Form 1120 Schedule J

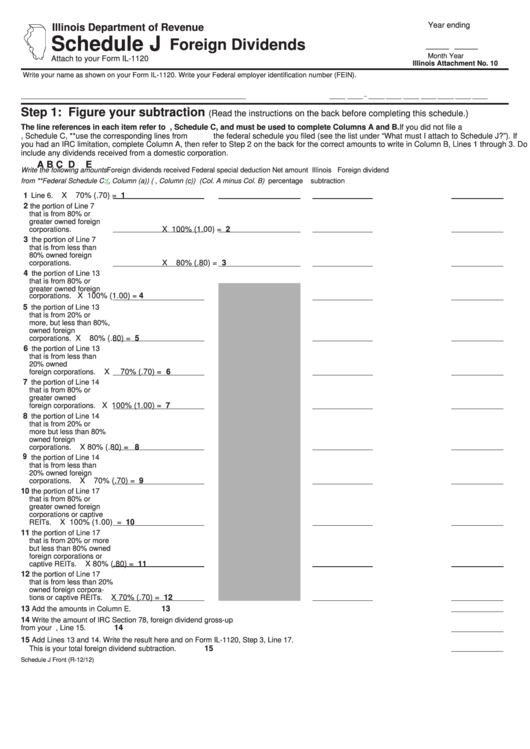

Form 1120 Schedule J - You can download or print current. Web form 1120 department of the treasury internal revenue service u.s. Step 1, line 1 — do not include any amount reported on line 6 of federal. Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. A foreign corporation is any corporation. Web schedule j 1120 form: Web for more information: A foreign corporation is any corporation. Enter the applicable authority of the equivalent exemption. For example, enter a citation of the statute in the country.

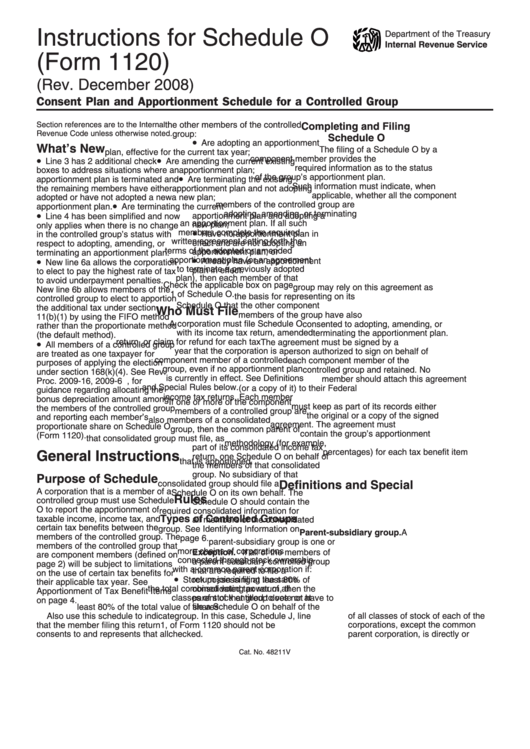

A member of a controlled group,. Lines 1 and 2, form 1120. Web for more information: Web form 1120 department of the treasury internal revenue service u.s. Members of a controlled group (form 1120 only). In general, you should follow the instructions on the form, with the following exceptions: Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Enter the total amount you received during this tax period from a. For example, enter a citation of the statute in the country.

Web schedule j 1120 form: Web form 1120 department of the treasury internal revenue service u.s. Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. Corporation income tax return, on the taxable income of the bank, excluding the life insurance department; Web a partial tax computed on form 1120, u.s. A member of a controlled group,. Dividends, inclusions, and special deductions. Check the “yes” box if the corporation is a specified domestic entity that is required to file form. Web for more information: A foreign corporation is any corporation.

Schedule J Attach To Your Form Il1120 Foreign Dividends printable

In general, you should follow the instructions on the form, with the following exceptions: For example, enter a citation of the statute in the country. You can download or print current. Enter the total amount you received during this tax period from a. Members of a controlled group (form 1120 only).

Form 1120 Schedule J Instructions

A foreign corporation is any corporation. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade or. Enter the applicable authority of the equivalent exemption. Web fincen form 114 is not a tax form, do not.

Form 1120 (Schedule M3) Net Reconciliation for Corporations

A partial tax on the. Enter the applicable authority of the equivalent exemption. Web schedule j 1120 form: Corporation income tax return, on the taxable income of the bank, excluding the life insurance department; In general, you should follow the instructions on the form, with the following exceptions:

Form 1120 (Schedule M3) Net Reconciliation for Corporations

A member of a controlled group,. Enter the applicable authority of the equivalent exemption. Members of a controlled group (form 1120 only). In general, you should follow the instructions on the form, with the following exceptions: Step 1, line 1 — do not include any amount reported on line 6 of federal.

1120s Create A Digital Sample in PDF

You can download or print current. Web a partial tax computed on form 1120, u.s. Dividends, inclusions, and special deductions. A partial tax on the. In general, you should follow the instructions on the form, with the following exceptions:

Editable IRS Form 1120S (Schedule K1) 2018 2019 Create A Digital

A foreign corporation is any corporation. Enter the applicable authority of the equivalent exemption. Step 1, line 1 — do not include any amount reported on line 6 of federal. A partial tax on the. Web schedule j 1120 form:

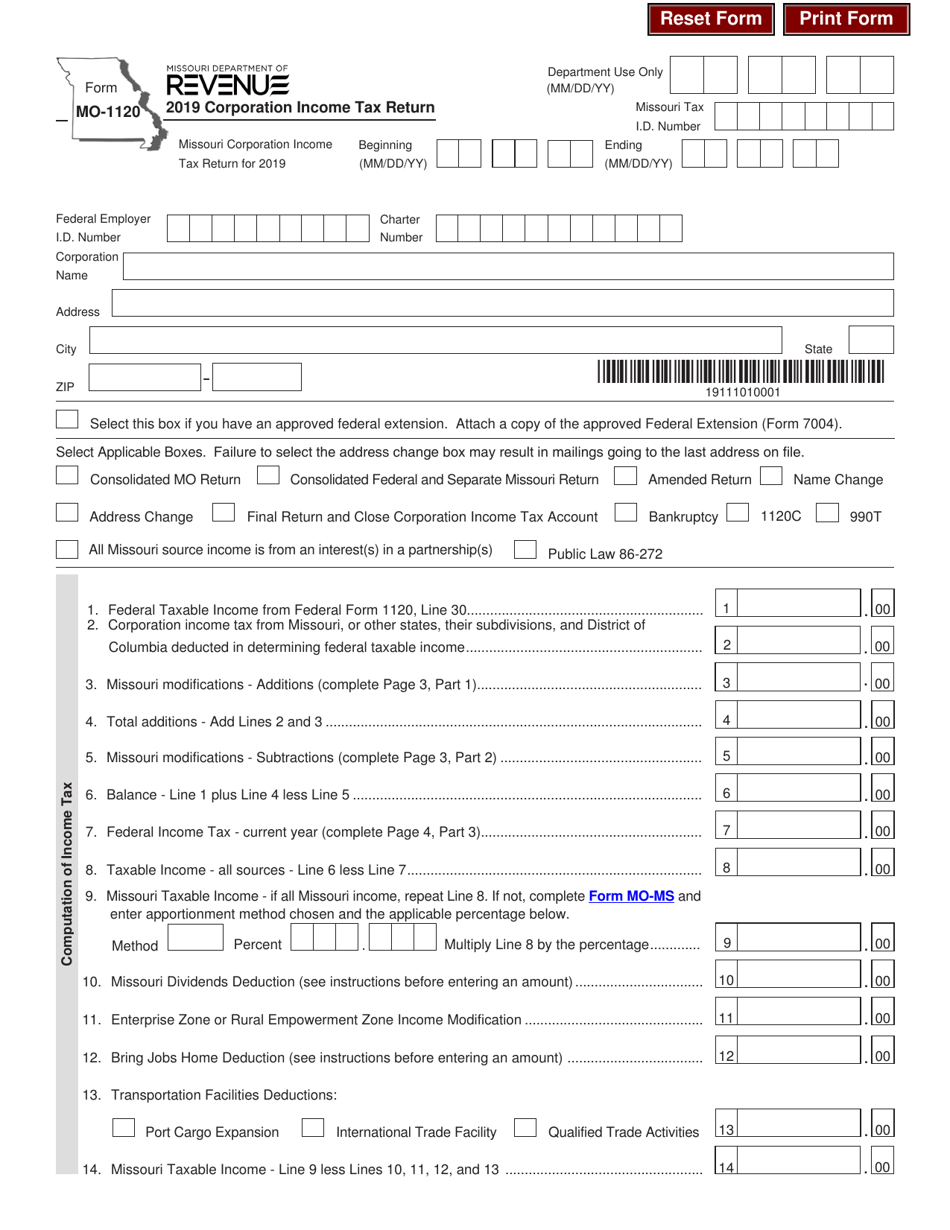

Form MO1120 Download Fillable PDF or Fill Online Corporation

Web a partial tax computed on form 1120, u.s. Corporation income tax return for calendar year 2013 or tax year beginning, 2013, ending, 20 information. Corporation income tax return, on the taxable income of the bank, excluding the life insurance department; A partial tax on the. Enter the applicable authority of the equivalent exemption.

Solved Form 1120 (2018) Schedule J Tax Computation and

Check the “yes” box if the corporation is a specified domestic entity that is required to file form. You can download or print current. Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. Dividends, inclusions, and special deductions. Enter the total amount.

Instructions For Schedule O (Form 1120) 2008 printable pdf download

A member of a controlled group,. You can download or print current. Lines 1 and 2, form 1120. Members of a controlled group (form 1120 only). Enter the total amount you received during this tax period from a.

Schedule G Form 1120 Instructions 2016 Best Product Reviews

Web a partial tax computed on form 1120, u.s. Web form 1120 department of the treasury internal revenue service u.s. Lines 1 and 2, form 1120. Web use schedule j (form 1040) to elect to figure your 2022 income tax by averaging, over the previous 3 years (base years), all or part of your 2022 taxable income from your trade.

A Member Of A Controlled Group,.

Enter the total amount you received during this tax period from a. Web a partial tax computed on form 1120, u.s. Enter the applicable authority of the equivalent exemption. Web form 1120 department of the treasury internal revenue service u.s.

Web Fincen Form 114 Is Not A Tax Form, Do Not File It With Your Return.

Dividends, inclusions, and special deductions. Web we last updated the form 1120 foreign dividends in january 2023, so this is the latest version of schedule j, fully updated for tax year 2022. A partial tax on the. Web for more information:

Corporation Income Tax Return For Calendar Year 2013 Or Tax Year Beginning, 2013, Ending, 20 Information.

Step 1, line 1 — do not include any amount reported on line 6 of federal. A foreign corporation is any corporation. For example, enter a citation of the statute in the country. Members of a controlled group (form 1120 only).

In General, You Should Follow The Instructions On The Form, With The Following Exceptions:

Corporation income tax return, on the taxable income of the bank, excluding the life insurance department; You can download or print current. A foreign corporation is any corporation. Check the “yes” box if the corporation is a specified domestic entity that is required to file form.