Colorado Tax Exemption Form

Colorado Tax Exemption Form - Web we have two colorado sales tax exemption forms available for you to print or save as a pdf file. If your husband or wife If any of these links are broken, or you can't find the form you need, please let us know. Web general instructions purpose of form this form is used to certify to sellers that a purchase qualifies for exemption under title 39, article 26 of the colorado revised statutes. Certain products and services are exempt form colorado state sales tax. Also, exemptions may be specific to a state, county, city or special district. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. Web files a properly executed exemption certificate from all of our customers who claim sales tax exemption. The following documents must be submitted with your application or it will be returned. For sellers, accepting and keeping this document helps you get correct information about the purchaser, which helps you prove this is an exempt sale during a tax audit.

Web we have two colorado sales tax exemption forms available for you to print or save as a pdf file. Web organizations that are exempt from federal income tax under 501(c)(3) will generally be approved for a sales tax certificate of exemption in colorado. Web general instructions purpose of form this form is used to certify to sellers that a purchase qualifies for exemption under title 39, article 26 of the colorado revised statutes. If you purchase tax free for a reason for which this form does not provide, please send us your special certificate or statement. Web if you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. If you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. If your husband or wife You can find resale certificates for other states here. Theform will be kept confidential. Also, exemptions may be specific to a state, county, city or special district.

To find the identification number of a colorado charitable organization, use the charity lookup tool or visit the colorado secretary of state's office website. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. Web organizations that are exempt from federal income tax under 501(c)(3) will generally be approved for a sales tax certificate of exemption in colorado. For sellers, accepting and keeping this document helps you get correct information about the purchaser, which helps you prove this is an exempt sale during a tax audit. If we do not have this certificate, we are obligated to collect the tax for the state in which the property is delivered. Attach a copy of your federal determination letter from the irs showing under which classification code you are exempt. Complete the application for sales tax exemption for colorado organizations ( dr 0715 ). Also, exemptions may be specific to a state, county, city or special district. Web general instructions purpose of form this form is used to certify to sellers that a purchase qualifies for exemption under title 39, article 26 of the colorado revised statutes. If you purchase tax free for a reason for which this form does not provide, please send us your special certificate or statement.

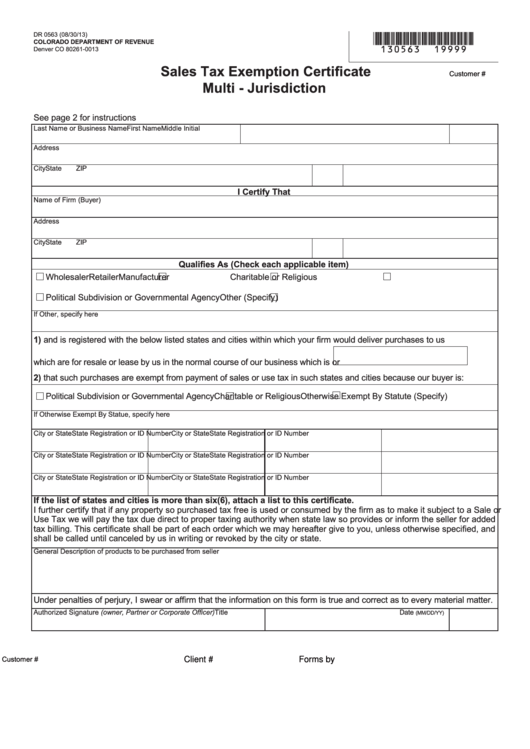

Fillable Form Dr 0563 Sales Tax Exemption Certificate Multi

If your husband or wife Web if you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. You can find resale certificates for other states here. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. Web organizations.

Colorado Resale Certificate Dresses Images 2022

If your husband or wife If you purchase tax free for a reason for which this form does not provide, please send us your special certificate or statement. If we do not have this certificate, we are obligated to collect the tax for the state in which the property is delivered. Attach a copy of your federal determination letter from.

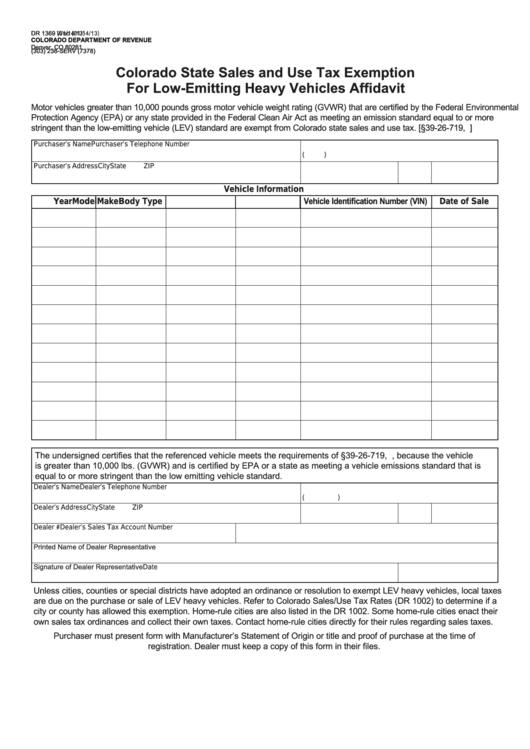

Form Dr 1369 Colorado State Sales And Use Tax Exemption For Low

Attach a copy of your federal determination letter from the irs showing under which classification code you are exempt. If you purchase tax free for a reason for which this form does not provide, please send us your special certificate or statement. Theform will be kept confidential. Web home assessors' office resources forms index forms index a | c |.

Religious Exemption Letters For Employees / Colorado Vaccine Exemption

Web general instructions purpose of form this form is used to certify to sellers that a purchase qualifies for exemption under title 39, article 26 of the colorado revised statutes. If any of these links are broken, or you can't find the form you need, please let us know. If you are entitled to sales tax exemption, please complete the.

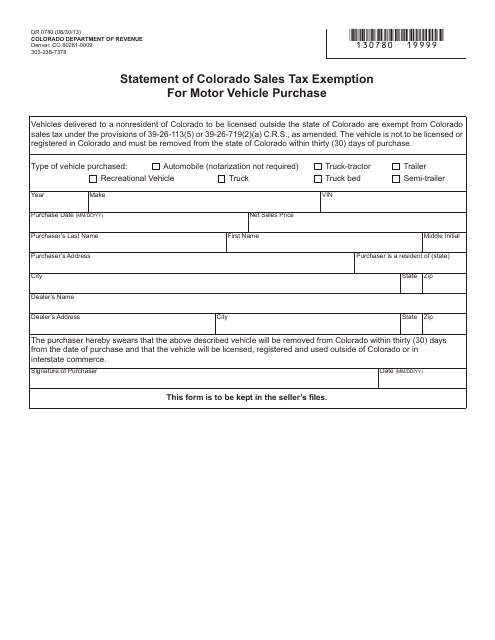

Form DR0780 Download Fillable PDF or Fill Online Statement of Colorado

The following documents must be submitted with your application or it will be returned. Web we have two colorado sales tax exemption forms available for you to print or save as a pdf file. Web home assessors' office resources forms index forms index a | c | e | g | m | o | p | q | r.

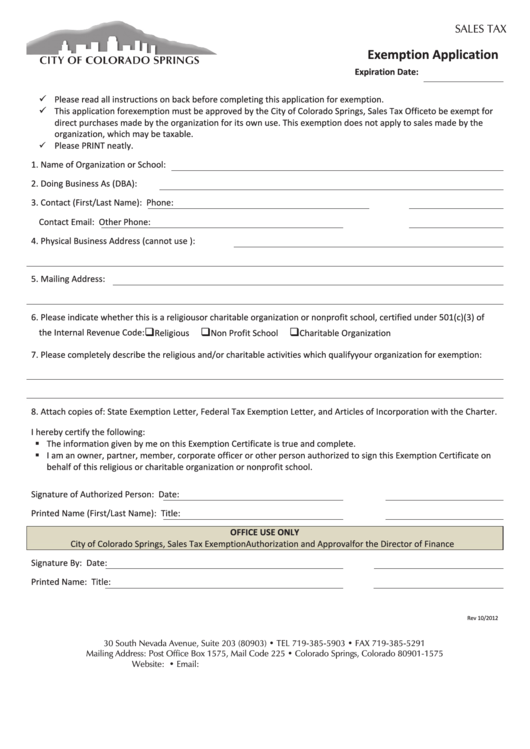

Exemption Application Form Colorado Springs printable pdf download

To find the identification number of a colorado charitable organization, use the charity lookup tool or visit the colorado secretary of state's office website. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. If we do not have this certificate, we are obligated to collect the tax.

Bupa Tax Exemption Form Iowa Sales Tax Exemption Certificate Form

If you purchase tax free for a reason for which this form does not provide, please send us your special certificate or statement. The informationis neededtoensurethat noonereceivesthe exemptiononmorethanoneproperty. Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation. The following documents must be submitted with your application or.

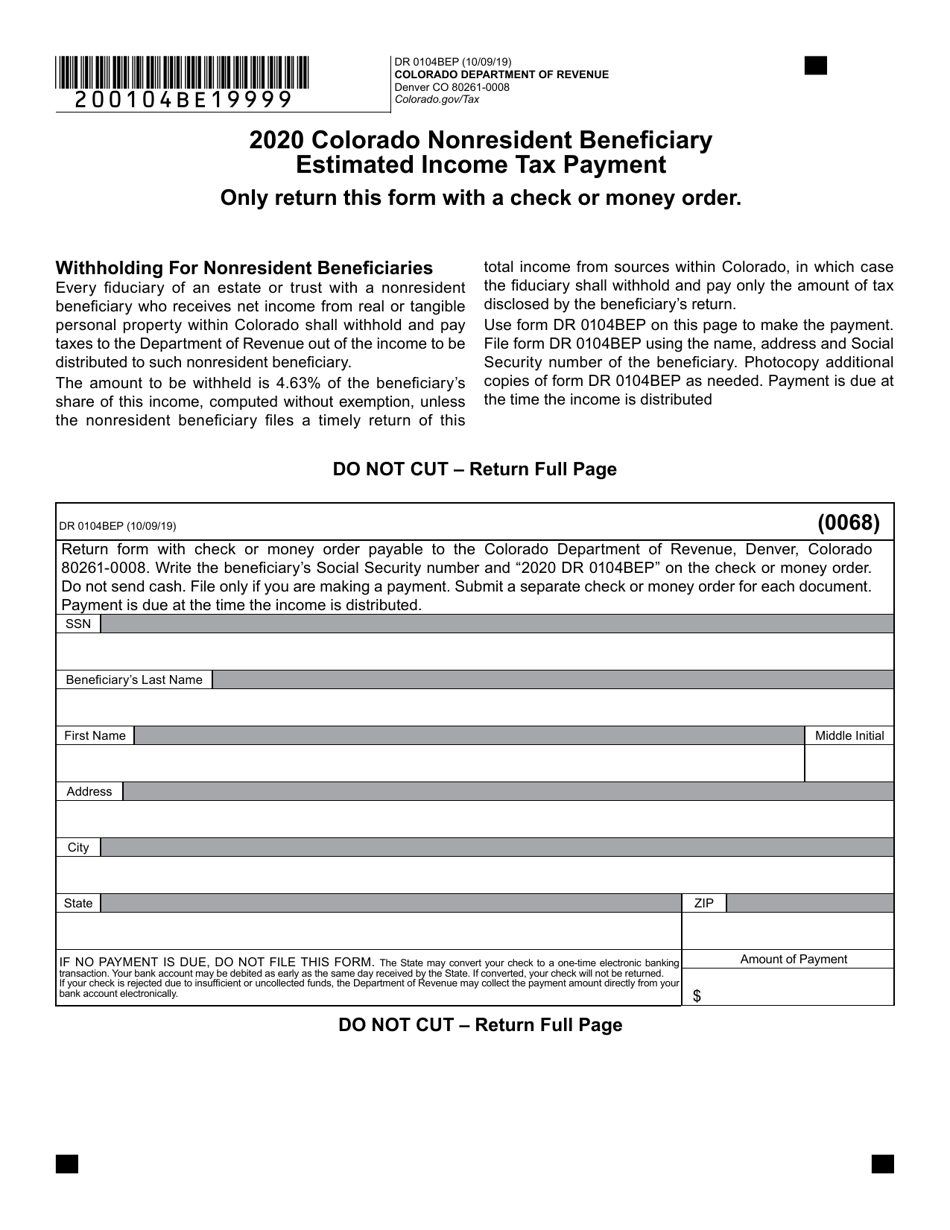

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

If you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. Certain products and services are exempt form colorado state sales tax. Complete the application for sales tax exemption for colorado organizations ( dr 0715 ). For sellers, accepting and keeping this document helps you get correct information about the.

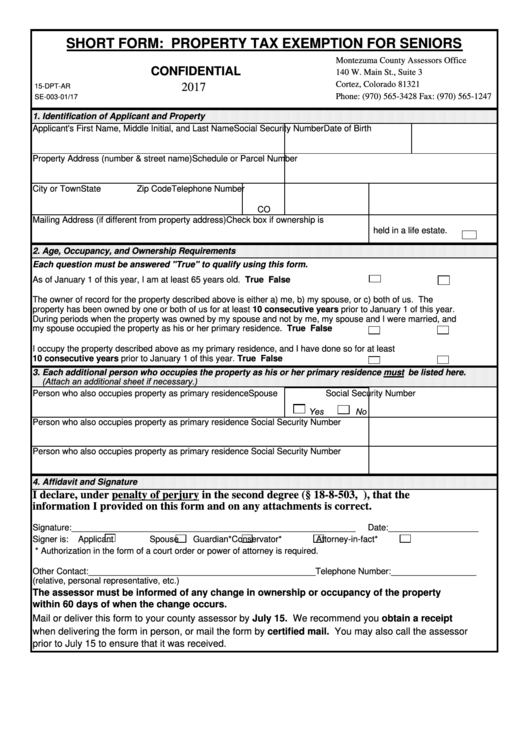

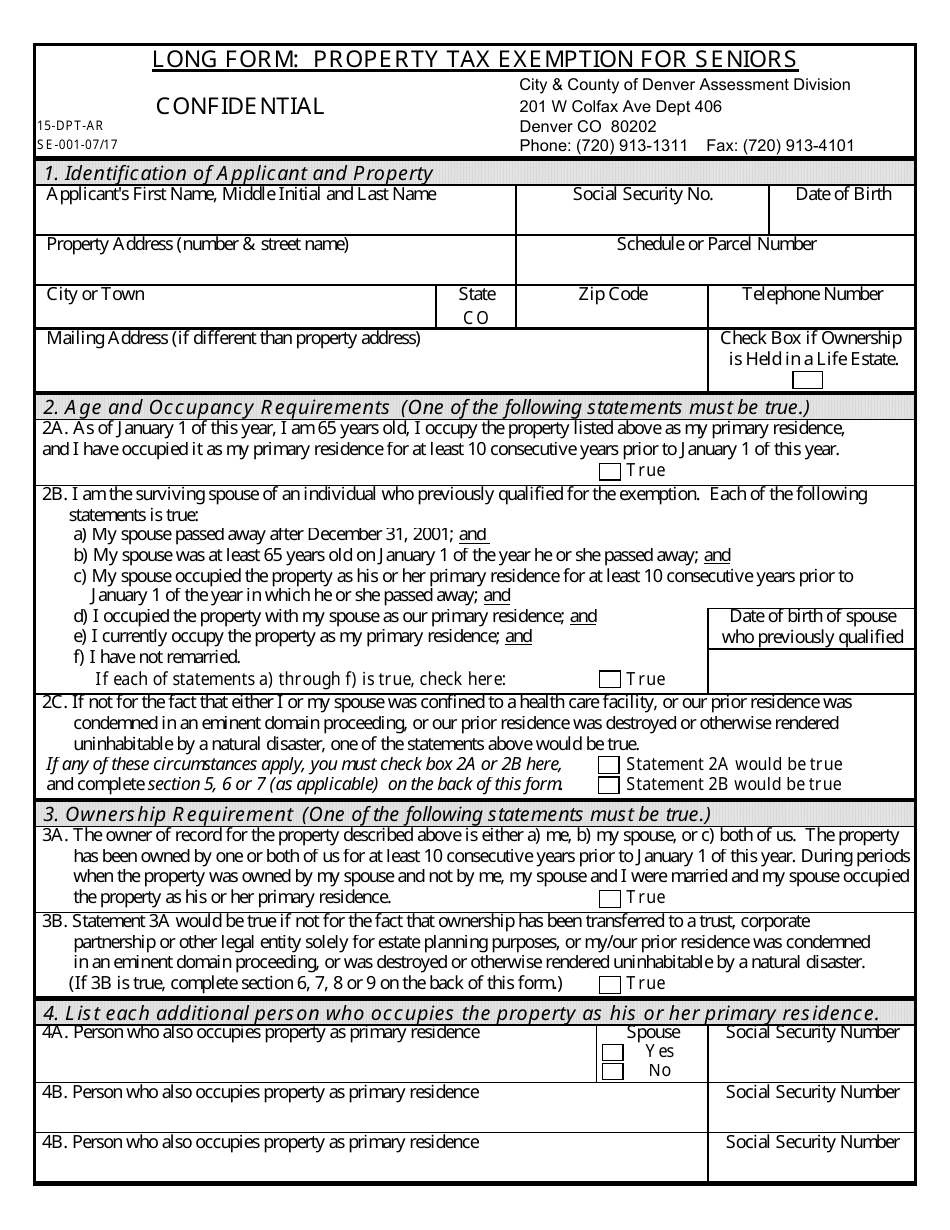

Form 15DPTAR Fill Out, Sign Online and Download Printable PDF

Theform will be kept confidential. If you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. If your husband or wife Web home assessors' office resources forms index forms index a | c | e | g | m | o | p | q | r | s abatement.

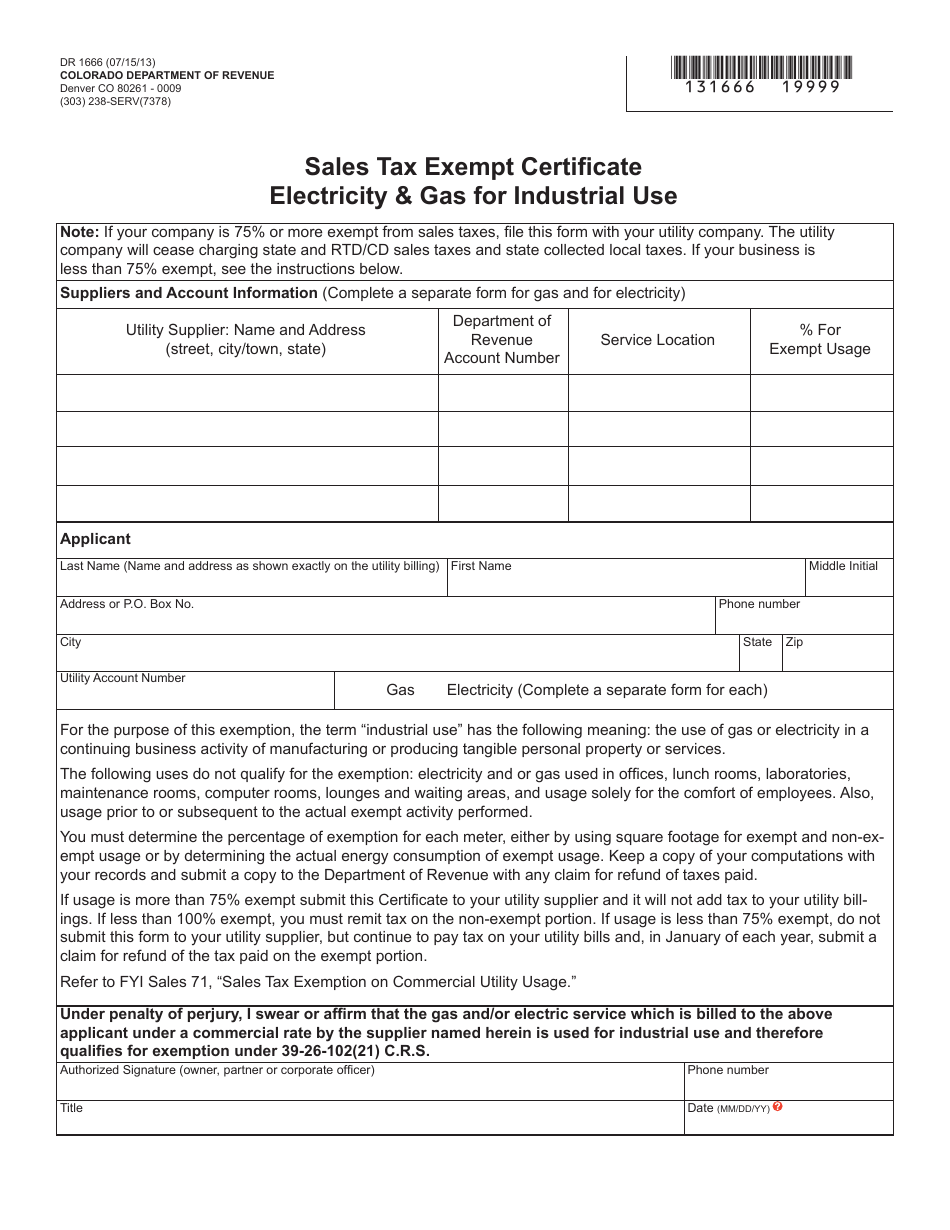

Form DR1666 Download Fillable PDF or Fill Online Sales Tax Exempt

Certain products and services are exempt form colorado state sales tax. For sellers, accepting and keeping this document helps you get correct information about the purchaser, which helps you prove this is an exempt sale during a tax audit. The following documents must be submitted with your application or it will be returned. Web if you are entitled to sales.

If We Do Not Have This Certificate, We Are Obligated To Collect The Tax For The State In Which The Property Is Delivered.

If any of these links are broken, or you can't find the form you need, please let us know. Web home assessors' office resources forms index forms index a | c | e | g | m | o | p | q | r | s abatement writeable one year petition (prints letter size) writeable two year petition (prints letter size) important information and instructions for filing a petition for abatement or refund of taxes certification of levies & revenue instructions forms Also, exemptions may be specific to a state, county, city or special district. Attach a copy of your federal determination letter from the irs showing under which classification code you are exempt.

Certain Products And Services Are Exempt Form Colorado State Sales Tax.

Web if you are entitled to sales tax exemption, please complete the certificate and send it to us at your earliest convenience. You can find resale certificates for other states here. Web we have two colorado sales tax exemption forms available for you to print or save as a pdf file. For sellers, accepting and keeping this document helps you get correct information about the purchaser, which helps you prove this is an exempt sale during a tax audit.

The Following Documents Must Be Submitted With Your Application Or It Will Be Returned.

If your husband or wife Theform will be kept confidential. Complete the application for sales tax exemption for colorado organizations ( dr 0715 ). Carefully review the guidance publication linked to the exemption listed below to ensure that the exemption applies to your specific tax situation.

Web Organizations That Are Exempt From Federal Income Tax Under 501(C)(3) Will Generally Be Approved For A Sales Tax Certificate Of Exemption In Colorado.

The informationis neededtoensurethat noonereceivesthe exemptiononmorethanoneproperty. Web files a properly executed exemption certificate from all of our customers who claim sales tax exemption. To find the identification number of a colorado charitable organization, use the charity lookup tool or visit the colorado secretary of state's office website. Web general instructions purpose of form this form is used to certify to sellers that a purchase qualifies for exemption under title 39, article 26 of the colorado revised statutes.