When To Stop Paying Creditors Chapter 7

When To Stop Paying Creditors Chapter 7 - Apply today for financial freedom! Compare online the best pay off debt. Web when to stop using credit cards before filing chapter 7 you'll want to stop credit card use as soon as you realize that you can't pay for your purchases and certainly as soon as you decide to file for bankruptcy. A chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. Web chapter 7 provides relief to debtors regardless of the amount of debts owed or whether a debtor is solvent or insolvent. However, some forms of debt, such as back taxes, court. Web the process of filing chapter 7 bankruptcy generally takes 80 to 100 days from filing to when your debts are discharged. Ad compare the best pay off debt. Therefore, you should stop paying credit card bills if you are about to file for bankruptcy to avoid wasting your. Web if you are under a contract, for example for your residential lease or your cell phone, you can elect to “reject” (or cancel) the contract as part of your chapter 7 filing.

Web you can strip off a junior lien in chapter 13 (not chapter 7) if the value of your home is less than what you owe on the first mortgage. Chapter 7 bankruptcy proceedings can potentially discharge many forms of debt, including credit. Web if you pay back a creditor within a specific period of time before filing bankruptcy, the payment is considered a “preferential transfer.” the bankruptcy trustee can “undo” a preferential transfer. Web an individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or comply with orders of the court, or the debtor voluntarily dismissed the previous case after creditors. Therefore, you should stop paying credit card bills if you are about to file for bankruptcy to avoid wasting your. Web chapter 7 bankruptcy can eliminate credit card balances and other debt, and give you a fresh start, usually within a few months. This rings especially true if you were. But, if you pay more than $600 to any other creditor within 90 days before filing,. Web a creditor could garnish your wages (take money out of your paycheck), levy (seize) the funds in your bank account, or take valuable property. Web yes, you can.

Web because if you make enough money to do so, you probably won't qualify for chapter 7 bankruptcy. We've helped 205 clients find attorneys today. However, depending on how long it had been since you filed chapter 7… Web chapter 7 provides relief to debtors regardless of the amount of debts owed or whether a debtor is solvent or insolvent. Many people worry that falling behind on their credit card monthly payments before filing bankruptcy will look bad on their credit report and destroy their credit. Here are some of the things you should be prepared to do during a chapter 7. While chapter 7 bankruptcies can be relatively straightforward for the debtor, creditors. What can you not do before a chapter 7. Chapter 7 bankruptcy proceedings can potentially discharge many forms of debt, including credit. Web get debt relief now.

How to Stop Creditors from Calling in Jeff Kelly Law Offices

The court requires filers with significant disposable income to pay some or all of your credit card debt through a chapter 13 repayment plan. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. Web get debt relief now. Web the process of filing chapter 7 bankruptcy generally.

Chapter 13 Creditors Meeting YouTube

Plus, a bankruptcy filing will remain on your credit. Web when to stop using credit cards before filing chapter 7 you'll want to stop credit card use as soon as you realize that you can't pay for your purchases and certainly as soon as you decide to file for bankruptcy. A chapter 7 trustee is appointed to convert the debtor’s.

Are creditors threatening collections or legal action? Farber Group

Web if you pay back a creditor within a specific period of time before filing bankruptcy, the payment is considered a “preferential transfer.” the bankruptcy trustee can “undo” a preferential transfer. Apply today for financial freedom! The court requires filers with significant disposable income to pay some or all of your credit card debt through a chapter 13 repayment plan..

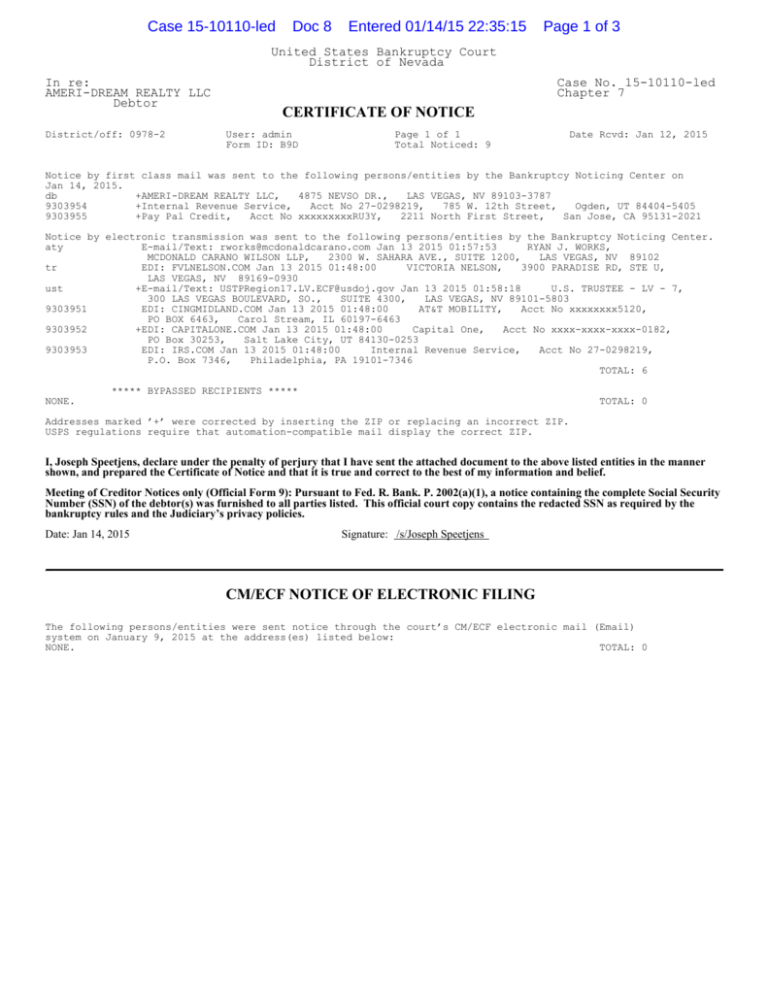

Meeting of Creditors Chapter 7 Asset NonIndividual

Web because if you make enough money to do so, you probably won't qualify for chapter 7 bankruptcy. Web get debt relief now. Web yes, you can. However, some forms of debt, such as back taxes, court. Web an individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition.

Settling debt with creditors vs Chapter 7 Bankruptcy YouTube

Therefore, you should stop paying credit card bills if you are about to file for bankruptcy to avoid wasting your. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. Plus, a bankruptcy filing will remain on your credit. Less effective chapter 13 bankruptcy options would likely be.

Meeting of the Creditors Chapter 7 Bankruptcy Lawyer

Plus, a bankruptcy filing will remain on your credit. Web you can strip off a junior lien in chapter 13 (not chapter 7) if the value of your home is less than what you owe on the first mortgage. Ad compare the best pay off debt. Web an individual cannot file under chapter 7 or any other chapter, however, if.

Stop Creditor Harassment San Jose Bankruptcy Attorney San Francisco

Under bankruptcy law, you can't choose or prefer one creditor over another. Web a creditor could garnish your wages (take money out of your paycheck), levy (seize) the funds in your bank account, or take valuable property. Web chapter 7 bankruptcy can eliminate credit card balances and other debt, and give you a fresh start, usually within a few months..

STOP CREDITORS FROM HARASSING YOU Chapter 7 & 13 Bankruptcy YouTube

Many people worry that falling behind on their credit card monthly payments before filing bankruptcy will look bad on their credit report and destroy their credit. Here are some of the things you should be prepared to do during a chapter 7. However, depending on how long it had been since you filed chapter 7… Using credit cards before filing.

How To Stop Paying Credit Cards Legally? Insurance Noon

Less effective chapter 13 bankruptcy options would likely be available. Web the process of filing chapter 7 bankruptcy generally takes 80 to 100 days from filing to when your debts are discharged. Web chapter 7 bankruptcy can eliminate credit card balances and other debt, and give you a fresh start, usually within a few months. Web in a chapter 7.

» Three Main Reasons Why Creditors Will Not Object to Your Chapter 7

However, the better question is, should you? That's not to say you can't pay your regular monthly bills—you can. Web because if you make enough money to do so, you probably won't qualify for chapter 7 bankruptcy. What can you not do before a chapter 7. Web if you are overwhelmed by debt and ready to stop the harassing collection.

Less Effective Chapter 13 Bankruptcy Options Would Likely Be Available.

Web under both chapter 7 and chapter 13 bankruptcy, your discharge will wipe out credit card debt. Using credit cards before filing for chapter 7 bankruptcy can have downsides. Web chapter 7 bankruptcy erases most unsecured debts, that is, debts without collateral, like medical bills, credit card debt and personal loans. Here are some of the things you should be prepared to do during a chapter 7.

Web Get Debt Relief Now.

Web chapter 7 bankruptcy can eliminate credit card balances and other debt, and give you a fresh start, usually within a few months. However, depending on how long it had been since you filed chapter 7… Chapter 7 bankruptcy proceedings can potentially discharge many forms of debt, including credit. Web when you’re filing chapter 7, there’s more suspicion if your spending spikes in the months before filing because your unsecured debts can be eliminated.

Plus, A Bankruptcy Filing Will Remain On Your Credit.

Ad compare the best pay off debt. Apply today for financial freedom! First name continue because you'll want to avoid mistakes after filing your chapter 7 case, you'll find tips for successfully navigating the bankruptcy process. Web if you pay back a creditor within a specific period of time before filing bankruptcy, the payment is considered a “preferential transfer.” the bankruptcy trustee can “undo” a preferential transfer.

The Court Requires Filers With Significant Disposable Income To Pay Some Or All Of Your Credit Card Debt Through A Chapter 13 Repayment Plan.

Web the process of filing chapter 7 bankruptcy generally takes 80 to 100 days from filing to when your debts are discharged. A chapter 7 trustee is appointed to convert the debtor’s assets into cash for distribution among creditors. While chapter 7 bankruptcies can be relatively straightforward for the debtor, creditors. Web an individual cannot file under chapter 7 or any other chapter, however, if during the preceding 180 days a prior bankruptcy petition was dismissed due to the debtor's willful failure to appear before the court or comply with orders of the court, or the debtor voluntarily dismissed the previous case after creditors.