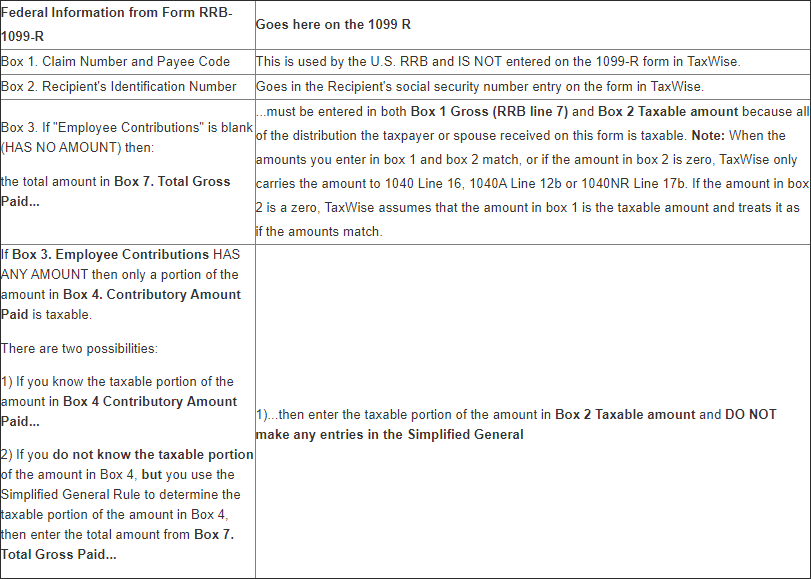

Rrb 1099 R Form

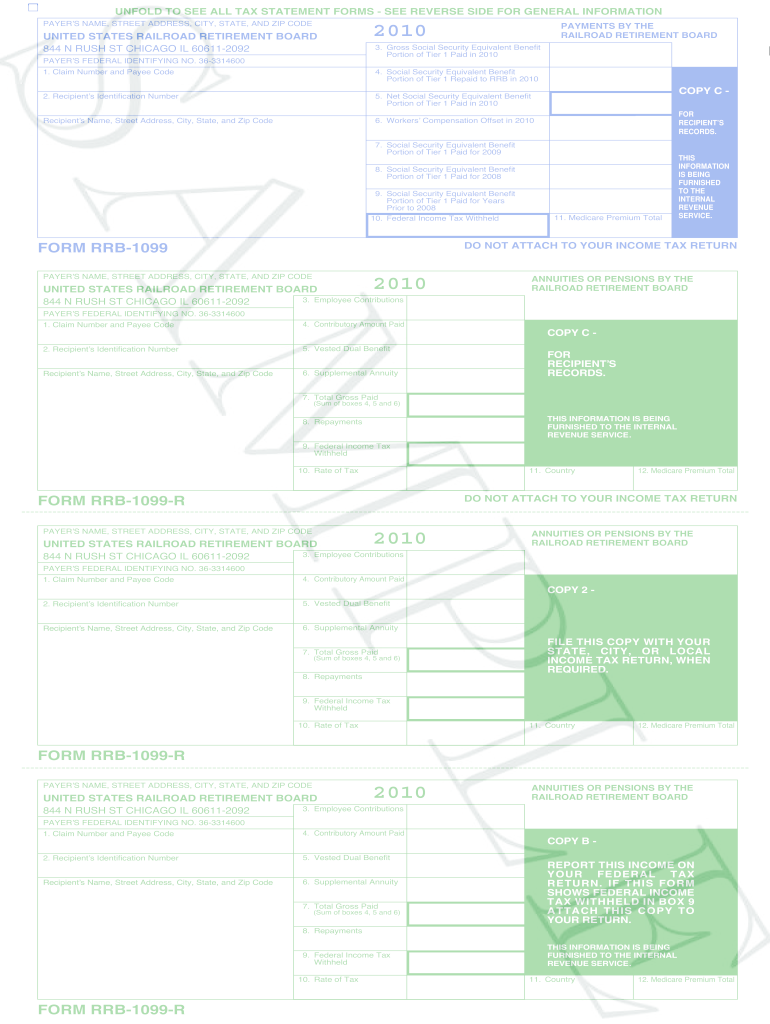

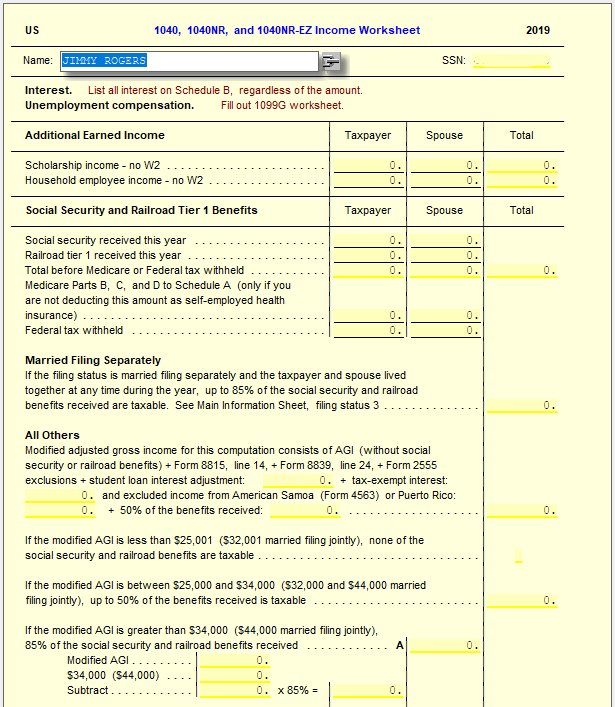

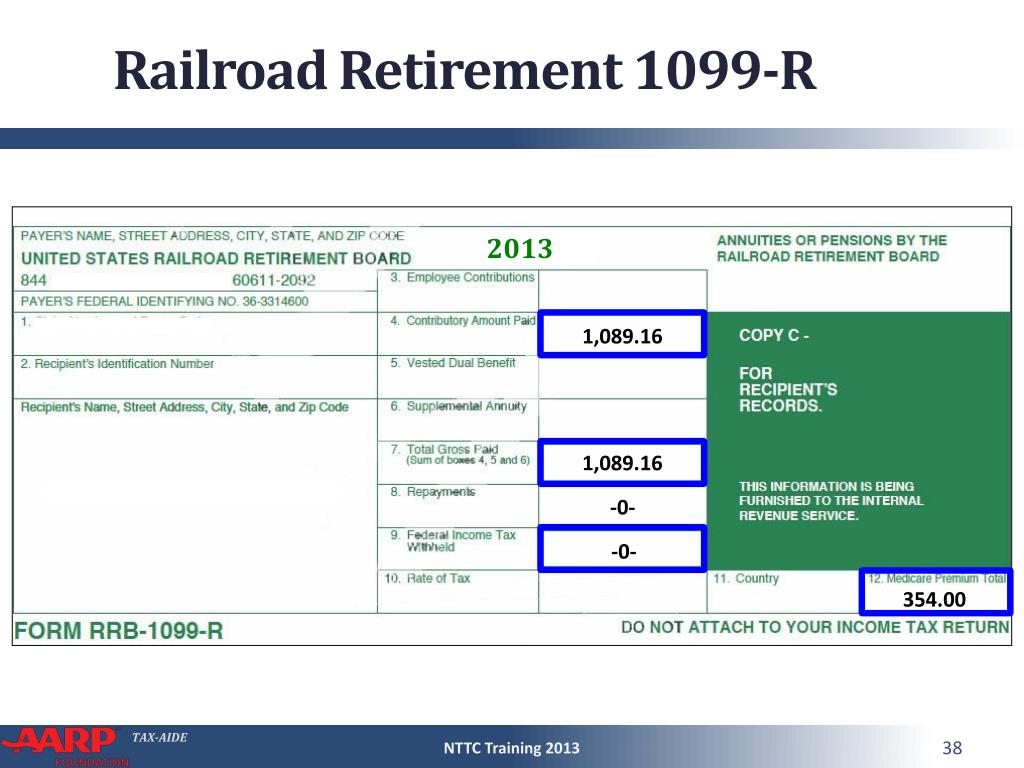

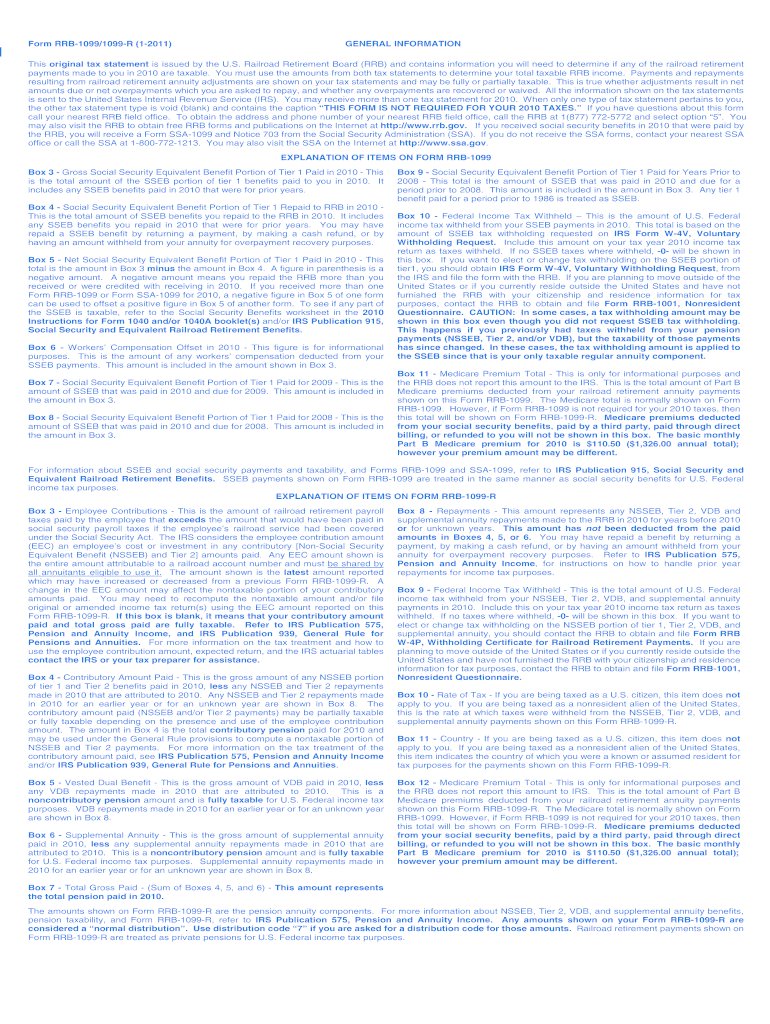

Rrb 1099 R Form - These payments are treated as private pensions. Sign in to your turbotax account and open or continue your return; Box 9, federal income tax withheld; From within your taxact return ( online or desktop), click federal. Click retirement plan income in the federal quick q&a topics menu to expand. Web for internal revenue service center file with form 1096. Within 5 years 11 1st year of desig. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. Web for internal revenue service center file with form 1096.

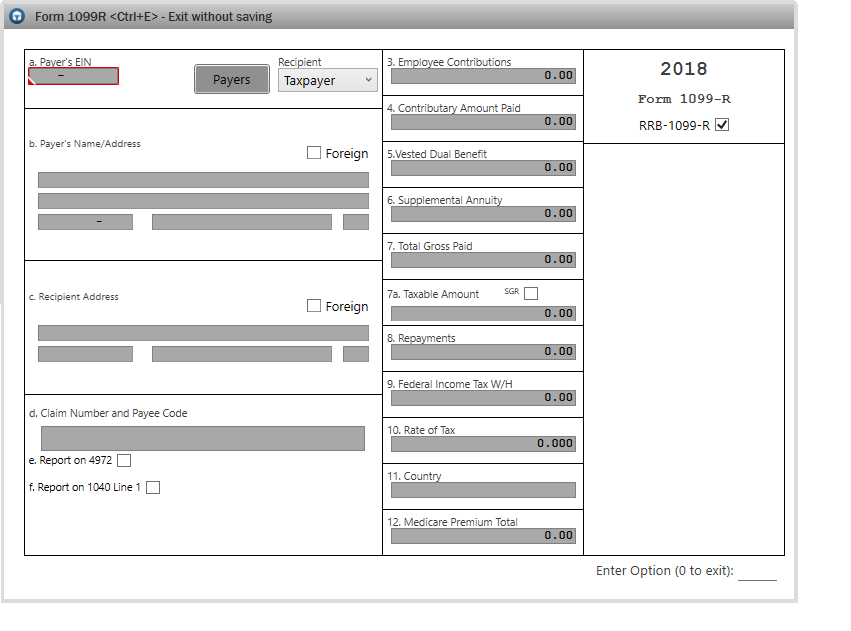

Within 5 years 11 1st year of desig. Webmaster@rrb.gov to view and download pdf documents, you need the free acrobat reader. There are two categories of benefits paid under the railroad retirement act: These payments are treated as private pensions for u.s. Click retirement plan income in the federal quick q&a topics menu to expand. To enter this information in your taxact return: Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. Railroad retirement board (rob) and represents payments made to you in the tax year indicated on the statement. Sign in to your turbotax account and open or continue your return; You will need to determine if any of the railroad retirement payments made to you are taxable.

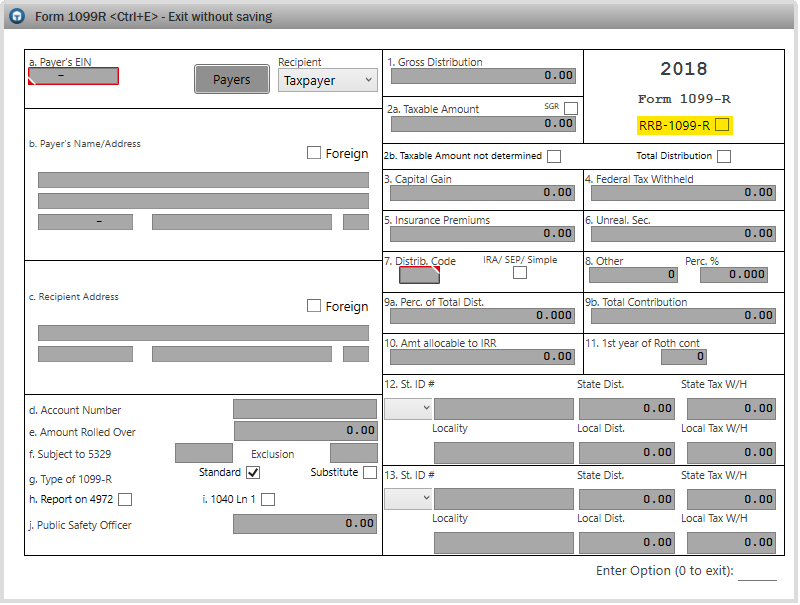

Intuit lacerte tax contact lacerte tax support Railroad retirement board (rob) and represents payments made to you in the tax year indicated on the statement. Show details we are not affiliated with any brand or entity on this form. Box 9, federal income tax withheld; Click retirement plan income in the federal quick q&a topics menu to expand. Any individual retirement arrangements (iras). Web social security equivalent benefits, form rrb 1099 tier 1 (blue form) are entered on the social security benefits screen. Enter the ein and payer's information. We recommend using the latest version. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ).

Railroad Benefits (RRB1099) UltimateTax Solution Center

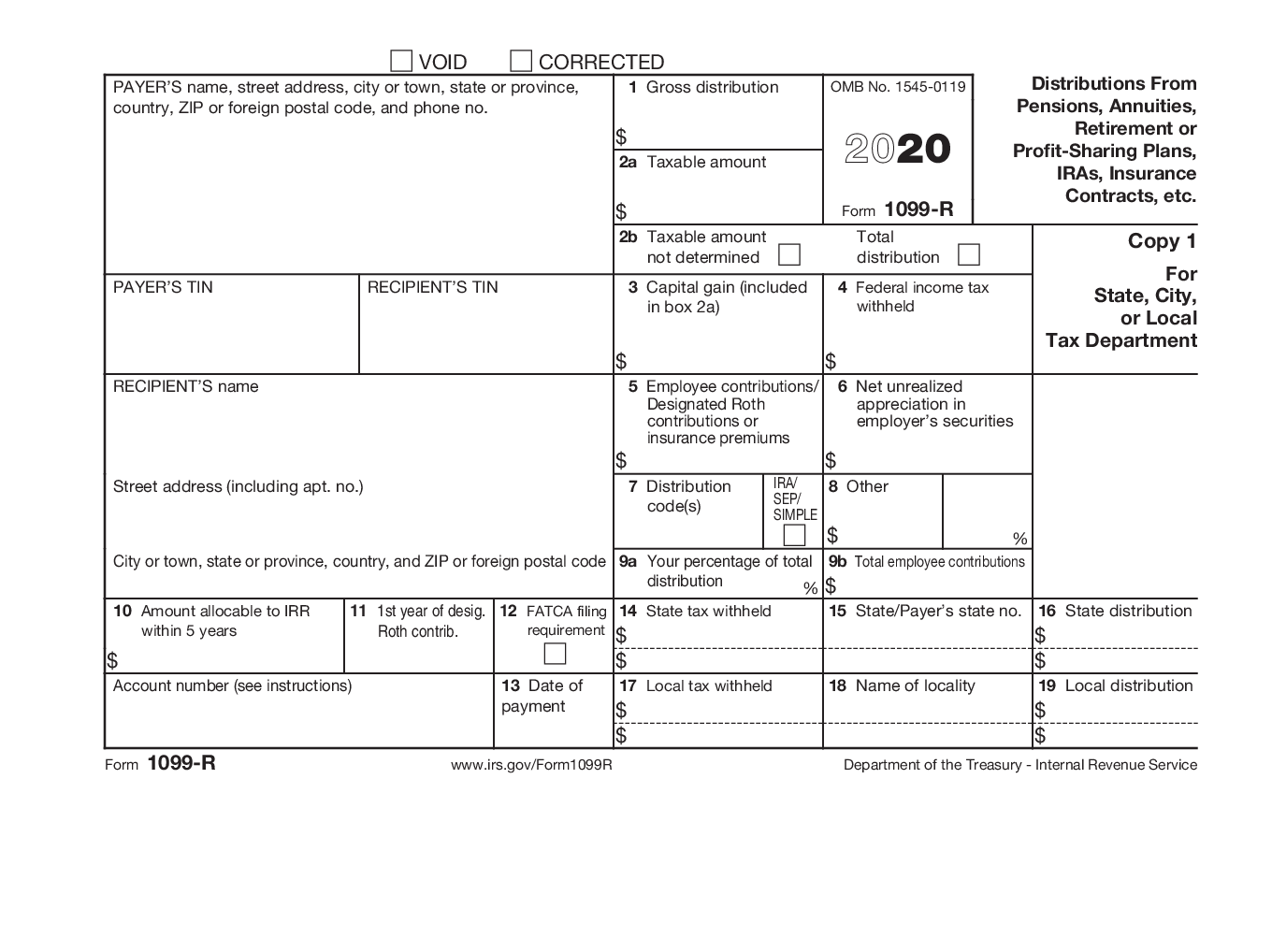

Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. 12 fatca filing requirement 13 date of payment cat. Web for internal revenue service center file with form 1096. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,.

Rrb 1099 Form Fill Out and Sign Printable PDF Template signNow

$ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Webmaster@rrb.gov to view and download pdf documents, you need the free acrobat reader. And box 3, total employee contributions (if. Annuities, pensions, insurance contracts, survivor income benefit plans. No.) for privacy act and paperwork reduction act notice, see the 2021 general instructions.

How to Print and File 1099R

How it works upload the rrb 1099 r simplified method worksheet edit & sign rrb 1099 from anywhere save your changes and share form rrb 1099 r pdf rate the rrb 1099 r 4.7 satisfied 194 votes Railroad retirement board (rrb) and represents payments made to you in the tax year indicated on the statement. Web use a form rrb.

Railroad Benefits (RRB1099) UltimateTax Solution Center

Citizen and nonresident alien beneficiaries. To enter this information in your taxact return: Within 5 years 11 1st year of desig. Click retirement plan income in the federal quick q&a topics menu to expand. These payments are treated as private pensions.

1099R Software to Create, Print & EFile IRS Form 1099R

$ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Citizen and nonresident alien beneficiaries. You will need to determine if any of the railroad retirement payments made to you are taxable. Webmaster@rrb.gov to view and download pdf documents, you need the free acrobat reader. There are two categories of benefits paid.

PPT Retirement IRAs and Pensions PowerPoint Presentation

Railroad retirement board (rob) and represents payments made to you in the tax year indicated on the statement. Intuit lacerte tax contact lacerte tax support Box 9, federal income tax withheld; Policy and systems | email: There are two categories of benefits paid under the railroad retirement act:

Form RRB1099R Railroad Retirement Benefits Support

You will need to determine if any of the railroad retirement payments made to you are taxable. Enter the amount from box 7, total gross paid of the rrb; Web for internal revenue service center file with form 1096. Within 5 years 11 1st year of desig. Railroad retirement board (rrb) and represents payments made to you in the tax.

Form 1099R

Webmaster@rrb.gov to view and download pdf documents, you need the free acrobat reader. Show details we are not affiliated with any brand or entity on this form. From within your taxact return ( online or desktop) click federal. You will need to determine if any of the railroad retirement payments made to you are taxable. From within your taxact return.

Form RRB1099R Railroad Retirement Benefits Support

How it works upload the rrb 1099 r simplified method worksheet edit & sign rrb 1099 from anywhere save your changes and share form rrb 1099 r pdf rate the rrb 1099 r 4.7 satisfied 194 votes Railroad retirement board (rob) and represents payments made to you in the tax year indicated on the statement. Web if you want to.

Rrb 1099 R Form Fill Out and Sign Printable PDF Template signNow

Web for internal revenue service center file with form 1096. Citizen and nonresident alien beneficiaries. $ for privacy act and paperwork reduction act notice, see the 2023 general instructions for certain information returns. Within 5 years 11 1st year of desig. Enter the ein and payer's information.

$ For Privacy Act And Paperwork Reduction Act Notice, See The 2023 General Instructions For Certain Information Returns.

From within your taxact return ( online or desktop) click federal. We recommend using the latest version. Web for internal revenue service center file with form 1096. And box 3, total employee contributions (if.

To Enter This Information In Your Taxact Return:

From within your taxact return ( online or desktop), click federal. 12 fatca filing requirement 13 date of payment cat. Web if you want to request a duplicate income tax statement now, go to the online request form. Web for internal revenue service center file with form 1096.

Click Retirement Plan Income In The Federal Quick Q&A Topics Menu To Expand.

Sign in to your turbotax account and open or continue your return; From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen, then click federal ). Any individual retirement arrangements (iras). Box 9, federal income tax withheld;

These Payments Are Treated As Private Pensions For U.s.

To enter this information in your taxact return: Enter the ein and payer's information. Citizen and nonresident alien beneficiaries. No.) for privacy act and paperwork reduction act notice, see the 2021 general instructions for certain information returns.