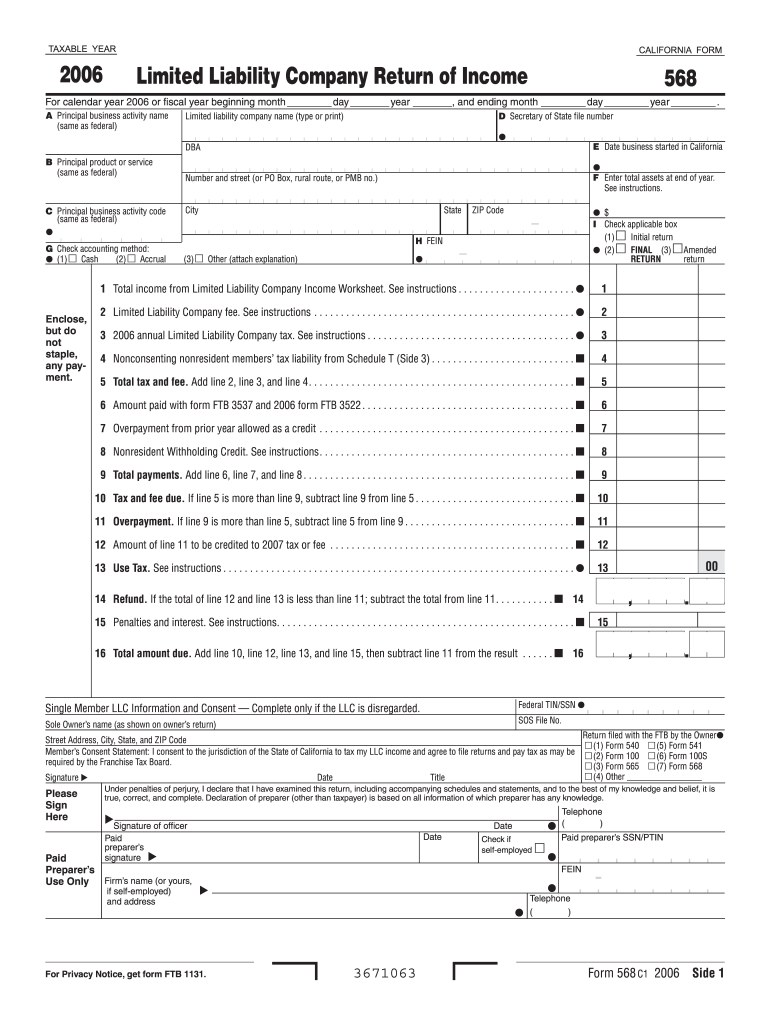

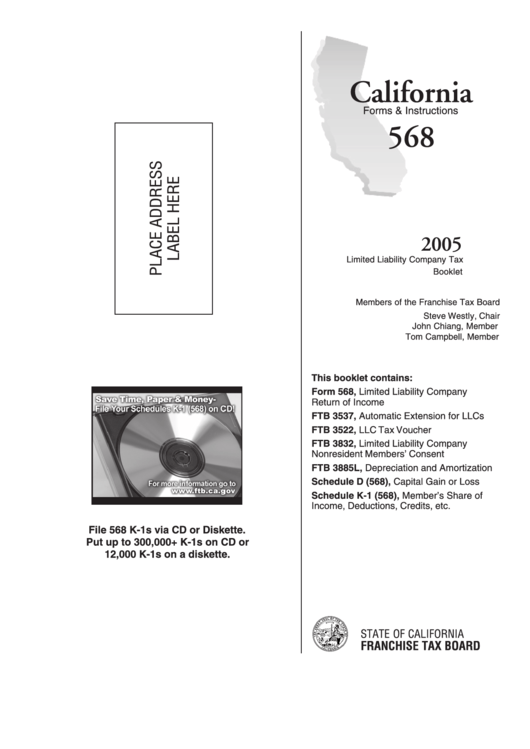

Form 568 2023

Form 568 2023 - Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web this is the amount you expect to enter on the llc’s 2023 form 568, limited liability company return of income, side 1, line 2, limited liability company fee. Llcs classified as a disregarded entity or. This amount needs to be prepaid and filed with form 3522. Web we last updated california form 568 from the franchise tax board in february 2023. For example, the 2023 tax needs. 9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Get everything done in minutes. Web handy tips for filling out form ca 568 instructions online. Web ca form 568 due dates 2023 california state form 568 for limited liability companies.

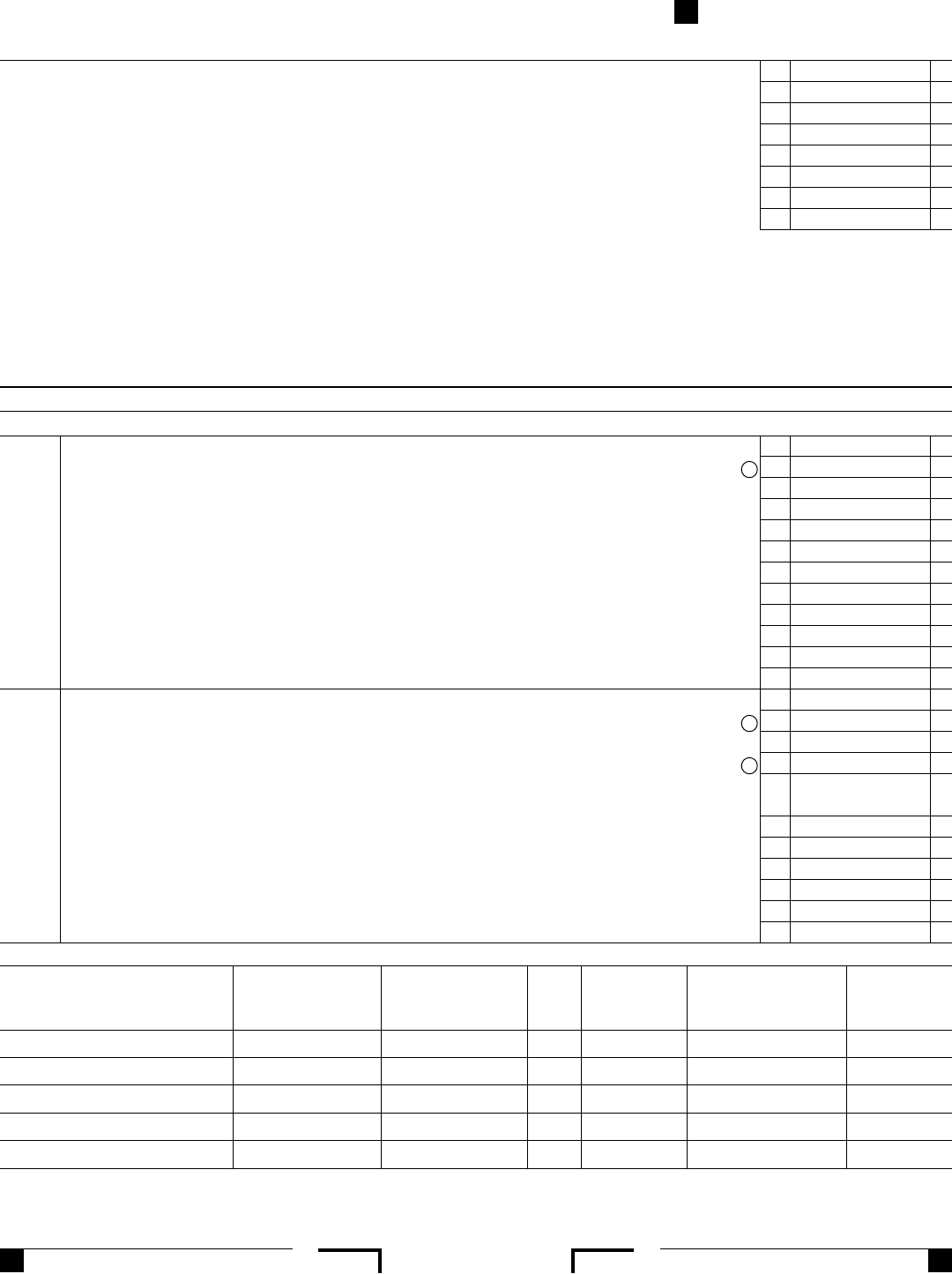

Web what is form 568? Web we last updated california form 568 from the franchise tax board in february 2023. 9568 county road 373, new bloomfield, mo is a single family home that contains 1,900 sq ft and was built in 1988. Get everything done in minutes. 16, 2023, to file and pay taxes. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. They are subject to the annual tax, llc fee and credit limitations. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web this is the amount you expect to enter on the llc’s 2023 form 568, limited liability company return of income, side 1, line 2, limited liability company fee. 3537 (llc), payment for automatic extension.

View our emergency tax relief page. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. This tax form is basically treated as an income return for llcs in california. What is the california llc tax due date? This form is for income earned in tax year 2022,. Web how do i know if i should file california form 568, llc return of income for this year? Web 568 form (pdf) | 568 booklet april 15, 2023 2022 personal income tax returns due and tax due state: Printing and scanning is no longer the best way to manage documents. It contains 0 bedroom and 2. Web form 568 is due on march 31st following the end of the tax year.

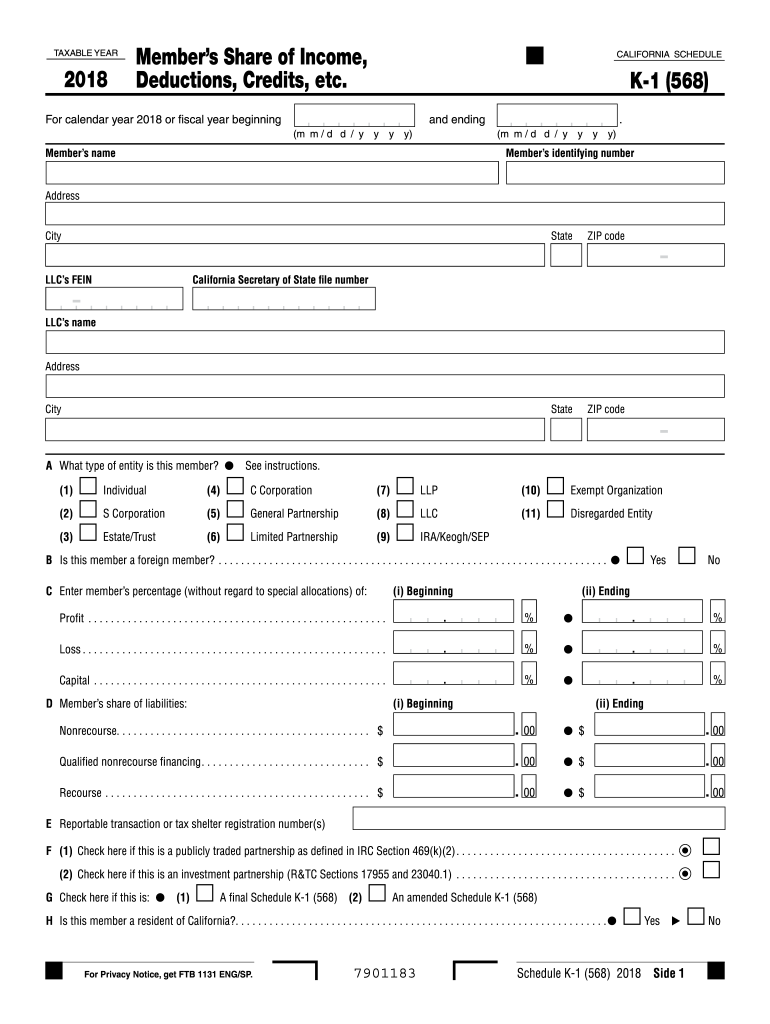

California k 1 instructions Fill out & sign online DocHub

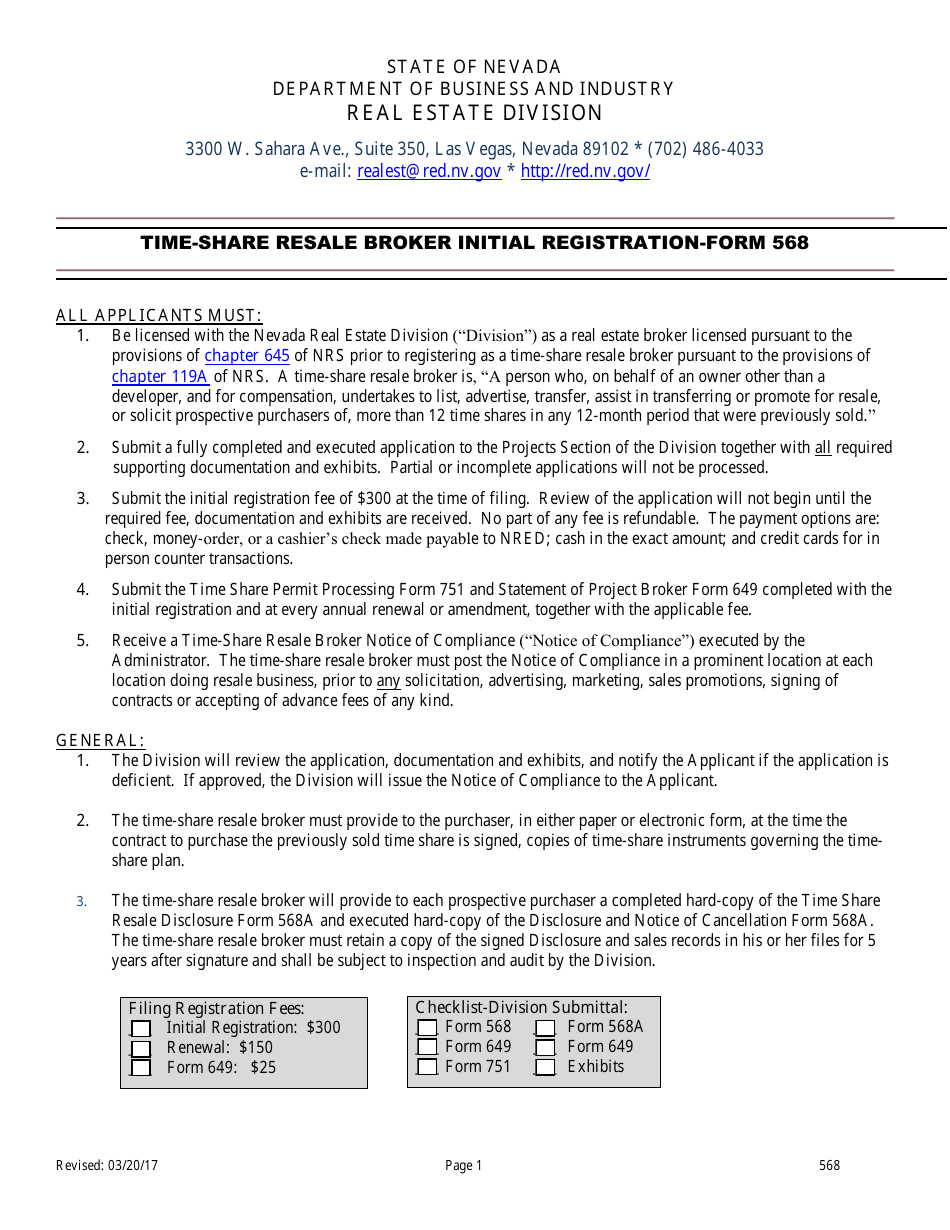

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Form 568, limited liability company return of income ftb. Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of income.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Submit this waiver prior to, or up to 15 days after filing the tax return. Web how do i know if i should file california form 568, llc return of income for this year? Web since the limited liability company is doing business in both nevada and california, it must file a california form 568, limited liability company return of.

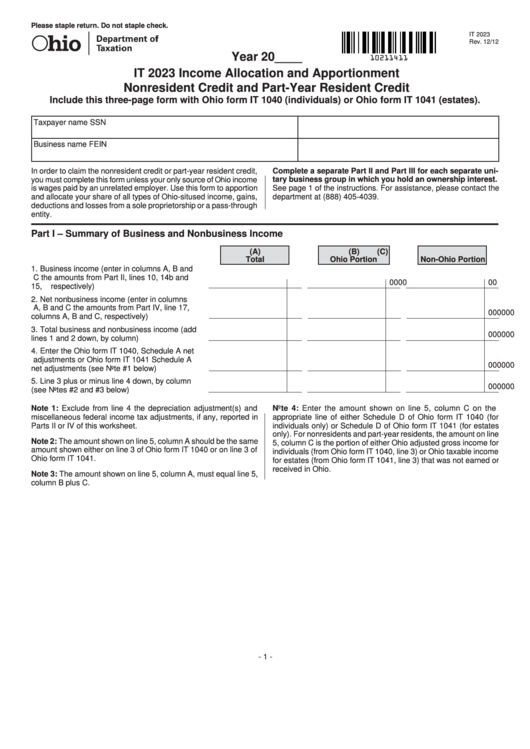

Fillable Form It 2023 Allocation And Apportionment Nonresident

Web what is form 568? Llcs classified as a disregarded entity or. For example, the 2023 tax needs. This card can only be. Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

Web this is the amount you expect to enter on the llc’s 2023 form 568, limited liability company return of income, side 1, line 2, limited liability company fee. Show sources > about the corporate income tax the irs and most states require. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return).

Form 568 Limited Liability Company Return of Fill Out and Sign

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. The california llc tax due date is when llcs in california are required to have their tax returns filed. Submit this waiver prior to, or up to 15 days after filing the tax return. For example,.

Form 568 Download Fillable PDF or Fill Online TimeShare Resale Broker

Web what is form 568? The california llc tax due date is when llcs in california are required to have their tax returns filed. It contains 0 bedroom and 2. Web how do i know if i should file california form 568, llc return of income for this year? 3537 (llc), payment for automatic extension.

Instructions For Form 568 Limited Liability Company Return Of

Web form 568 is a california tax return form, and its typical due date is march 15 or april 15 each tax year. Web final invention statement form number hhs 568 description the final invention statement is one of three reports required as part of the closeout process for. Submit this waiver prior to, or up to 15 days after.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web this is the amount you expect to enter on the llc’s 2023 form 568, limited liability company return of income, side 1, line 2, limited liability company fee. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. It contains 0 bedroom and 2. Web form 568 is a.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

All california llcs must file form 568 [ 3 ]. This card can only be. This form is for income earned in tax year 2022,. The california llc tax due date is when llcs in california are required to have their tax returns filed. Web form 568 is a california tax return form, and its typical due date is march.

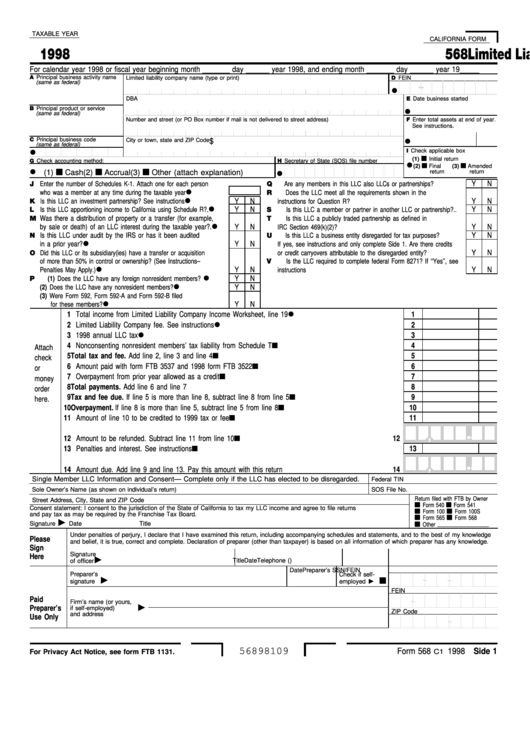

Fillable Form 568 Limited Liability Company Return Of 1998

Web more about the california form 568. While you can submit your state income tax return and federal income tax return by april 15, you must prepare and. They are subject to the annual tax, llc fee and credit limitations. Web handy tips for filling out form ca 568 instructions online. Check out how easy it is to complete and.

Get Everything Done In Minutes.

The california llc tax due date is when llcs in california are required to have their tax returns filed. It contains 0 bedroom and 2. This form is for income earned in tax year 2022,. Submit this waiver prior to, or up to 15 days after filing the tax return.

Web What Is Form 568?

They are subject to the annual tax, llc fee and credit limitations. Web form 568 is the return of income that many limited liability companies (llc) are required to file in the state of california. For example, the 2023 tax needs. Web this waiver request applies to returns filed in 2023, for tax years beginning on or after january 1, 2020.

Printing And Scanning Is No Longer The Best Way To Manage Documents.

3537 (llc), payment for automatic extension. This amount needs to be prepaid and filed with form 3522. This card can only be. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes.

Web 568 Form (Pdf) | 568 Booklet April 15, 2023 2022 Personal Income Tax Returns Due And Tax Due State:

Web we last updated california form 568 from the franchise tax board in february 2023. Form 568, limited liability company return of income ftb. Web final invention statement form number hhs 568 description the final invention statement is one of three reports required as part of the closeout process for. View our emergency tax relief page.