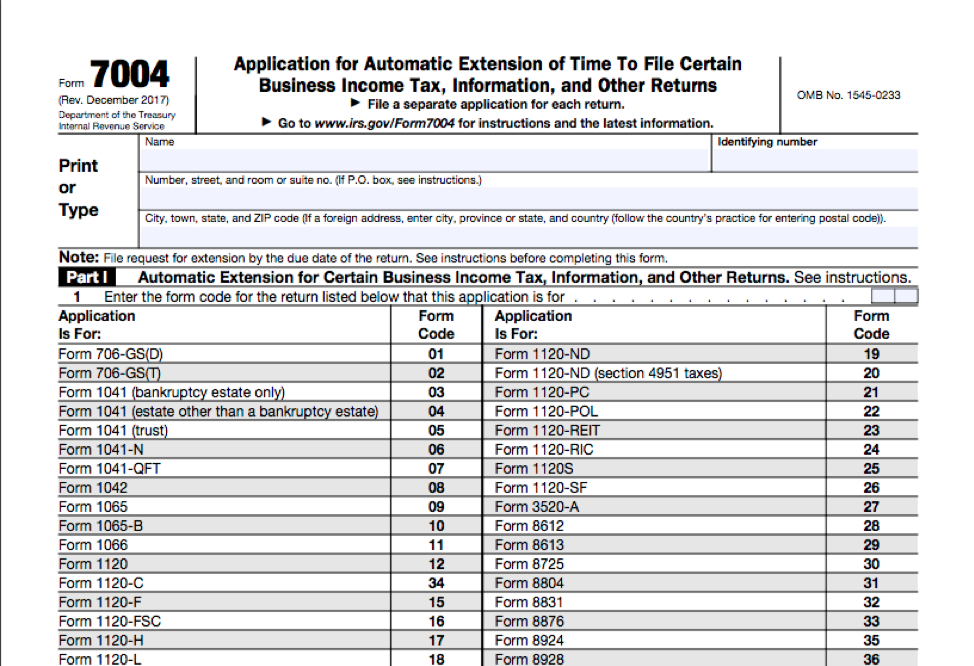

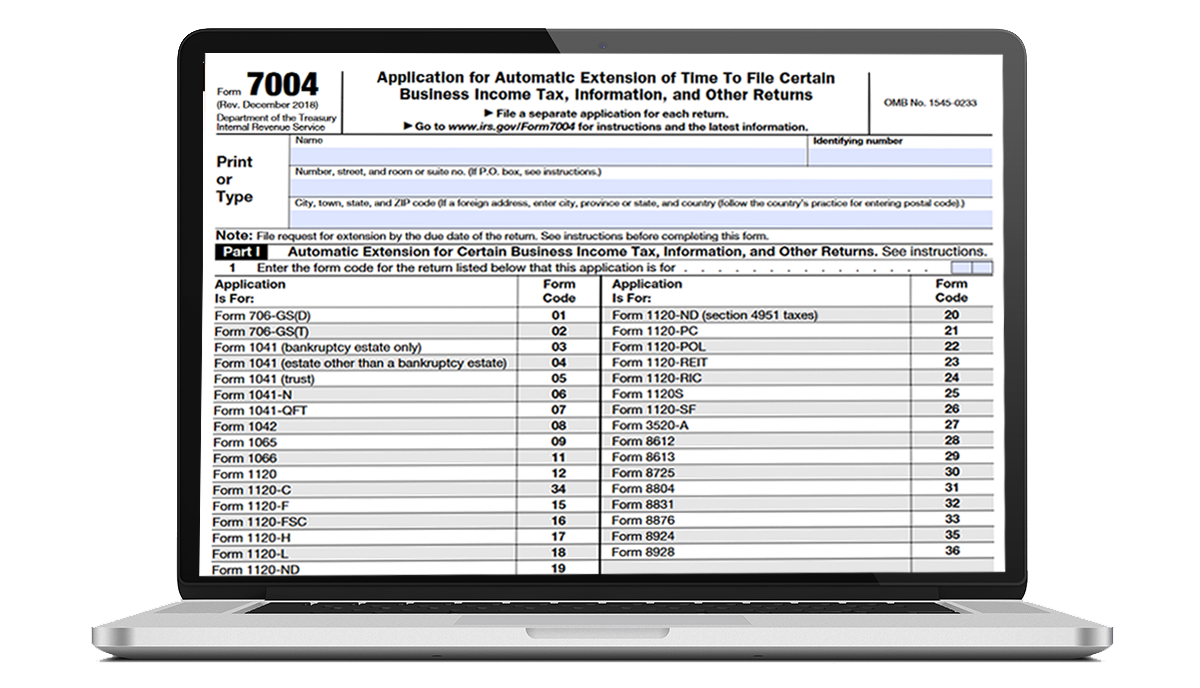

Web address identifying number (employer identification number or social security number) part i: Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Select the appropriate form from the table below to determine where to. Web more about the federal form 7004 corporate income tax extension ty 2022. Web purpose of form. Web in december 2017, the irs updated its instructions regarding form 7004. The following instructions were revised: Form 7004 is a tax document used by businesses who want to receive an automatic extension of time to file their taxes for the year. Web follow these steps to print a 7004 in turbotax business: Web use the chart to determine where to file form 7004 based on the tax form you complete.

Web address identifying number (employer identification number or social security number) part i: Web in plain terms, form 7004 is a tax form most business owners can use to request more time to file their business income tax returns. Web according to the irs 7004 form instructions, this document is required for corporations, partnerships, and certain trusts that need additional time to submit their income tax. Web in december 2017, the irs updated its instructions regarding form 7004. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns is used to request an automatic extension of time. Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Automatic extension for certain business income tax,. Web here are the general form 7004 instructions, so you can get a gauge on what information is needed: Web purpose of form.

Business Tax Extension Form 7004 Comes with Tentative Taxes YouTube

Automatic extension for certain business income tax,. Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Work with federal tax credits and incentives specialists who have decades of experience. Citizen, resident alien, nonresident u.s. Business information enter the name of your business on.

20182022 Form IRS 7004 Fill Online, Printable, Fillable, Blank pdfFiller

With your return open, select search and enter extend; Web here are the general form 7004 instructions, so you can get a gauge on what information is needed: Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web purpose of form. Business information.

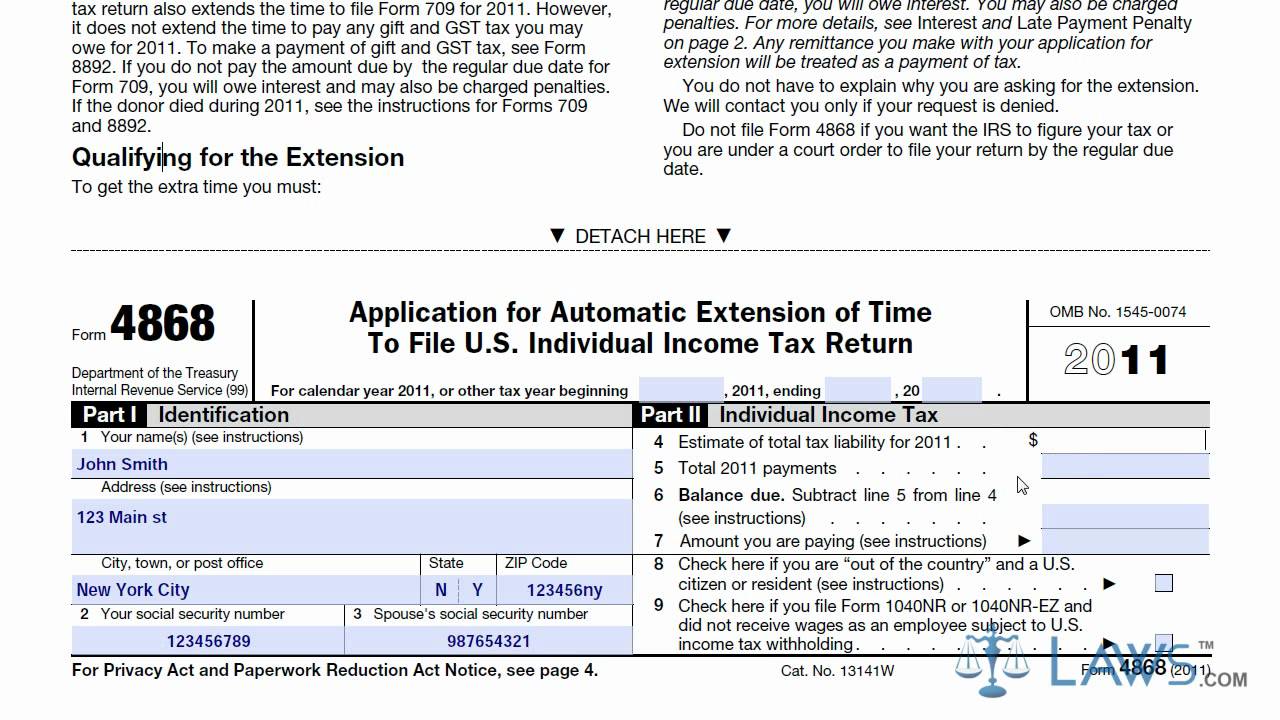

Learn How to Fill the Form 4868 Application for Extension of Time To

Form 7004 is a tax document used by businesses who want to receive an automatic extension of time to file their taxes for the year. Citizen, resident alien, nonresident u.s. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Use this form to request an automatic extension of time.

How Long Is An Extension For Business Taxes Business Walls

Web use the chart to determine where to file form 7004 based on the tax form you complete. Ad with the right expertise, federal tax credits and incentives could benefit your business. Select the appropriate form from the table below to determine where to. Automatic extension for certain business income tax,. Business information enter the name of your business on.

Form 7004 Application For Automatic Extension Of Time To File

Web the deadline to file business tax extension form 7004 is based on the type of tax return, what form you need to extend, the business type, and it’s fiscal tax year. Web in december 2017, the irs updated its instructions regarding form 7004. Web use the chart to determine where to file form 7004 based on the tax form.

EFile 7004 Online 2022 File Business Tax extension Form

Automatic extension for certain business income tax,. Ad with the right expertise, federal tax credits and incentives could benefit your business. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web address identifying number (employer identification number or social security number) part i: Web more about the federal form 7004 corporate.

Irs Form 7004 amulette

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web here are the general form 7004 instructions, so you can get a gauge on what information is needed: With your return open, select search and enter extend; Select the appropriate form from the table below to determine where to..

Irs Form 7004 amulette

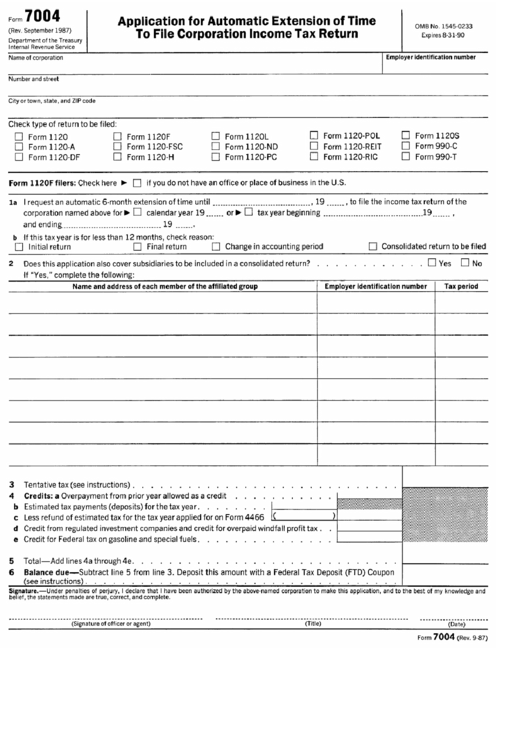

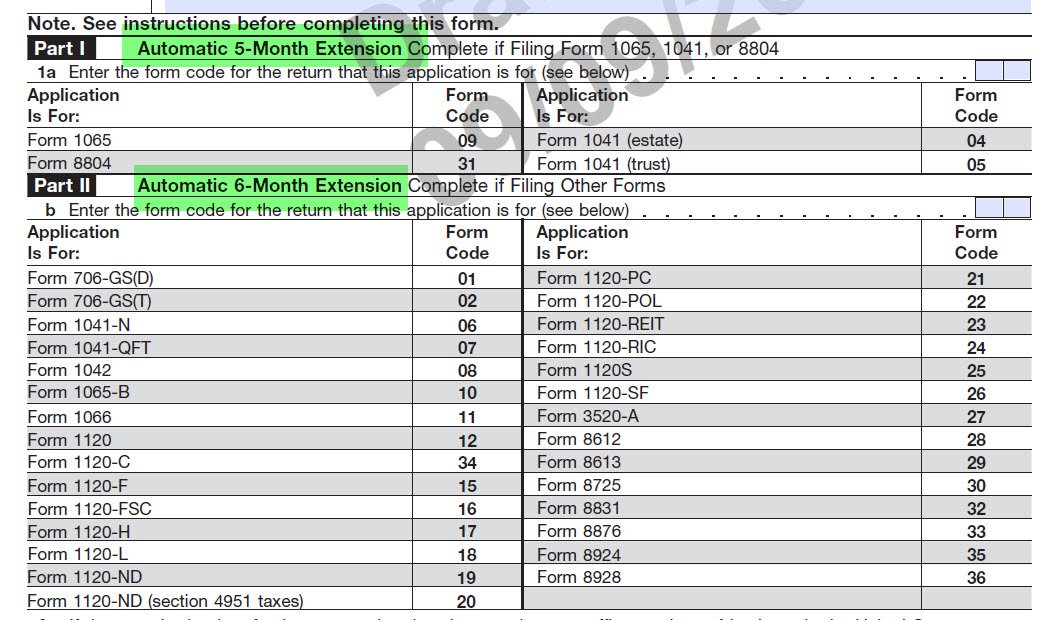

Web more about the federal form 7004 corporate income tax extension ty 2022. Work with federal tax credits and incentives specialists who have decades of experience. Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. The form's structure was changed, and it now consists of. Web use the chart.

can i file form 7004 late Extension Tax Blog

At the top of the form, print or type your: Citizen, resident alien, nonresident u.s. The form's structure was changed, and it now consists of. Use this form to request an automatic extension of time for filing of certain business income tax. Automatic extension for certain business income tax,.

IRS Form 7004 Automatic Extension for Business Tax Returns

Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web more about the federal form 7004 corporate income tax extension ty 2022. Web purpose of form. Web use the chart to determine where to file form 7004 based on the tax form you complete. Ad with the right expertise,.

Web The Deadline To File Business Tax Extension Form 7004 Is Based On The Type Of Tax Return, What Form You Need To Extend, The Business Type, And It’s Fiscal Tax Year.

Web 5 rows we last updated the irs automatic business extension instructions in february 2023, so this is the. With your return open, select search and enter extend; Web form 7004 application for automatic extension of time to file certain business income tax, information, and other returns is used to request an automatic extension of time. Web more about the federal form 7004 corporate income tax extension ty 2022.

Web According To The Irs 7004 Form Instructions, This Document Is Required For Corporations, Partnerships, And Certain Trusts That Need Additional Time To Submit Their Income Tax.

Work with federal tax credits and incentives specialists who have decades of experience. Web here are the general form 7004 instructions, so you can get a gauge on what information is needed: Use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

At The Top Of The Form, Print Or Type Your:

Business information enter the name of your business on form 7004 as you entered it on the previous year's income. Select the appropriate form from the table below to determine where to. Web use the chart to determine where to file form 7004 based on the tax form you complete. Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns.

Automatic Extension For Certain Business Income Tax,.

Citizen, resident alien, nonresident u.s. Ad with the right expertise, federal tax credits and incentives could benefit your business. The following instructions were revised: The form's structure was changed, and it now consists of.