Can You File Form 8843 Online

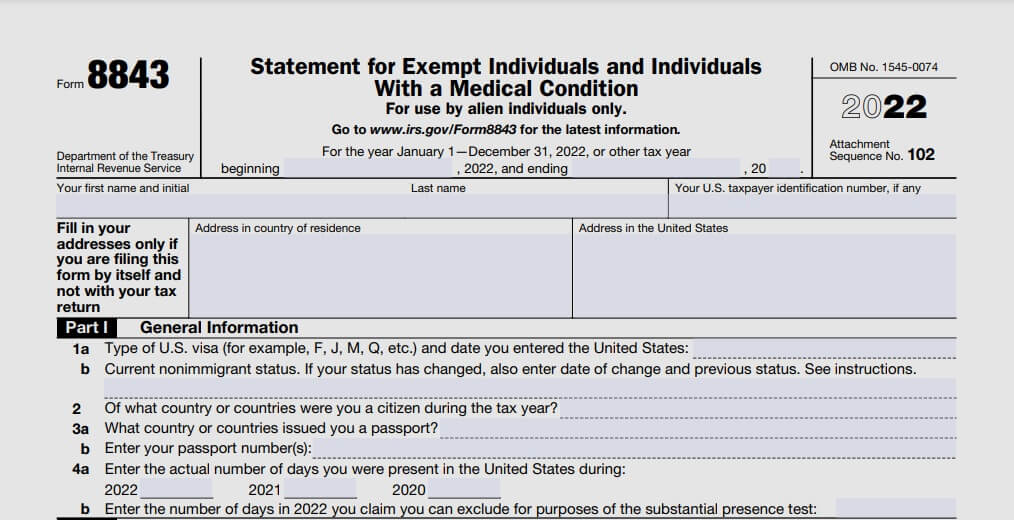

Can You File Form 8843 Online - Web there is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently working in the u.s. Source income in 2022 you only need complete the irs form 8843 to fulfill your federal tax filing. Web all international students and their dependents must complete and submit form 8843 every year. How do i complete form 8843? Isl highly recommends you send this form with tracking. Get ready for tax season deadlines by completing any required tax forms today. Web there are several ways to submit form 4868. Web if you are a nonresident tax filer, and have no u.s. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Complete, edit or print tax forms instantly.

Fill in all required fields in the selected document using our professional pdf. Web it cannot be sent electronically. Ad register and subscribe now to work on your irs 8843 & more fillable forms. This guide has been created to assist you in completing the form 8843. Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead. Web who is an exempt individual? You were present in the u.s. Ad access irs tax forms. If you've tried to complete form 8843 on your own, you know just how confusing it. A refund to an employee of excess social security,.

You must file form 8843 by june 15, 2022. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. In f/j status for any portion of the previous calendar year (the year for which. If you are a nonresident individual, you must file form 8843 to explain the basis of your claim that you can exclude days of presence in the united states for the. The internal revenue service (irs) has more information about form 8843, including how to file it. Web employers cannot use form 843 to request an abatement of fica tax, rrta tax, or income tax withholding. Web the service center where you would be required to a file a current year tax return for the tax to which your claim or request relates. If you've tried to complete form 8843 on your own, you know just how confusing it. Learn how to fill out and. Who is required to file form 8843?

What is Form 8843 and How Do I File it? Sprintax Blog

Isl highly recommends you send this form with tracking. If you've tried to complete form 8843 on your own, you know just how confusing it. In f/j status for any portion of the previous calendar year (the year for which. Web employers cannot use form 843 to request an abatement of fica tax, rrta tax, or income tax withholding. Cu.

Sprintax Tax Service Office of International Student and Scholar

You must file form 8843 by june 15, 2022. Web who is an exempt individual? Ad access irs tax forms. A refund to an employee of excess social security,. Web it cannot be sent electronically.

Form 8843 Instructions How to fill out 8843 form online & file it

Web there is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently working in the u.s. The irs instructions for form 8843 summarizes who qualifies as an exempt individual. Get ready for tax season deadlines by completing any required tax forms today. Web how do i file form 8843?.

Form 8843 Statement for Exempt Individuals and Individuals with a

Get ready for tax season deadlines by completing any required tax forms today. Fill in all required fields in the selected document using our professional pdf. Web the service center where you would be required to a file a current year tax return for the tax to which your claim or request relates. Web there are several ways to submit.

'Form 8843' 태그의 글 목록 Bluemoneyzone

Web employers cannot use form 843 to request an abatement of fica tax, rrta tax, or income tax withholding. Santa barbara santa cruz write/type your first and last name, us taxpayer identification number (itin or ssn) if you have one, foreign and local us address. Web if you are a nonresident tax filer, and have no u.s. The irs instructions.

Form 8843 YouTube

You were present in the u.s. Web how do i file form 8843? Ad access irs tax forms. Web the service center where you would be required to a file a current year tax return for the tax to which your claim or request relates. You can find a document outlining mailing locations around athens below.

Form 8843 Instructions How to fill out 8843 form online & file it

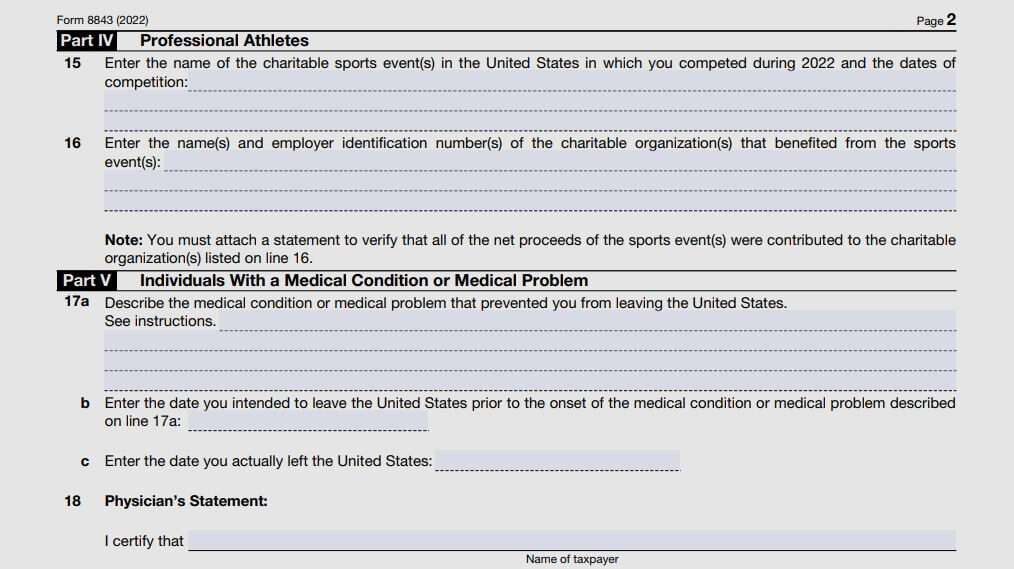

This guide has been created to assist you in completing the form 8843. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web tips for completing form 8843 when filling out form 8843, tax preparers must obtain information on why the student or scholar is in this country and information.

Tax how to file form 8843 (1)

Web it cannot be sent electronically. Web yes yes no no for paperwork reduction act notice, see instructions. Web tips for completing form 8843 when filling out form 8843, tax preparers must obtain information on why the student or scholar is in this country and information about the. Ad access irs tax forms. Web you must file form 8843 if.

IRS Form 8843 Editable and Printable Statement to Fill out

Citizens also do not need to file the form 8843. Web how do i file form 8843? A refund to an employee of excess social security,. Web there is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently working in the u.s. Income are required to file this form.

Form 8843 Instructions How to fill out 8843 form online & file it

How do i complete form 8843? Web there is one tax form that all nonresident alien taxpayers must file even if they have no income and are not currently working in the u.s. Web tips for completing form 8843 when filling out form 8843, tax preparers must obtain information on why the student or scholar is in this country and.

See The Instructions For The.

A refund to an employee of excess social security,. Web yes yes no no for paperwork reduction act notice, see instructions. Who is required to file form 8843? This guide has been created to assist you in completing the form 8843.

If You've Tried To Complete Form 8843 On Your Own, You Know Just How Confusing It.

The internal revenue service (irs) has more information about form 8843, including how to file it. Cu students and scholars, as well as their spouses and dependents, in. Glacier tax prep can assist in determining whether you qualify as a resident alien or nonresident alien for tax. Mail your tax return by the due date (including extensions) to the address shown in your tax.

Income Are Required To File This Form With The Irs.

You can find a document outlining mailing locations around athens below. If you are a nonresident individual, you must file form 8843 to explain the basis of your claim that you can exclude days of presence in the united states for the. Web employers cannot use form 843 to request an abatement of fica tax, rrta tax, or income tax withholding. Web how do i file form 8843?

Click The Button Get Form To Open It And Begin Editing.

Web when is the filing deadline? Web who is an exempt individual? Fill in all required fields in the selected document using our professional pdf. Web these messages can arrive in the form of an unsolicited text or email to lure unsuspecting victims to provide valuable personal and financial information that can lead.