Wisconsin 1099 Form

Wisconsin 1099 Form - Web watch your mailbox: A new online application is available on the department of revenue's website which allows individuals and their authorized. Web dorcommunications@wisconsin.gov or 608.266.2300. An irs form that you will get from etf by january 31 if you are receiving a wrs benefit payment. Claimants' statements are available online for the past six years,. If the amount paid by you to the contractor was. Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Learn more about how to simplify your businesses 1099 reporting. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. It includes your total benefit amount, the taxable portion of the benefit,.

If the amount paid by you to the contractor was. Learn more about how to simplify your businesses 1099 reporting. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits. Requesting previously filed tax returns. My.unemployment.wisconsin.gov log on using your username and password. Web wisconsin department of revenue: The wisconsin department of revenue mandates employers and other payers to file 1099 forms,. Web watch your mailbox: Unemployment benefits paid to you federal and state income taxes withheld from your benefits repayments of overpaid. If you received less than $600, you will not receive a 1099,.

Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web dorcommunications@wisconsin.gov or 608.266.2300. Web wisconsin department of revenue: Learn more about how to simplify your businesses 1099 reporting. Web all 1099s have been sent to child care providers who received $600 or more through the child care counts program. What are the 1099 filing requirements for the state of wisconsin? Unemployment benefits paid to you federal and state income taxes withheld from your benefits repayments of overpaid. A new online application is available on the department of revenue's website which allows individuals and their authorized. Web watch your mailbox:

【人気ダウンロード!】 form 1099nec nonemployee compensation 665839Form 1099nec

Any refund or overpayment credit amount issued during 2022 to anyone who claimed. Web wisconsin department of revenue: Learn more about how to simplify your businesses 1099 reporting. My.unemployment.wisconsin.gov log on using your username and password. The wisconsin department of revenue mandates employers and other payers to file 1099 forms,.

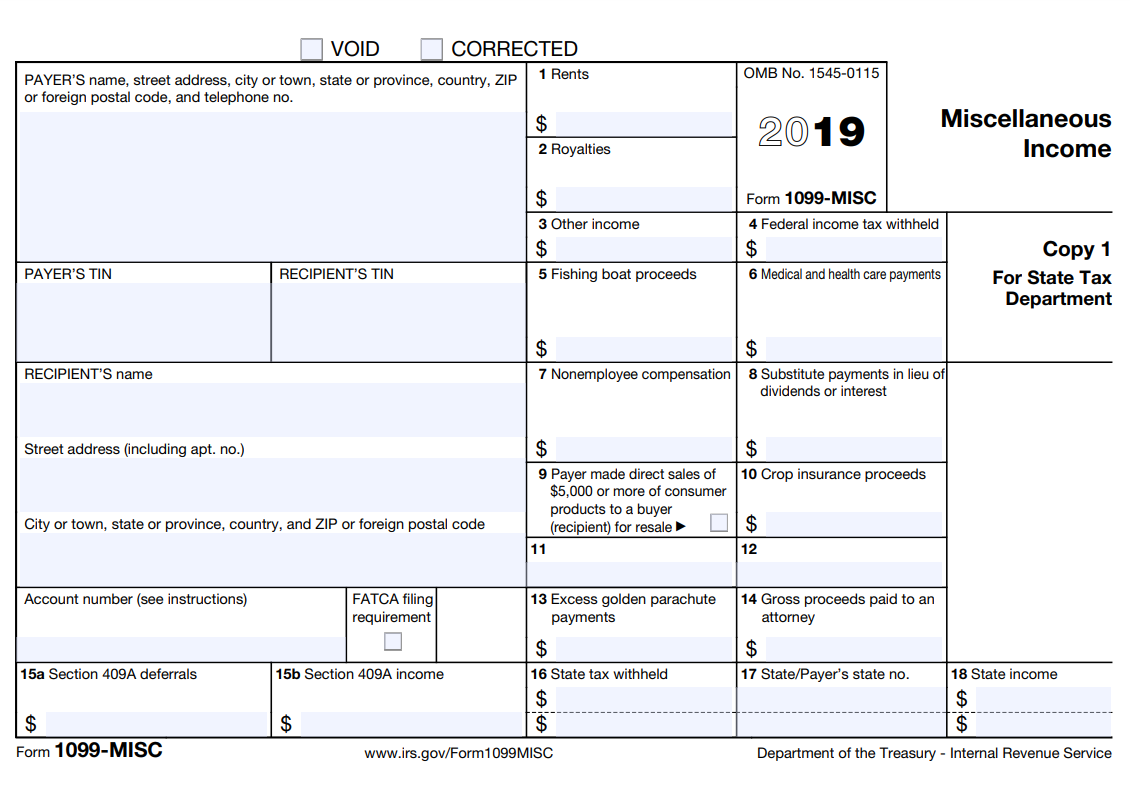

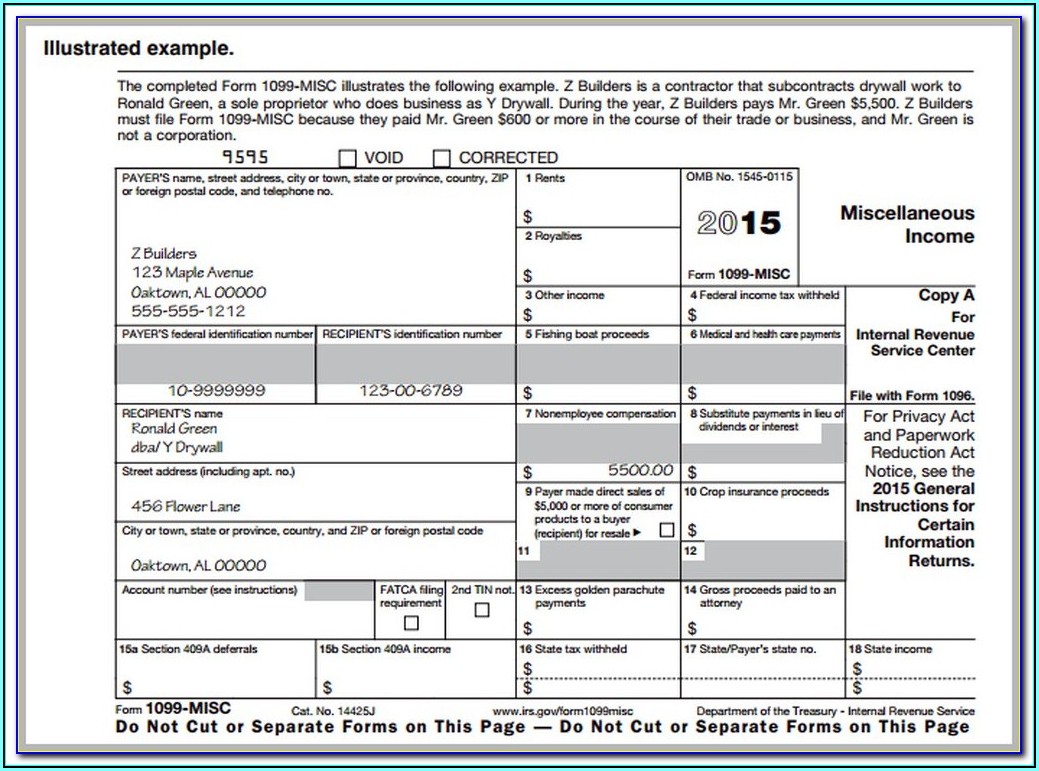

Wisconsin 1099 Misc form Best Of form 1096 A Simple Guide to Mailing

Web watch your mailbox: My.unemployment.wisconsin.gov log on using your username and password. Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web wisconsin department of revenue: Unemployment benefits paid to you federal and state income taxes withheld from your benefits repayments of overpaid.

Filing 1099 Forms For Employees Universal Network

What are the 1099 filing requirements for the state of wisconsin? Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. If you received less than $600, you will not receive a 1099,. Learn more about how to simplify your businesses 1099 reporting. Any refund or overpayment credit amount issued during 2022 to anyone who.

W2 & 1099NEC Printing and Efiling Software, FREE Trial

Web wisconsin department of revenue: Requesting previously filed tax returns. My.unemployment.wisconsin.gov log on using your username and password. The wisconsin department of revenue mandates employers and other payers to file 1099 forms,. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage audits.

1099 Form Fillable Pdf Form Resume Examples Wk9yWNXV3D

A new online application is available on the department of revenue's website which allows individuals and their authorized. Web all 1099s have been sent to child care providers who received $600 or more through the child care counts program. Web dorcommunications@wisconsin.gov or 608.266.2300. Web wisconsin department of revenue: If the amount paid by you to the contractor was.

Wisconsin Form 1099 Filing Universal Network Free Nude Porn Photos

The wisconsin department of revenue mandates employers and other payers to file 1099 forms,. Requesting previously filed tax returns. What are the 1099 filing requirements for the state of wisconsin? Any refund or overpayment credit amount issued during 2022 to anyone who claimed. Claimants' statements are available online for the past six years,.

1099NEC or 1099MISC What has changed and why it matters Pro News Report

An irs form that you will get from etf by january 31 if you are receiving a wrs benefit payment. Web wisconsin department of revenue: Learn more about how to simplify your businesses 1099 reporting. Uslegalforms allows users to edit, sign, fill & share all type of documents online. If you received less than $600, you will not receive a.

Wisconsin Retirement System Form 1099 R Universal Network

My.unemployment.wisconsin.gov log on using your username and password. The wisconsin department of revenue mandates employers and other payers to file 1099 forms,. Web dorcommunications@wisconsin.gov or 608.266.2300. Web all 1099s have been sent to child care providers who received $600 or more through the child care counts program. Claimants' statements are available online for the past six years,.

How To File Form 1099NEC For Contractors You Employ VacationLord

What are the 1099 filing requirements for the state of wisconsin? Web wisconsin department of revenue: Forms for all state taxes (income, business, estate, partnership, sales, utility, manufacturing, alcohol, withholding, telco,. Web dorcommunications@wisconsin.gov or 608.266.2300. Web wisconsin dor my tax account allows taxpayers to register tax accounts, file taxes, make payments, check refund statuses, search for unclaimed property, and manage.

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

What are the 1099 filing requirements for the state of wisconsin? Requesting previously filed tax returns. An irs form that you will get from etf by january 31 if you are receiving a wrs benefit payment. My.unemployment.wisconsin.gov log on using your username and password. Web watch your mailbox:

If The Amount Paid By You To The Contractor Was.

What are the 1099 filing requirements for the state of wisconsin? Claimants' statements are available online for the past six years,. Web watch your mailbox: Sign up now to go paperless.

Web Wisconsin Dor My Tax Account Allows Taxpayers To Register Tax Accounts, File Taxes, Make Payments, Check Refund Statuses, Search For Unclaimed Property, And Manage Audits.

Web dorcommunications@wisconsin.gov or 608.266.2300. The wisconsin department of revenue mandates employers and other payers to file 1099 forms,. Web wisconsin department of revenue: It includes your total benefit amount, the taxable portion of the benefit,.

Unemployment Benefits Paid To You Federal And State Income Taxes Withheld From Your Benefits Repayments Of Overpaid.

An irs form that you will get from etf by january 31 if you are receiving a wrs benefit payment. Web all 1099s have been sent to child care providers who received $600 or more through the child care counts program. Uslegalforms allows users to edit, sign, fill & share all type of documents online. A new online application is available on the department of revenue's website which allows individuals and their authorized.

Requesting Previously Filed Tax Returns.

My.unemployment.wisconsin.gov log on using your username and password. Learn more about how to simplify your businesses 1099 reporting. If you received less than $600, you will not receive a 1099,. Any refund or overpayment credit amount issued during 2022 to anyone who claimed.