Form 1120 W Instructions

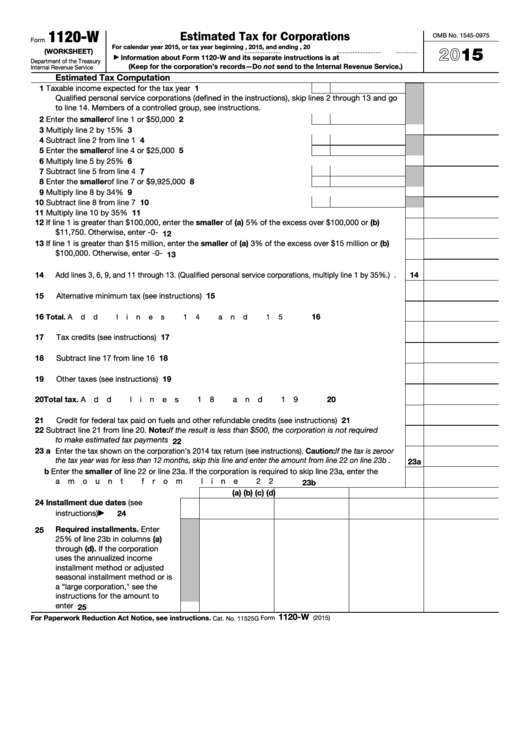

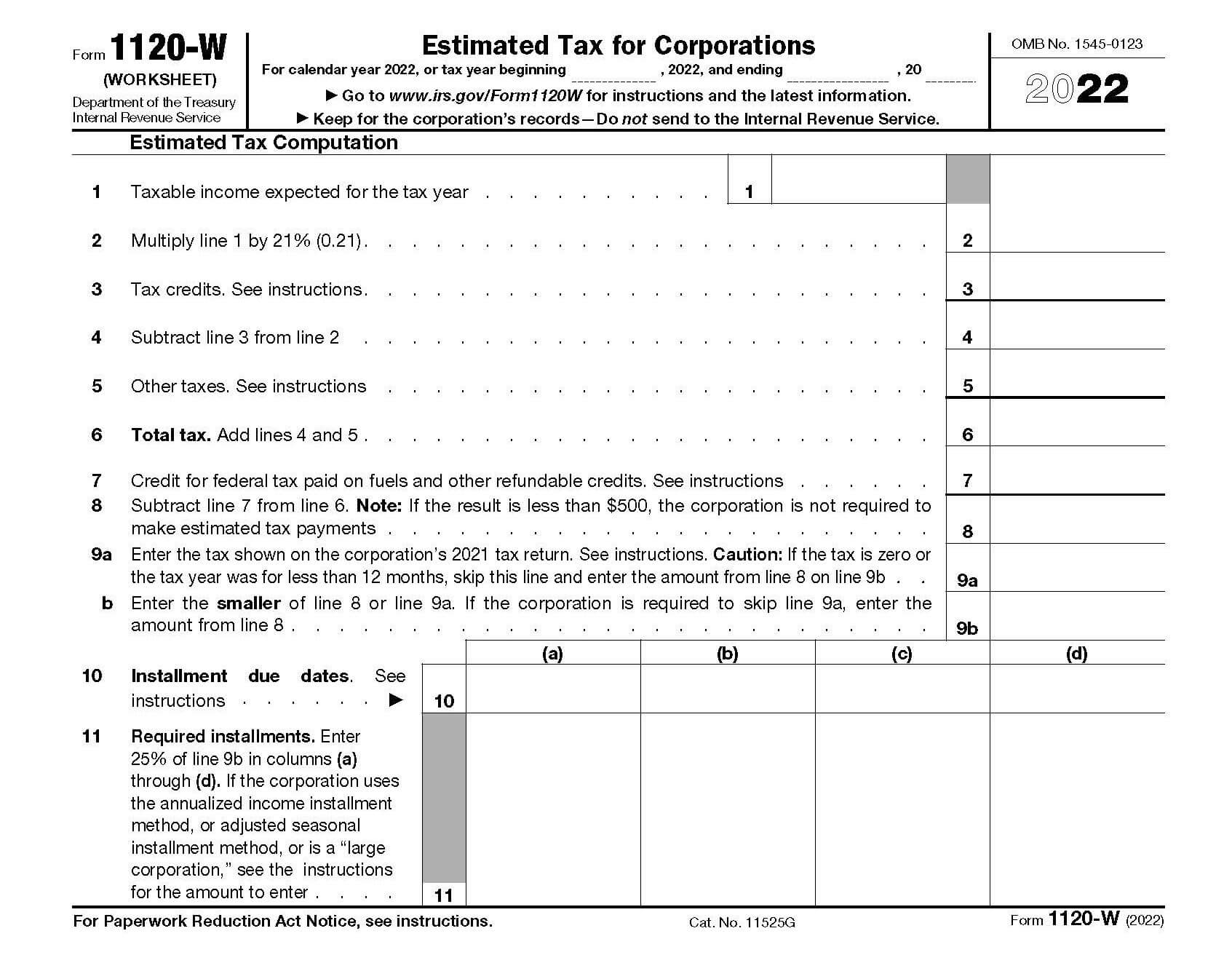

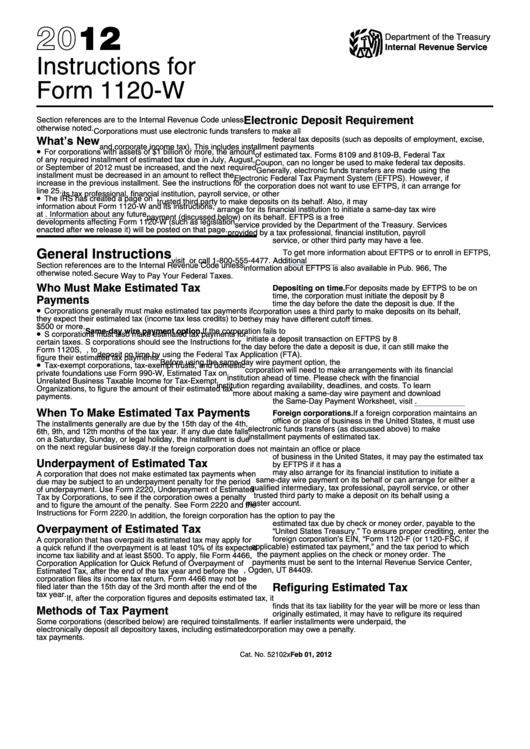

Form 1120 W Instructions - Estimated tax for corporations keywords: Web for instructions and the latest information. Web form 1120 department of the treasury internal revenue service u.s. If you are an s corporation expecting to owe federal tax of. Your taxable income is simply your revenues minus allowable deductions. If a return was not filed for. Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate. Please use the link below to. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Enter your expected taxable income for the tax year.

Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Web form 1120 department of the treasury internal revenue service u.s. Estimated tax for corporations keywords: Please use the link below to. Enter your expected taxable income for the tax year. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Use this form to report the. Web for instructions and the latest information. All other entities must determine their estimated.

Web for instructions and the latest information. Please use the link below to. Web if you have completed your tax return, and you are using the desktop program, locate your estimated tax due in taxact ® by following these steps: Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate. Corporation income tax return, including recent updates, related forms and instructions on how to file. Income tax liability of a foreign. Use this form to report the. Your taxable income is simply your revenues minus allowable deductions. If a return was not filed for. Estimated tax for corporations keywords:

Form 1120 Schedule J Instructions

Use this form to report the. Web form 1120 department of the treasury internal revenue service u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Web information about form 1120, u.s. Enter your expected taxable income for the tax year.

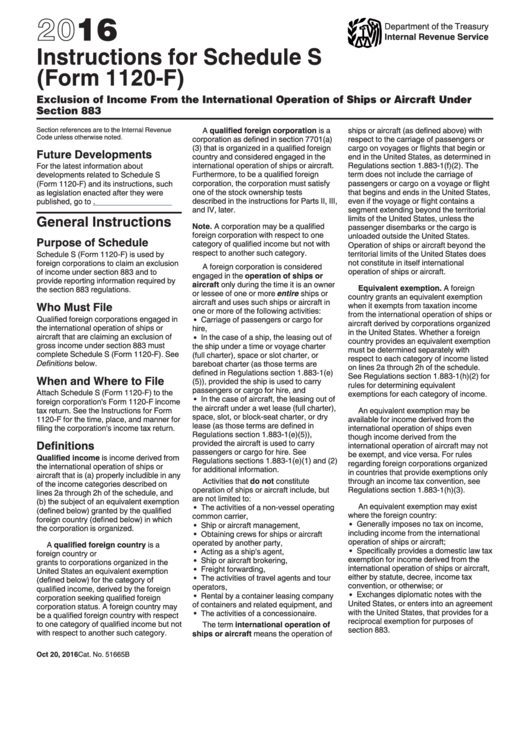

Instructions For Schedule S (form 1120f) 2016 printable pdf download

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Estimated tax for corporations keywords: Income tax liability of a foreign. Your taxable income is simply your revenues minus allowable deductions. Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions.

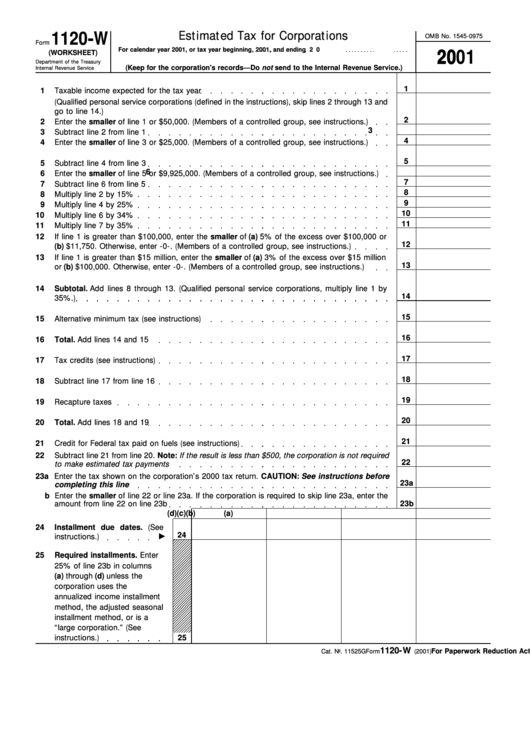

Fillable Form 1120W (Worksheet) Estimated Tax For Corporations

All other entities must determine their estimated. Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate. Corporation income tax return, including recent updates, related forms and instructions on how to file. Corporation income tax return, to report the income, gains,.

Who Should Use IRS Form 1120W?

Your taxable income is simply your revenues minus allowable deductions. If a return was not filed for. If you are an s corporation expecting to owe federal tax of. Estimated tax for corporations keywords: Income tax liability of a foreign.

Instructions For Form 1120W 2012 printable pdf download

Corporation income tax return, including recent updates, related forms and instructions on how to file. If a return was not filed for. Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate. Income tax liability of a foreign. Web form 1120.

Instructions For Form 1120Pc 2010 printable pdf download

Please use the link below to. Web information about form 1120, u.s. Web form 1120 department of the treasury internal revenue service u.s. All other entities must determine their estimated. Your taxable income is simply your revenues minus allowable deductions.

Instructions For Form 1120H 2008 printable pdf download

All other entities must determine their estimated. Web information about form 1120, u.s. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Enter your expected taxable income for the tax year. Corporation income tax return, including recent updates, related forms and instructions on how to file.

Fillable Form 1120W (Worksheet) Estimated Tax For Corporations

Your taxable income is simply your revenues minus allowable deductions. Enter your expected taxable income for the tax year. Estimated tax for corporations keywords: Income tax liability of a foreign. Use this form to report the.

form 1120l instructions Fill Online, Printable, Fillable Blank

Web information about form 1120, u.s. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate. Corporation income tax return for calendar year 2022 or tax.

Instructions For Form 1120Fsc 2007 printable pdf download

Use this form to report the. If a return was not filed for. Enter your expected taxable income for the tax year. Income tax liability of a foreign. Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate.

Please Use The Link Below To.

Corporation income tax return, including recent updates, related forms and instructions on how to file. If you are an s corporation expecting to owe federal tax of. Web form 1120 department of the treasury internal revenue service u.s. Estimated tax for corporations keywords:

Enter Your Expected Taxable Income For The Tax Year.

Use this form to report the. Web for instructions and the latest information. Web if you have completed your tax return, and you are using the desktop program, locate your estimated tax due in taxact ® by following these steps: Income tax liability of a foreign.

Web Information About Form 1120, U.s.

If a return was not filed for. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income. Your taxable income is simply your revenues minus allowable deductions. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to.

All Other Entities Must Determine Their Estimated.

Web for any charitable contribution of food during 2020 and 2021 to which section 170(e)(3)(c) applies, a corporation can deduct qualified contributions of up to 25% of their aggregate.