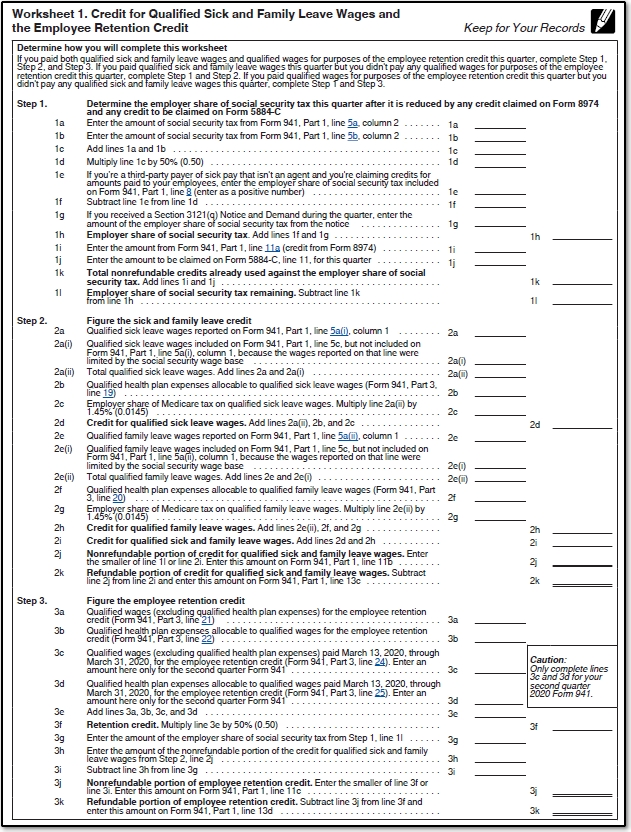

Worksheet 1 Form 941

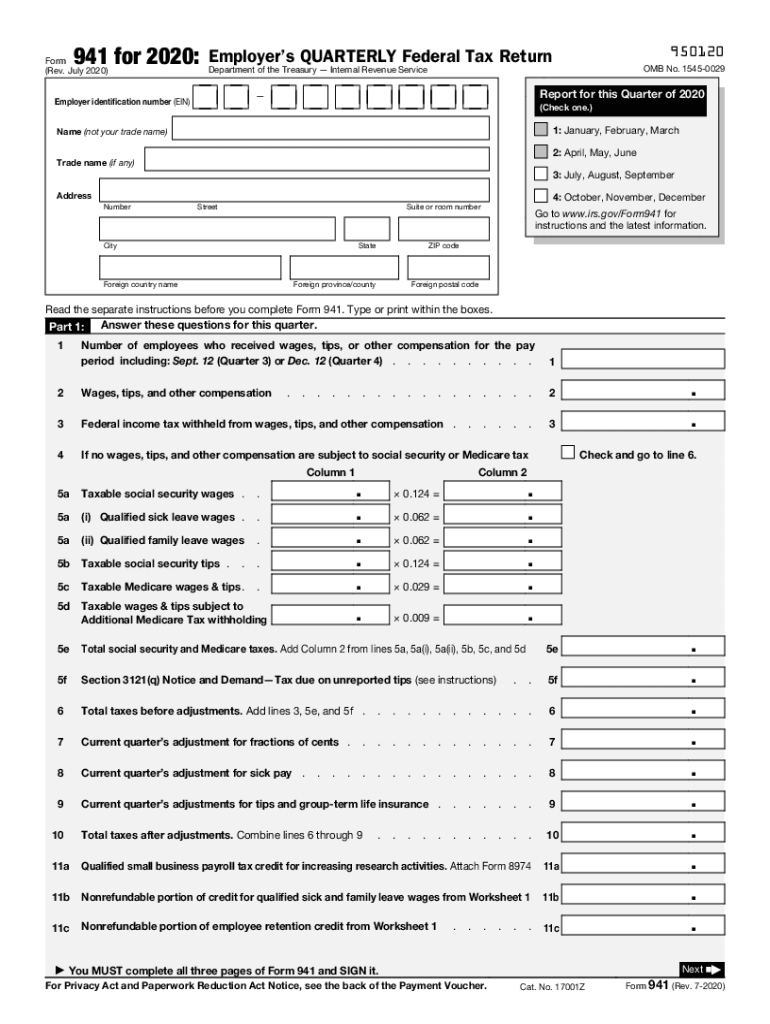

Worksheet 1 Form 941 - This is just a helpful tool that the irs created to help you calculate the refundable and nonrefundable portion of tax credits. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. The 941 form mentions worksheet 1 and line items that will come from worksheet 1, but it's not included when filling out the 941. We are trying to take the credit on the 941 form which requires a worksheet 1. Web what is the purpose of worksheet 1? Web what is worksheet 1? In das 2021, a different version of the worksheet is specific to quarter 2021. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county

Know about the new and revised 941 worksheets and it’s steps at taxbandits. In das 2021, a different version of the worksheet is specific to quarter 2021. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web changes to form 941 (rev. Because this is a quarterly tax return, the business must complete it at the end of every quarter. Form 941 is used to determine Web worksheet 1 for form 941 i am trying to complete my 941 for quarter 2 2020 and worksheet 1 is no where to be found. This worksheet is for your records and to assist you in completing the new data fields of form 941. Who will find worksheet 1 helpful? Worksheet 1 is not an official attachment to form 941, therefore you won’t have to worry about submitting it to the irs.

Explain your corrections for this quarter. It is only a tool to aid in the calculations while filing form 941 for 2022. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. We need it to figure and collect the right amount of tax. The credit for sick & family leave wages and employee retention credit (worksheet1) is designed to accompany the newly revised form 941 for the second quarter of 2020 and beyond. These changes are based on form 8974 changes for the first quarter of 2023. A second version of the worksheet in das 2020 was released to calculate the credit for quarters 3 and 4. March 2023) employer’s quarterly federal tax return department of the treasury — internal revenue service employer identification number (ein) — name (not your trade name) trade name (if any) address number street suite or room number city state zip code foreign country name foreign province/county Web the form 941 for the quarter for which the credit is being claimed has been filed. Why is worksheet 1 important?

941 Worksheet 1 Credit for Qualified Sick and Family Leave Wages and

Form 941 is used to determine The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. Web changes to form 941 (rev. It reports information related to certain withholdings: Who will find worksheet 1 helpful?

How to fill out IRS Form 941 2019 PDF Expert

Web cheer reply stan99sp level 1 october 05, 2020 06:18 am thank you but i need it for the employee retention tax credit and not to defer the social security tax, they have a spot to enter the form 7200 advances but the client did not take any. The credit for sick & family leave wages and employee retention credit.

Irs Forms 2020 Printable Fill Out and Sign Printable PDF Template

Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. These changes are based on form 8974 changes for the first quarter of 2023. Income tax, social security tax, and medicare tax. Web here january 12, 2023 draft as of instructions for form 941 (rev. It has a series.

Worksheet 1 Can Help You Complete The Revised Form 941 Blog TaxBandits

The irs has updated the first step of worksheet 1 and reintroduced worksheet 2. Web the form 941 for the quarter for which the credit is being claimed has been filed. We are trying to take the credit on the 941 form which requires a worksheet 1. Know about the new and revised 941 worksheets and it’s steps at taxbandits..

941x Worksheet 1 Excel

Form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on a quarterly basis. In das 2021, a different version of the worksheet is specific to quarter 2021. We need it to figure and collect the right amount of tax. The irs has updated the first step of worksheet 1 and reintroduced worksheet 2. Explain.

Form 941 Instructions & FICA Tax Rate [+ Mailing Address]

Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on Web what is worksheet 1? Any employer who files the quarterly employment tax form to the irs under cares act and employees retention credit should use this. The july 2020 revision of form 941.

Employee Retention Credit Calculation Worksheet

Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. What are the new changes in form 941 worksheets for 2023? Web here january 12, 2023 draft as of instructions for form 941 (rev. Form 941, employer's quarterly federal tax return, is used by businesses who file their taxes on.

Form 941

We are trying to take the credit on the 941 form which requires a worksheet 1. The 941 form mentions worksheet 1 and line items that will come from worksheet 1, but it's not included when filling out the 941. Because this is a quarterly tax return, the business must complete it at the end of every quarter. For more.

Updated Form 941 Worksheet 1, 2, 3 and 5 for Q2 2021 Revised 941

Web changes to form 941 (rev. In das 2021, a different version of the worksheet is specific to quarter 2021. This is just a helpful tool that the irs created to help you calculate the refundable and nonrefundable portion of tax credits. Why is worksheet 1 important? Any employer who files the quarterly employment tax form to the irs under.

Worksheet for 2016 Forms W3/941

A second version of the worksheet in das 2020 was released to calculate the credit for quarters 3 and 4. The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. March 2023) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the.

Who Will Find Worksheet 1 Helpful?

Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. Web information about form 941, employer's quarterly federal tax return, including recent updates, related forms, and instructions on how to file. These changes are based on form 8974 changes for the first quarter of 2023. Don’t worry, you don’t have to attach worksheet 1 to irs form 941 when you submit it to the irs.

Web Here January 12, 2023 Draft As Of Instructions For Form 941 (Rev.

We are trying to take the credit on the 941 form which requires a worksheet 1. Web use worksheet 1 to figure the credit for leave taken before april 1, 2021. In das 2021, a different version of the worksheet is specific to quarter 2021. This is just a helpful tool that the irs created to help you calculate the refundable and nonrefundable portion of tax credits.

Because This Is A Quarterly Tax Return, The Business Must Complete It At The End Of Every Quarter.

These changes are based on form 8974 changes for the first quarter of 2023. Web form 941 for 2023: Web the form 941 for the quarter for which the credit is being claimed has been filed. What are the new changes in form 941 worksheets for 2023?

Web Worksheet 1 For Form 941 I Am Trying To Complete My 941 For Quarter 2 2020 And Worksheet 1 Is No Where To Be Found.

Form 941 is used to determine Use worksheet 3 to figure the credit for leave taken after march 31, 2021, and before october 1, 2021. Web beginning with the second quarter 2020 form 941, the form has been updated to include worksheet 1 (on page 5) that is used to calculate the credits. March 2023) employer's quarterly federal tax return department of the treasury internal revenue service section references are to the internal revenue code unless otherwise noted.

![Form 941 Instructions & FICA Tax Rate [+ Mailing Address]](https://fitsmallbusiness.com/wp-content/uploads/2018/12/word-image-1461-730x932.png)

.jpg)