Az Income Tax Form

Az Income Tax Form - Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov. Web whether you are an individual or business, you can find out where your refund is, make a payment, and more. Arizona form 140 check box 82f if filing under extension 82f spouse’s. Web for tax years ending on or before december 31, 2019, individuals with an adjusted gross income of at least $5,500 must file taxes, and an arizona resident is subject to tax on. Web arizona annual payment withholding tax return: Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web resident personal income tax return arizona form 140 do not staple any items to the return. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Employees can still claim exemption from state income tax on the. As a result, we are revising withholding percentages and are requiring.

Web resident personal income tax return arizona form 140 do not staple any items to the return. Information for filing your electronic individual income or small. Web 26 rows arizona corporation income tax return (short form) corporate tax forms :. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. This form should be completed after. Web whether you are an individual or business, you can find out where your refund is, make a payment, and more. Web arizona state income tax forms for tax year 2022 (jan. Web arizona annual payment withholding tax return:

Web all arizona taxpayers must file a form 140 with the arizona department of revenue. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Arizona form 140 check box 82f if filing under extension 82f spouse’s. Find forms for your industry in minutes. Employer's election to not withhold arizona taxes in december (includes instructions). Web resident personal income tax return arizona form 140 do not staple any items to the return. Complete, edit or print tax forms instantly. Web state of arizona department of revenue toggle navigation. 1 withhold from gross taxable wages at the percentage checked (check only one. Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov.

Form 10f Tax In Word Format Tax Walls

Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web whether you are an individual or business, you can find out where your refund is, make a payment, and more. Web resident personal.

1040ez Printable Form carfare.me 20192020

Streamlined document workflows for any industry. This form is used by residents who file an individual income tax return. Payment for unpaid income tax small business payment type options include: Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web arizona annual payment withholding tax return:

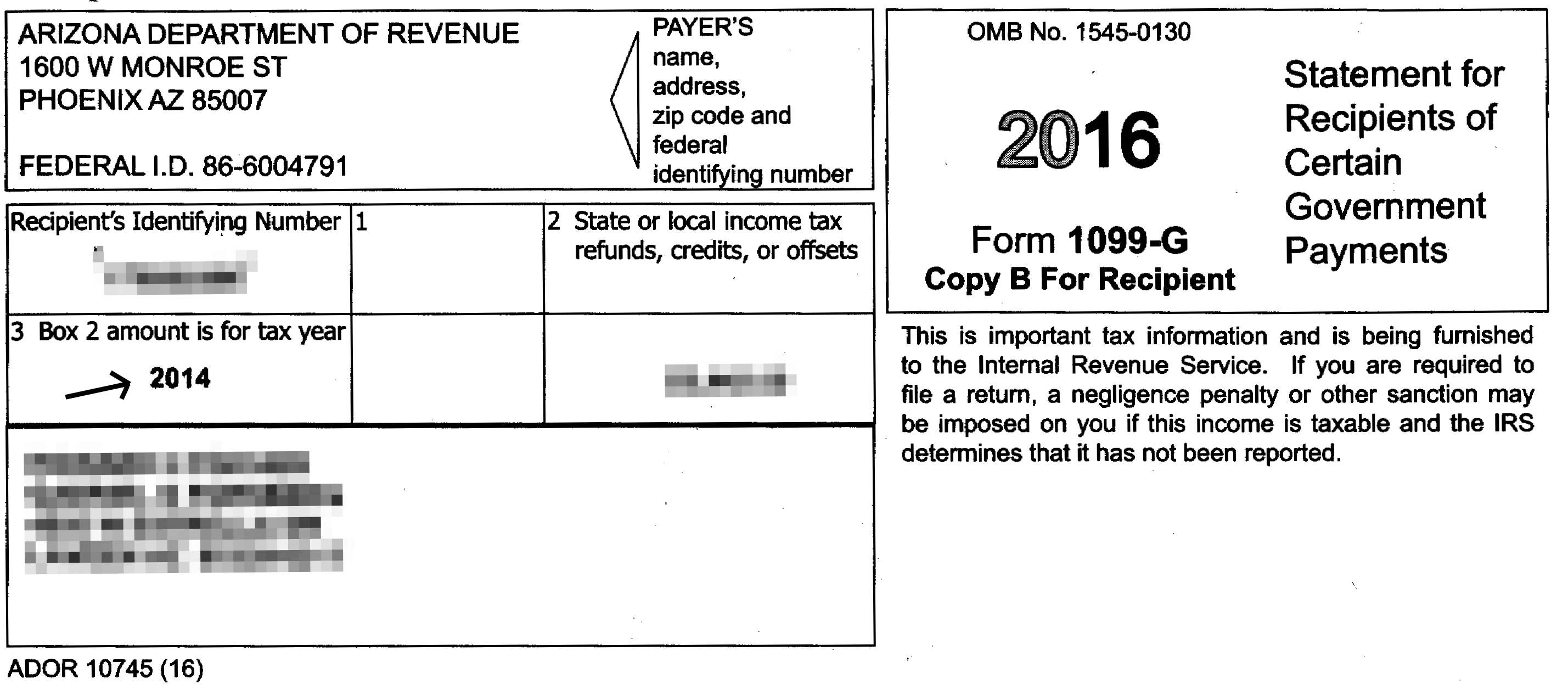

Hold up on doing your taxes; Arizona tax form 1099G is flawed The

Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov. Employer's election to not withhold arizona taxes in december (includes instructions). Web for tax years ending on or before december 31, 2019, individuals with an adjusted gross income of at least $5,500 must file taxes, and an arizona resident is subject.

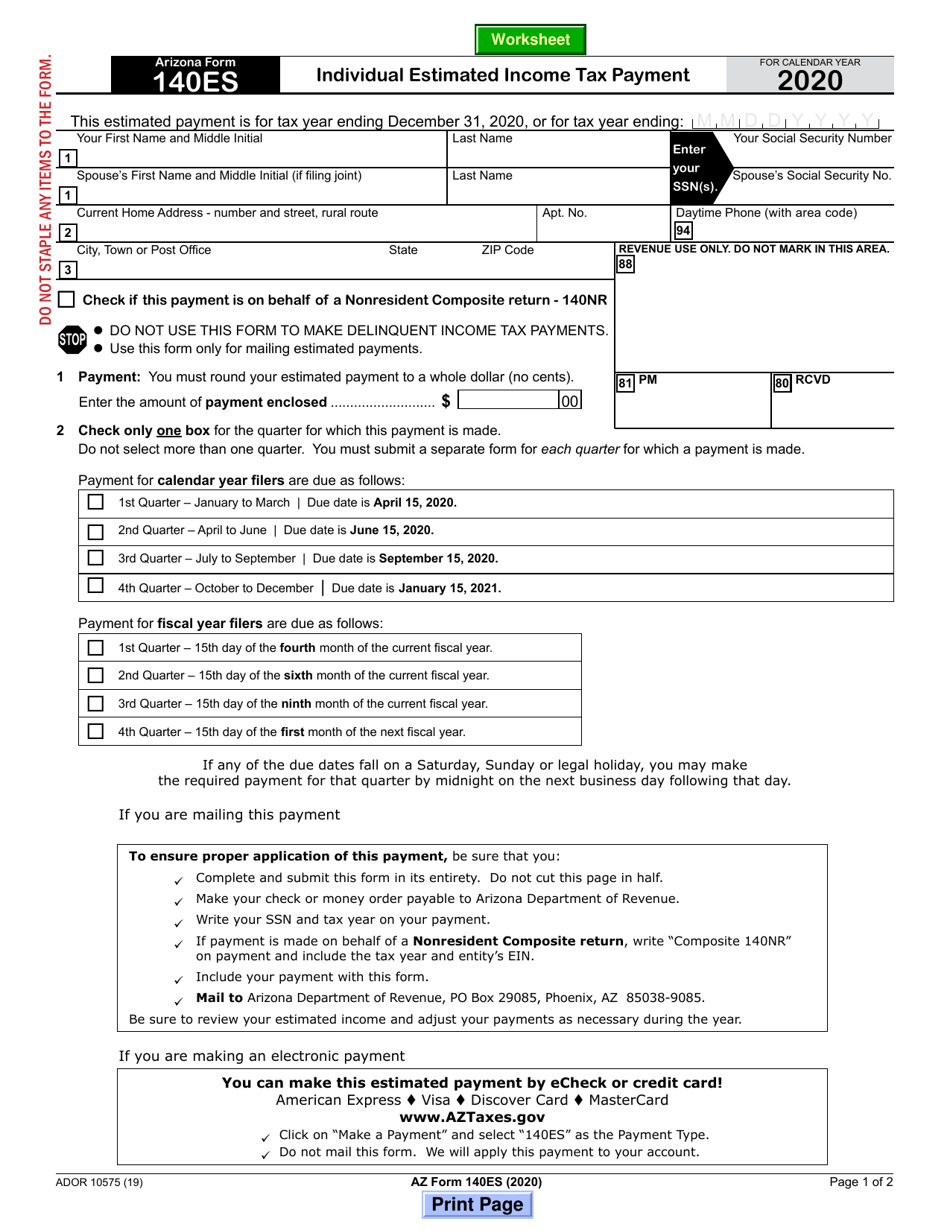

Arizona Form 140ES (ADOR10575) Download Fillable PDF or Fill Online

Web 26 rows arizona corporation income tax return (short form) corporate tax forms :. Web arizona annual payment withholding tax return: Details on how to only prepare and print an. Payment for unpaid income tax small business payment type options include: Employees can still claim exemption from state income tax on the.

Report ‘Unfair’ Arizona tax system unduly burdens poor residents

Complete, edit or print tax forms instantly. 1 withhold from gross taxable wages at the percentage checked (check only one. Details on how to only prepare and print an. Information for filing your electronic individual income or small. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding.

1040ez Arizona State Tax Form Universal Network

Web resident personal income tax return arizona form 140 do not staple any items to the return. Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov. Complete, edit or print tax forms instantly. Web 26 rows arizona corporation income tax return (short form) corporate tax forms :. Streamlined document workflows.

Revenue Canada Previous Years Tax Forms

Web for tax years ending on or before december 31, 2019, individuals with an adjusted gross income of at least $5,500 must file taxes, and an arizona resident is subject to tax on. Web 26 rows arizona corporation income tax return (short form) corporate tax forms :. Web resident personal income tax return arizona form 140 do not staple any.

Forms and help filing your AZ tax returns.

Arizona form 140 check box 82f if filing under extension 82f spouse’s. Ad download or email az dor 140es & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding. Web arizona state income tax forms for tax year.

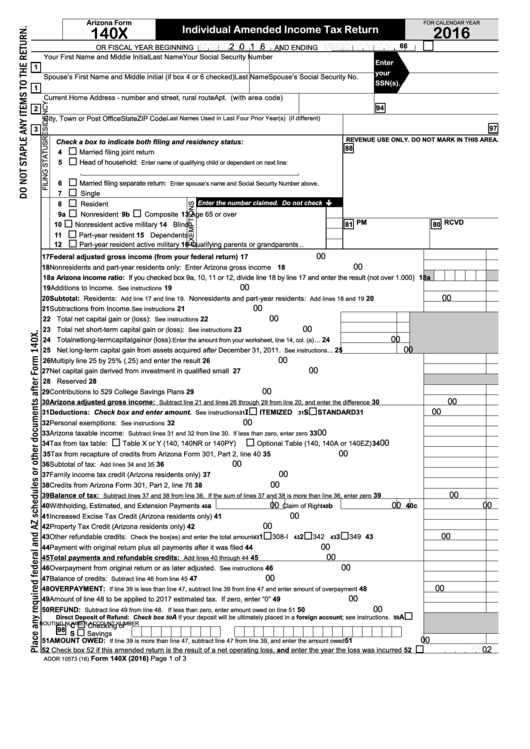

Fillable Arizona Form 140x Individual Amended Tax Return

Ad download or email az dor 140es & more fillable forms, register and subscribe now! Information for filing your electronic individual income or small. Employer's election to not withhold arizona taxes in december (includes instructions). This form is used by residents who file an individual income tax return. Web arizona income tax forms 2022 arizona printable income tax forms 96.

301 Moved Permanently

Web whether you are an individual or business, you can find out where your refund is, make a payment, and more. As a result, we are revising withholding percentages and are requiring. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Web arizona state income tax forms for tax year 2022 (jan..

Web The Most Common Arizona Income Tax Form Is The Arizona Form 140.

As a result, we are revising withholding percentages and are requiring. This form should be completed after. File your business taxes, apply for a license, or pay the majority of. Ad download or email az dor 140es & more fillable forms, register and subscribe now!

Payment For Unpaid Income Tax Small Business Payment Type Options Include:

Web only tax returns for transaction privilege tax (tpt), use tax and withholding tax can be filed using aztaxes.gov. This form is used by residents who file an individual income tax return. Find forms for your industry in minutes. Web 26 rows arizona corporation income tax return (short form) corporate tax forms :.

Arizona Form 140 Check Box 82F If Filing Under Extension 82F Spouse’s.

Employees can still claim exemption from state income tax on the. Information for filing your electronic individual income or small. Web arizona state income tax forms for tax year 2022 (jan. Web whether you are an individual or business, you can find out where your refund is, make a payment, and more.

Employer's Election To Not Withhold Arizona Taxes In December (Includes Instructions).

Details on how to only prepare and print an. Web state of arizona department of revenue toggle navigation. 1 withhold from gross taxable wages at the percentage checked (check only one. Web questions and answers for new arizona form a 4 (2023) changes to arizona income tax withholding.

/1040-tax-return-5a68a8e48023b90019451c13.jpg)