Form 12277 Irs

Form 12277 Irs - Getting the irs to withdraw a lien can be a huge benefit for your clients. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. Web today we’re tackling irs form 12277, application for withdrawal of federal tax lien. You will need form 12277 called application for withdrawal of filed notice of federal tax lien. Web need help filling out irs form 12277? Web taxpayers may apply for a withdrawal using irs form 12277, application for withdrawal of filed form 668(y), notice of federal tax lien. Page one you fill out and send to us. The 12277 can be complicated, but we've got the information you need to get your lien withdrawn the first time. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly.

Web irs form 12277 is the option to resolve from a resolved tax lien. Getting the irs to withdraw a lien can be a huge benefit for your clients. Web this article will walk you through irs form 12277, which is the tax form taxpayers use to obtain a withdrawal of a filed tax lien. This application process, including the conditions under which a withdrawal may be issued, is. Web form 12277, application for withdrawal of filed form 668 (y), notice of federal tax lien (internal revenue code section 6323 (j) download. This can negatively impact your credit even after you’ve resolved your. Web taxpayers may apply for a withdrawal using irs form 12277, application for withdrawal of filed form 668(y), notice of federal tax lien. You will need form 12277 called application for withdrawal of filed notice of federal tax lien. Web notice of federal tax lien relief when there is a notice of federal tax lien (nftl) filed, there are various options for relief depending on your circumstances. Download or email form 12277 & more fillable forms, register and subscribe now!

Web today we’re tackling irs form 12277, application for withdrawal of federal tax lien. Getting the irs to withdraw a lien can be a huge benefit for your clients. Download or email form 12277 & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web this article will walk you through irs form 12277, which is the tax form taxpayers use to obtain a withdrawal of a filed tax lien. Web a federal tax lien is a legal claim to your property (such as real property, securities and vehicles), including property that you acquire after the lien arises. Web need help filling out irs form 12277? Web irs form 12277 is the option to resolve from a resolved tax lien. Web one of the difficult to comprehension papers here is irs form 12277 that is developed to withdraw the previously filed irs form 668 (y). Web form 12277 came about from the irs fresh start initiative, which offers options to taxpayers to allow them to improve their standings with the irs and get back on track.

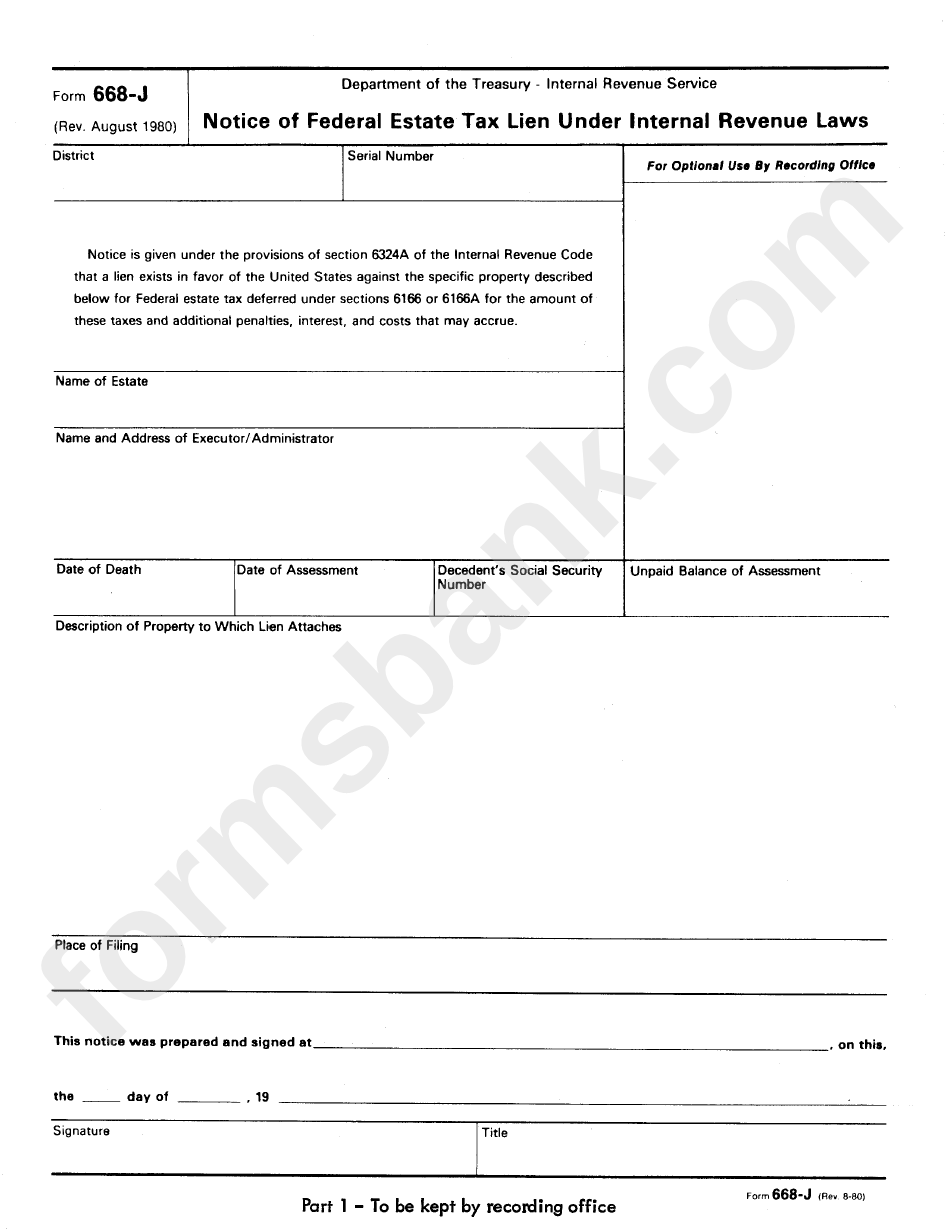

Form 668J Notice Of Federal Estate Tax Lien Under Internal Revenue

Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. Web need help filling out irs form 12277? Ad download or email form 12277 & more fillable forms, register and subscribe now! Read our short guide to figure.

Form 12277 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Web report error it appears you don't have a pdf plugin for this browser. Getting the irs to withdraw a lien can be a huge benefit for your clients. This can negatively impact your credit even after you’ve resolved your. Web the irs lien release form (form 12277) is a form that would.

Form 12277 Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. The form is two pages long. Web potential employers or creditors can still access public records that show you have a tax lien on your property. Getting the irs to withdraw a lien can be a huge benefit for your clients. Web taxpayers may apply for a withdrawal using irs form 12277, application.

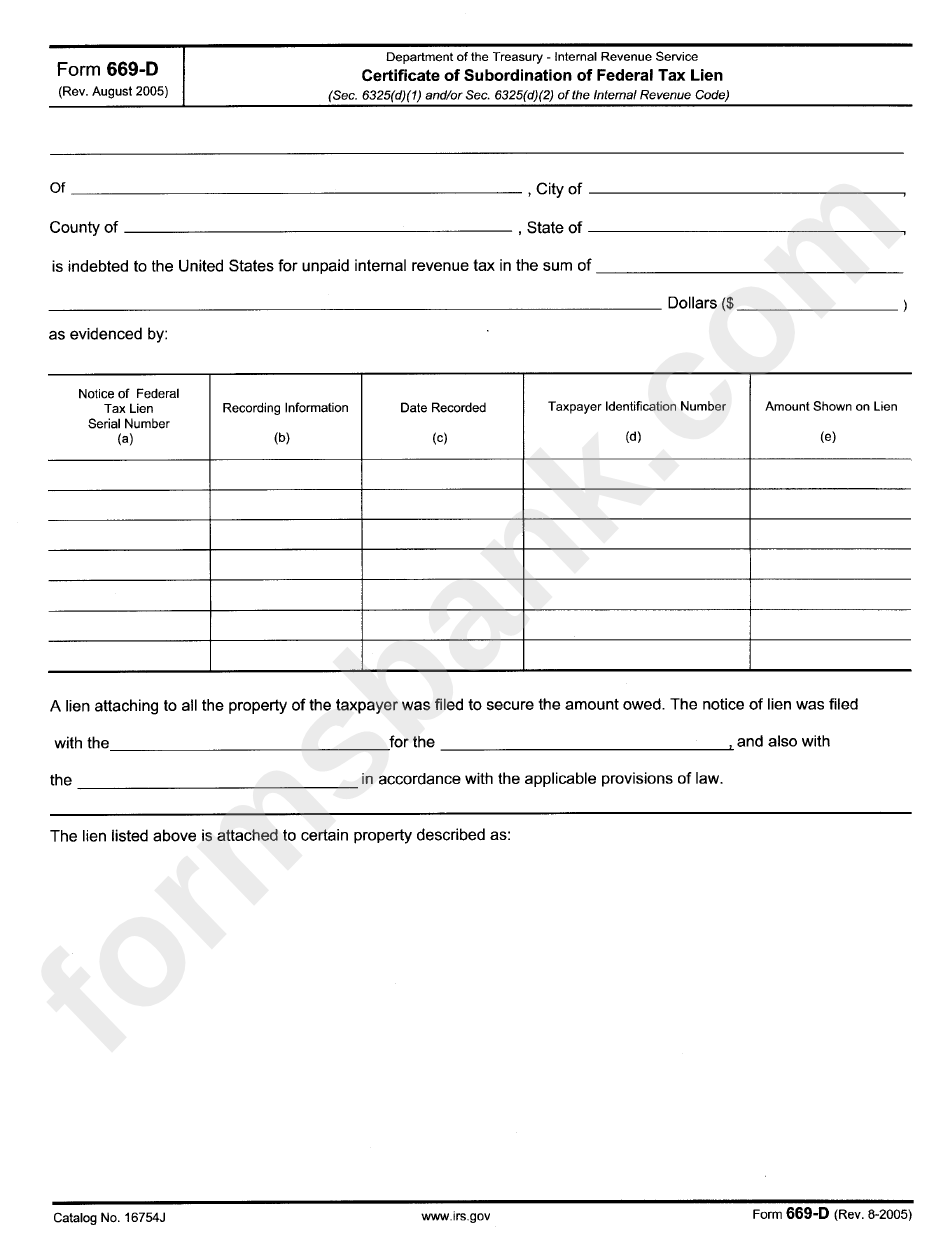

Form 669D Certificate Of Subordination Of Federal Tax Lien printable

You will need form 12277 called application for withdrawal of filed notice of federal tax lien. Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. Complete, edit or print tax forms instantly. Web form 12277 (october 2011).

Form 12277 Edit, Fill, Sign Online Handypdf

Web form 12277 came about from the irs fresh start initiative, which offers options to taxpayers to allow them to improve their standings with the irs and get back on track. Web need help filling out irs form 12277? Ad access irs tax forms. Web form 12277 (october 2011) department of the treasury — internal revenue service application for withdrawal.

File IRS Form 12277 to resolve a claim against your property

Web potential employers or creditors can still access public records that show you have a tax lien on your property. Web report error it appears you don't have a pdf plugin for this browser. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web irs form 12277 is the option to resolve from a resolved tax lien.

IRS Form 12277 Instructions

Ad download or email form 12277 & more fillable forms, register and subscribe now! Web september 06, 2019 purpose (1) this transmits a revision to irm 5.12.9, federal tax lien, withdrawal of notice of federal tax lien. Web need help filling out irs form 12277? Web form 12277 came about from the irs fresh start initiative, which offers options to.

How to fill out IRS Form 12277 for lien removal Archives Business Tax

Web form 12277 came about from the irs fresh start initiative, which offers options to taxpayers to allow them to improve their standings with the irs and get back on track. Web potential employers or creditors can still access public records that show you have a tax lien on your property. The 12277 can be complicated, but we've got the.

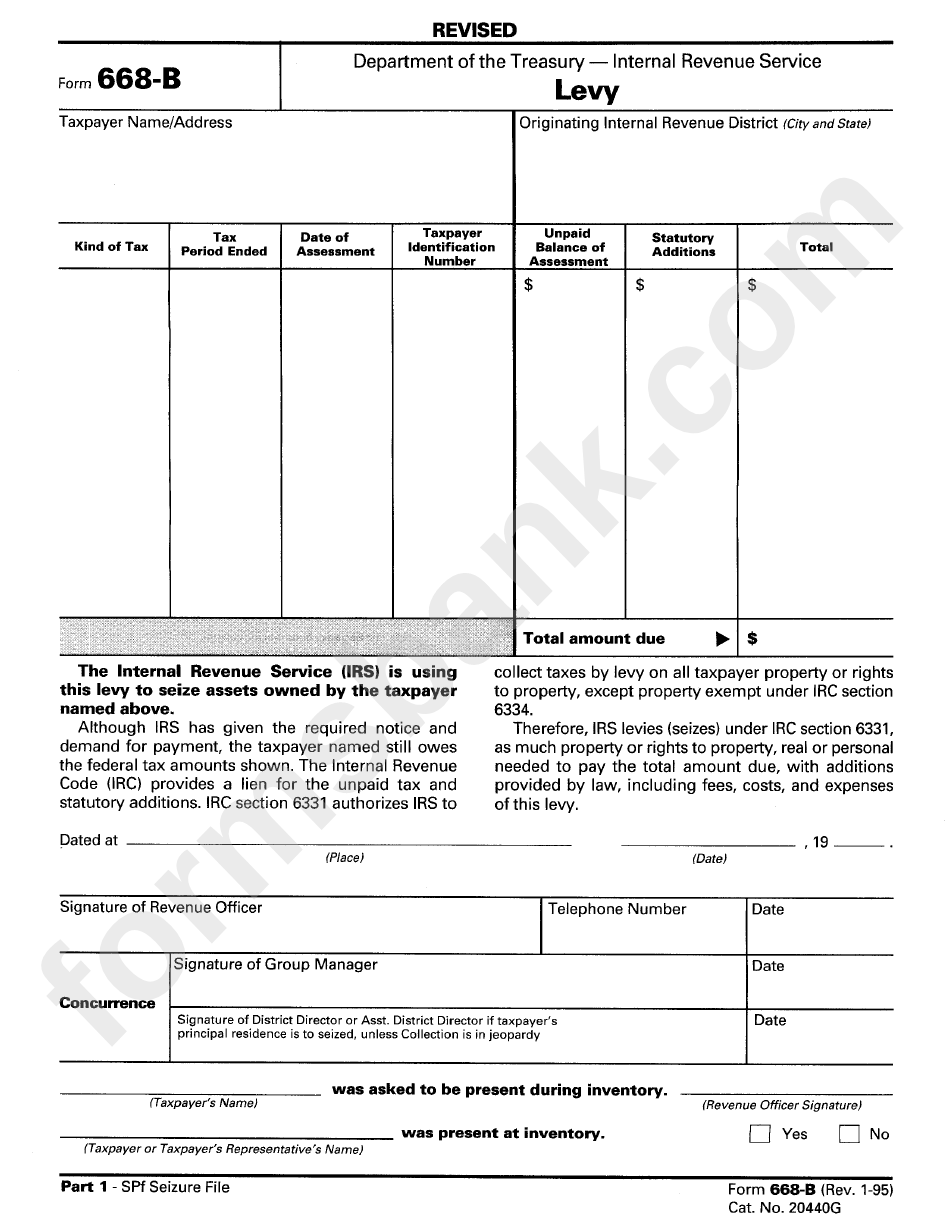

Form 668B Levy Department Of The Treasury printable pdf download

Getting the irs to withdraw a lien can be a huge benefit for your clients. Web potential employers or creditors can still access public records that show you have a tax lien on your property. Web form 12277 came about from the irs fresh start initiative, which offers options to taxpayers to allow them to improve their standings with the.

Form 12277 Instructions 2021 2022 IRS Forms Zrivo

Getting the irs to withdraw a lien can be a huge benefit for your clients. Web requesting a withdrawal of the filed notice of federal tax lien. Web form 12277 (october 2011) department of the treasury — internal revenue service application for withdrawal of filed form 668(y), notice of federal tax lien (internal. Web one of the difficult to comprehension.

Download Or Email Form 12277 & More Fillable Forms, Register And Subscribe Now!

You will need form 12277 called application for withdrawal of filed notice of federal tax lien. Web report error it appears you don't have a pdf plugin for this browser. Web potential employers or creditors can still access public records that show you have a tax lien on your property. Complete, edit or print tax forms instantly.

Getting The Irs To Withdraw A Lien Can Be A Huge Benefit For Your Clients.

Web irs form 12277 is the option to resolve from a resolved tax lien. This can negatively impact your credit even after you’ve resolved your. Web taxpayers may apply for a withdrawal using irs form 12277, application for withdrawal of filed form 668(y), notice of federal tax lien. Web requesting a withdrawal of the filed notice of federal tax lien.

Web How To Complete Irs Tax Form 12277.

Web the irs lien release form (form 12277) is a form that would release a taxpayer from a lien imposed by the internal revenue service (irs), once the debt has been satisfied. Web a federal tax lien is a legal claim to your property (such as real property, securities and vehicles), including property that you acquire after the lien arises. Web notice of federal tax lien relief when there is a notice of federal tax lien (nftl) filed, there are various options for relief depending on your circumstances. Read our short guide to figure out the.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web today we’re tackling irs form 12277, application for withdrawal of federal tax lien. Web september 06, 2019 purpose (1) this transmits a revision to irm 5.12.9, federal tax lien, withdrawal of notice of federal tax lien. Web this article will walk you through irs form 12277, which is the tax form taxpayers use to obtain a withdrawal of a filed tax lien. Ad access irs tax forms.