Where To Mail Form 9465

Where To Mail Form 9465 - You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. Web how to file form 9465 & address to send to. December 2018) department of the treasury internal revenue service. Then, mail the form to the irs. Visit tax help from form 9465 for more information on paper filing. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. All pages of form 9465 are available on the irs website. If you owe $50,000 or less in taxes, penalties, and interest, you might be able to submit an online installment agreement application through the irs website.

Web how to file form 9465 electronically. Where to mail form 9465 Web if the return is filed after march 31, it may take the irs longer to reply. If you are filing form 9465 with your return, attach it to the front of your return when you file. No street address is needed. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. For instructions and the latest information. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. Visit tax help from form 9465 for more information on paper filing.

Web where to get form 9465: Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service center address shown below the client address. For instructions and the latest information. Visit tax help from form 9465 for more information on paper filing. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. Where to mail form 9465 To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. If you are filing form 9465 with your return, attach it to the front of your return when you file.

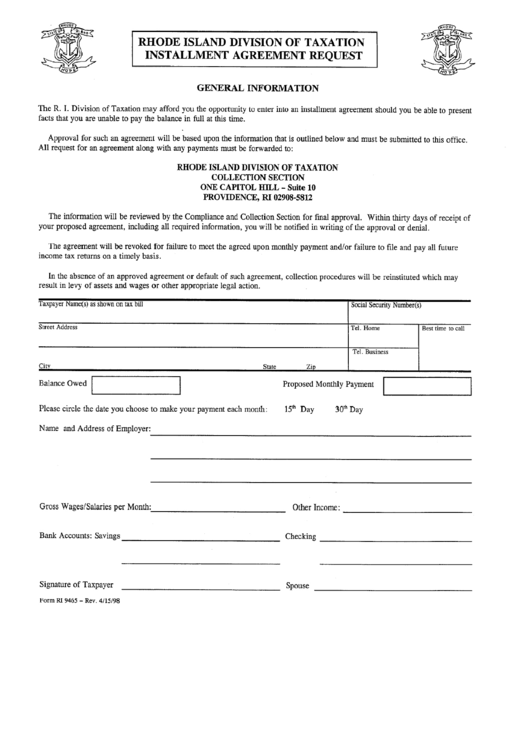

Form Ri 9465 Installment Agreement Request printable pdf download

If you are filing form 9465 with your return, attach it to the front of your return when you file. Web if the return is filed after march 31, it may take the irs longer to reply. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information.

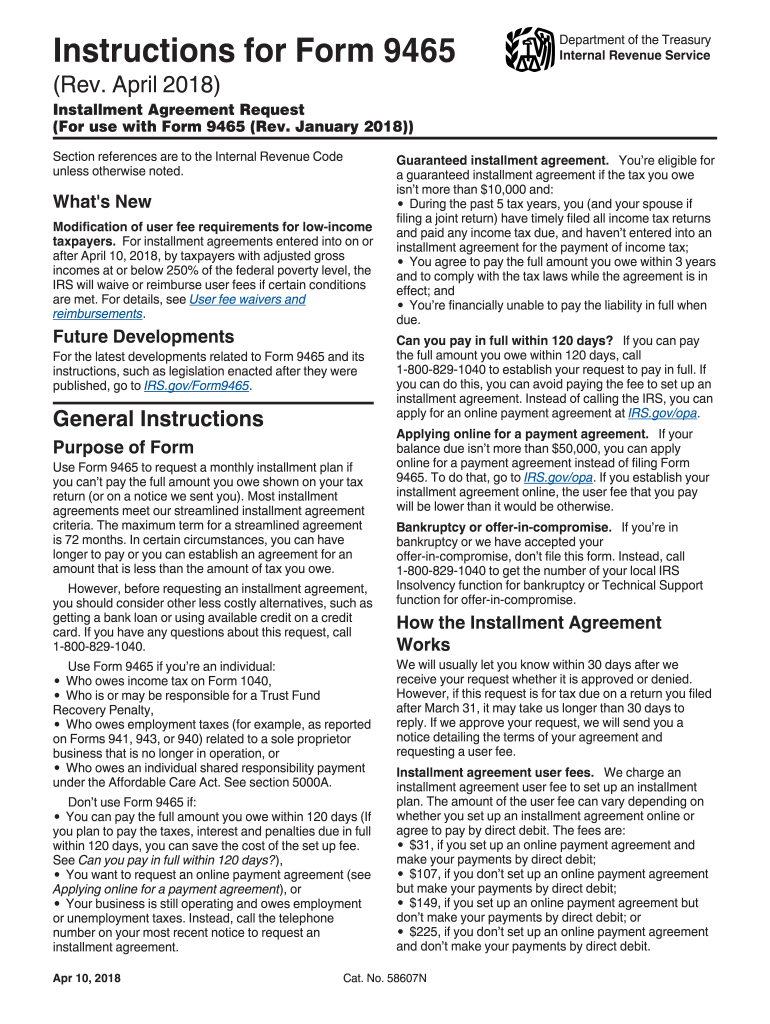

Instructions for Form 9465 Rev April Instructions for Form 9465

Web where to get form 9465: For instructions and the latest information. You can submit form 9465 on its own, or if you are filing your tax return and can't afford to pay the balance, you can submit form 9465 with your. All pages of form 9465 are available on the irs website. Web how to file form 9465 &.

IRS Form 9465 Installment Agreement Request

If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. Web attach form 9465 to the front of your return and send it to the address shown in your tax return.

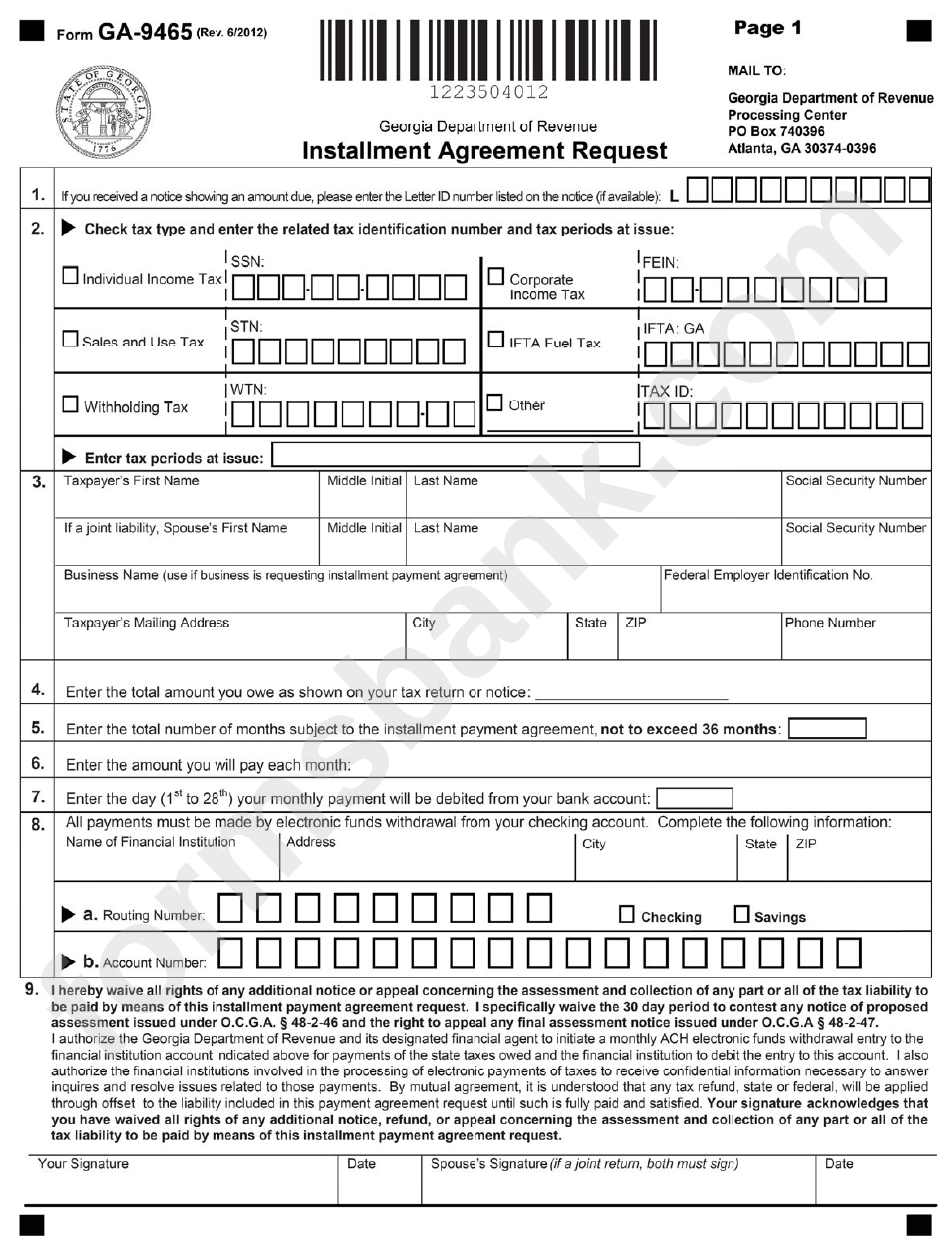

Form Ga9465 Installment Agreement Request printable pdf download

If you are filing this form with your tax return, attach it to the front of the return. Web where to get form 9465: Visit tax help from form 9465 for more information on paper filing. If the return has already been filed or you're filing this form in response to a notice, mail it to the internal revenue service.

Where To Mail Irs Installment Agreement Form 433 D Form Resume

If you have already filed your return or you are filing this form in response to a notice, file form 9465 by itself with the internal revenue service center at the address below for the place where you live. If you are filing this form with your tax return, attach it to the front of the return. If you are.

IRS Form 9465 Instructions for How to Fill it Correctly

Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Then, mail the form to the irs. Web find out where to mail your completed form. Web information about form 9465, installment agreement request, including recent updates, related forms and instructions on how to file. If you have.

Irs Form 9465 Fillable and Editable PDF Template

If you are filing this form with your tax return, attach it to the front of the return. If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. No street address is needed. If you have already filed your return or you are filing this form in response to.

Imágenes de Where Do I Mail Irs Installment Agreement Payments

Where to mail form 9465 If you owe $50,000 or less in taxes, penalties, and interest, you might be able to submit an online installment agreement application through the irs website. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. Web information about form 9465, installment agreement.

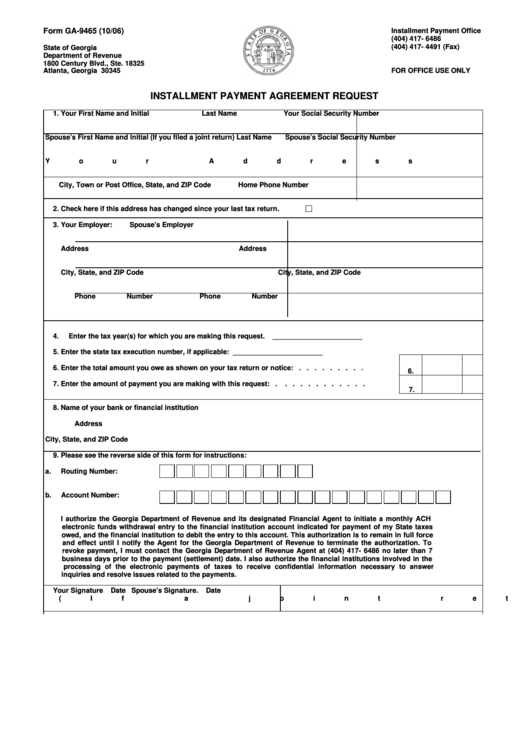

Form Ga9465 Installment Payment Agreement Request printable pdf download

Web how to file form 9465 & address to send to. No street address is needed. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. You can submit form 9465 on its own, or if you are filing your tax return and can't afford.

IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]

If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. If you are filing form 9465 with your return, attach it to the front of your return when you file. Then,.

Instead, Call Dec 23, 2021 Cat.

Web how to file form 9465 & address to send to. Form 9465 is used by taxpayers to request a monthly installment plan if they cannot pay the full amount of tax they owe. To file form 9465 on paper, click on the pdf link on the irs's website, print it out, and fill out the information by hand. Web how to file form 9465 electronically.

Web Information About Form 9465, Installment Agreement Request, Including Recent Updates, Related Forms And Instructions On How To File.

If you owe $50,000 or less in taxes, penalties, and interest, you might be able to submit an online installment agreement application through the irs website. If you are filing this form with your tax return, attach it to the front of the return. Web attach form 9465 to the front of your return and send it to the address shown in your tax return booklet. If you are filing form 9465 with your return, attach it to the front of your return when you file.

You Can Submit Form 9465 On Its Own, Or If You Are Filing Your Tax Return And Can't Afford To Pay The Balance, You Can Submit Form 9465 With Your.

Web where to get form 9465: If you are filing form 9465 separate from your return, refer to the tables below to determine the correct filing address. Web if the return is filed after march 31, it may take the irs longer to reply. Visit tax help from form 9465 for more information on paper filing.

No Street Address Is Needed.

All pages of form 9465 are available on the irs website. Web find out where to mail your completed form. If you have already filed your return or you’re filing this form in response to a notice, file form 9465 by itself with the internal revenue service center using the address in the table below that applies to you. December 2018) department of the treasury internal revenue service.

![IRS Form 9465 [Can't Pay Your Taxes All At Once? READ THIS]](https://help.taxreliefcenter.org/wp-content/uploads/2018/04/ecommerce-payment-pay-money-buy-form-9465-instructions-pb.jpg)