Form 4136 Instructions

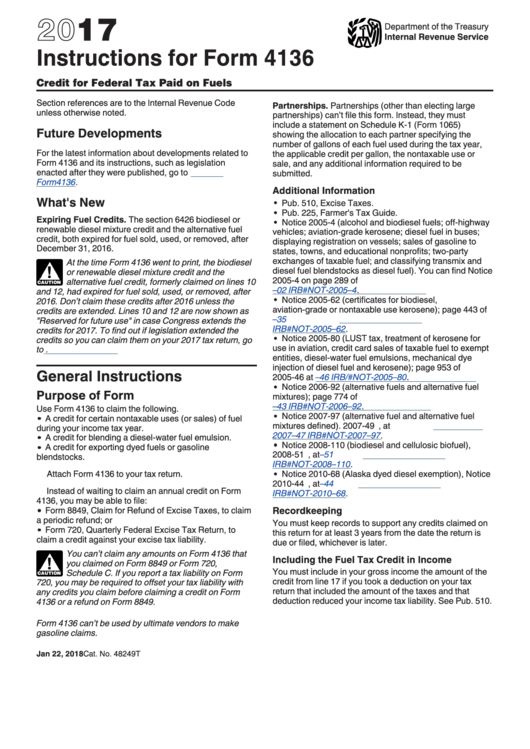

Form 4136 Instructions - Web irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the type of fuels used, and the type of business use the credit is claimed for. You can’t claim any amounts on form 4136 that you claimed on form 8849, form 8864, or form 720, schedule c. Do i have to wait for. A credit for certain nontaxable uses (or sales) of fuel; Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Department of the treasury internal revenue service. To claim this credit, complete form 4136: If so, you must report the amount you claim as income on schedule c. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject to tax.

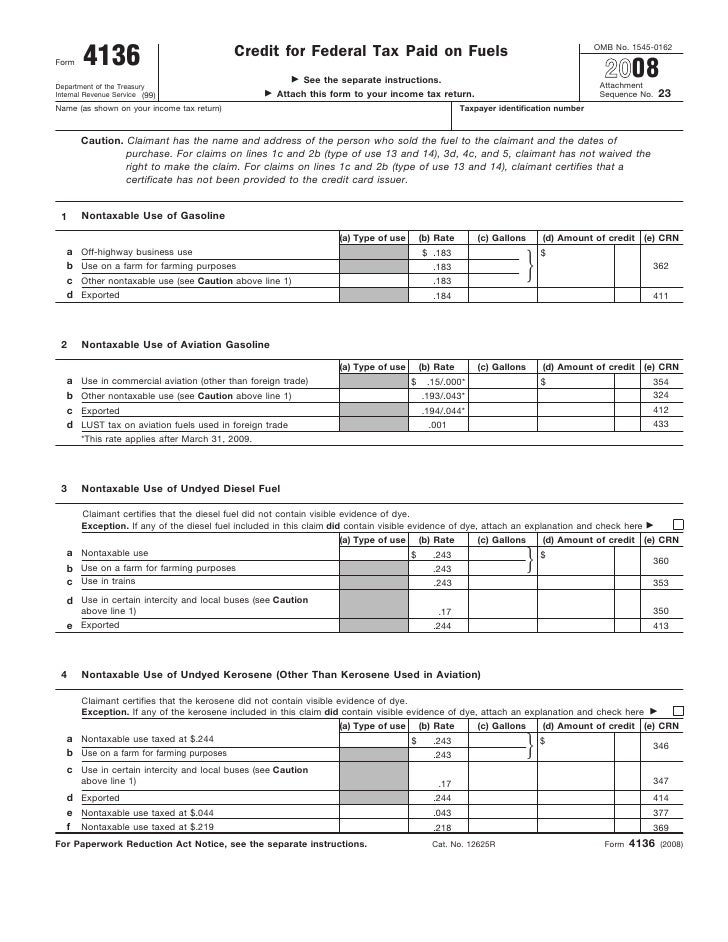

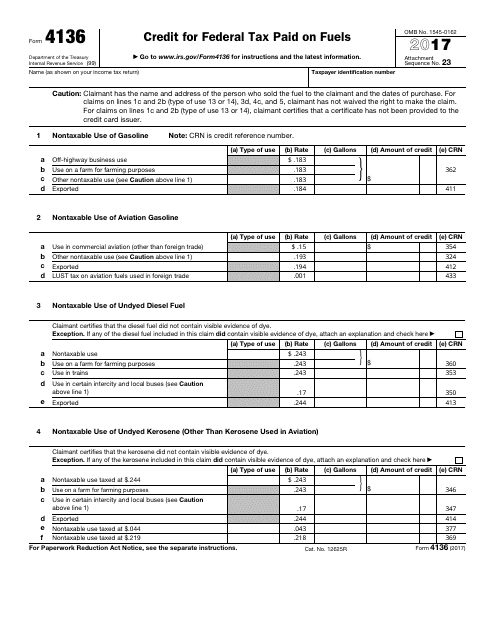

Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. You can’t claim any amounts on form 4136 that you claimed on form 8849, form 8864, or form 720, schedule c. 23 name (as shown on your income tax return) taxpayer identification number Or •form 720, quarterly federal excise tax return, to claim a credit against your excise tax liability. Credit for federal tax paid on fuels. If so, you must report the amount you claim as income on schedule c. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. For instructions and the latest information. If you have $243 worth of credits, for example, that cuts your tax bill by the full $243. Web 4136, you may be able to file:

A credit for certain nontaxable uses (or sales) of fuel; You can’t claim any amounts on form 4136 that you claimed on form 8849, form 8864, or form 720, schedule c. Do i have to wait for. Credit for federal tax paid on fuels. Go to irs publication 510 excise taxes (including fuel tax credits and refunds) for definitions and information on nontaxable uses. To claim this credit, complete form 4136: Form 8849, claim for refund of excise taxes, to claim a periodic refund; 23 name (as shown on your income tax return) taxpayer identification number Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Department of the treasury internal revenue service.

Form 4136Credit for Federal Tax Paid on Fuel

The credits available on form 4136 are: Credit for federal tax paid on fuels. Do i have to wait for. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. To see which fuel credits are still available, go to irs instructions for form 4136 credit for federal tax paid on fuels.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject to tax. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. If so,.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

You can’t claim any amounts on form 4136 that you claimed on form 8849, form 8864, or form 720, schedule c. Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject to tax. If you report a tax. Web use form 4136 to claim a credit for federal taxes paid on certain.

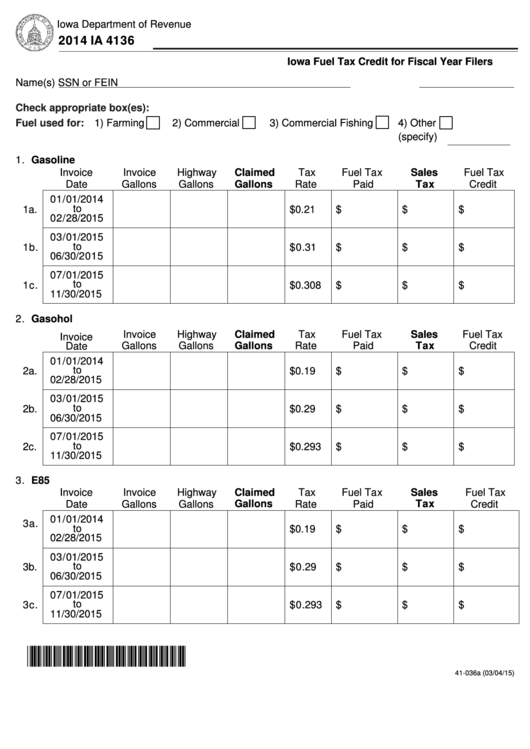

Fillable Form Ia 4136 Fuel Tax Credit For Fiscal Year Filers 2014

To claim this credit, complete form 4136: Instead of waiting to claim an annual credit on form 4136, you may be able to file: Web attach form 4136 to your tax return. •form 8849, claim for refund of excise taxes, to claim a periodic refund; Form 720, quarterly federal excise tax return, to claim a credit against your excise tax.

How to Prepare IRS Form 4136 (with Form) wikiHow

For instructions and the latest information. Web attach form 4136 to your tax return. Instead of waiting to claim an annual credit on form 4136, you may be able to file: To see which fuel credits are still available, go to irs instructions for form 4136 credit for federal tax paid on fuels. A credit for exporting dyed fuels or.

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Or •form 720, quarterly federal excise tax return, to claim a credit against your excise tax liability. To see which fuel credits are still available, go to irs instructions for form 4136 credit for federal tax paid on fuels. Web attach form 4136 to your tax return. Form 720, quarterly federal excise tax return, to claim a credit against your.

How to Prepare IRS Form 4136 (with Form) wikiHow

For instructions and the latest information. Or •form 720, quarterly federal excise tax return, to claim a credit against your excise tax liability. •form 8849, claim for refund of excise taxes, to claim a periodic refund; Web 4136, you may be able to file: Instead of waiting to claim an annual credit on form 4136, you may be able to.

Form 4136Credit for Federal Tax Paid on Fuel

For instructions and the latest information. Web the tax credits calculated on form 4136 directly reduce your tax obligations. If you have $243 worth of credits, for example, that cuts your tax bill by the full $243. To claim this credit, complete form 4136: The biodiesel or renewable diesel mixture credit;

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

If so, you must report the amount you claim as income on schedule c. The biodiesel or renewable diesel mixture credit; Do i have to wait for. Go to irs publication 510 excise taxes (including fuel tax credits and refunds) for definitions and information on nontaxable uses. 23 name (as shown on your income tax return) taxpayer identification number

How to Prepare IRS Form 4136 (with Form) wikiHow

If you have $243 worth of credits, for example, that cuts your tax bill by the full $243. Credit for federal tax paid on fuels at www.irs.gov. Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject.

Web Form 4136 Department Of The Treasury Internal Revenue Service (99) Credit For Federal Tax Paid On Fuels A Go To Www.irs.gov/Form4136 For Instructions And The Latest Information.

Credit for federal tax paid on fuels. Web the tax credits calculated on form 4136 directly reduce your tax obligations. Instead of waiting to claim an annual credit on form 4136, you may be able to file: You can’t claim any amounts on form 4136 that you claimed on form 8849, form 8864, or form 720, schedule c.

Go To Irs Publication 510 Excise Taxes (Including Fuel Tax Credits And Refunds) For Definitions And Information On Nontaxable Uses.

Tax credits are more powerful than tax deductions, which simply reduce the amount of your income that’s subject to tax. For instructions and the latest information. If you report a tax. Or •form 720, quarterly federal excise tax return, to claim a credit against your excise tax liability.

If You Have $243 Worth Of Credits, For Example, That Cuts Your Tax Bill By The Full $243.

Department of the treasury internal revenue service. •form 8849, claim for refund of excise taxes, to claim a periodic refund; Web attach form 4136 to your tax return. Do i have to wait for.

If So, You Must Report The Amount You Claim As Income On Schedule C.

Web irs form 4136, credit for federal tax paid on fuels, enables certain taxpayers to claim a fuel credit, depending on the type of fuels used, and the type of business use the credit is claimed for. Web 4136, you may be able to file: A credit for exporting dyed fuels or gasoline. The credits available on form 4136 are: