Form 2848 Poa

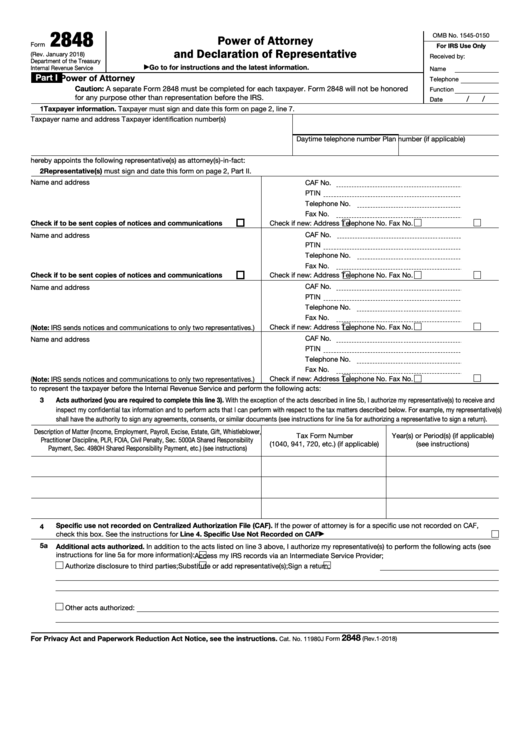

Form 2848 Poa - For instructions and the latest information. Failure to provide information could result in a penalty. Power of attorney and declaration of representative. Form 8821, tax information authorization pdf. Date / / part i power of attorney. In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Date / / part i power of attorney. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Use form 2848 to authorize an individual to represent you before the irs.

In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Failure to provide information could result in a penalty. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. For instructions and the latest information. Web submit forms 2848 and 8821 online. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Print out and complete the 2848 form to authorize the attorney to act on your behalf. The individual you authorize must be a person eligible to practice before the irs. March 2012) department of the treasury internal revenue service.

Power of attorney and declaration of representative. January 2021) department of the treasury internal revenue service. Print out and complete the 2848 form to authorize the attorney to act on your behalf. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Use form 2848 to authorize an individual to represent you before the irs. Web about form 2848, power of attorney and declaration of representative. Form 2848, power of attorney and declaration of representative pdf. The individual you authorize must be a person eligible to practice before the irs. Web submit forms 2848 and 8821 online.

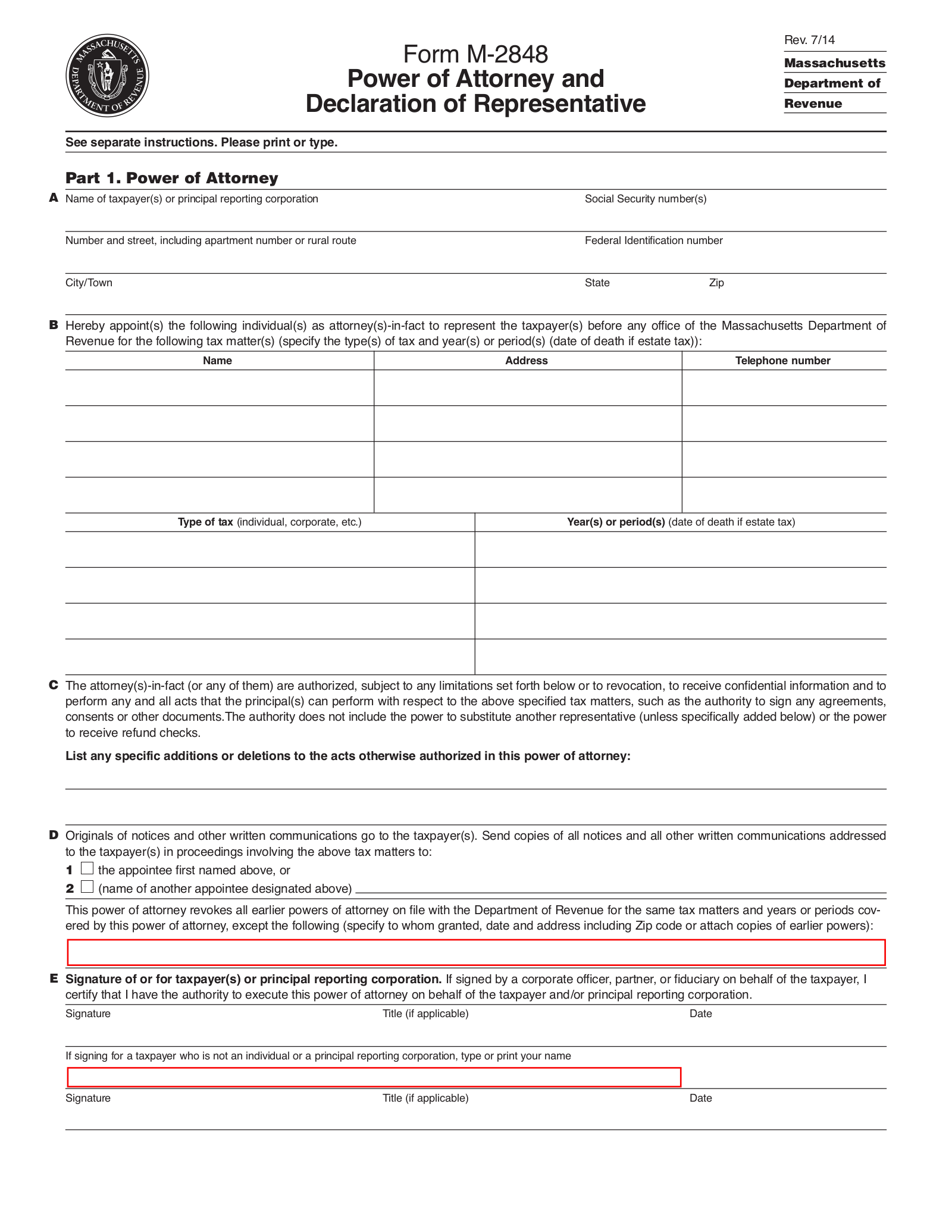

Massachusetts Tax Power of Attorney Form (M2848) eForms

Web get form 2848, power of attorney, to file in 2023. March 2012) department of the treasury internal revenue service. Web about form 2848, power of attorney and declaration of representative. Web submit forms 2848 and 8821 online. Power of attorney and declaration of representative.

Form 2848 Power of Attorney and Declaration of Representative IRS

Web about form 2848, power of attorney and declaration of representative. The individual you authorize must be a person eligible to practice before the irs. Check out our detailed instructions & examples to complete the declaration efficiently & quickly Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Power of attorney and declaration.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Use form 2848 to authorize an individual to represent you before the irs. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. You may authorize a student who works in a qualified low income taxpayer clinic (litc) or student tax clinic. Form 2848, power of attorney and declaration of representative pdf. For instructions.

Publication 947 Practice Before the IRS and Power of Attorney

Web get form 2848, power of attorney, to file in 2023. March 2012) department of the treasury internal revenue service. Date / / part i power of attorney. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Form 2848, power of attorney and declaration of representative pdf.

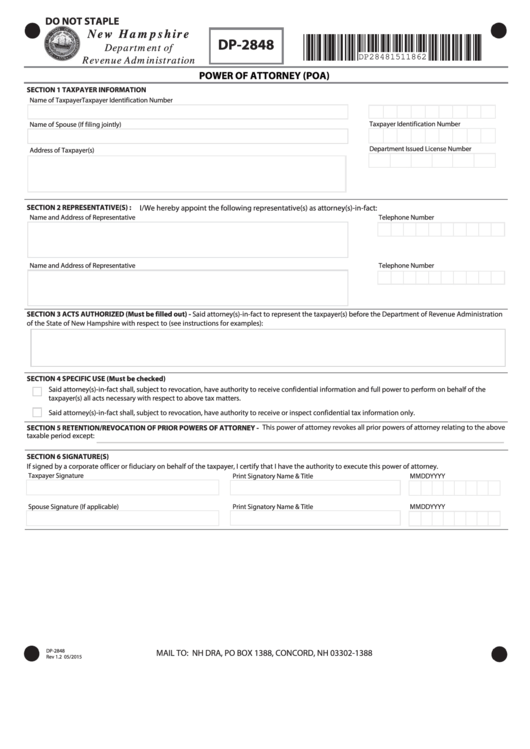

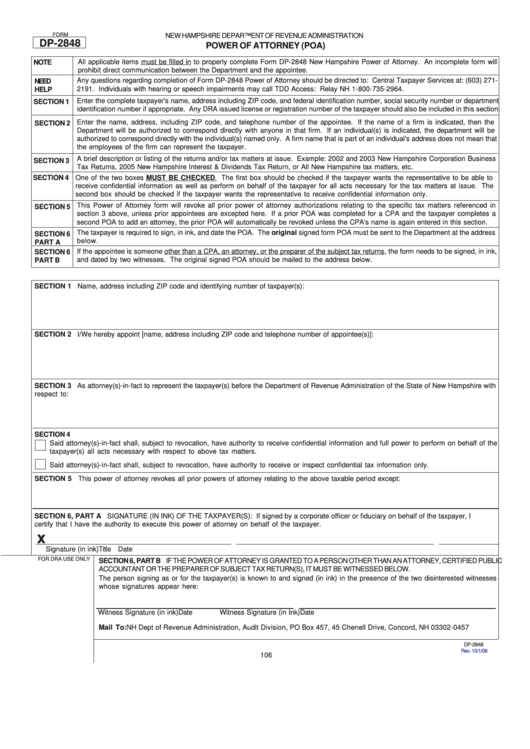

Form Dp2848 Power Of Attorney (Poa) New Hampshire Department Of

Date / / part i power of attorney. Web about form 2848, power of attorney and declaration of representative. Power of attorney and declaration of representative. For instructions and the latest information. The individual you authorize must be a person eligible to practice before the irs.

Form Dp2848 Power Of Attorney (Poa) New Hampshire Department Of

Date / / part i power of attorney. In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Web get form 2848, power of attorney, to file.

Fillable Form 2848 Power Of Attorney And Declaration Of

Form 8821, tax information authorization pdf. For instructions and the latest information. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. March 2012) department of the treasury internal revenue service. Check out our detailed instructions & examples to complete the declaration.

The Purpose of IRS Form 2848

Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Web about form 2848, power of attorney and declaration of representative. Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Web for more information on.

Form 2848 Instructions for IRS Power of Attorney Community Tax

Form 2848, power of attorney and declaration of representative pdf. Form 8821, tax information authorization pdf. March 2012) department of the treasury internal revenue service. Web get form 2848, power of attorney, to file in 2023. Form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr.

4.31.2 TEFRA Examinations Field Office Procedures Internal Revenue

Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Web for more information on designating a partnership representative, see form 8979, partnership representative revocation, designation, and resignation, and its instructions. March 2012) department of the treasury internal revenue service. In november 2022, the irs updated its guidance regarding who can sign form 2848,.

You May Authorize A Student Who Works In A Qualified Low Income Taxpayer Clinic (Litc) Or Student Tax Clinic.

Form 8821, tax information authorization pdf. March 2012) department of the treasury internal revenue service. Power of attorney and declaration of representative. Form 2848, power of attorney and declaration of representative pdf.

Form 2848 Is Used By The Pr To Appoint A Power Of Attorney To Act On Its Behalf In Its Capacity As The Pr Of The Bba Partnership.

Power of attorney *65203221w* this form is authorized by various acts found in illinois compiled statutes. Power of attorney and declaration of representative. Date / / part i power of attorney. Web submit forms 2848 and 8821 online.

The Individual You Authorize Must Be A Person Eligible To Practice Before The Irs.

Use form 2848 to authorize an individual to represent you before the irs. Failure to provide information could result in a penalty. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Web get form 2848, power of attorney, to file in 2023.

Web For More Information On Designating A Partnership Representative, See Form 8979, Partnership Representative Revocation, Designation, And Resignation, And Its Instructions.

Date / / part i power of attorney. In november 2022, the irs updated its guidance regarding who can sign form 2848, power of attorney and declaration of representative (poa), submitted on behalf of a limited liability company (llc) treated as a partnership or disregarded entity for federal income tax purposes. Print out and complete the 2848 form to authorize the attorney to act on your behalf. Web about form 2848, power of attorney and declaration of representative.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at11.45.57AM-685a3de0020a41b7a4b15d2226d2a93b.png)