What Is The Turbotax Consent Form

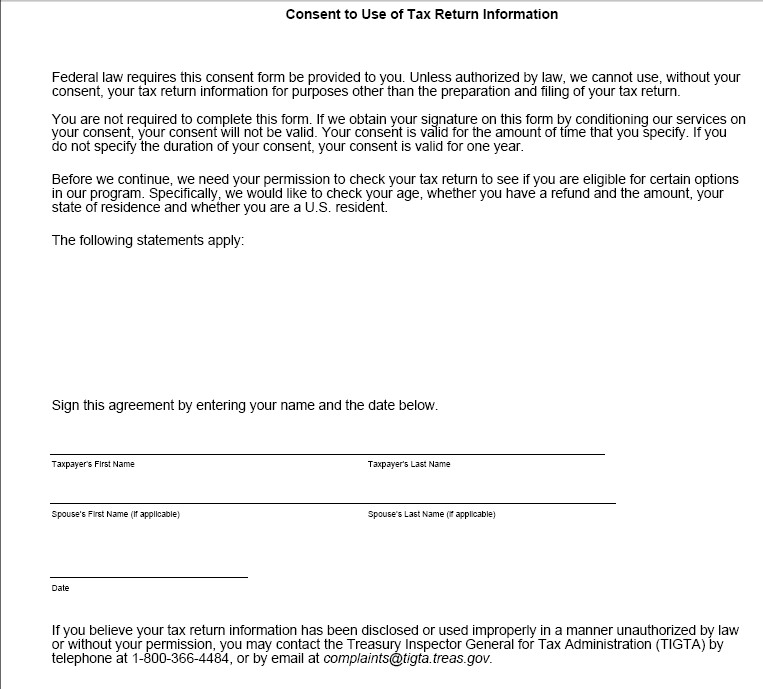

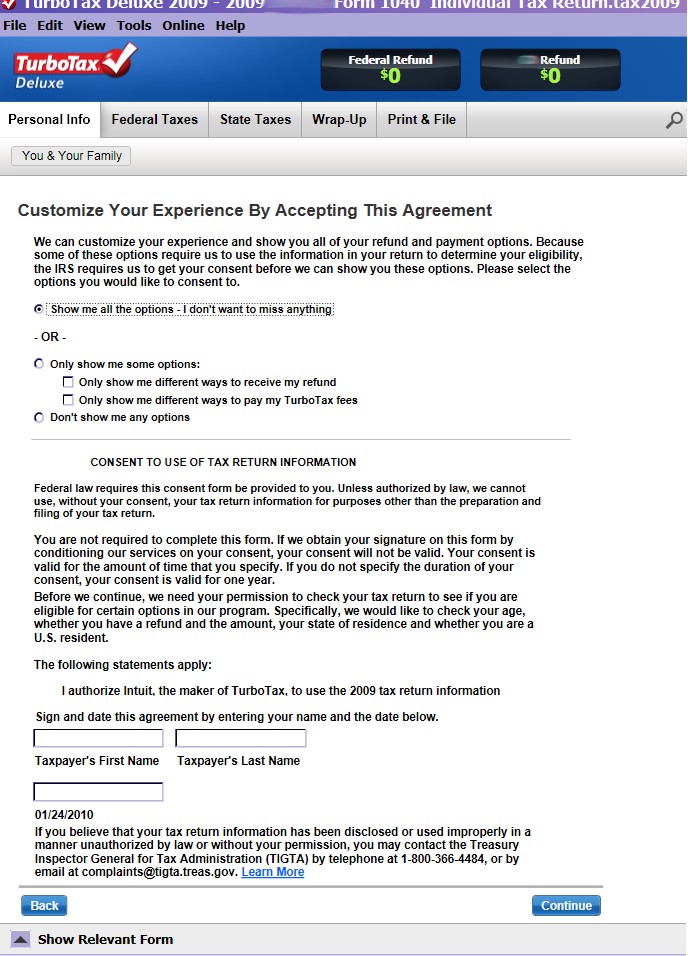

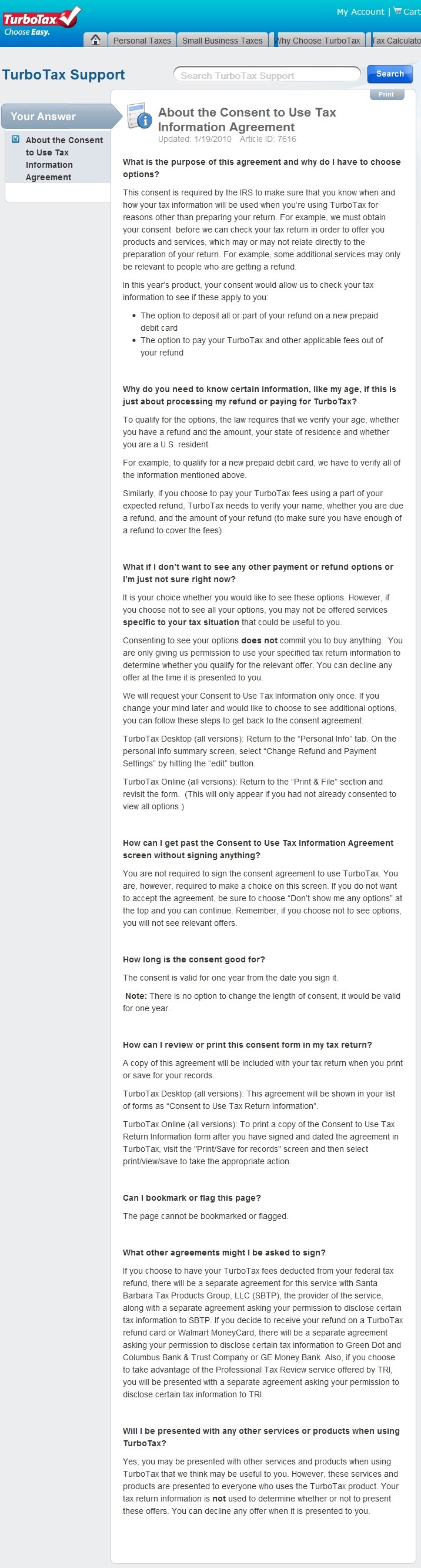

What Is The Turbotax Consent Form - Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. In fact, this consent form allows intuit and their. Web what is the consent to use of tax return information? Federal law requires this consent form be provided to you (“you” refers to. This is a requirement from the irs in order to file your return. 2.1k views 1 year ago. Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally. Web i'm a little confused by the consent to disclosure form. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web deluxe to maximize tax deductions.

Web for turbotax, you have to email privacy@intuit.com. Federal law requires this consent form be provided to you (“you” refers to. Free military tax filing discount. Web limit provides you receive to only whichever you need Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally. It may seem silly, but. Do most people agree and consent? Turbotax live tax expert products. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax software. Web 1 best answer.

This is what the consent form is allowing us to do. Authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally. I consent to allow my intermediate. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Turbotax live tax expert products. What are the pluses and minuses? The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. It may seem silly, but. Be sure to mention that you’d like to revoke your “consent for use of tax return information.” Web 1 best answer.

TurboTax 2016 Deluxe Home and Business Free Download 10kSoft

Web deluxe to maximize tax deductions. It may seem silly, but. Turbotax live tax expert products. What are the pluses and minuses? Be sure to mention that you’d like to revoke your “consent for use of tax return information.”

What is the TurboTax consent form? YouTube

Free military tax filing discount. Unless authorized by law, we cannot use your tax return information for purposes other. Web what is the consent to use of tax return information? Web consents are paper or electronic documents that contain specific information, including the names of the tax return preparer and the taxpayer. It may seem silly, but.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

This is what the consent form is allowing us to do. Web what is the consent to use of tax return information? It may seem silly, but. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Web limit provides you receive to only.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Web for turbotax, you have to email privacy@intuit.com. I consent to allow my intermediate. Federal law requires this consent form be provided to you (“you” refers to. Web 1 best answer. Easily sort by irs forms to find the product that best fits your tax.

TurboTax Maker Linked To Fight Against ‘ReturnFree’ Tax System

Easily sort by irs forms to find the product that best fits your tax. Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your refund to pay. Web see what tax forms are included in turbotax basic, deluxe, premier and home & business tax.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

2.1k views 1 year ago. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed. Unless authorized by law, we cannot use your tax return information for purposes other. Web 1 best answer. In fact, this consent form allows intuit and their.

CONVERTING TURBOTAX FILES TO PDF

Web 1 best answer. 2.1k views 1 year ago. Unless authorized by law, we cannot use your tax return information for purposes other. Web for turbotax, you have to email privacy@intuit.com. Web this year's scam is a bogus consent form at the start of the process that looks as if the irs requires that it be signed.

Adoptive Child Worksheet Turbotax Worksheet Resume Examples

In fact, this consent form allows intuit and their. Web deluxe to maximize tax deductions. Do most people agree and consent? Web consent to use of tax return information (“we,” “us,” and “our”) printed name of tax preparer. I consent to allow my intermediate.

form 2106 turbotax Fill Online, Printable, Fillable Blank

What are the pluses and minuses? In fact, this consent form allows intuit and their. 2.1k views 1 year ago. Easily sort by irs forms to find the product that best fits your tax. Federal law requires this consent form be provided to you (“you” refers to.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

Web deluxe to maximize tax deductions. Do most people agree and consent? Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your refund to pay. Web for turbotax, you have to email privacy@intuit.com. Unless authorized by law, we cannot use your tax return information.

Unless Authorized By Law, We Cannot Use Your Tax Return Information For Purposes Other.

Web 1 best answer. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Web for turbotax, you have to email privacy@intuit.com. Web consents are paper or electronic documents that contain specific information, including the names of the tax return preparer and the taxpayer.

What Are The Pluses And Minuses?

Web file form 8821 to: Web limit provides you receive to only whichever you need This is what the consent form is allowing us to do. Web no, the disclosure agreement is to allow the turbotax program to access your information to determine if you qualify for things such as using your refund to pay.

When Setting Up Your Account, You Will Review A Page Titled Personalize Your Taxslayer Experience With Two Consents (For.

Web what is the consent to use of tax return information? Easily sort by irs forms to find the product that best fits your tax. It may seem silly, but. Federal law requires this consent form be provided to you (“you” refers to.

Web I'm A Little Confused By The Consent To Disclosure Form.

I consent to allow my intermediate. Web the quote is federal law requires this consent form be provided to you. Do most people agree and consent? This is a requirement from the irs in order to file your return.