Form 5471 Schedule I

Form 5471 Schedule I - Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. Adjustments to foreign income taxes. Lines a, b, and c. Reference id number of foreign corporation. Shareholder(s) of a cfc to file irs form 8892, u.s. New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation. Further, in the case of the form 5471 multiple filer exception, the partnership or s. Web schedule a stock of the foreign corporation for 5471. Comparison to income tax expense reported on schedule c (form 5471). Amounts not reported in part i.

Under schedule a, the filer is required to include a description of each type of stock — including the total amount of stock issued by the corporation at the beginning of the accounting period, and at the end of the accounting period. Comparison to income tax expense reported on schedule c (form 5471). Persons with respect to certain foreign corporations, is an information statement (information return) (as opposed to a tax return) for certain u.s. Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. December 2021) department of the treasury internal revenue service. Schedule e, part i, has been divided into section 1 (taxes paid or On page 2, schedule e, part ii, column (g) has been repurposed to request taxes suspended under section 909. Lines a, b, and c. Web schedule a stock of the foreign corporation for 5471. Web foreign corporation’s that file form 5471 use this schedule to report information determined at the cfc level with respect to amounts used in the determination of income inclusions by u.s.

Schedule e, part i, has been divided into section 1 (taxes paid or Web schedule a stock of the foreign corporation for 5471. Comparison to income tax expense reported on schedule c (form 5471). Amounts not reported in part i. Web description of each class of stock held by shareholder. This description should match the corresponding description entered in schedule a, column (a). December 2021) department of the treasury internal revenue service. Shareholder(s) of a cfc to file irs form 8892, u.s. Shareholder calculation of gilti , and may. Changes to separate schedule e (form 5471).

A Dive into the New Form 5471 Categories of Filers and the Schedule R

Shareholder calculation of gilti , and may. Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. December 2021) department of the treasury internal revenue service. Web description of each class of stock held by shareholder. Persons with respect to certain foreign corporations, is an information statement (information return).

The Tax Times IRS Issues Updated New Form 5471 What's New?

Web on page 6 of form 5471, schedule i, line 9 is new. Shareholder(s) of a cfc to file irs form 8892, u.s. Name of person filing form 5471. New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation. Web description of each class of stock held by shareholder.

Demystifying the Form 5471 Part 9. Schedule G SF Tax Counsel

Comparison to income tax expense reported on schedule c (form 5471). Web foreign corporation’s that file form 5471 use this schedule to report information determined at the cfc level with respect to amounts used in the determination of income inclusions by u.s. On page 2, schedule e, part ii, column (g) has been repurposed to request taxes suspended under section.

IRS Form 5471 (Schedule J) 2018 2019 Fillable and Editable PDF Template

Part i—taxes for which a foreign tax credit is allowed. Changes to separate schedule e (form 5471). Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. Amounts not reported in part i. This description should match the corresponding description entered in schedule a, column (a).

2018 Form IRS 5471 Fill Online, Printable, Fillable, Blank PDFfiller

Web form 5471, officially called the information return of u.s. Number ofshares held at beginning of annual accounting period number ofshares held at end of annual accounting period form 5471 (rev. Schedule e, part i, has been divided into section 1 (taxes paid or Web description of each class of stock held by shareholder. Web schedule a stock of the.

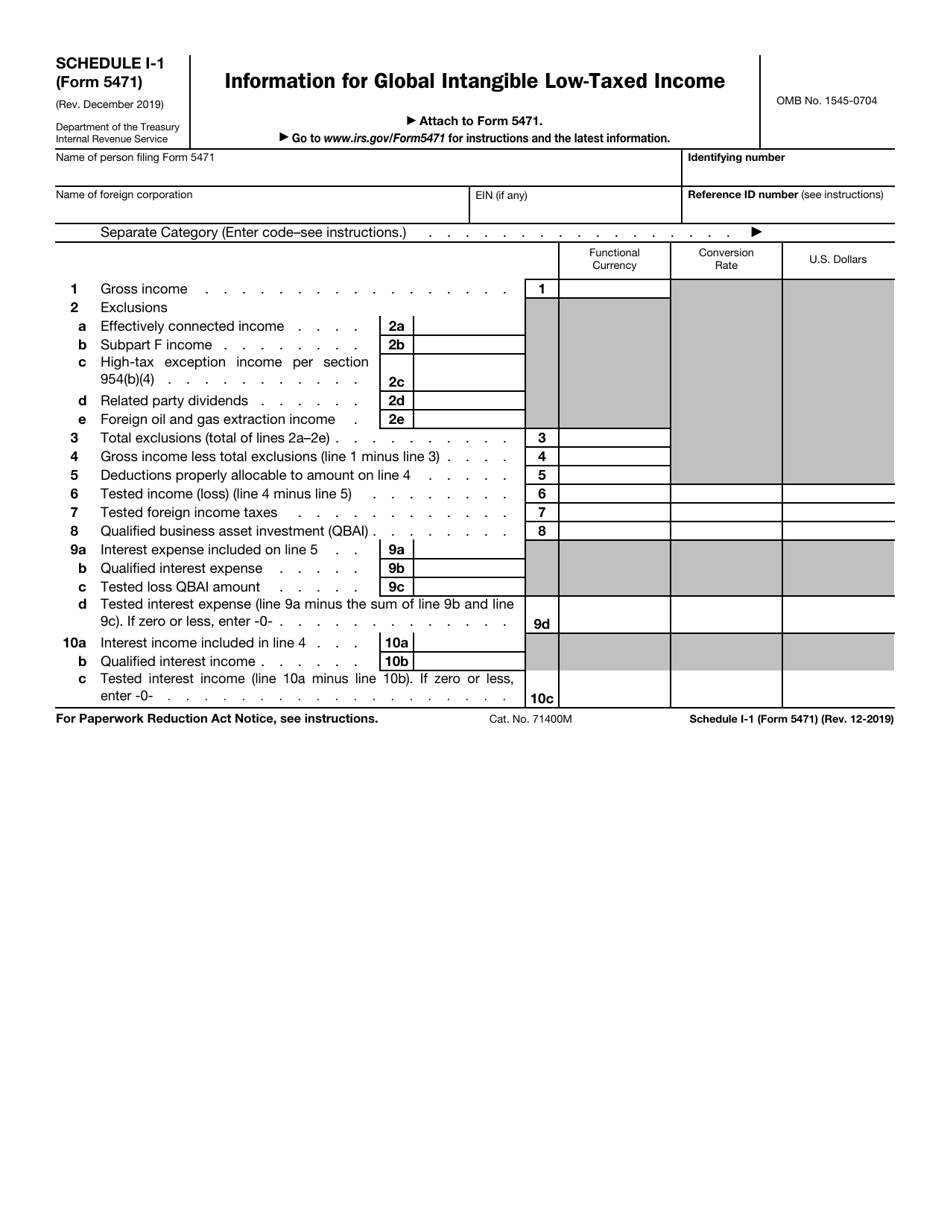

IRS Form 5471 Schedule I1 Download Fillable PDF or Fill Online

Name of person filing form 5471. This description should match the corresponding description entered in schedule a, column (a). Lines a, b, and c. December 2021) department of the treasury internal revenue service. Under schedule a, the filer is required to include a description of each type of stock — including the total amount of stock issued by the corporation.

A Deep Dive Into the IRS Form 5471 Schedule E Reporting and Tracking

Reference id number of foreign corporation. December 2021) department of the treasury internal revenue service. Lines a, b, and c. Schedule e, part i, has been divided into section 1 (taxes paid or New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation.

form 5471 schedule e1 Fill Online, Printable, Fillable Blank form

Part i—taxes for which a foreign tax credit is allowed. Changes to separate schedule e (form 5471). Adjustments to foreign income taxes. Shareholder calculation of gilti , and may. Under schedule a, the filer is required to include a description of each type of stock — including the total amount of stock issued by the corporation at the beginning of.

IRS Form 5471 Schedule E Download Fillable PDF or Fill Online

Under schedule a, the filer is required to include a description of each type of stock — including the total amount of stock issued by the corporation at the beginning of the accounting period, and at the end of the accounting period. Web schedule a stock of the foreign corporation for 5471. Persons with respect to certain foreign corporations, is.

20122021 Form IRS 5471 Schedule O Fill Online, Printable, Fillable

Web foreign corporation’s that file form 5471 use this schedule to report information determined at the cfc level with respect to amounts used in the determination of income inclusions by u.s. Shareholder(s) of a cfc to file irs form 8892, u.s. Name of person filing form 5471. On page 2, schedule e, part ii, column (g) has been repurposed to.

Reference Id Number Of Foreign Corporation.

Amounts not reported in part i. Web schedule a stock of the foreign corporation for 5471. Comparison to income tax expense reported on schedule c (form 5471). Further, in the case of the form 5471 multiple filer exception, the partnership or s.

Persons With Respect To Certain Foreign Corporations, Is An Information Statement (Information Return) (As Opposed To A Tax Return) For Certain U.s.

December 2021) department of the treasury internal revenue service. Web on page 6 of form 5471, schedule i, line 9 is new. Web foreign corporation’s that file form 5471 use this schedule to report information determined at the cfc level with respect to amounts used in the determination of income inclusions by u.s. Shareholder calculation of gilti , and may.

This Description Should Match The Corresponding Description Entered In Schedule A, Column (A).

Shareholder(s) of a cfc to file irs form 8892, u.s. On page 2, schedule e, part ii, column (g) has been repurposed to request taxes suspended under section 909. New line 9 requests the sum of the hybrid deduction accounts with respect to stock of the foreign corporation. Changes to separate schedule e (form 5471).

Lines A, B, And C.

Part i—taxes for which a foreign tax credit is allowed. Web description of each class of stock held by shareholder. Under schedule a, the filer is required to include a description of each type of stock — including the total amount of stock issued by the corporation at the beginning of the accounting period, and at the end of the accounting period. Web form 5471, officially called the information return of u.s.