Who Must File Form 5500 For Health Insurance

Who Must File Form 5500 For Health Insurance - Department of labor's efast 2 or ifile systems. Web plans with more than 100 participants on the first day of the plan year must file form 5500 with the department of labor (dol) each year whether funded or unfunded. Web what does form 5500 mean? Approximately 60,500 group health plans filed a form 5500 for 2018, an increase of nearly 5 percent. Web since january 1, 2010, all forms in the 5500 series must be filed electronically using the u.s. Web form 5500 version selection tool. Web the form 5500 series was jointly developed by the u.s. Web welfare plans and group insurance arrangements (gias) filing as dfes should be assigned plan numbers starting with 501 and consecutive numbers should be assigned. Web form 5500 is used for plans that have 100 or more participants. Department of labor (dol), internal revenue service (irs), and the pension benefit guaranty corporation.

Web what does form 5500 mean? Approximately 60,500 group health plans filed a form 5500 for 2018, an increase of nearly 5 percent. Web welfare plans and group insurance arrangements (gias) filing as dfes should be assigned plan numbers starting with 501 and consecutive numbers should be assigned. Plans protected by erisa and. Department of labor (dol), internal revenue service (irs), and the pension benefit guaranty corporation. Web since january 1, 2010, all forms in the 5500 series must be filed electronically using the u.s. Web plans with more than 100 participants on the first day of the plan year must file form 5500 with the department of labor (dol) each year whether funded or unfunded. On the first day of their employee retirement income security act ( erisa) plan year (which is different than the. Web the form 5500 series was jointly developed by the u.s. Web any employer that sponsors health & welfare benefit plans covered by title i of erisa is required to file a form 5500 for those benefit plans.

Approximately 60,500 group health plans filed a form 5500 for 2018, an increase of nearly 5 percent. Web the form 5500 series was jointly developed by the u.s. Web welfare plans and group insurance arrangements (gias) filing as dfes should be assigned plan numbers starting with 501 and consecutive numbers should be assigned. Plans protected by erisa and. Department of labor (dol), internal revenue service (irs), and the pension benefit guaranty corporation. Web form 5500 version selection tool. Department of labor's efast 2 or ifile systems. Form 5500 is a form that companies who provide benefits to their employees must file with the department of labor. Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year. An unfunded excess benefit plan.

irs form 5500 instructions 2014 Fill out & sign online DocHub

Web find out who must file form 5500 for health insurance. Web what does form 5500 mean? On the first day of their employee retirement income security act ( erisa) plan year (which is different than the. An unfunded excess benefit plan. Web welfare plans and group insurance arrangements (gias) filing as dfes should be assigned plan numbers starting with.

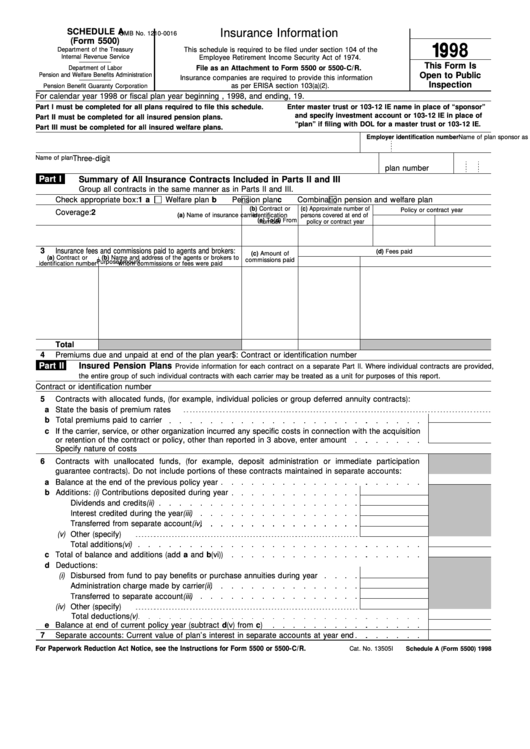

Fillable Schedule A (Form 5500) Insurance Information 1998

Web since january 1, 2010, all forms in the 5500 series must be filed electronically using the u.s. Web employers that sponsored group health plans and filed the form 5500. Department of labor's efast 2 or ifile systems. Plans protected by erisa and. Web find out who must file form 5500 for health insurance.

Slide Deck Advanced Prospecting with the Form 5500 Judy Diamond

Web employers that sponsored group health plans and filed the form 5500. On the first day of their employee retirement income security act ( erisa) plan year (which is different than the. An unfunded excess benefit plan. Web plans with more than 100 participants on the first day of the plan year must file form 5500 with the department of.

How to File Form 5500EZ Solo 401k

Web form 5500 is used for plans that have 100 or more participants. On the first day of their employee retirement income security act ( erisa) plan year (which is different than the. Web all “funded” welfare plans must file a form 5500; Web plans with more than 100 participants on the first day of the plan year must file.

Discovery for Health and Welfare Benefit Plans Required ERISA

Department of labor's efast 2 or ifile systems. On the first day of their employee retirement income security act ( erisa) plan year (which is different than the. Web welfare plans and group insurance arrangements (gias) filing as dfes should be assigned plan numbers starting with 501 and consecutive numbers should be assigned. Web since january 1, 2010, all forms.

Failing to File Form 5500 Just Became More Costly Graydon Law

Form 5500 is a form that companies who provide benefits to their employees must file with the department of labor. Web the form 5500 series was jointly developed by the u.s. Department of labor's efast 2 or ifile systems. Web any employer that sponsors health & welfare benefit plans covered by title i of erisa is required to file a.

Form 5500 Instructions 5 Steps to Filing Correctly (2023)

Web plans with more than 100 participants on the first day of the plan year must file form 5500 with the department of labor (dol) each year whether funded or unfunded. Web form 5500 is used for plans that have 100 or more participants. Web most health and welfare plans with more than 100 participants on the first day of.

Brian Strother on LinkedIn Contact Us

On the first day of their employee retirement income security act ( erisa) plan year (which is different than the. Web plans with more than 100 participants on the first day of the plan year must file form 5500 with the department of labor (dol) each year whether funded or unfunded. Web find out who must file form 5500 for.

File The Health Insurance Claim Form Stock Image Image of doctor

Form 5500 is a form that companies who provide benefits to their employees must file with the department of labor. Plans protected by erisa and. Web form 5500 version selection tool. Department of labor's efast 2 or ifile systems. Web find out who must file form 5500 for health insurance.

Web the form 5500 series was jointly developed by the u.s. An unfunded excess benefit plan. Web all “funded” welfare plans must file a form 5500; Web plans with more than 100 participants on the first day of the plan year must file form 5500 with the department of labor (dol) each year whether funded or unfunded. Web any employer.

Web The Form 5500 Series Was Jointly Developed By The U.s.

Plans protected by erisa and. Department of labor (dol), internal revenue service (irs), and the pension benefit guaranty corporation. Web any employer that sponsors health & welfare benefit plans covered by title i of erisa is required to file a form 5500 for those benefit plans. Web form 5500 version selection tool.

Web Form 5500 Is Used For Plans That Have 100 Or More Participants.

An unfunded excess benefit plan. Web find out who must file form 5500 for health insurance. Web most health and welfare plans with more than 100 participants on the first day of the plan year must file form 5500 with the dol each year. Department of labor's efast 2 or ifile systems.

Web What Does Form 5500 Mean?

Web employers that sponsored group health plans and filed the form 5500. Web since january 1, 2010, all forms in the 5500 series must be filed electronically using the u.s. Web all “funded” welfare plans must file a form 5500; Web welfare plans and group insurance arrangements (gias) filing as dfes should be assigned plan numbers starting with 501 and consecutive numbers should be assigned.

Web Plans With More Than 100 Participants On The First Day Of The Plan Year Must File Form 5500 With The Department Of Labor (Dol) Each Year Whether Funded Or Unfunded.

Approximately 60,500 group health plans filed a form 5500 for 2018, an increase of nearly 5 percent. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Form 5500 is a form that companies who provide benefits to their employees must file with the department of labor. On the first day of their employee retirement income security act ( erisa) plan year (which is different than the.