Worksheet For Form 2210

Worksheet For Form 2210 - Is line 6 equal to or. Information about form 2210 and its. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. Underpayment of estimated tax by individuals, estates, and trusts. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Web penalties, interest and exceptions. Enter the total penalty from line 14 of the worksheet for. You don’t owe a penalty. Round all money items to whole dollars. Easily fill out pdf blank, edit, and sign them.

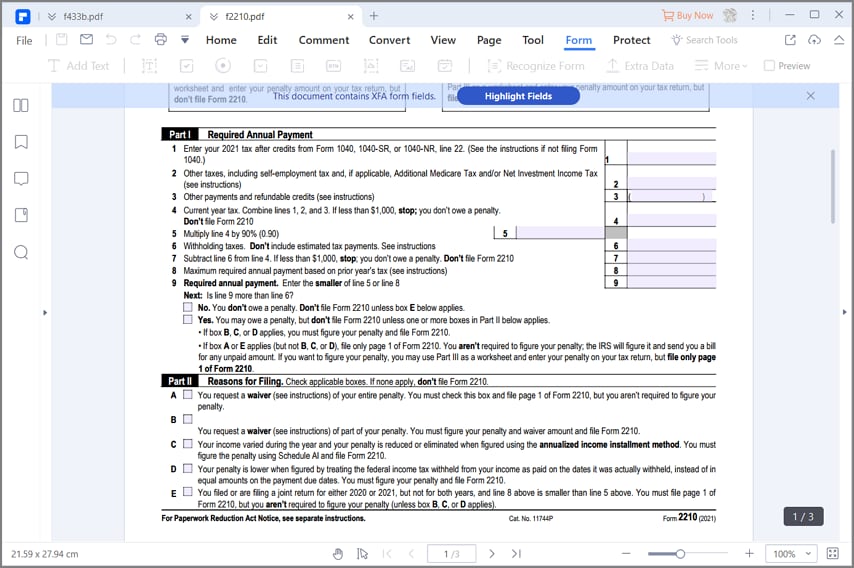

Part ii reasons for filing. Save or instantly send your ready documents. No d complete lines 8 and 9 below. Yes adon’t file form 2210. Is line 4 or line 7 less than $1,000? If more than one payment was applied to fully pay the underpayment amount in a column (line 1a), enter. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. Web form 2210 can be used as a worksheet and doesn't need to be filed with your tax return in many cases. Web instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to. Enter the total penalty from line 14 of the worksheet for.

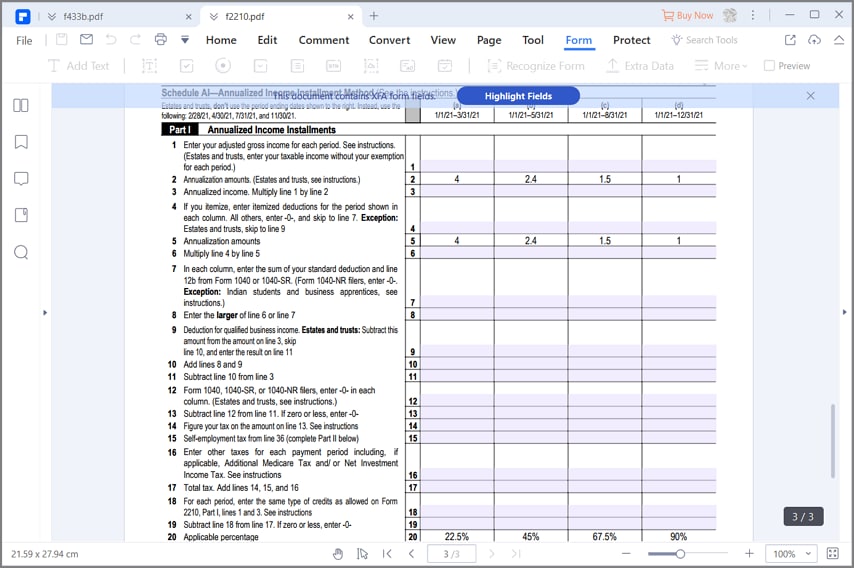

Web worksheet for form 2210, part iv, section b—figure the penalty =iiiii (penalty worksheet) keep for your records complete rate period 1 of each column before going to the next. Underpayment of estimated tax by individuals, estates, and trusts. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Easily fill out pdf blank, edit, and sign them. Web worksheet and enter your penalty on your tax return, but file only page 1 of form 2210. Web (use the worksheet for form 2210, part iv, section b—figure the penalty in the instructions.) 27 : Web penalties, interest and exceptions. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Department of the treasury internal revenue service. No d complete lines 8 and 9 below.

IRS Form 2210Fill it with the Best Form Filler

Round all money items to whole dollars. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Web complete lines 1 through 7 below. It can be used to determine if there is a penalty and you may. Easily fill out pdf blank, edit, and sign them.

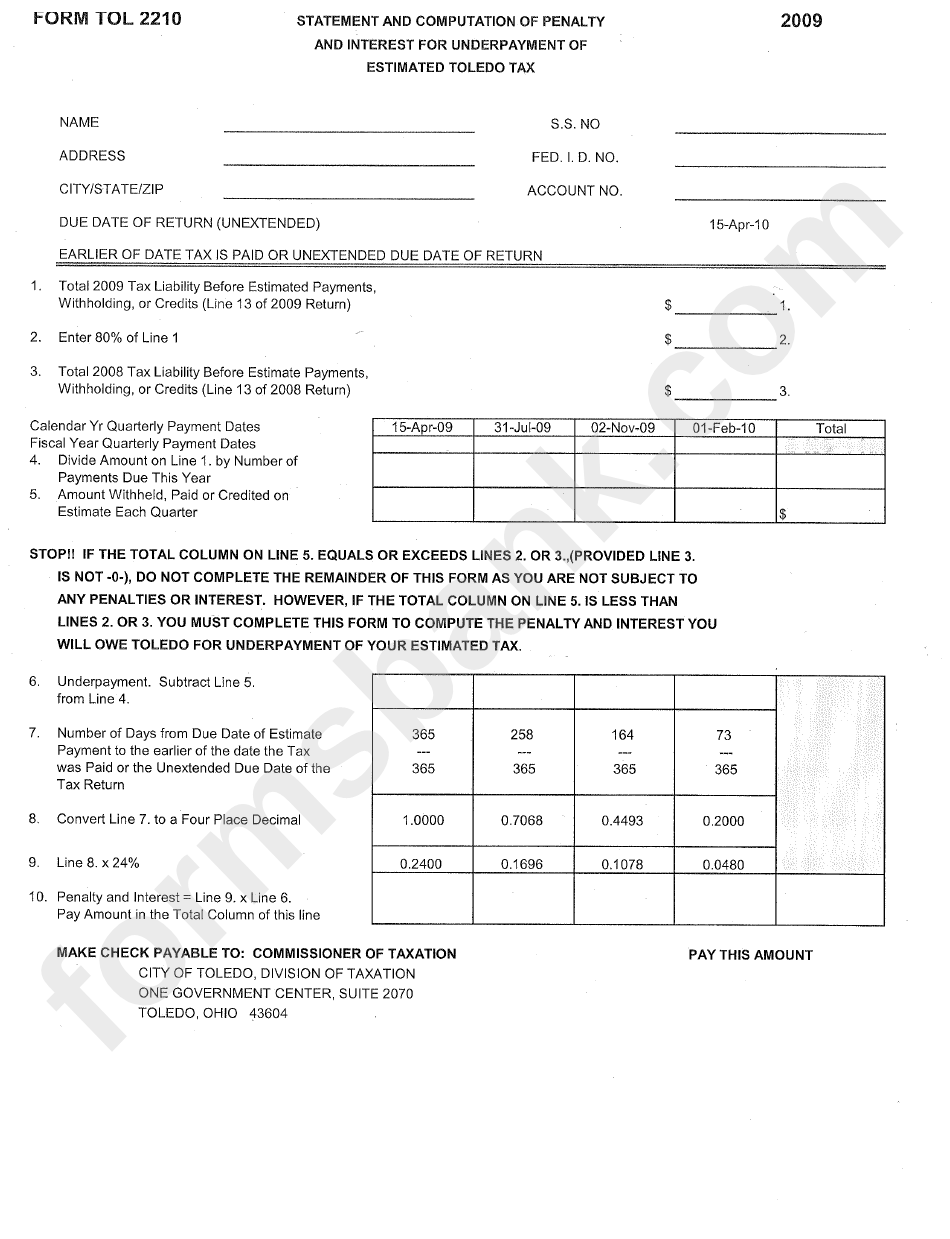

Form Tol 2210 Statement And Computation Of Penalty And Interest

Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Department of the treasury internal revenue service. Enter the total penalty from line 14 of the worksheet for. No d complete lines 8 and 9 below.

IRS Form 2210Fill it with the Best Form Filler

Information about form 2210 and its. Web worksheet for form 2210, part iv, section b—figure the penalty =iiiii (penalty worksheet) keep for your records complete rate period 1 of each column before going to the next. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Web worksheet (worksheet for form 2210, part iii, section b—figure the.

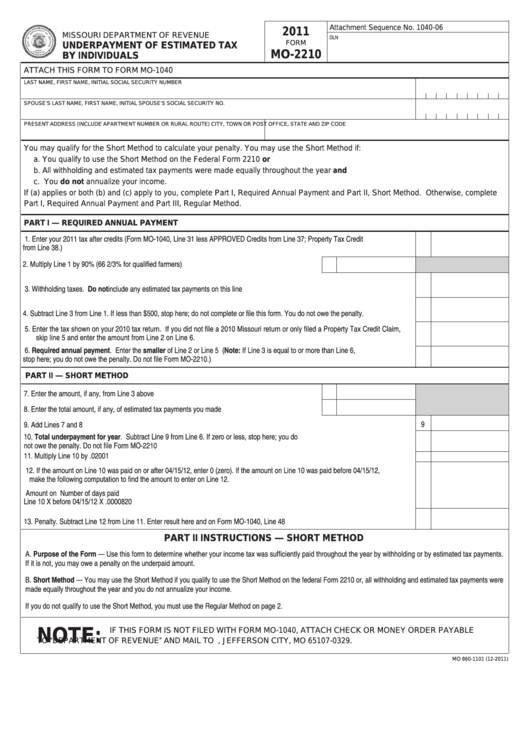

Fillable Form Mo2210 Underpayment Of Estimated Tax By Individuals

No d complete lines 8 and 9 below. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Part ii reasons for filing. It can be used to determine if there is a penalty and you may. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers.

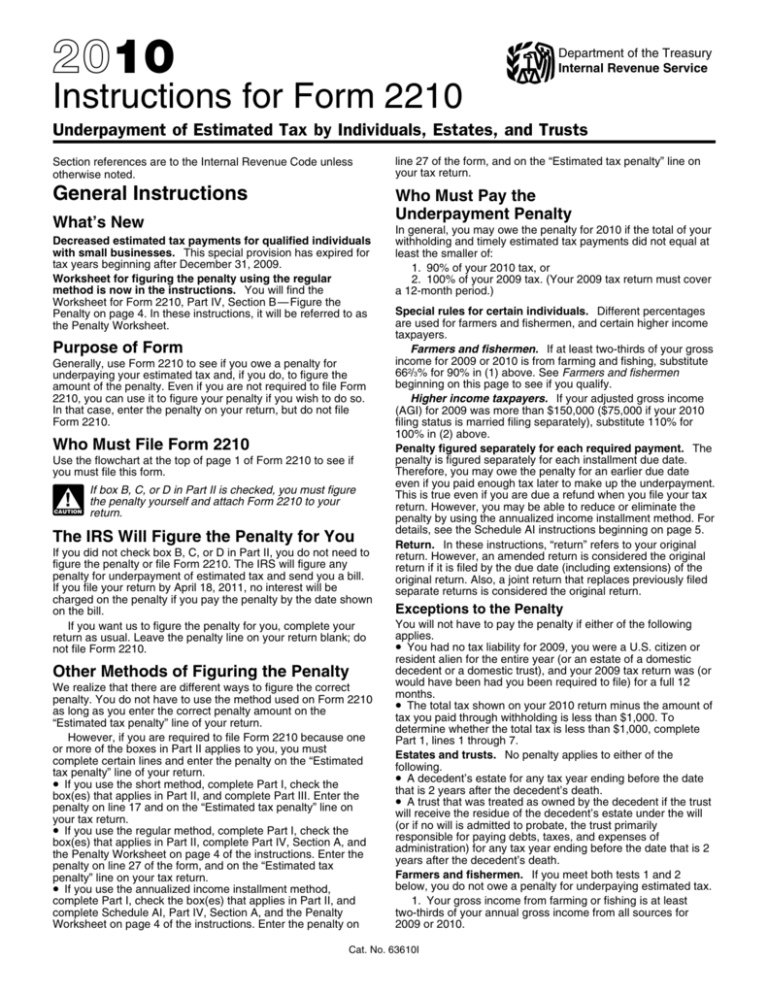

Instructions for Form 2210

Enter the total penalty from line 14 of the worksheet for. Web penalties, interest and exceptions. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. You don’t owe a penalty. Web instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service.

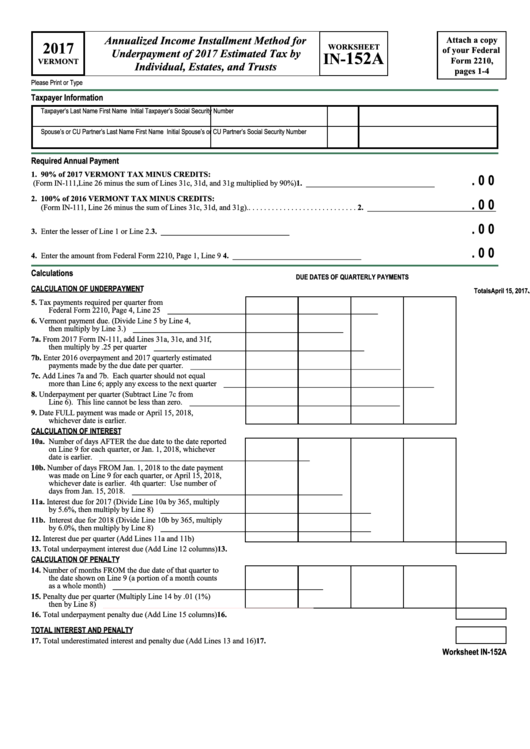

Form 2210 Worksheet In152a Annualized Installment Method

Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. The information in this section completes form 2210 or form 2210f and calculates the penalty for failure to file, penalty for failure to pay, and. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Save or instantly send.

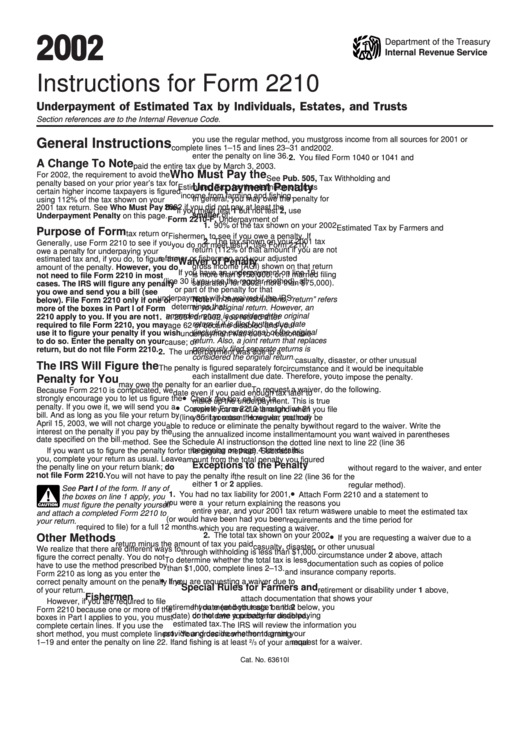

Instructions For Form 2210 Underpayment Of Estimated Tax By

Web form 2210 can be used as a worksheet and doesn't need to be filed with your tax return in many cases. Save or instantly send your ready documents. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. If more than one payment.

Instructions For Form 2210 Underpayment Of Estimated Tax By

It can be used to determine if there is a penalty and you may. The information in this section completes form 2210 or form 2210f and calculates the penalty for failure to file, penalty for failure to pay, and. You don’t owe a penalty. Web penalties, interest and exceptions. Is line 4 or line 7 less than $1,000?

Form 2210 Fill and Sign Printable Template Online US Legal Forms

Part ii reasons for filing. Web form 2210 is used to determine how much you owe in underpayment penalties on your balance due. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax. Yes adon’t file form 2210. Web worksheet and enter your penalty on your tax return, but file only page.

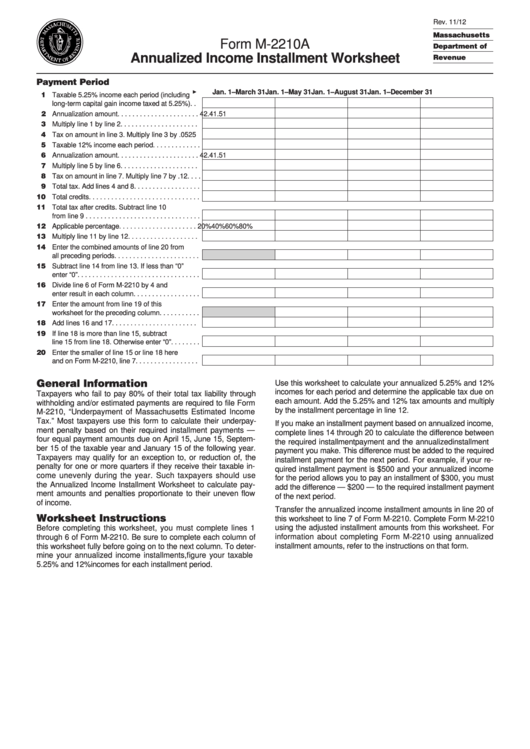

Fillable Form M2210a Annualized Installment Worksheet

Yes adon’t file form 2210. It can be used to determine if there is a penalty and you may. Web worksheet for form 2210, part iv, section b—figure the penalty =iiiii (penalty worksheet) keep for your records complete rate period 1 of each column before going to the next. Web complete lines 1 through 7 below. Department of the treasury.

Information About Form 2210 And Its.

Easily fill out pdf blank, edit, and sign them. Web complete lines 1 through 7 below. Web worksheet for form 2210, part iv, section b—figure the penalty =iiiii (penalty worksheet) keep for your records complete rate period 1 of each column before going to the next. Enter the penalty on form 2210, line 19, and on the “estimated tax penalty” line on your tax.

Web Worksheet (Worksheet For Form 2210, Part Iii, Section B—Figure The Penalty), Later.

No d complete lines 8 and 9 below. The information in this section completes form 2210 or form 2210f and calculates the penalty for failure to file, penalty for failure to pay, and. Web worksheet (worksheet for form 2210, part iii, section b—figure the penalty), later. Is line 4 or line 7 less than $1,000?

If None Apply, Don’t File Form 2210.

Web instructions for form 2210 underpayment of estimated tax by individuals, estates, and trusts department of the treasury internal revenue service section references are to. Web (use the worksheet for form 2210, part iv, section b—figure the penalty in the instructions.) 27 : Yes adon’t file form 2210. Part ii reasons for filing.

Web Worksheet And Enter Your Penalty On Your Tax Return, But File Only Page 1 Of Form 2210.

Web penalties, interest and exceptions. Round all money items to whole dollars. Save or instantly send your ready documents. If more than one payment was applied to fully pay the underpayment amount in a column (line 1a), enter.