Wv Non Resident Tax Form

Wv Non Resident Tax Form - Use form wv/nrer to apply for a refund of the amount of tax withheld on the sale or transfer of wv real property interest(s) by a nonresident individual. Complete, edit or print tax forms instantly. In addition to completing this summary form, each tax credit has a. More about the west virginia form it140nrc. Web tax information and assistance: Web hereby certify, under penalties provided by law, that i am not a resident of west virginia, that i reside in the state of ________________ and live at the address shown on this. This publication provides general information regarding. This return is required if the nonresident has taxable income from any other west virginia source. We last updated west virginia form it140nrs in april 2021 from the west virginia department of revenue. If at any time hereafter i become a resident of west virginia, or otherwise lose my status of being exempt from west virginia withholding taxes, i will.

You can download or print. Web from wages paid to me. If you had west virginia income from a source other than wages and/or. Download or email wv/nrsr & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Web if you are domiciled in west virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to west virginia. Web tax information and assistance: Complete, edit or print tax forms instantly. More about the west virginia form it140nrc. If at any time hereafter i become a resident of west virginia, or otherwise lose my status of being exempt from west virginia withholding taxes, i will.

How do i request a. Web more about the west virginia form it140nrs nonresident. If you had west virginia income from a source other than wages and/or. Web west virginia withholding requirements for sales of real property by nonresidents. In addition to completing this summary form, each tax credit has a. Use form wv/nrer to apply for a refund of the amount of tax withheld on the sale or transfer of wv real property interest(s) by a nonresident individual. Web this form is used by individuals to summarize tax credits that they claim against their personal income tax. Get ready for tax season deadlines by completing any required tax forms today. Web fi ling the income tax return. Web if you are domiciled in west virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to west virginia.

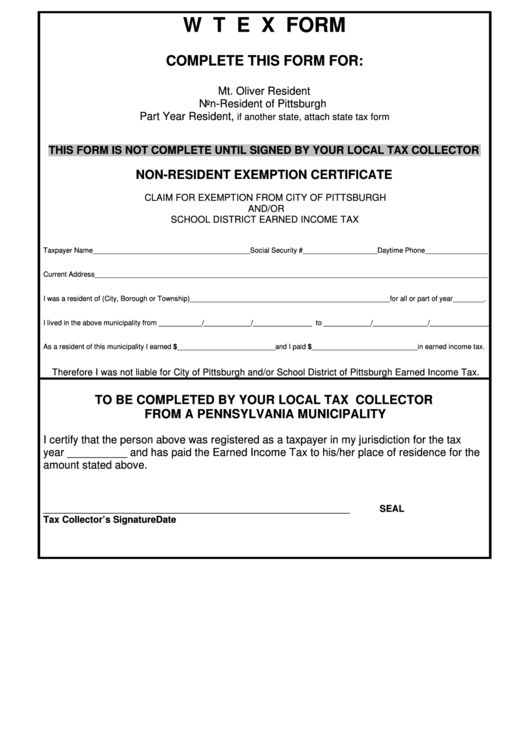

Form Wtex NonResident Exemption Certificate printable pdf download

You can download or print. If at any time hereafter i become a resident of west virginia, or otherwise lose my status of being exempt from west virginia withholding taxes, i will. Get ready for tax season deadlines by completing any required tax forms today. Web more about the west virginia form it140nrs nonresident. In addition to completing this summary.

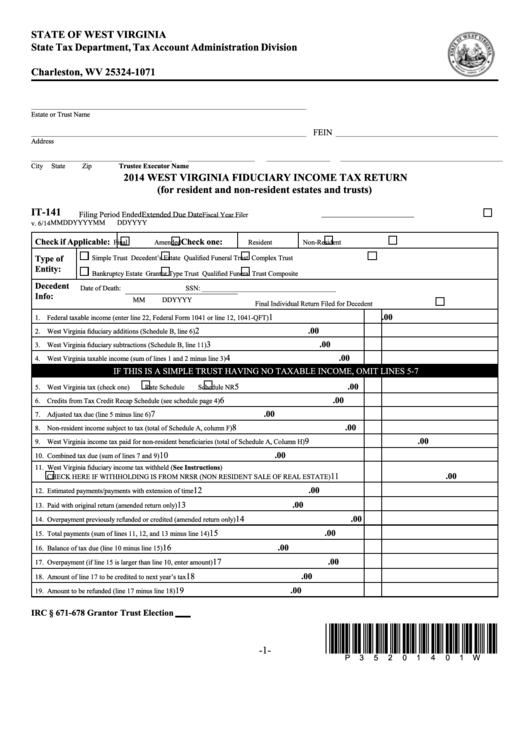

Form It141 West Virginia Fiduciary Tax Return (For Resident

Use form wv/nrer to apply for a refund of the amount of tax withheld on the sale or transfer of wv real property interest(s) by a nonresident individual. Complete, edit or print tax forms instantly. How do i request a. Web more about the west virginia form it140nrs nonresident. If at any time hereafter i become a resident of west.

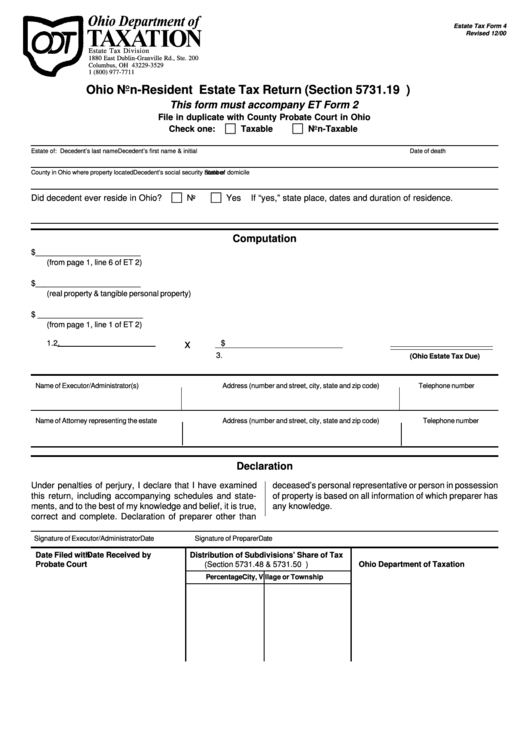

Estate Tax Form 4 Ohio NonResident Estate Tax Return 2000

Download or email wv/nrsr & more fillable forms, register and subscribe now! Get ready for tax season deadlines by completing any required tax forms today. If you had west virginia income from a source other than wages and/or. Use form wv/nrer to apply for a refund of the amount of tax withheld on the sale or transfer of wv real.

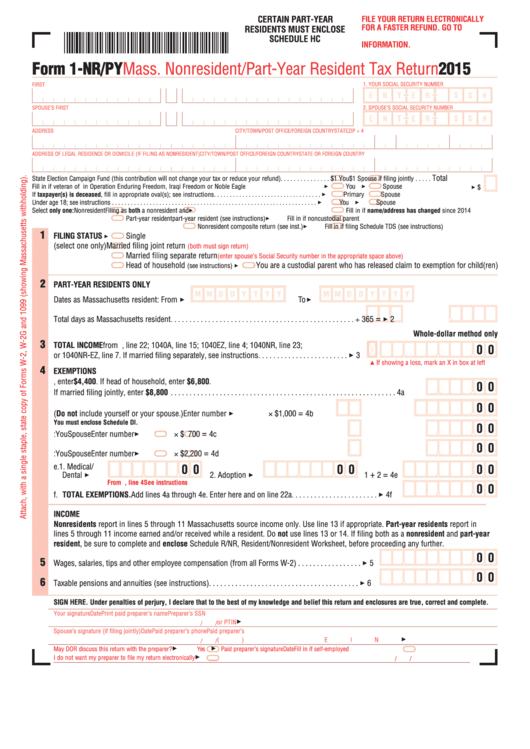

Form 1Nr/py Mass. Nonresident/partYear Resident Tax Return 2015

Web if you are domiciled in west virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to west virginia. Web this form is used by individuals to summarize tax credits that they claim against their personal income tax. If you had west virginia income from a source.

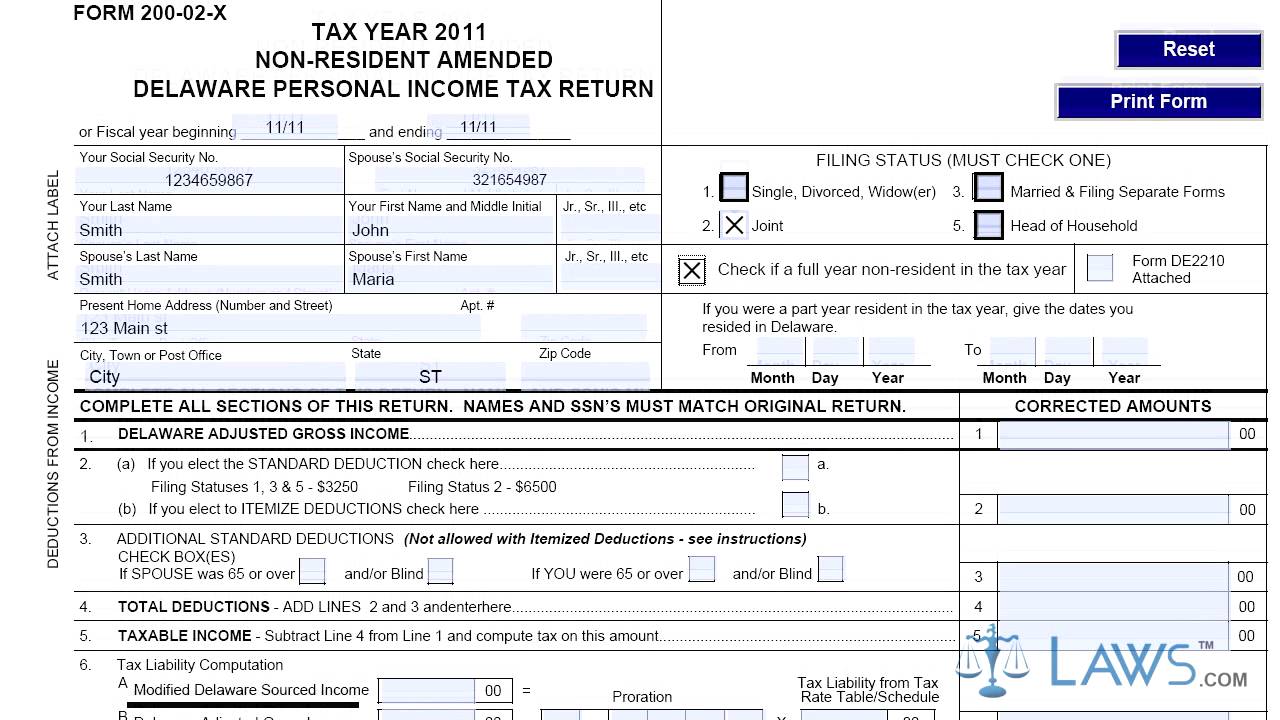

Form 200 02 X Non Resident Amended Delaware Personal Tax Return

Download or email wv/nrsr & more fillable forms, register and subscribe now! If you had west virginia income from a source other than wages and/or. In addition to completing this summary form, each tax credit has a. Web fi ling the income tax return. If at any time hereafter i become a resident of west virginia, or otherwise lose my.

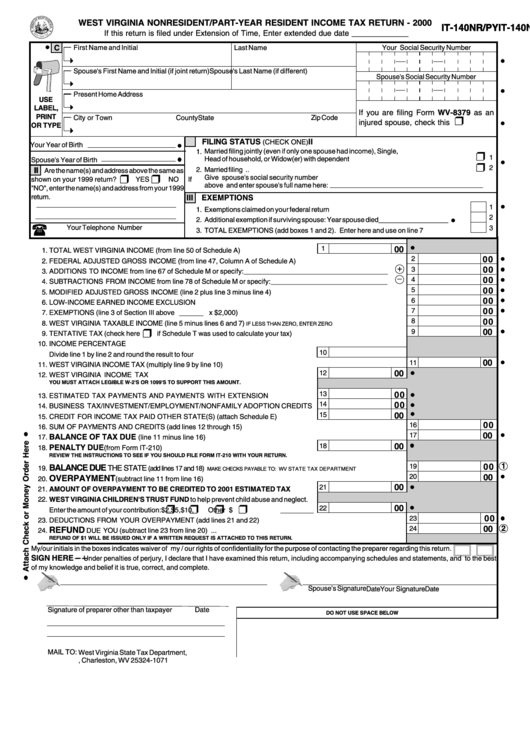

Form It140nr/py West Virginia Nonresident/partYear Resident

Complete, edit or print tax forms instantly. This publication provides general information regarding. Web fi ling the income tax return. If at any time hereafter i become a resident of west virginia, or otherwise lose my status of being exempt from west virginia withholding taxes, i will. If you had west virginia income from a source other than wages and/or.

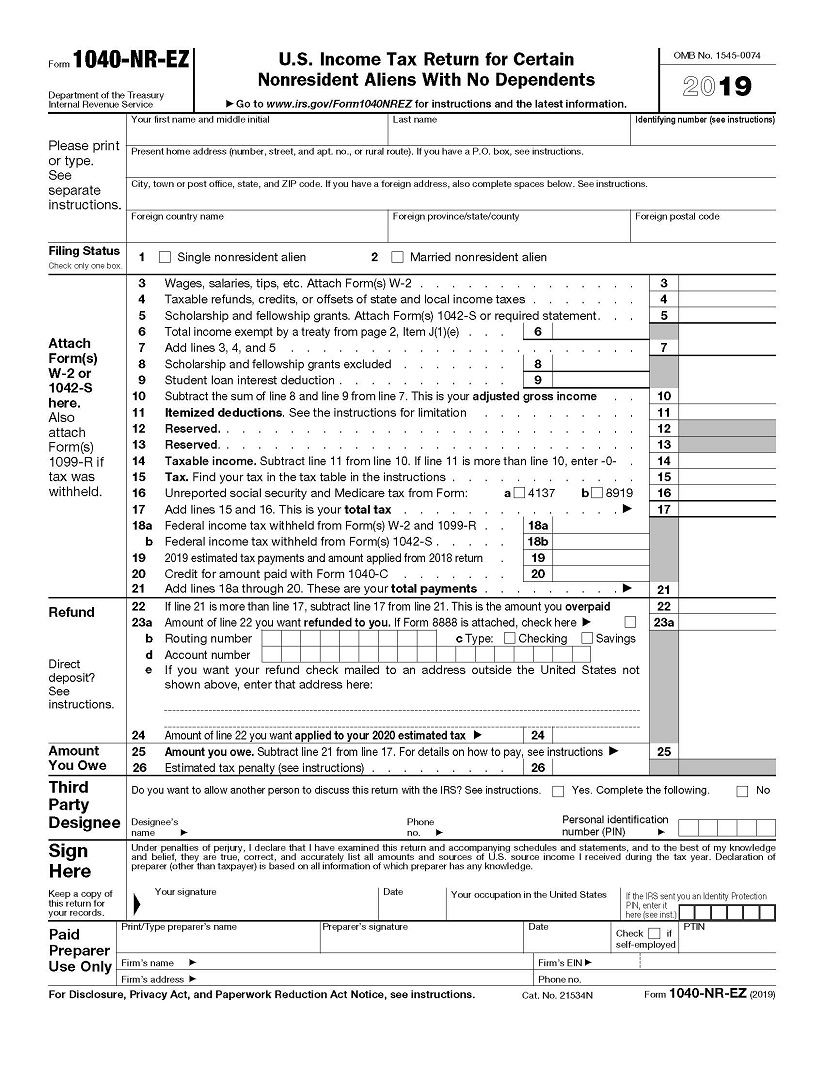

The Complete J1 Student Guide to Tax in the US

Use form wv/nrer to apply for a refund of the amount of tax withheld on the sale or transfer of wv real property interest(s) by a nonresident individual. Web this form is used by individuals to summarize tax credits that they claim against their personal income tax. How do i request a. We last updated west virginia form it140nrs in.

Delaware Non Resident Form 200 02 Fill Out and Sign Printable PDF

You can download or print. Web hereby certify, under penalties provided by law, that i am not a resident of west virginia, that i reside in the state of ________________ and live at the address shown on this. Complete, edit or print tax forms instantly. Web tax information and assistance: Download or email wv/nrsr & more fillable forms, register and.

Which nonresident US tax forms you should file YouTube

If you had west virginia income from a source other than wages and/or. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. We last updated west virginia form it140nrs in april 2021 from the west virginia department of revenue. In addition to completing this summary form, each tax credit has a.

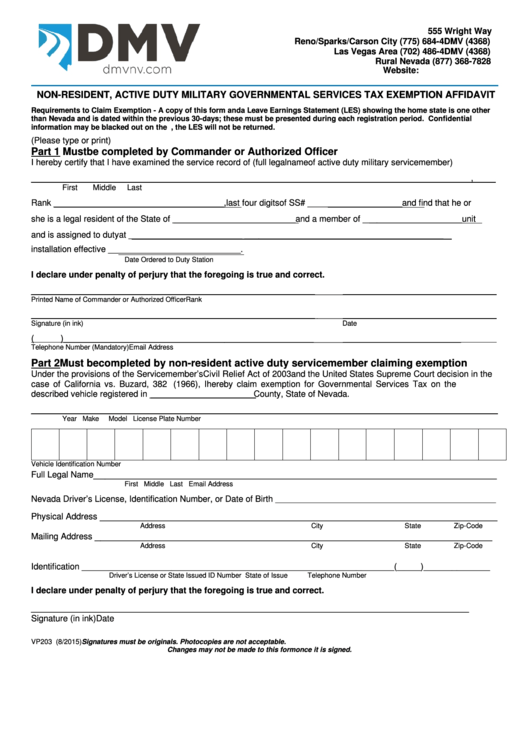

Top 51 Nevada Dmv Forms And Templates free to download in PDF format

Web if you are domiciled in west virginia and spent more than 30 days in the state, you must file a resident return and report all of your income to west virginia. If you had west virginia income from a source other than wages and/or. We last updated west virginia form it140nrs in april 2021 from the west virginia department.

Web If You Are Domiciled In West Virginia And Spent More Than 30 Days In The State, You Must File A Resident Return And Report All Of Your Income To West Virginia.

Web hereby certify, under penalties provided by law, that i am not a resident of west virginia, that i reside in the state of ________________ and live at the address shown on this. Web fi ling the income tax return. This return is required if the nonresident has taxable income from any other west virginia source. Web more about the west virginia form it140nrs nonresident.

In Addition To Completing This Summary Form, Each Tax Credit Has A.

Web from wages paid to me. We last updated west virginia form it140nrs in april 2021 from the west virginia department of revenue. Web this form is used by individuals to summarize tax credits that they claim against their personal income tax. Web west virginia withholding requirements for sales of real property by nonresidents.

This Publication Provides General Information Regarding.

You can download or print. If at any time hereafter i become a resident of west virginia, or otherwise lose my status of being exempt from west virginia withholding taxes, i will. If you had west virginia income from a source other than wages and/or. Web tax information and assistance:

Use Form Wv/Nrer To Apply For A Refund Of The Amount Of Tax Withheld On The Sale Or Transfer Of Wv Real Property Interest(S) By A Nonresident Individual.

How do i request a. Get ready for tax season deadlines by completing any required tax forms today. Download or email wv/nrsr & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly.