Dc Non Resident Tax Form 2022

Dc Non Resident Tax Form 2022 - 4% of the taxable income. Web nonresidents are not required to file a dc return. Nonresident alien income tax return. You can download or print. Web the internal revenue service, tax forms and publications, 1111 constitution ave. Taxpayers who used this form in. If the taxable income is: Web filing status / standard deduction: Print in capital letters using black ink. Upon request of your employer, you must file this.

Although we can’t respond individually to each comment. You can download or print. Commonwealth signature signature under penalties of law,. Upon request of your employer, you must file this. If the due date for filing a. File with employer when requested. Details concerning the various taxes used by the district are presented in this. Web nonresidents are not required to file a dc return. If the taxable income is: Sales and use tax forms.

If the due date for filing a. Print in capital letters using black ink. Although we can’t respond individually to each comment. Upon request of your employer, you must file this. Web rates for tax year 2022. Web the internal revenue service, tax forms and publications, 1111 constitution ave. File with employer when requested. Commonwealth signature signature under penalties of law,. Details concerning the various taxes used by the district are presented in this. If you work in dc but are a resident of another state, you are not subject to dc income tax.

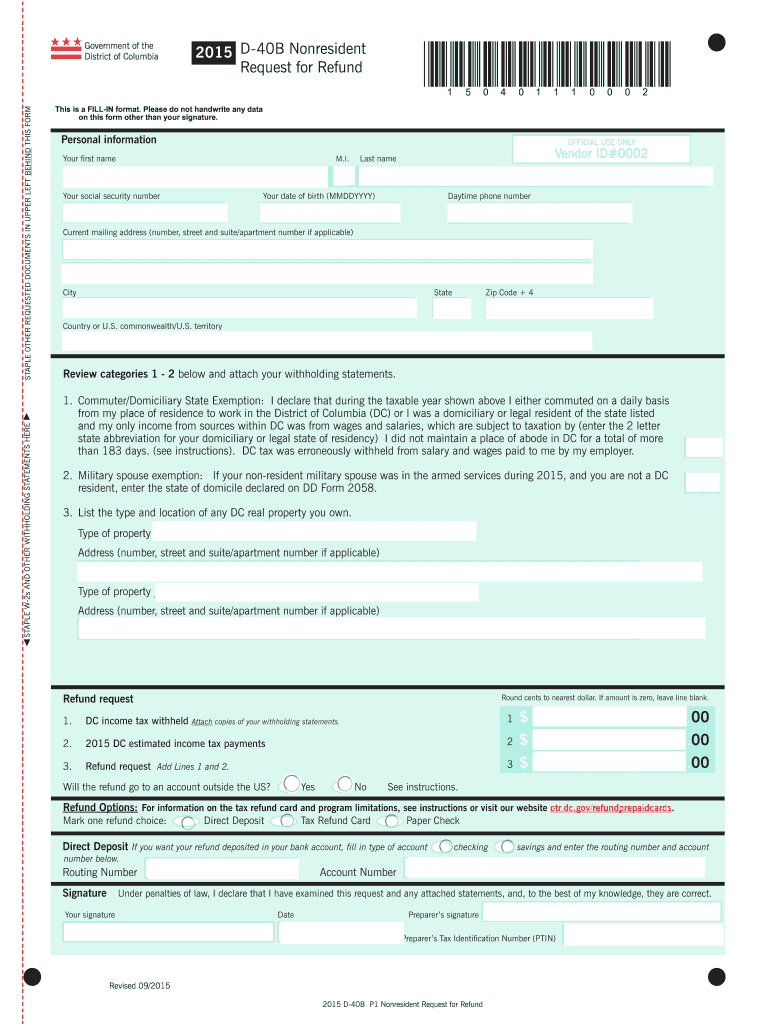

D 40B Fill Out and Sign Printable PDF Template signNow

If you work in dc but are a resident of another state, you are not subject to dc income tax. Web individual income tax forms 2023 tax filing season(tax year 2022) due to production delays, paper forms/booklets for the district of columbia 2022 individual income tax (d. File with employer when requested. The tax rates for tax years beginning after.

Dc d 40 2019 online fill in form Fill out & sign online DocHub

Irs use only—do not write or. Commonwealth signature signature under penalties of law,. Web rates for tax year 2022. Although we can’t respond individually to each comment. If the taxable income is:

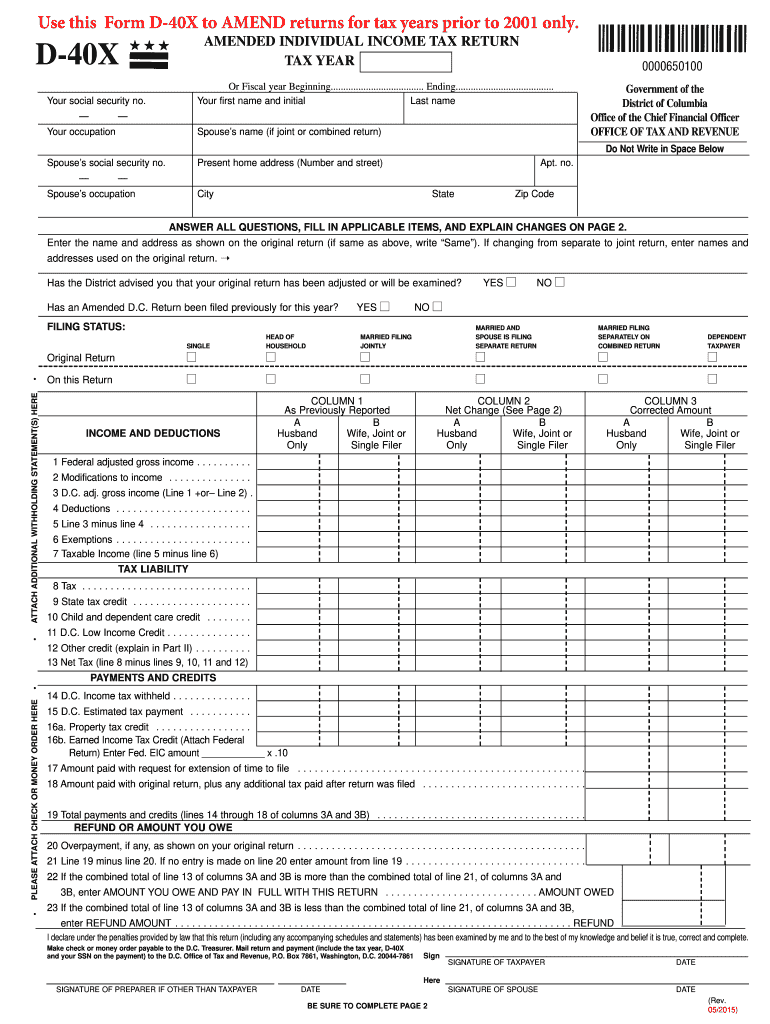

Doing business in Australia from India(n) perspective. Accurate

Taxpayers who used this form in. Nonresident alien income tax return. Print in capital letters using black ink. Irs use only—do not write or. Web the internal revenue service, tax forms and publications, 1111 constitution ave.

Michigan 1040 Fill Out and Sign Printable PDF Template signNow

Sales and use tax forms. If the taxable income is: Commonwealth signature signature under penalties of law,. Details concerning the various taxes used by the district are presented in this. Web individual income tax forms 2023 tax filing season(tax year 2022) due to production delays, paper forms/booklets for the district of columbia 2022 individual income tax (d.

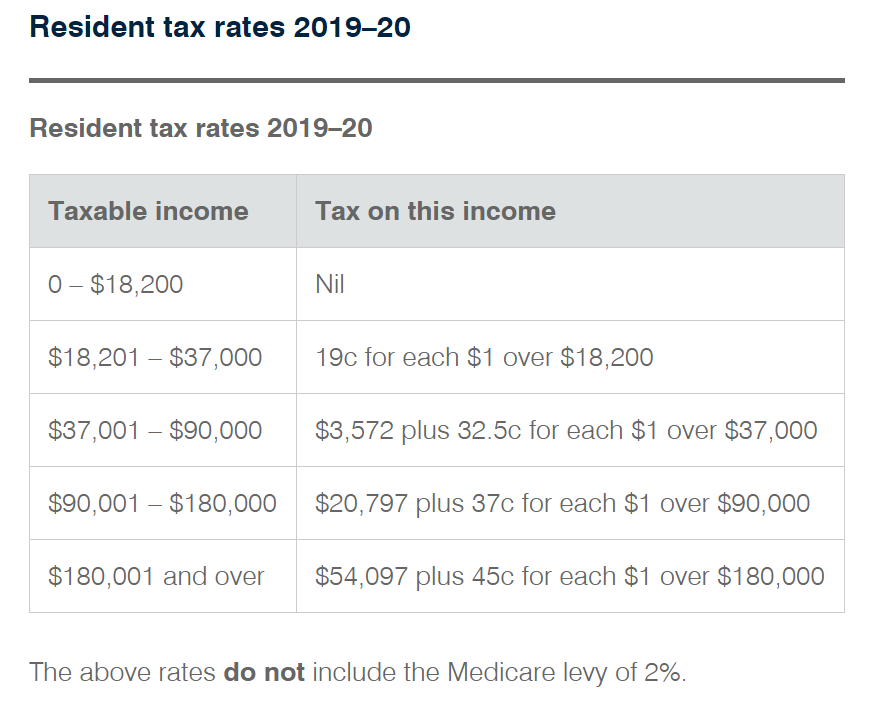

Nr5 Fill Out and Sign Printable PDF Template signNow

If you work in dc but are a resident of another state, you are not subject to dc income tax. Web registration and exemption tax forms. File with employer when requested. Upon request of your employer, you must file this. Although we can’t respond individually to each comment.

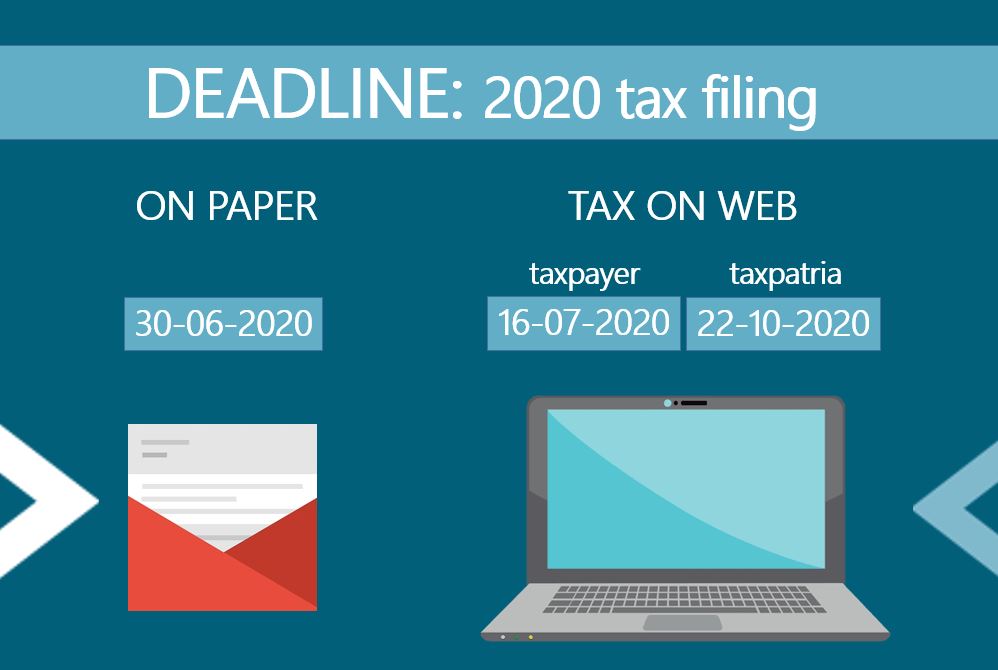

Resident tax filing season 2020 when are taxes due? Taxpatria

Web rates for tax year 2022. Web registration and exemption tax forms. If the taxable income is: Web individual income tax forms 2023 tax filing season(tax year 2022) due to production delays, paper forms/booklets for the district of columbia 2022 individual income tax (d. Web filing status / standard deduction:

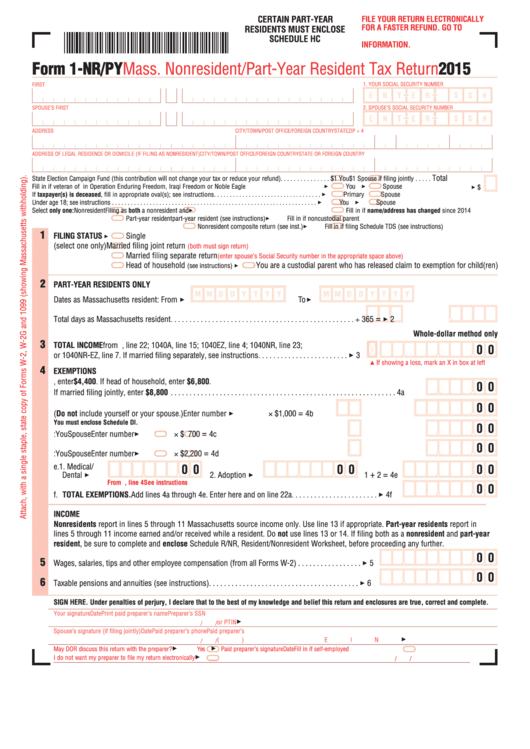

Form 1Nr/py Mass. Nonresident/partYear Resident Tax Return 2015

File with employer when requested. Web the internal revenue service, tax forms and publications, 1111 constitution ave. You can download or print. Taxpayers who used this form in. 4% of the taxable income.

Tax from nonresidents in Spain, what is it and how to do it properly

Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Sales and use tax forms. If you work in dc but are a resident of another state, you are not subject to dc income tax. If the due date for filing a. Web the internal.

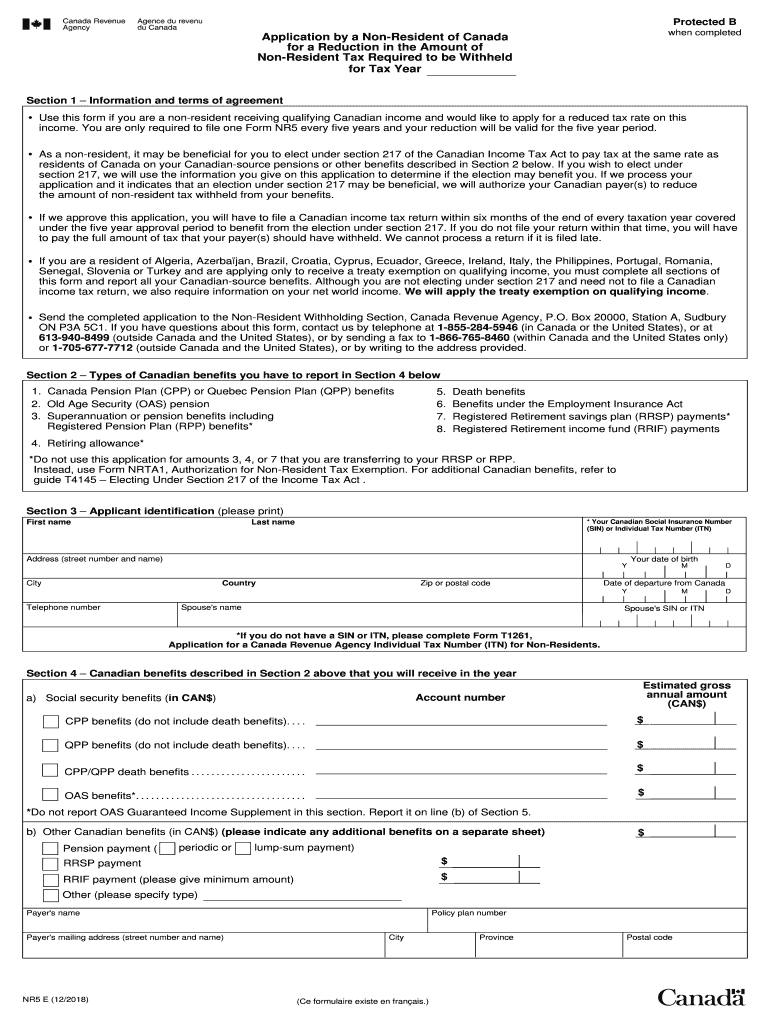

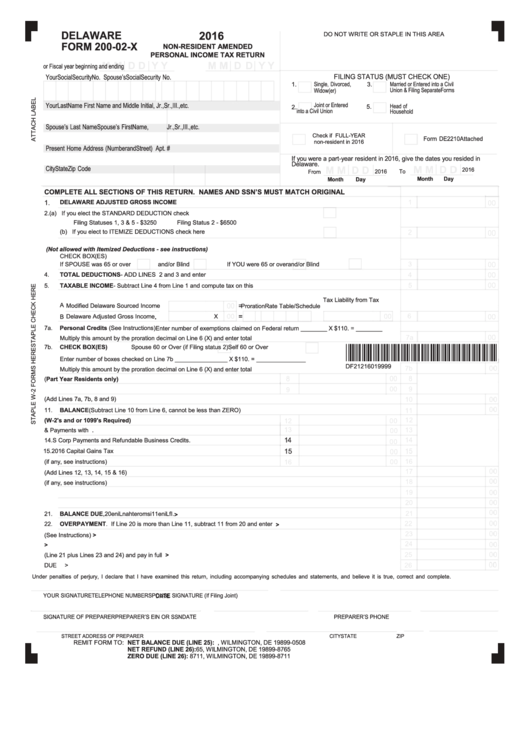

Fillable Form 20002X NonResident Amended Personal Tax

Web the internal revenue service, tax forms and publications, 1111 constitution ave. Details concerning the various taxes used by the district are presented in this. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Web filing status / standard deduction: Upon request of your.

Details Concerning The Various Taxes Used By The District Are Presented In This.

Irs use only—do not write or. Web registration and exemption tax forms. You can download or print. If the taxable income is:

Web Nonresidents Are Not Required To File A Dc Return.

Web filing status / standard deduction: Sales and use tax forms. Web individual income tax forms and instructions for single and joint filers with no dependents and all other filers on or before may 17, 2021. Although we can’t respond individually to each comment.

If You Work In Dc But Are A Resident Of Another State, You Are Not Subject To Dc Income Tax.

Print in capital letters using black ink. Nonresident alien income tax return. Taxpayers who used this form in. 4% of the taxable income.

File With Employer When Requested.

Web individual income tax forms 2023 tax filing season(tax year 2022) due to production delays, paper forms/booklets for the district of columbia 2022 individual income tax (d. Web rates for tax year 2022. Upon request of your employer, you must file this. The tax rates for tax years beginning after 12/31/2021 are: