What Is Income Limit For Chapter 7

What Is Income Limit For Chapter 7 - Instead, a standard formula is applied to each individual debtor. Monthly maximum of 3% of applicable monthly income, except no such limit. Instead, the means test considers your entire financial picture to determine. To find out the limit, you have to compare your income to the median income for a. Web if your total disposable income is less than $7,700 over the next five years: Web calculating your household income. The average american in 2020 rotates between. Web you can earn significant monthly income and qualify for chapter 7 bankruptcy if you have a large family or considerable but reasonable expenses, such as a high mortgage and car loan payments, taxes, and other expenses. Without using the means test, you will not be able. Web in a nutshell bankruptcy laws don't specify a minimum debt requirement to file chapter 7 bankruptcy.

What is chapter 7 bankruptcy? If you income is below the allowable level you may be able to file for. Monthly maximum of 3% of applicable monthly income, except no such limit. Chapter 7 bankruptcy doesn't have one particular passing income amount. Web if your total disposable income is less than $7,700 over the next five years: Web according to the bankruptcy code, any person that makes more than the median income in the state they reside in needs to take a means test to figure out if they qualify for a chapter 7 bankruptcy, depending on. Web calculating your household income. Read on to find out from the bankruptcy lawyers at husker law in omaha. Web megan foukes june 17, 2019 the income limit to file for a chapter 7 bankruptcy depends on the state you live in. If the amount is between $7,700 and $12,850:

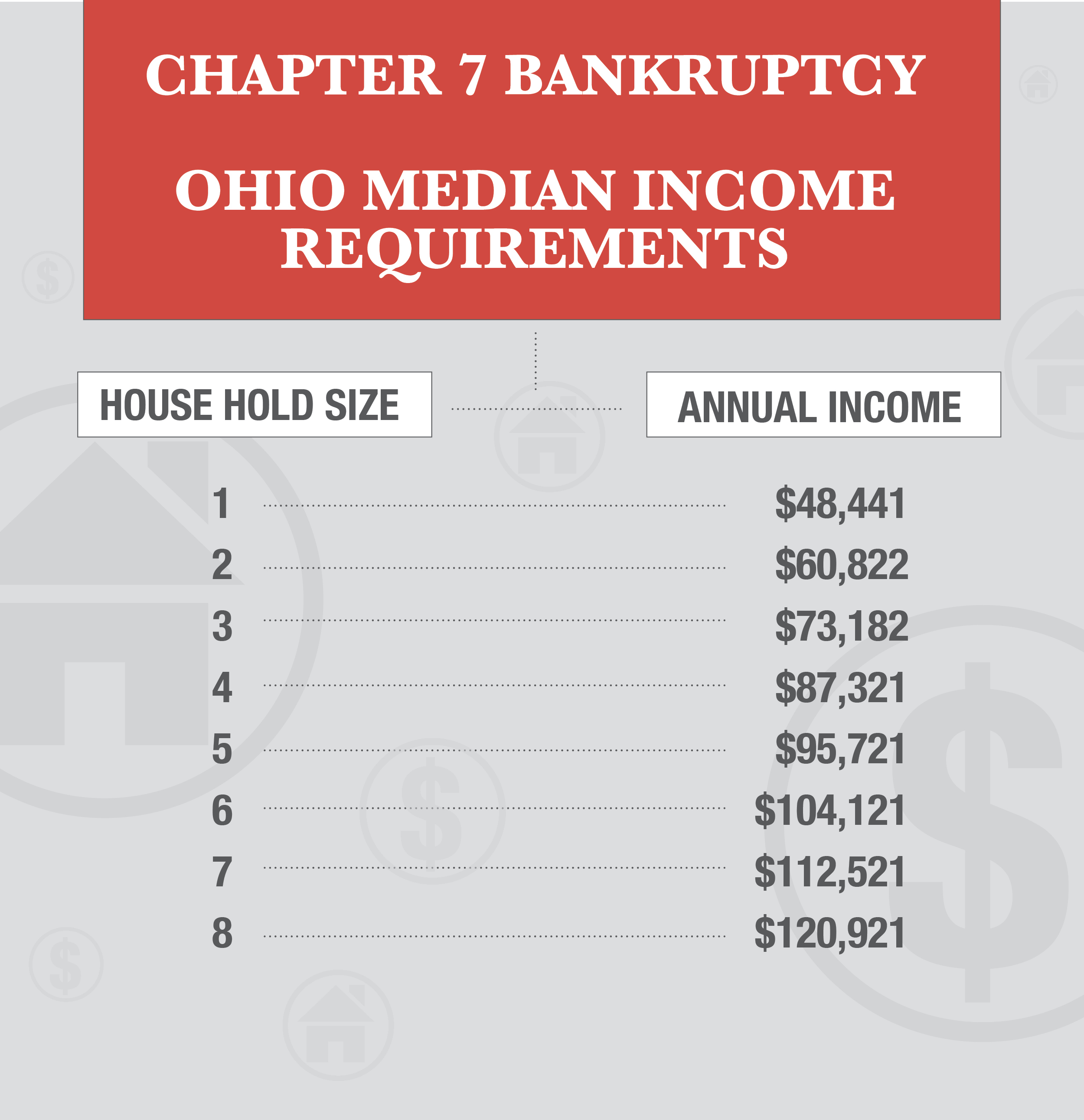

Web because median incomes vary by state and household size, the income limit for filing a chapter 7 varies as well. Instead, the means test considers your entire financial picture to determine. So, if your income was less than that and you had three people living in your household, you would qualify to file. You may qualify for chapter 7 bankruptcy and move on to part 5 of the form. Web february 25, 2021 considering filing chapter 7 bankruptcy? Michael anderson september 4, 2021 chapter 7 bankruptcy provides relief from debt by wiping out most unsecured debt and giving. Web according to the bankruptcy code, any person that makes more than the median income in the state they reside in needs to take a means test to figure out if they qualify for a chapter 7 bankruptcy, depending on. To find out the limit, you have to compare your income to the median income for a. What is chapter 7 bankruptcy? Web to file for chapter 7 bankruptcy a person’s household income level must be below the allowable adjusted median income for that household size.

And Purchase Price Limits IHDA

Why take a means test? Web february 25, 2021 considering filing chapter 7 bankruptcy? Web according to the bankruptcy code, any person that makes more than the median income in the state they reside in needs to take a means test to figure out if they qualify for a chapter 7 bankruptcy, depending on. Learn what the income limit is.

USDA Loan Limit Eligibility for 2022

Monthly maximum of 3% of applicable monthly income, except no such limit. This means that if you make $55,659 yearly before taxes are taken out, you’re in luck! Learn what the income limit is and other useful information about filing chapter 7 in our guide. Web according to the bankruptcy code, any person that makes more than the median income.

Chapter 7 Limit in Jeffrey Kelly Law Offices

Web according to the bankruptcy code, any person that makes more than the median income in the state they reside in needs to take a means test to figure out if they qualify for a chapter 7 bankruptcy, depending on. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Web calculating your.

Blog Chart Type Limit Calculation Novogradac

Monthly maximum of 3% of applicable monthly income, except no such limit. So, if your income was less than that and you had three people living in your household, you would qualify to file. If you income is below the allowable level you may be able to file for. As long as you qualify to file and meet all the.

Do I Qualify For Chapter 7 Bankruptcy? Paolucci Law

The average american in 2020 rotates between. Introduction to general financial requirements (a) 130 cmr 520.000 describes the rules governing financial eligibility for masshealth. Web november 1, 2021 do you know what the income limit is if you want to file chapter 7 bankruptcy? Learn what the income limit is and other useful information about filing chapter 7 in our.

IRS Clarifies How to Calculate Limits for LIHTC Average

You may qualify for chapter 7 bankruptcy and move on to part 5 of the form. Web megan foukes june 17, 2019 the income limit to file for a chapter 7 bankruptcy depends on the state you live in. Web calculating your household income. Web if the debtor's income is less than 150% of the poverty level (as defined in.

Nevada Ranks Last in Personal Growth since the Recession Guinn

Web because median incomes vary by state and household size, the income limit for filing a chapter 7 varies as well. Instead, the means test considers your entire financial picture to determine. Web calculating your household income. Chapter 7 bankruptcy doesn't have one particular passing income amount. Web megan foukes june 17, 2019 the income limit to file for a.

What Is The Limit For Chapter 13? Junior Rutledge

Instead, a standard formula is applied to each individual debtor. This means that if you make $55,659 yearly before taxes are taken out, you’re in luck! Web because median incomes vary by state and household size, the income limit for filing a chapter 7 varies as well. Web there is no set limit of how much a debtor can earn.

limit raised by Rs 2 lakh for OBC noncreamy layer in AP The

As long as you qualify to file and meet all the requirements, you can file chapter 7 and have your. If you income is below the allowable level you may be able to file for. Why take a means test? Web there is no set limit of how much a debtor can earn to be eligible for a chapter 7.

Child Tax Credit Limit Trending US

Monthly maximum of 3% of applicable monthly income, except no such limit. Instead, a standard formula is applied to each individual debtor. If you income is below the allowable level you may be able to file for. Chapter 7 bankruptcy doesn't have one particular passing income amount. Without using the means test, you will not be able.

Web If The Debtor's Income Is Less Than 150% Of The Poverty Level (As Defined In The Bankruptcy Code), And The Debtor Is Unable To Pay The Chapter 7 Fees Even In Installments, The Court May Waive The Requirement That.

Read on to find out from the bankruptcy lawyers at husker law in omaha. Web calculating your household income. Chapter 7 bankruptcy doesn't have one particular passing income amount. What is chapter 7 bankruptcy?

Web Bankruptcy Law What Is The Income Limit For Chapter 7?

Web let’s first look at: Web megan foukes june 17, 2019 the income limit to file for a chapter 7 bankruptcy depends on the state you live in. As long as you qualify to file and meet all the requirements, you can file chapter 7 and have your. Web to file for chapter 7 bankruptcy a person’s household income level must be below the allowable adjusted median income for that household size.

So, If Your Income Was Less Than That And You Had Three People Living In Your Household, You Would Qualify To File.

Web february 25, 2021 considering filing chapter 7 bankruptcy? Web in a nutshell bankruptcy laws don't specify a minimum debt requirement to file chapter 7 bankruptcy. Web there is no set limit of how much a debtor can earn to be eligible for a chapter 7 bankruptcy; The average american in 2020 rotates between.

To Find Out The Limit, You Have To Compare Your Income To The Median Income For A.

Monthly maximum of 3% of applicable monthly income, except no such limit. Michael anderson september 4, 2021 chapter 7 bankruptcy provides relief from debt by wiping out most unsecured debt and giving. A chapter 7 bankruptcy is a short process, typically lasting only. You may qualify for chapter 7 bankruptcy and move on to part 5 of the form.