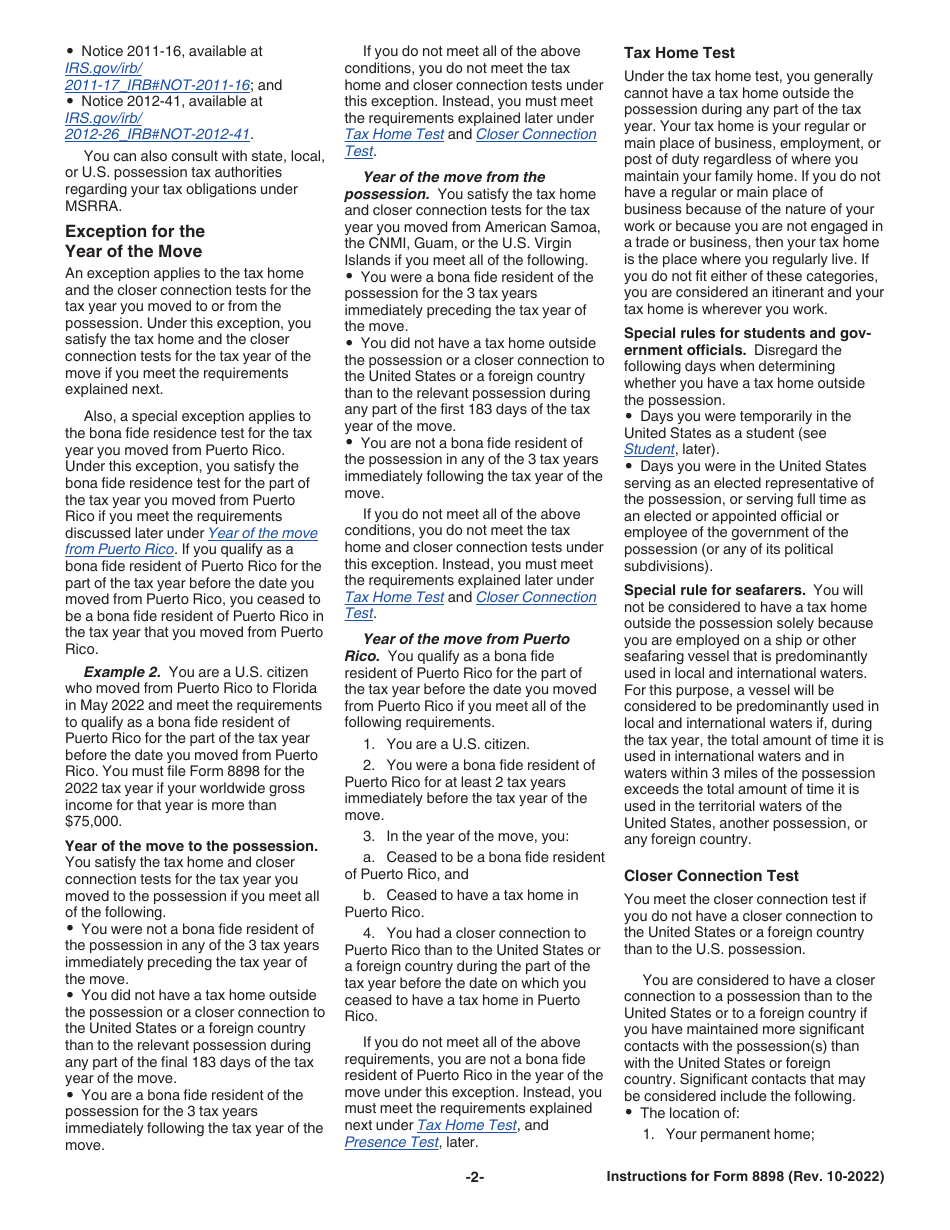

Form 8898 Instructions

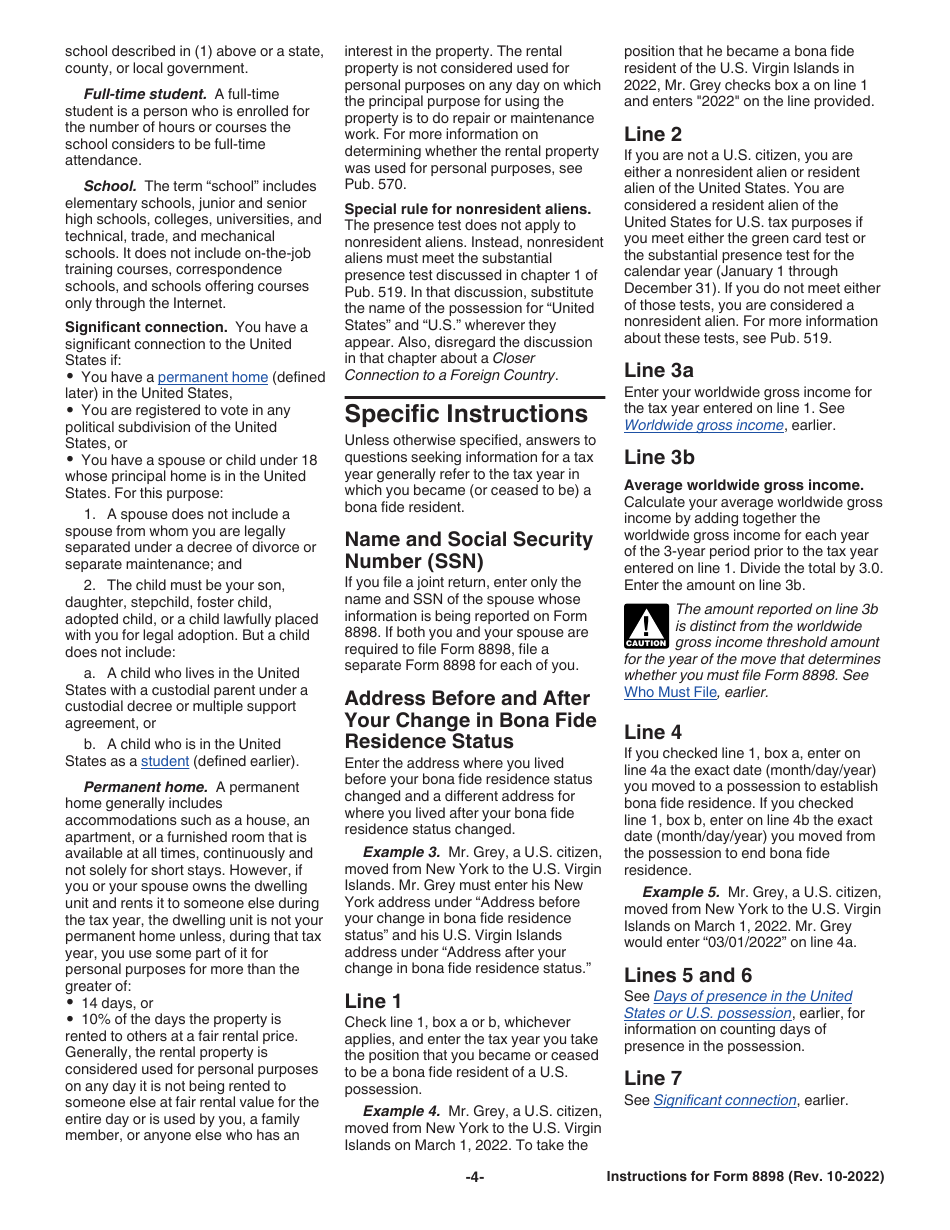

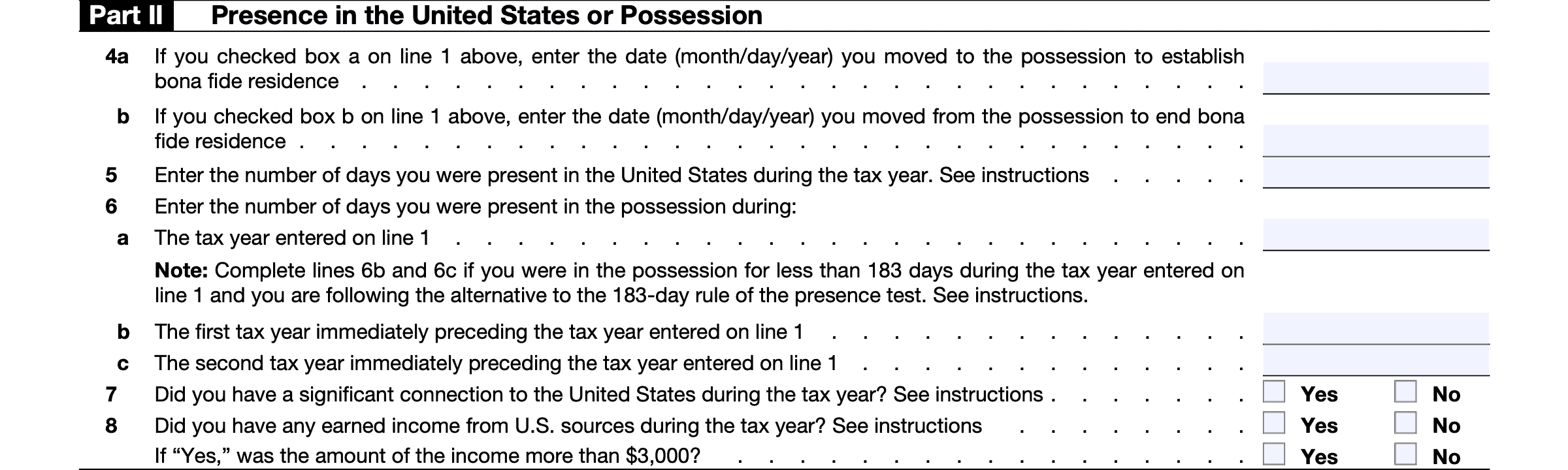

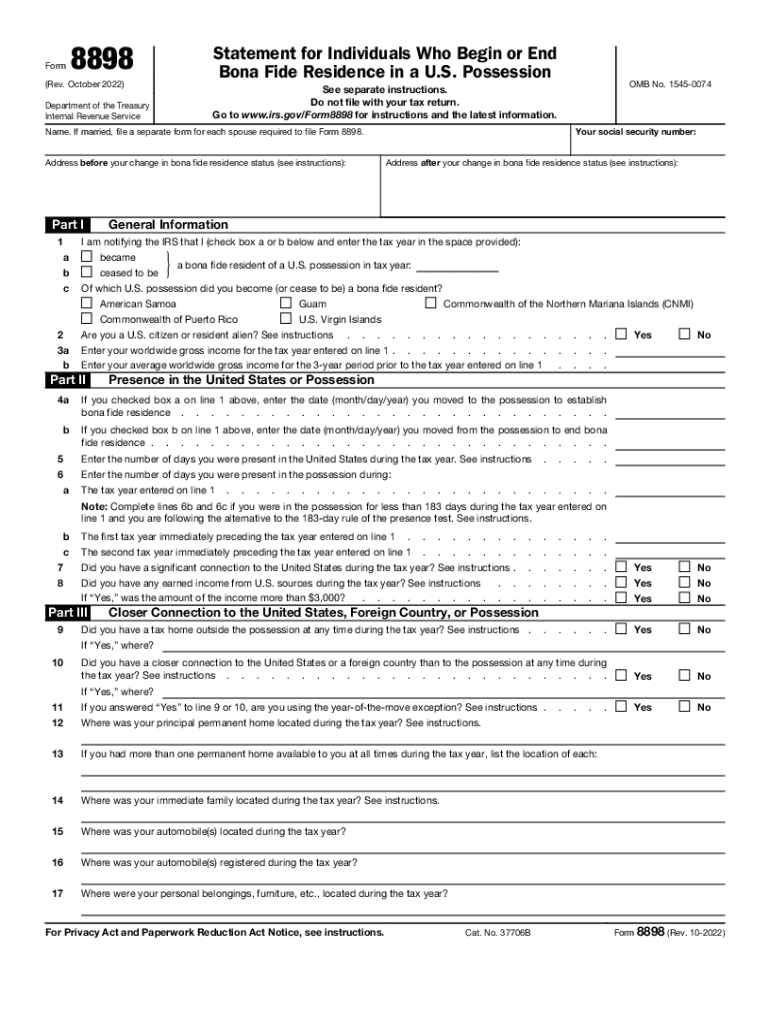

Form 8898 Instructions - Web draft instructions for form 8898, statement for individuals who begin or end bona fide residence in a u.s. Statement for individuals who begin or end bona fide residence in a u.s. Possession, released july 21 add new line 3a to. Web general instructions purpose of form use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. See bona fide residence, on this. Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898: Web instructions to printers form 8898, page 2 of 2 margins: Web form 8898 (final rev. Top 13 mm (1⁄ 2), center sides. October 2020)departmentof the treasury internal revenue service statement for individuals who begin or end bona fide residence in a u.s.

When and where to file file form 8898 by the due. How to complete and file irs form 8898. Possession, released july 21 add new line 3a to. Web instructions to printers form 8898, page 2 of 2 margins: Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. File the form by itself at the following address: Top 13 mm (1⁄ 2), center sides. Web follow the simple instructions below: File form 8898 by the due date (including extensions) for filing. Web in this tax guide article, we’ll cover what you need to know about this tax form, to include:

You became or ceased to be a bona fide all of. October 2020)departmentof the treasury internal revenue service statement for individuals who begin or end bona fide residence in a u.s. File form 8898 by the due date (including extensions) for filing. Web use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Possession in accordance with section 937(c). Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898: 2022), statement for individuals who begin or end bona fide residence in a u.s. Possession, includes a new line for the taxpayer's. Web when and where to file. Web form 8898 is used to notify the irs of a change in residency status for a u.s.

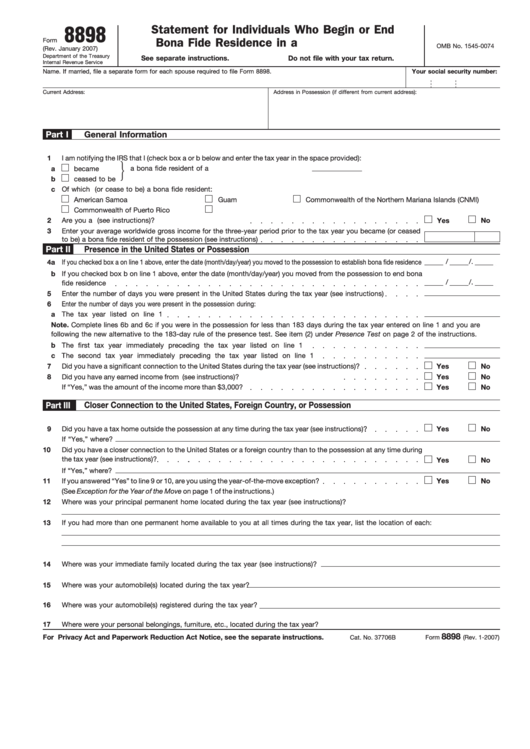

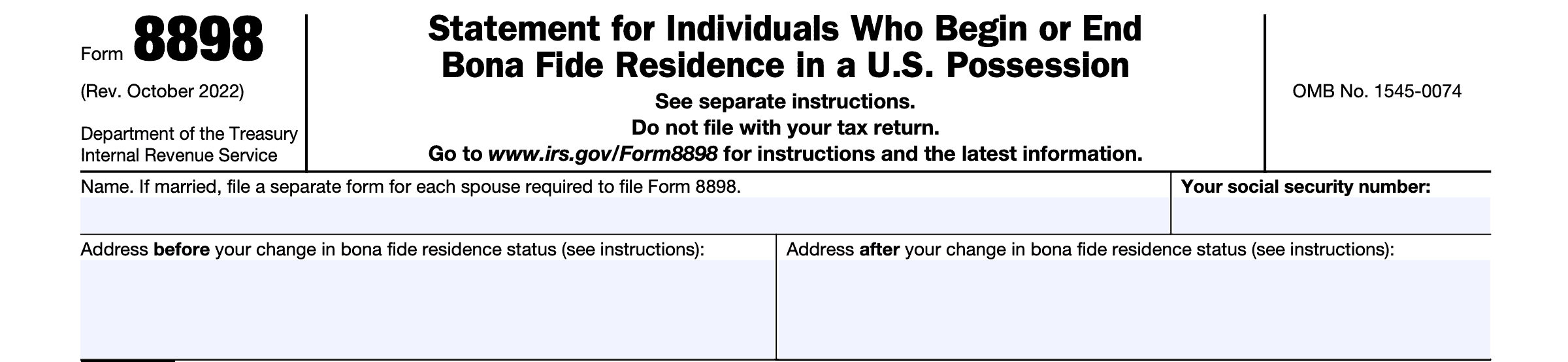

Form 8898 Statement For Individuals Who Begin Or End Bona Fide

2022), statement for individuals who begin or end bona fide residence in a u.s. Web up to $3 cash back use form 8898 to notify the irs that states (even if you may exclude part or year in compliance with military orders. Web follow the simple instructions below: Possession, includes a new line for the taxpayer's. Web use form 8889.

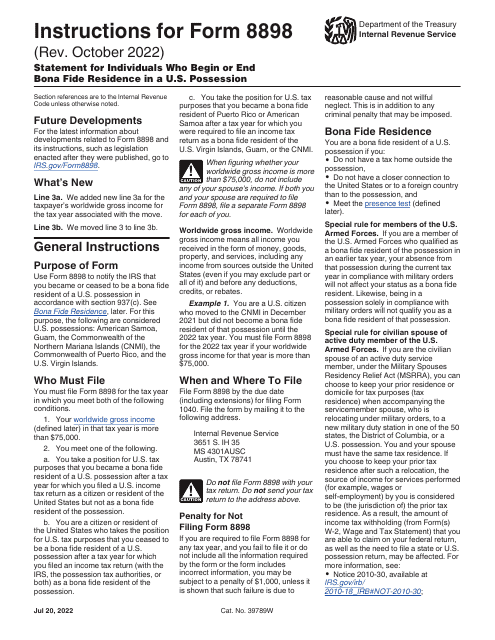

Download Instructions for IRS Form 8898 Statement for Individuals Who

Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898: When individuals aren?t associated with document administration and law operations, submitting irs docs can be very exhausting. American samoa, guam, the commonwealth of the. When and where to file file form 8898 by the due. Web up to $3 cash back use form 8898 to notify.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

File form 8898 by the due date (including extensions) for filing. Possession, includes a new line for the taxpayer's. Web follow the simple instructions below: Web form8898 (march 2006) department of the treasuryinternal revenue service statement for individuals who begin or endbona fide residence in a u.s. Web instructions for form 8898, statement of individuals who begin or end bona.

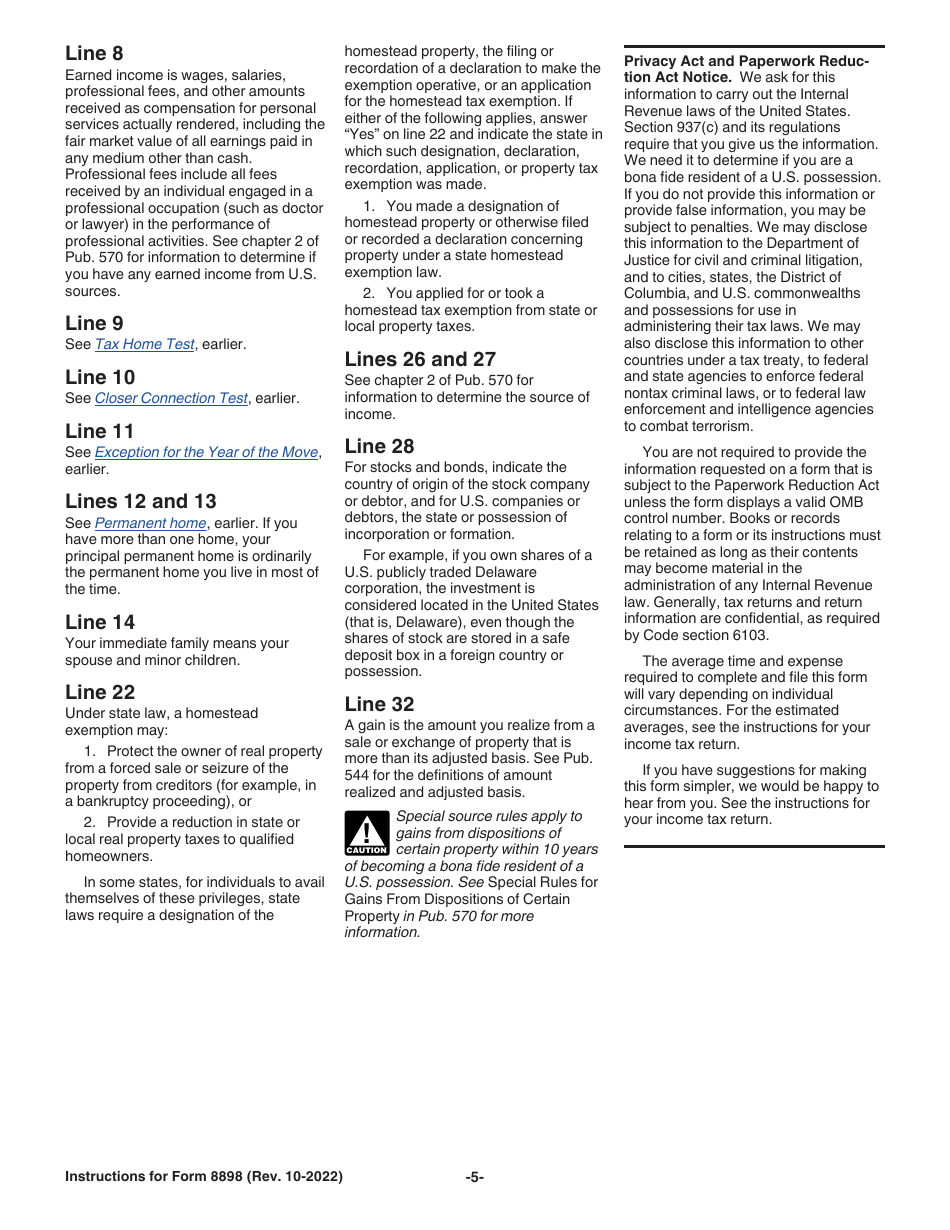

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

Citizen who moved to the cnmi in december 2021 but did not become a bona fide resident of that possession until the 2022 tax year. Web use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. You became or ceased to be a bona fide all of. Web form8898.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

Web instructions for form 8898, statement of individuals who begin or end bona fide residence in a u.s. Web instructions to printers form 8898, page 2 of 2 margins: Web in this tax guide article, we’ll cover what you need to know about this tax form, to include: Web draft instructions for form 8898, statement for individuals who begin or.

Form 8898 Fill Out and Sign Printable PDF Template signNow

Who must file form 8898. You became or ceased to be a bona fide all of. Web general instructions purpose of form use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Web when and where to file. Web use form 8898 to notify the irs that you became.

Download Instructions for IRS Form 8898 Statement for Individuals Who

Web form 8898 is used to notify the irs of a change in residency status for a u.s. Web up to $3 cash back use form 8898 to notify the irs that states (even if you may exclude part or year in compliance with military orders. Web use form 8898 to notify the irs that you became or ceased to.

IRS Form 8898 Instructions U.S. Territory Bona Fide Residence

Web you must file form 8898 for the 2022 tax year if your worldwide gross income for that year is more than $75,000. See bona fide residence, on this. You became or ceased to be a bona fide all of. Possession in accordance with section 937(c). Web instructions to printers form 8898, page 2 of 2 margins:

Download Instructions for IRS Form 8898 Statement for Individuals Who

How to complete and file irs form 8898. Web use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Type, draw, or upload an image of your handwritten signature and place it. Web instructions to printers form 8898, page 2 of 2 margins: Top 13 mm (1⁄ 2), center.

Download Instructions for IRS Form 8898 Statement for Individuals Who

Citizen who moved to the cnmi in december 2021 but did not become a bona fide resident of that possession until the 2022 tax year. American samoa, guam, the commonwealth of the. File form 8898 by the due date (including extensions) for filing. File the form by itself at the following address: File form 8898 by the due date (including.

American Samoa, Guam, The Commonwealth Of The.

You became or ceased to be a bona fide all of. Web general instructions purpose of form use form 8898 to notify the irs that you became or ceased to be a bona fide resident of a u.s. Web use form 8889 to: See bona fide residence, on this.

Citizen Who Moved To The Cnmi In December 2021 But Did Not Become A Bona Fide Resident Of That Possession Until The 2022 Tax Year.

October 2020)departmentof the treasury internal revenue service statement for individuals who begin or end bona fide residence in a u.s. Web when and where to file. Report health savings account (hsa) contributions (including those made on your behalf and employer contributions), figure your hsa deduction, report. Type, draw, or upload an image of your handwritten signature and place it.

Web Use Form 8898 To Notify The Irs That You Became Or Ceased To Be A Bona Fide Resident Of A U.s.

Web form8898 (march 2006) department of the treasuryinternal revenue service statement for individuals who begin or endbona fide residence in a u.s. Top 13 mm (1⁄ 2), center sides. Web instructions for form 8898, statement of individuals who begin or end bona fide residence in a u.s. When and where to file file form 8898 by the due.

Web Form 8898 Is Used To Notify The Irs Of A Change In Residency Status For A U.s.

File the form by itself at the following address: Web instructions for form 8883, asset allocation statement under section 338 2002 form 8898: How to complete and file irs form 8898. Possession, released july 21 add new line 3a to.