1099 Form Real Estate

1099 Form Real Estate - Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Free, easy returns on millions of items. Each type is used to report a different kind of. Where you report information on the form depends on how you use. No separate billing for these taxes. Where this information is reported depends on the use of the. All substitute statements to recipients must contain the tax year, form number, and form name prominently displayed together. You will report the information on a specific part of the form,. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web www.irs.gov/form1099s instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real.

By tina orem updated may 25, 2023 edited by. Web a 1099 form is a record that an entity or person (not your employer) gave or paid you money. You will report the information on a specific part of the form,. Web as per the irs norms, irs form 1099 s to report proceeds made from real estate transactions i.e., sales of: Web 1099 real estate tax reporting. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Ad find deals and low prices on 1099s forms at amazon.com. Each type is used to report a different kind of. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web epr properties (nyse:epr) is the leading experiential real estate investment trust (reit), specializing in select enduring experiential properties in the real estate industry.

Web a 1099 form is a record that an entity or person (not your employer) gave or paid you money. Web 3.earnest monies and additional deposits: Each type is used to report a different kind of. All substitute statements to recipients must contain the tax year, form number, and form name prominently displayed together. How the property is used (personal, investment, business) will. No separate billing for these taxes. Web as a real estate investor, you will receive a tax statement known as a 1099 form. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited. Improved or unimproved lands including air spaces.

Form 1099S Proceeds from Real Estate Transactions (2014) Free Download

Web 3.earnest monies and additional deposits: Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web a 1099 form is a record that an entity or person (not your employer) gave or paid you money. Improved or unimproved lands including air spaces. Web as a real estate investor, you will receive a tax.

Form 1099S Proceeds from Real Estate Transactions (2014) Free Download

By tina orem updated may 25, 2023 edited by. Web for residents of kansas city, real and personal property taxes, other than for railroads and utilities, are included on the county property tax bill. You will report the information on a specific part of the form,. Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2.

Everything You Need To Know About Form 1099S Blog TaxBandits

By tina orem updated may 25, 2023 edited by. How the property is used (personal, investment, business) will. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web 3.earnest monies and additional deposits: Free shipping on qualified orders.

IRS Form 1099 Reporting for Small Business Owners

How the property is used (personal, investment, business) will. You will report the information on a specific part of the form,. Where you report information on the form depends on how you use. When an individual or entity earns income, under federal tax law, that income must be reported to the internal revenue service (irs) so. Free shipping on qualified.

Stimulus Payments Shouldn't Decrease Your Tax Refund, But Collecting

Web epr properties (nyse:epr) is the leading experiential real estate investment trust (reit), specializing in select enduring experiential properties in the real estate industry. Where you report information on the form depends on how you use. Web for residents of kansas city, real and personal property taxes, other than for railroads and utilities, are included on the county property tax.

NJ Tax Preparer Admits Conspiring To Commit Tax Fraud Thru False Filing

All substitute statements to recipients must contain the tax year, form number, and form name prominently displayed together. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited. Ad ap leaders rely on iofm’s expertise to.

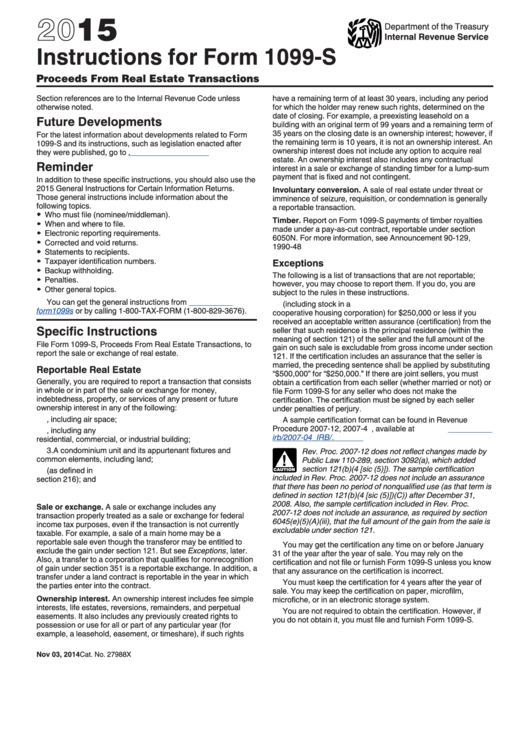

Instructions For Form 1099S Proceeds From Real Estate Transactions

Improved or unimproved lands including air spaces. Ad find deals and low prices on 1099s forms at amazon.com. Free shipping on qualified orders. How the property is used (personal, investment, business) will. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

Product Reviews

Free shipping on qualified orders. No separate billing for these taxes. All substitute statements to recipients must contain the tax year, form number, and form name prominently displayed together. Where you report information on the form depends on how you use. Improved or unimproved lands including air spaces.

What is a 1099 & 5498? uDirect IRA Services, LLC

Web 1099 real estate tax reporting. Web as a real estate investor, you will receive a tax statement known as a 1099 form. Web epr properties (nyse:epr) is the leading experiential real estate investment trust (reit), specializing in select enduring experiential properties in the real estate industry. Ad ap leaders rely on iofm’s expertise to keep them up to date.

1099 Form Independent Contractor Pdf / How to Do Taxes if You're a 1099

Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. How the property is used (personal, investment, business) will. Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited. Free.

Web A 1099 Form Is A Record That An Entity Or Person (Not Your Employer) Gave Or Paid You Money.

How the property is used (personal, investment, business) will. Web www.irs.gov/form1099s instructions for transferor for sales or exchanges of certain real estate, the person responsible for closing real estate transaction must report the real. Web epr properties (nyse:epr) is the leading experiential real estate investment trust (reit), specializing in select enduring experiential properties in the real estate industry. Where this information is reported depends on the use of the.

Where You Report Information On The Form Depends On How You Use.

By tina orem updated may 25, 2023 edited by. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Each type is used to report a different kind of. Web as a real estate investor, you will receive a tax statement known as a 1099 form.

Ad Find Deals And Low Prices On 1099S Forms At Amazon.com.

Free shipping on qualified orders. No separate billing for these taxes. Improved or unimproved lands including air spaces. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

When An Individual Or Entity Earns Income, Under Federal Tax Law, That Income Must Be Reported To The Internal Revenue Service (Irs) So.

Web 3.earnest monies and additional deposits: Web 1099 real estate tax reporting. Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited. You will report the information on a specific part of the form,.