What Is The 8862 Tax Form

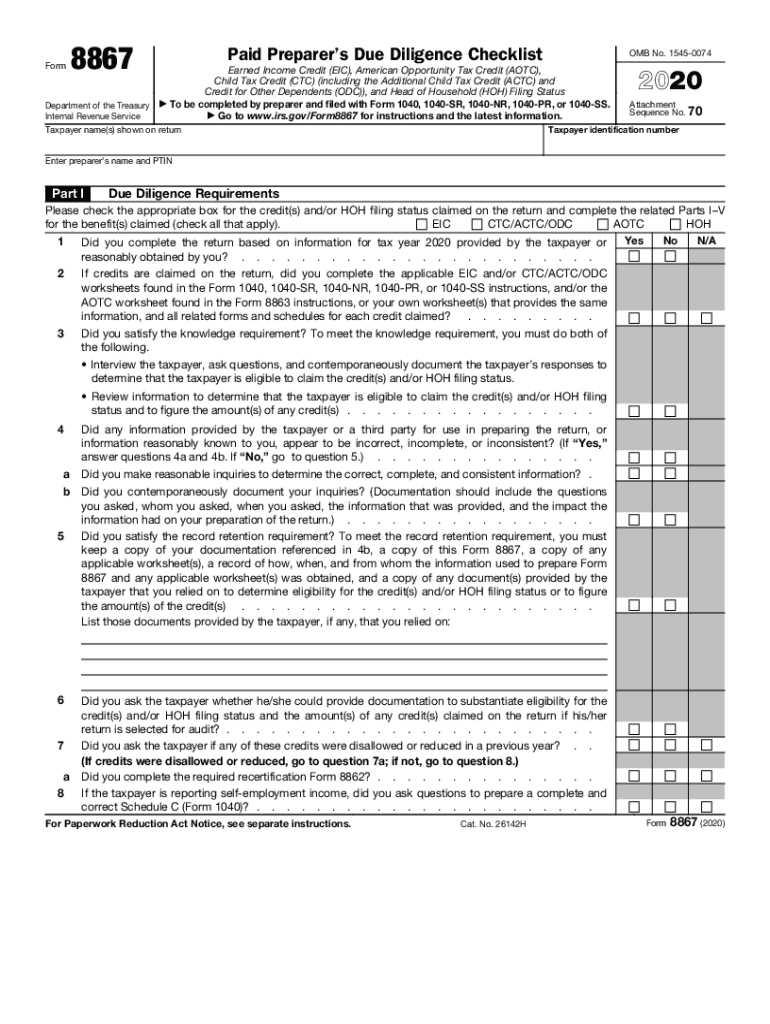

What Is The 8862 Tax Form - Web how do i enter form 8862? Web more from h&r block. Reconcile it with any advance payments of the premium tax credit (aptc). Ad access irs tax forms. Complete, edit or print tax forms instantly. This form is for income earned in tax year 2022, with tax returns due in april. It allows you to claim. Complete, edit or print tax forms instantly. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Married filing jointly vs separately.

Complete, edit or print tax forms instantly. Web how do i enter form 8862? Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web irs form 8862, information to claim certain credits after disallowance, is the federal form that a taxpayer may use to claim certain tax credits that were previously. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health. 596, earned income credit (eic), for the year for which. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Edit, sign or email irs 8862 & more fillable forms, register and subscribe now!

If the irs rejected one or more of these credits: Guide to head of household. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Edit, sign or email irs 8862 & more fillable forms, register and subscribe now! Web how it works open the form 8862 pdf and follow the instructions easily sign the irs form 8862 with your finger send filled & signed form 8862 irs or save rate the form 8862 print. If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Married filing jointly vs separately. Reconcile it with any advance payments of the premium tax credit (aptc). 596, earned income credit (eic), for the year for which. Ad access irs tax forms.

Why Most U.S. Citizens Residing Overseas Haven’t a Clue about the

Figure the amount of your premium tax credit (ptc). Web use form 8962 to: It allows you to claim. Web irs form 8862, information to claim certain credits after disallowance, is the federal form that a taxpayer may use to claim certain tax credits that were previously. Eitc, ctc, actc or aotc, you may have received a letter stating that.

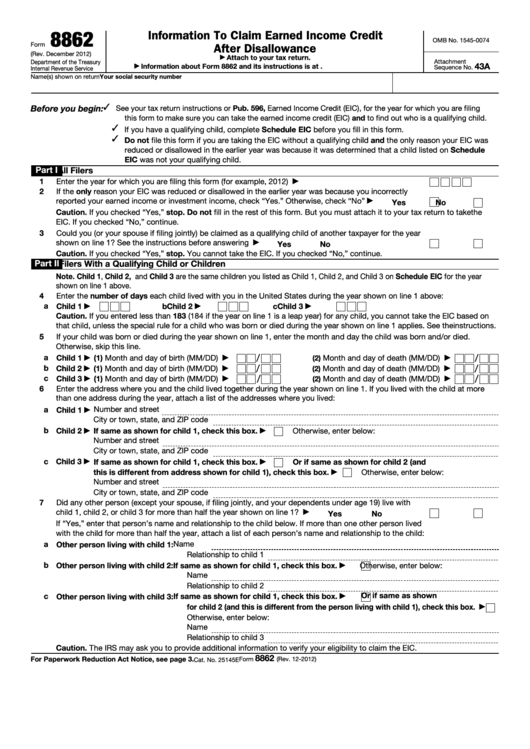

Instructions for IRS Form 8862 Information to Claim Certain Credits

Web how it works open the form 8862 pdf and follow the instructions easily sign the irs form 8862 with your finger send filled & signed form 8862 irs or save rate the form 8862 print. Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance.

Form 8862Information to Claim Earned Credit for Disallowance

Web tax tips & video homepage. Complete, edit or print tax forms instantly. Web irs form 8862, information to claim certain credits after disallowance, is the federal form that a taxpayer may use to claim certain tax credits that were previously. Ad access irs tax forms. If you are filing form 8862 because you received an irs letter, you should.

Form 8862 Information to Claim Earned Credit After

Search for 8862 and select the link to go to the section. Solved • by turbotax • 7249 • updated february 25, 2023 if your earned income credit (eic) was disallowed or reduced for. Web more from h&r block. Web it’s easy to do in turbotax. It allows you to claim.

Form 8862 (Rev. December 2012) Edit, Fill, Sign Online Handypdf

Complete, edit or print tax forms instantly. Complete irs tax forms online or print government tax documents. Web tax tips & video homepage. Answer the questions accordingly, and we’ll include form 8862 with your return. Web it’s easy to do in turbotax.

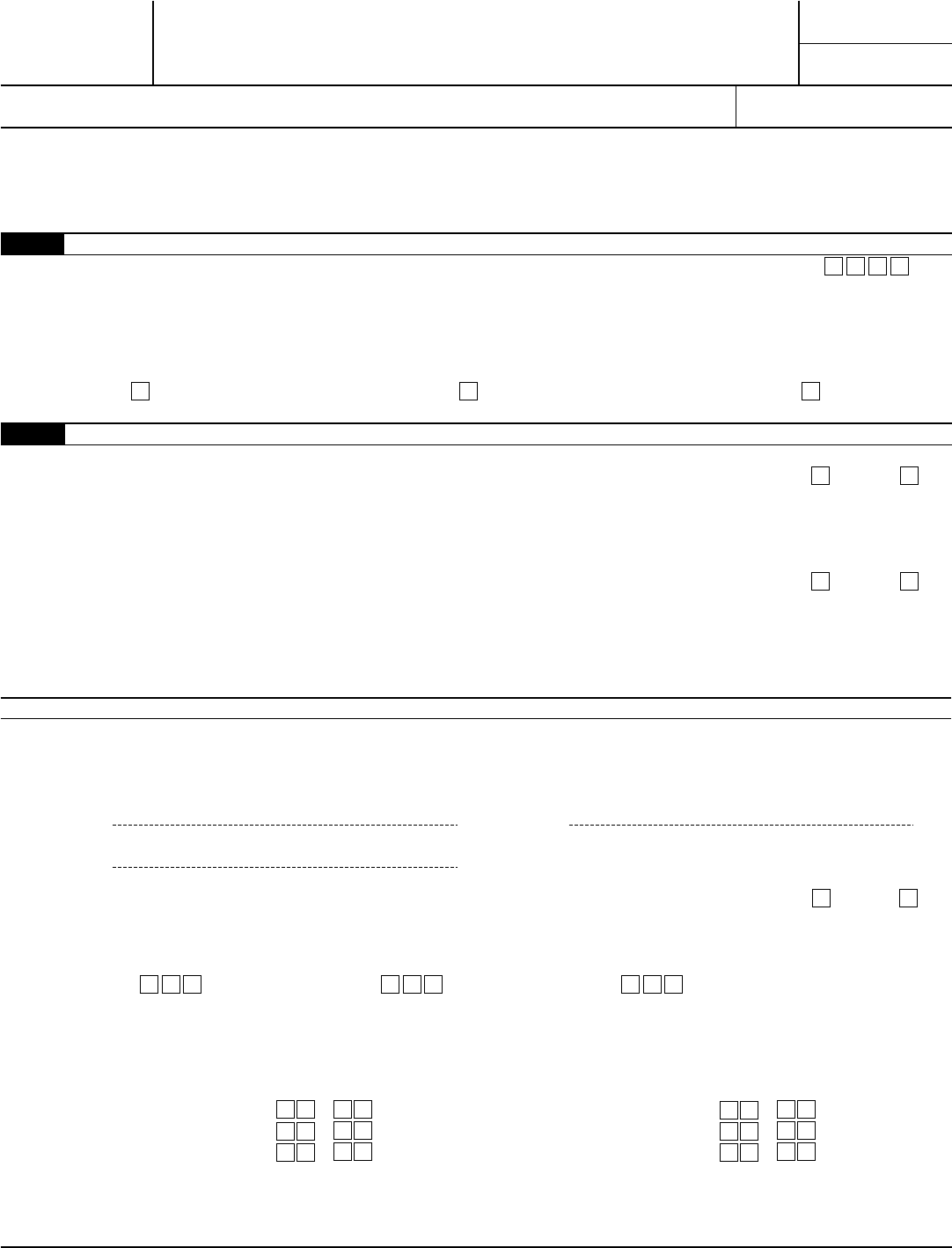

2020 Form IRS 8867 Fill Online, Printable, Fillable, Blank pdfFiller

Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Ad access irs tax forms. Web it’s easy to do in turbotax. Guide to head of household. Complete, edit or print tax forms instantly.

Fillable Form 8862 Information To Claim Earned Credit After

You must complete form 8862 and attach it to your tax return to claim the eic, ctc, rctc, actc, odc, or aotc if you meet the following criteria for any of. Complete, edit or print tax forms instantly. Web more from h&r block. United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs form.

Form 8862 Information to Claim Earned Credit After

Web form 8962 is used to calculate the amount of premium tax credit you’re eligible to claim if you paid premiums for health insurance purchased through the health. Figure the amount of your premium tax credit (ptc). 596, earned income credit (eic), for the year for which. If you are filing form 8862 because you received an irs letter, you.

IRS Publication Form 8867 Earned Tax Credit Irs Tax Forms

Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Web it’s easy to do in turbotax. Web how do i enter form 8862? You must complete form 8862 and attach it to your tax return.

8862 Tax Form Fill and Sign Printable Template Online US Legal Forms

Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Married filing jointly vs separately. Web information to claim earned income credit after disallowance before you begin:usee your tax return instructions or pub. Web use form 8962 to: United states (spanish) canada (french) how do i enter form 8862? instructions for form 8862 irs.

Web Information To Claim Earned Income Credit After Disallowance Before You Begin:usee Your Tax Return Instructions Or Pub.

Complete, edit or print tax forms instantly. Eitc, ctc, actc or aotc, you may have received a letter stating that the credit was disallowed. Web more from h&r block. Web tax tips & video homepage.

If The Irs Rejected One Or More Of These Credits:

It allows you to claim. Ad access irs tax forms. Figure the amount of your premium tax credit (ptc). Edit, sign or email irs 8862 & more fillable forms, register and subscribe now!

Reconcile It With Any Advance Payments Of The Premium Tax Credit (Aptc).

Web irs form 8862, information to claim certain credits after disallowance, is the federal form that a taxpayer may use to claim certain tax credits that were previously. If your return was rejected. Web how do i enter form 8862? Web we last updated federal form 8862 in december 2022 from the federal internal revenue service.

United States (Spanish) Canada (French) How Do I Enter Form 8862? Instructions For Form 8862 Irs Form 8862 Do You Live In The Us.

If you are filing form 8862 because you received an irs letter, you should send it to the address listed in the letter. Search for 8862 and select the link to go to the section. Web use form 8962 to: Married filing jointly vs separately.