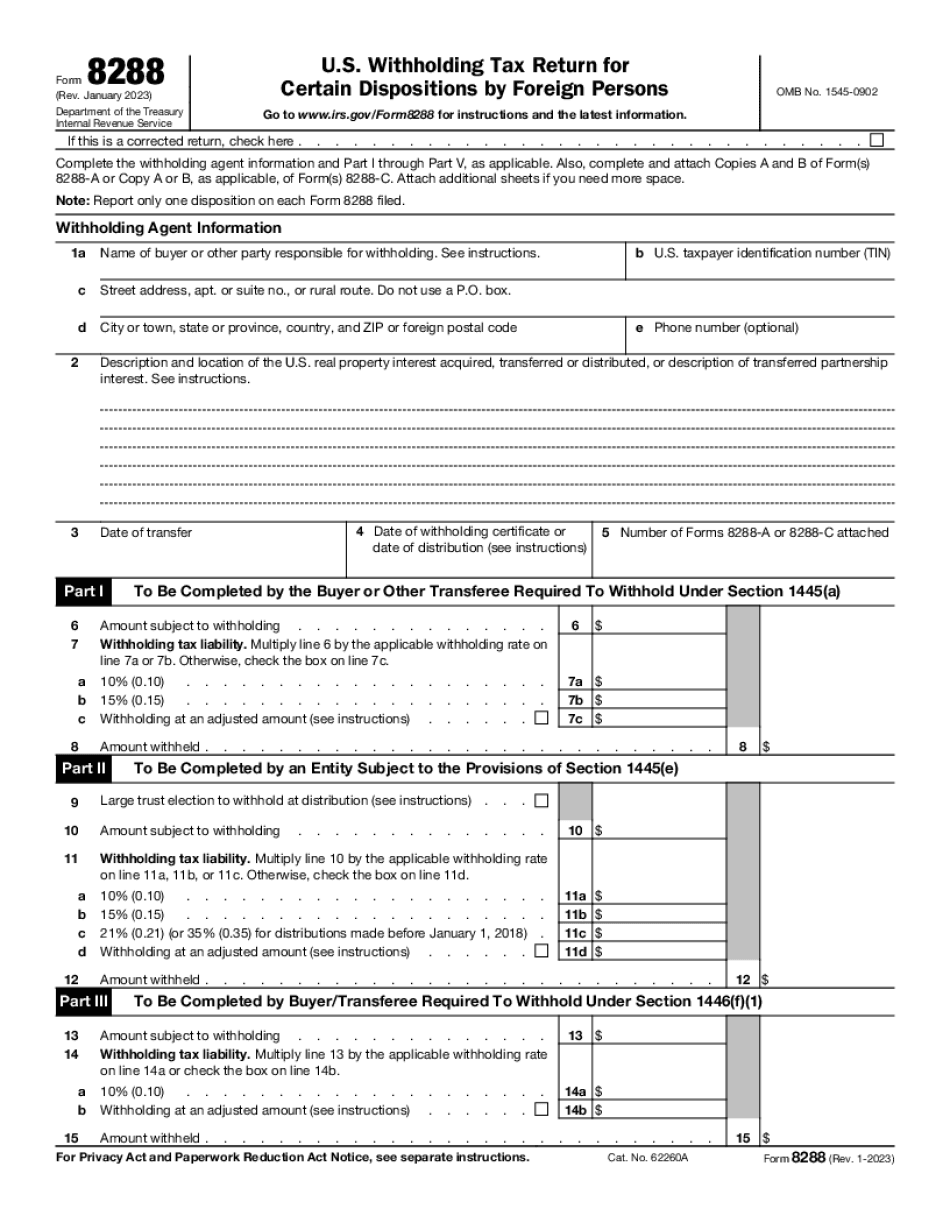

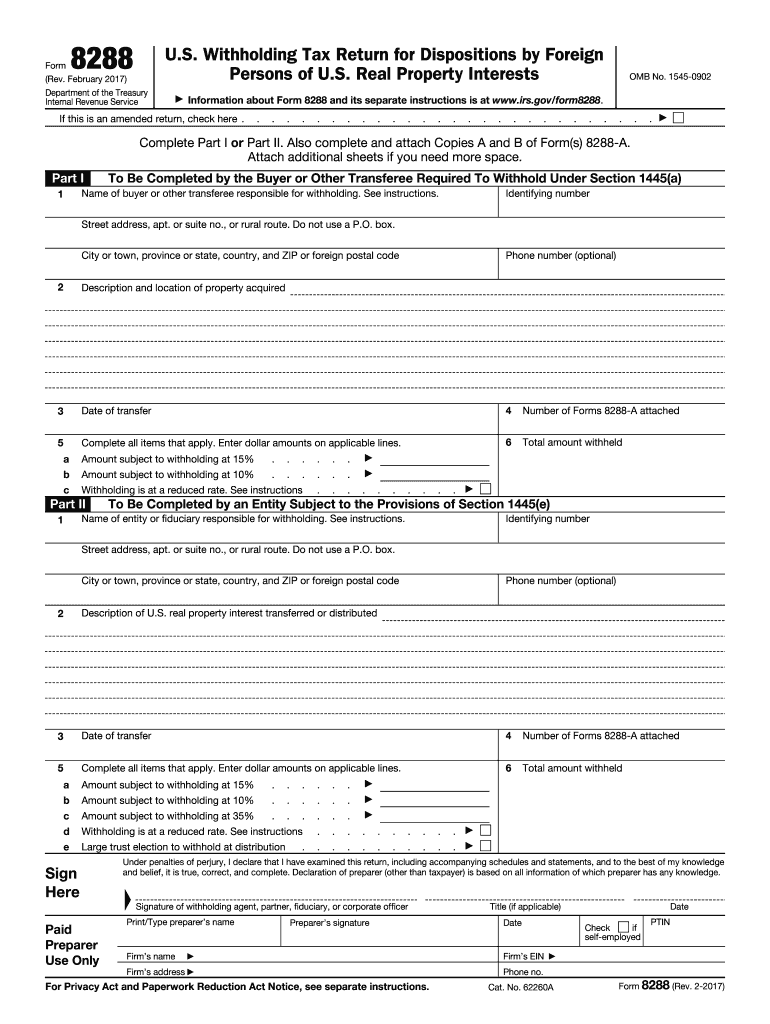

Firpta Form 8288

Firpta Form 8288 - Withholding tax return for dispositions by foreign persons of u.s. Notify the irs before the disposition or The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Real property interests | internal revenue service Real property interests) to pay over all amounts withheld. Web information about form 8288, u.s. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. This withholding serves to collect u.s. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Withholding tax return for dispositions by foreign persons of u.s.

Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. If this is a corrected return, check here. Notify the irs before the disposition or Use form 8288 to report and transmit the amount withheld.” who files form 8288? Web in most cases, the buyer must complete form 8288, u.s. Withholding tax return for dispositions by foreign persons of u.s. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Web information about form 8288, u.s. Withholding tax return for dispositions by foreign persons of u.s.

This withholding serves to collect u.s. Real property interests) to pay over all amounts withheld. Use form 8288 to report and transmit the amount withheld.” who files form 8288? Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s. Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Real property interests | internal revenue service Withholding tax return for dispositions by foreign persons of u.s. If this is a corrected return, check here. Real property interests, including recent updates, related forms and instructions on how to file.

Form 8288B Application for Withholding Certificate for Dispositions

Web information about form 8288, u.s. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Withholding tax return for certain dispositions by.

Firpta Form 8288 Fill online, Printable, Fillable Blank

If this is a corrected return, check here. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Web the withholding obligation also.

Form 8288B FIRPTA and reduced withholding

Web in most cases, the buyer must complete form 8288, u.s. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. Notify the irs before the disposition or Real property interests, where they will enter the amount subject to 10% or 15%.

Form 8288B and FIRPTA FIRPTA FIRPTA!

The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Web to apply for the firpta exemption: Tax that may be owed by the foreign person. Withholding tax return for dispositions by foreign persons of u.s. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by.

State Of Nc Firpta Affidavit Form Fill and Sign Printable Template

Web information about form 8288, u.s. Web to apply for the firpta exemption: Use form 8288 to report and transmit the amount withheld.” who files form 8288? Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Withholding tax return for dispositions by foreign persons.

What is FIRPTA and how do I avoid it? Sarasota/Manatee Area Real

Web in most cases, the buyer must complete form 8288, u.s. Withholding tax return for dispositions by foreign persons of u.s. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Web to apply for the firpta exemption: Web information about form 8288, u.s.

What is FIRPTA and How to Avoid It

Real property interests | internal revenue service Real property interests, where they will enter the amount subject to 10% or 15% withholding. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Real property interests, including recent updates, related forms and instructions on how to file. Web foreign.

Firpta Exemption Certificate Master of Documents

Withholding tax return for dispositions by foreign persons of u.s. Withholding tax return for dispositions by foreign persons of u.s. The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for certain dispositions by.

Form 8288B FIRPTA and reduced withholding

Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Real property interests | internal revenue service Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for dispositions by foreign persons of u.s. Web information about form 8288, u.s.

Form 8288, U.S. Withholding Tax Return for Dispositions by IRS

Web in most cases, the buyer must complete form 8288, u.s. If this is a corrected return, check here. This withholding serves to collect u.s. Web information about form 8288, u.s. Real property interests, including recent updates, related forms and instructions on how to file.

Notify The Irs Before The Disposition Or

This withholding serves to collect u.s. Web the withholding obligation also applies to foreign and domestic corporations, qualified investment entities, and the fiduciary of certain trusts and estates. Web wh is required to withhold $4,500, 15% of the of $30,000 amount realized by fp, and remit it to the internal revenue service with forms 8288, u.s. Web to apply for the firpta exemption:

Tax That May Be Owed By The Foreign Person.

Real property interests, where they will enter the amount subject to 10% or 15% withholding. Real property interests) to pay over all amounts withheld. Web in most cases, the buyer must complete form 8288, u.s. Withholding tax return for dispositions by foreign persons of u.s.

Withholding Tax Return For Dispositions By Foreign Persons Of U.s.

Withholding tax return for certain dispositions by foreign persons department of the treasury internal revenue service go to www.irs.gov/form8288 for instructions and the latest information. Use form 8288 to report and transmit the amount withheld.” who files form 8288? The 15% will be held in escrow while the firpta unit approves or rejects the application for reduced withholding. Real property interests | internal revenue service

Web Information About Form 8288, U.s.

Real property interests, including recent updates, related forms and instructions on how to file. Withholding tax return for dispositions by foreign persons of u.s. If this is a corrected return, check here. Web foreign persons use this form to apply for a withholding certificate to reduce or eliminate withholding on dispositions of u.s.