Why Is Turbotax Asking For Form 8615

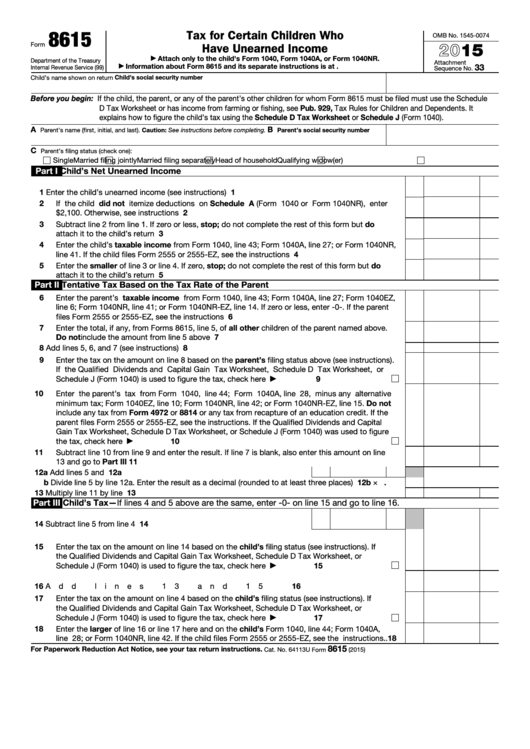

Why Is Turbotax Asking For Form 8615 - File an extension in turbotax online before the deadline to avoid a late filing penalty. If you have investment income. Web the form 8615 issue has been fixed. Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 is for what is commonly known as kiddie tax. the kiddie tax applies to any unearned income, not just investment income. Click jump to child’s income; For 2020, a child must file form 8615 if all. Web to fill out form 8615 in turbotax: The child had more than $2,200 of. Web march 27, 2023 11:53 am.

You had more than $2,300 of unearned income. Ago because of kiddie tax rules, if you have unearned income the tax rate is linked to your parents tax rate. If you are using the turbotax cd/download software program, open. 30 minutes later the return was. Web 1 2 comments best add a comment ronnevee • 3 yr. Click jump to child’s income; Web form 8615 is for what is commonly known as kiddie tax. the kiddie tax applies to any unearned income, not just investment income. Web march 27, 2023 11:53 am. The form is only required to be included on your return if all of the conditions below are met: i worked at the end of 2022 seems to infer that your were a ft.

Web 1 2 comments best add a comment ronnevee • 3 yr. Web form 8615 is used to figure your child's tax on unearned income. You had more than $2,300 of unearned income. Looking at the above answer, it seems to be because of this if a child's interest, dividends, and other. This is why you are. Form 8615 (the kiddie tax) applies to fulltime students, under 24. The child had more than $2,300 of unearned income. If you are using the turbotax cd/download software program, open. The child had more than $2,200 of unearned income. For 2020, a child must file form 8615 if all.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

2019) but the form isn't available on turbotax for filing. Web how do i file an irs extension (form 4868) in turbotax online? The child had more than $2,300 of unearned income. Web march 27, 2023 11:53 am. Web the irs website says that the new form 8615 (kiddie tax) is available (reflecting changes from dec.

TurboTax Why you should file your taxes early AOL Finance

Looking at the above answer, it seems to be because of this if a child's interest, dividends, and other. Web the form 8615 issue has been fixed. Web form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: Type child’s income in search in the upper right; How do.

PPT Don’t Miss Out On These Facts About the Form 8615 TurboTax

The form is only required to be included on your return if all of the conditions below are met: Web form 8615 must be filed for any child who meets all of the following conditions. Web form 8615 must be filed for any child who meets all of the following conditions. If turbotax is asking for your parents' income, it.

Why I Love TurboTax brokeGIRLrich

The child had more than $2,200 of. Web form 8615 is used to figure your child's tax on unearned income. Web how do i file an irs extension (form 4868) in turbotax online? The child is required to file a tax return. Web form 8615 is for what is commonly known as kiddie tax. the kiddie tax applies to any.

Why TurboTax Is Asking About Stimulus Checks

Looking at the above answer, it seems to be because of this if a child's interest, dividends, and other. The form is only required to be included on your return if all of the conditions below are met: Web form 8615 must be filed for any child who meets all of the following conditions. Ago because of kiddie tax rules,.

Why You Need TurboTax Premier File Taxes Digitally Divine Lifestyle

This is why you are. Obviously, in order to calculate the tax at. Web how do i file an irs extension (form 4868) in turbotax online? Parent's net lt gain shouldn't be less than or equal to zero. How do i clear and.

Why TurboTax Is Asking About Stimulus Checks

Web 1 2 comments best add a comment ronnevee • 3 yr. The child is required to file a tax return. Web form 8615 must be filed with the child’s tax return if all of the following apply: The child is required to file a tax return. Web form 8615 is used to figure your child's tax on unearned income.

Fillable Form 8615 Tax For Certain Children Who Have Unearned

Web to fill out form 8615 in turbotax: Web form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: Type child’s income in search in the upper right; Web the irs website says that the new form 8615 (kiddie tax) is available (reflecting changes from dec. If you have.

What Is IRS Form 8615 Tax For Certain Children Who Have TurboTax

Form 8615 (the kiddie tax) applies to fulltime students, under 24. Ago because of kiddie tax rules, if you have unearned income the tax rate is linked to your parents tax rate. If you are using the turbotax cd/download software program, open. Web 1 2 comments best add a comment ronnevee • 3 yr. Web form 8615 must be filed.

App Teardown Why TurboTax isn't Getting to 1 with a Million

Looking at the above answer, it seems to be because of this if a child's interest, dividends, and other. Type child’s income in search in the upper right; Obviously, in order to calculate the tax at. Parent's net lt gain shouldn't be less than or equal to zero. The child had more than $2,200 of unearned income.

Web Form 8615 Must Be Filed For Any Child Who Meets All Of The Following Conditions.

Web form 8615 is for what is commonly known as kiddie tax. the kiddie tax applies to any unearned income, not just investment income. Web when turbotax did the final checking on my child's return, it put out this complaint: For 2020, a child must file form 8615 if all. Web 1 2 comments best add a comment ronnevee • 3 yr.

Ago Because Of Kiddie Tax Rules, If You Have Unearned Income The Tax Rate Is Linked To Your Parents Tax Rate.

Web form 8615, tax for certain children who have unearned income, is required when a child meets all of the following conditions: Web march 27, 2023 11:53 am. The child had more than $2,200 of unearned income. The child had more than $2,200 of.

Looking At The Above Answer, It Seems To Be Because Of This If A Child's Interest, Dividends, And Other.

You had more than $2,300 of unearned income. Web form 8615 must be filed for any child who meets all of the following conditions. The child is required to file a tax return. Web the form 8615 issue has been fixed.

Web From 8615 Is For The Kiddie Tax, Which Calculates The Tax On Your Investment Income Over $2,100 At Your Parent's Tax Rate.

Web form 8615 is used to figure your child's tax on unearned income. If you have investment income. File an extension in turbotax online before the deadline to avoid a late filing penalty. Web the irs website says that the new form 8615 (kiddie tax) is available (reflecting changes from dec.